woah. new on DC docket. looks like the attorney general of DC filed 270 pages late Friday night documenting Facebook's multi-year resistance to discovery in its cover-up of Cambridge Analytica and related platform issues for 3yrs. stay with me until the end. /1

The most sensitive part is Facebook protecting these 4 executives from discovery/depositions. It's claimed to also be reason Zuckerberg was willing to pay $5B to the FTC.

It's an insult to every user a breach this problematic could happen without evidence from these 4 execs. /2

It's an insult to every user a breach this problematic could happen without evidence from these 4 execs. /2

I mean this claim involved one of more infamous political operatives in DC at Facebook involved in a cover-up that protected the use of data in the most controversial election operation in history and allowed senior execs to continue to trade on the stock in the process. /3

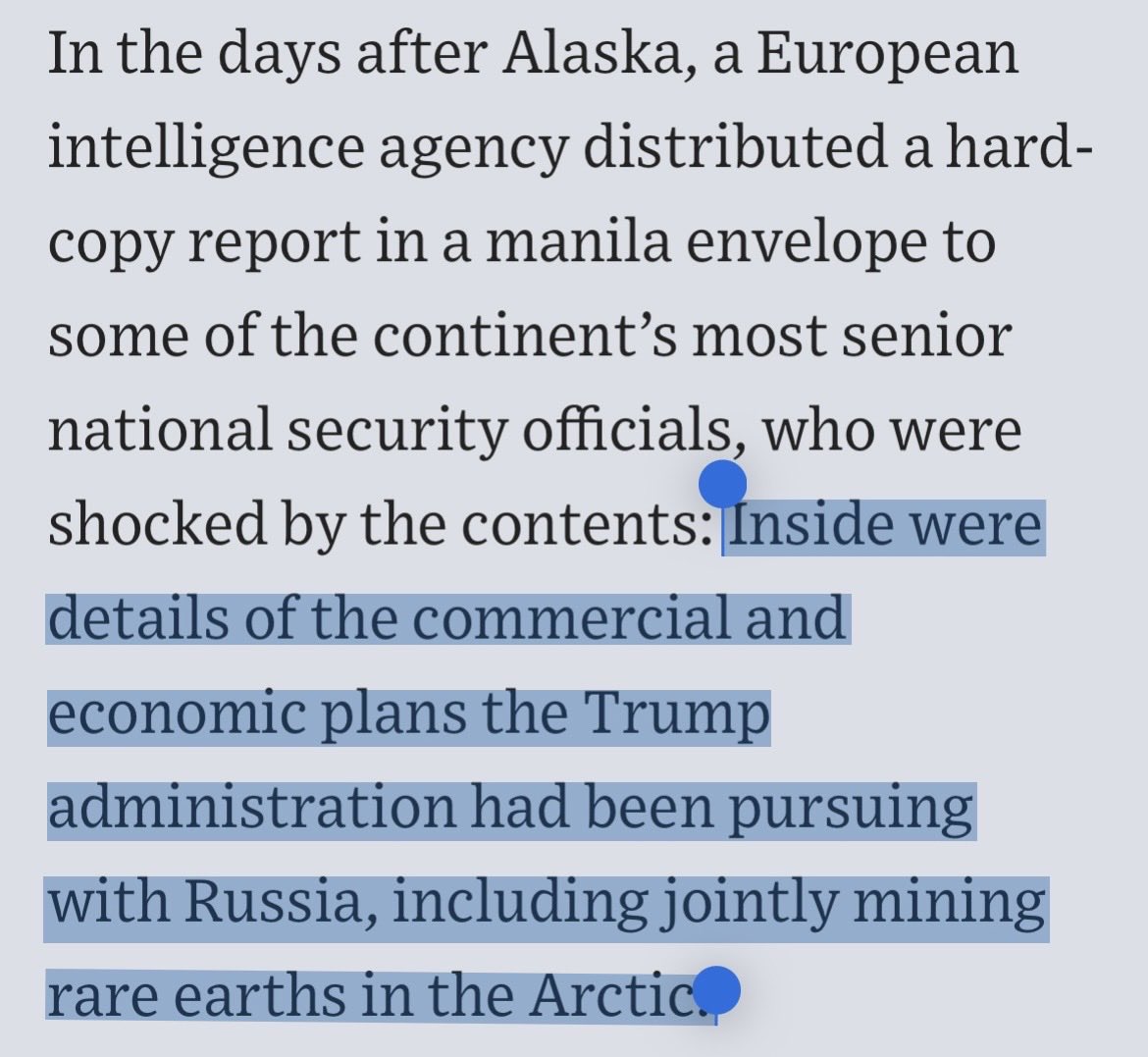

for the employees and former employees (which Facebook permitted discovery), we can't see all of the queries that were done but some of the terms are certainly ones that have long been of interest. /4

so DC will play out, Facebook argues nothing new can be discovered from Zuckerberg, Sandberg, Schrage and Kaplan. It's all duplicative information and burdensome. Yes, that's patently absurd. Which brings me to the popcorn... /5

there's always been a parallel (multidistrict) case in N California and now it has worked through same issue. The Special Master assigned to sort out the similar discovery issues determined indeed it's likely Zuckerberg and Sandberg possess relevant and unique information. /6

And the plaintiffs want the communications between Sandberg and Zuckerberg, between the two of them and the board (some already turned over in very active shareholder suits), third parties and others missed. Again, this involves a cover-up. /7

The Court has given them until January 31, 2022. Again, this involves the files of Mark Zuckerberg and Sheryl Sandberg. /8

And they know Sandberg's role. Much is redacted but a reminder she has never answered questions under oath about the scandal as far as we know it. NYT reported the topic was off limits the one time she testified to Congress. She refused summons from international Parliaments. /9

it gets better. After the court ordered the documents search for Zuckerberg and Sandberg, Facebook quickly followed up to seal whatever discovery comes of it but now was just denied by the Court. I doubt it's over but it's a strong signal much should be publicly available. /10

now turning back to the DC case... a number of documents are sealed in the 270pg report just posted but beyond the unredacted discovery terms, we learn of a dispute over "Mr. Zuckerberg's notebooks" (infamous) being subject to discovery as they are in the California case. /11

And we also learn of some of the more recent depositions. Barnes was on the ground in 2016 election. Zuckerberg and Allison Hendrix have been noticed for depositions (key exec in platform data issues and was a point on Cambridge Analytica cover-up from early on). /12

and a reminder, the 270pg report is for more time. FB has been stalling and frustrating courts for nearly 4yrs. That's how they win. And it's patently absurd they get away with it considering there is nothing to give us confidence their largest scandal won't happen again. /13

and I'll add to close, there is a massive shareholder suit regarding same cover-up and almost zero press coverage of any of this because it's (a) complex and (b) Facebook's network convinced influencers Cambridge Analytica was an overhyped story. /eof

https://twitter.com/jason_kint/status/1440304941428473857?s=20

Here is the full document now OCR searchable. ht @zamaan_qureshi @profcarroll

https://twitter.com/zamaan_qureshi/status/1470979174450049026

Also linking to this thread as it’s relevant to know we literally just learned after three years that Zuckerberg was deposed by the SEC on these matters back in 2019 and there is a sealed deposition transcript.

https://twitter.com/jason_kint/status/1465553056809037827

• • •

Missing some Tweet in this thread? You can try to

force a refresh