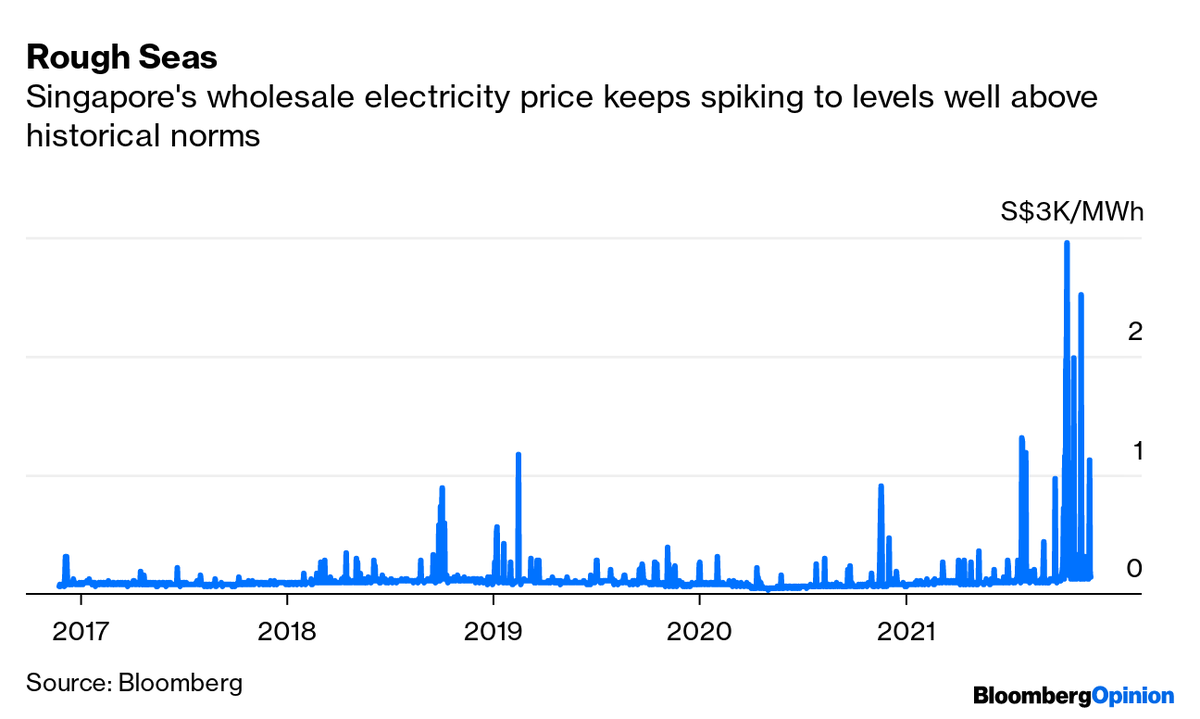

Think Europe is seeing crazy electricity prices amidst this winter's power crunch? It's got nothing on Singapore. 🧵

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

There's been a lot of headlines in recent weeks as a global and continent-wide gas shortage has driven Europe's wholesale power prices to more than $200 a megawatt-hour, extraordinary levels by normal standards.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

But Singapore routinely sees prices at 10 times those levels. They were at $2,184/MWh in October!

Even compared to European peak load prices, which is probably a better comparison, this is 5x higher.

Even compared to European peak load prices, which is probably a better comparison, this is 5x higher.

Quite a few people in Singapore have household contracts benchmarked to wholesale prices.

This saves them money on the official government tariff for most of the year, but at those prices it would cost $5 to run a typical oven for an hour.

This saves them money on the official government tariff for most of the year, but at those prices it would cost $5 to run a typical oven for an hour.

Those high European power prices have often been blamed on the renewable transition, for instance by Saudi Aramco's CEO Amin Nasser last week.

But that's clearly not the issue in Singapore, whose grid is about 98% fossil-fired.

But that's clearly not the issue in Singapore, whose grid is about 98% fossil-fired.

The truth of the matter is obvious: Fuel prices have been rising, so any electricity that depends on fuel purchases is getting more expensive.

The most fuel-dependent grids are experiencing the biggest price rises, and more fixed-cost renewables ought to alleviate the problem.

The most fuel-dependent grids are experiencing the biggest price rises, and more fixed-cost renewables ought to alleviate the problem.

Singapore has some genuinely unique problems here. There simply isn't the space for sufficient solar power, because 75% of the country is urban area, much of it high-rise. Wind speeds are too calm for wind and there's not enough water or elevation for hydro.

Nuclear won't work either. If you ever had just one accident, a 30km exclusion zone like we saw in Fukushima or Chernobyl requires you to evacuate the entire country.

Lee Kuan Yew once looked into establishing a nuclear plant on the tiny outlying rock of Pedra Branca but decided it was too risky.

Another option would be to import power from a neighboring state, but Singapore's relations with Malaysia and Indonesia are still a bit prickly (the country still has national service) and a plan to run an undersea cable to Australia might be impossible, engineering-wise.

Little wonder, then, that Singapore is one of just four of the top 30 emitters that still lack a firm net zero target date, along with Iran, Poland, and Egypt.

That position is particularly ironic in low-lying Singapore. Technically it's a member of the Small Island Developing States grouping, a UN union of largely poor developing countries most at risk of sea-level rise

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

There is one solution, however, that suits Singapore's geopolitical requirement to be powered by shipped fuel as well as its longstanding desire to use its position and massive infrastructure investment to become a linchpin of global transport and energy networks: Green hydrogen.

This space is new and moving very fast, but already you're seeing Asia's richest man Mukesh Ambani and Australia's government aiming at green H2 costing $1 to $1.50/kg by 2030, levels competitive with natural gas prices.

Shipping giant Maersk has already put in an order for methanol-powered container ships and the green methanol to fuel them (methanol, like ammonia, is essentially a hydrogen derivative if you build a zero-carbon commodity chemicals industry):

maersk.com/news/articles/…

maersk.com/news/articles/…

Singapore, with one of the world's biggest ports and a fuel refining sector that powers much of Asia, really needs to get out in front of these investments and be part of the transition. Instead it's being left behind while other countries race ahead.

That short-sightedness is not without consequences. By not thinking about how its energy system needs to change, Singapore is actually putting the national security it cares so much about at risk.

It needs to become a player in green H2 the same way it is a player in aviation, shipping and energy. If it doesn't do that the outcome could be worse than costly. (ends)

• • •

Missing some Tweet in this thread? You can try to

force a refresh