Adidas dropped their first NFT today.

The sale was capped at a max of 2 items per person and it sold out in less than a second

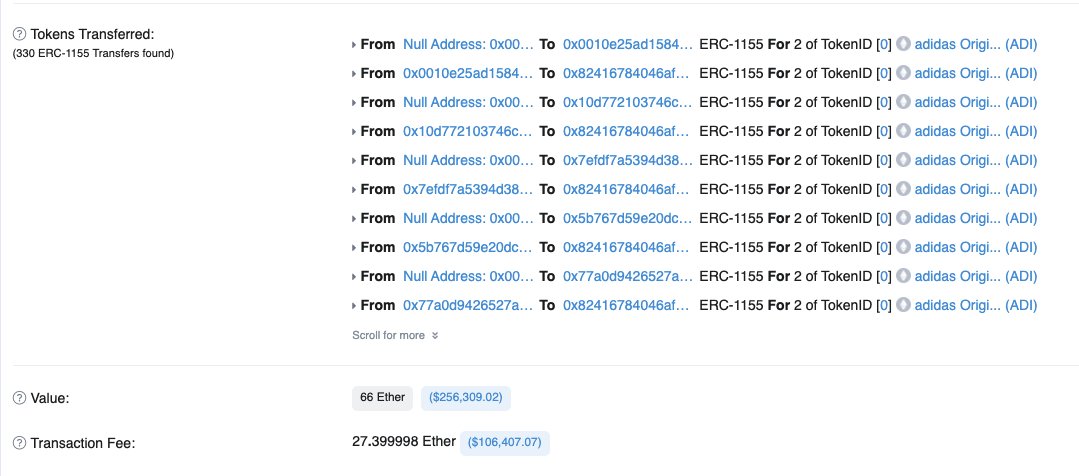

One person was able to purchase 330 in a single transaction using a custom smart contract

Quick 🧵 on how they did it

The sale was capped at a max of 2 items per person and it sold out in less than a second

One person was able to purchase 330 in a single transaction using a custom smart contract

Quick 🧵 on how they did it

Some quick context:

Adidas partnered with @BoredApeYC @gmoneyNFT and @punkscomic to release their first NFT

Due to the hype and demand, they limited the NFT sale to 2 per person.

Adidas partnered with @BoredApeYC @gmoneyNFT and @punkscomic to release their first NFT

https://twitter.com/adidasoriginals/status/1471909577658675204?s=20

Due to the hype and demand, they limited the NFT sale to 2 per person.

The custom smart contract was deployed a few hours before the minting

Contract address: etherscan.io/address/0xb2d0…

Contract address: etherscan.io/address/0xb2d0…

When executed - what it does is generate 165 sub smart contracts that would each individually mint 2 NFTs from the Adidas' smart contract, and then transfer them to the owner's main ETH address.

Since each sub smart contract has a unique address, the creator was able to avoid the 2 item limit imposed by the sale.

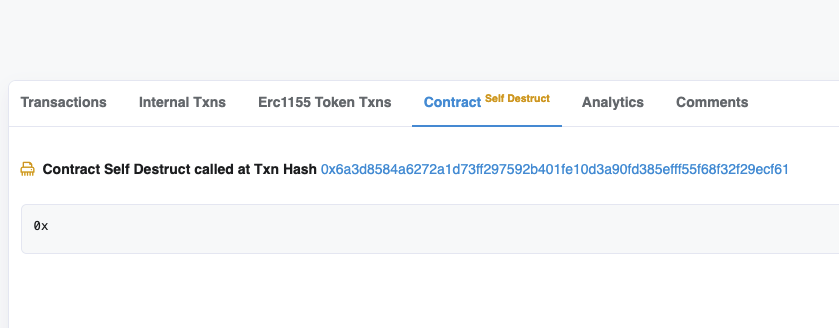

After sending the NFTs to the creator's main address, the child smart contract would self destruct

After sending the NFTs to the creator's main address, the child smart contract would self destruct

What was the the cost of packing all of these operations into one transaction?

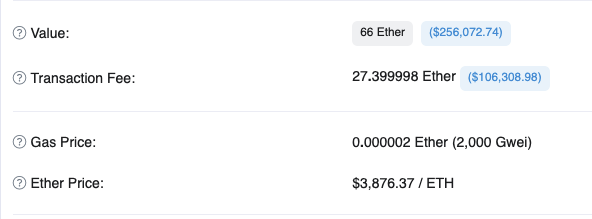

They paid 27.3 ETH ~ $104k in gas fees to process this, on top of 66 ETH ~$252k to pay for the items.

They paid 27.3 ETH ~ $104k in gas fees to process this, on top of 66 ETH ~$252k to pay for the items.

This means that they'd need the price of the NFT to raise from Ξ0.2 (mint price) to Ξ0.28 to break even on the gas they spent.

As the time of this writing, the price floor has skyrocketed to Ξ0.8 ETH. Netting them a theoretical profit of ~$600k 🤯

As the time of this writing, the price floor has skyrocketed to Ξ0.8 ETH. Netting them a theoretical profit of ~$600k 🤯

If you enjoyed this breakdown, feel free to share it with others 👇

https://twitter.com/Montana_Wong/status/1472023753865396227

Lot of people asked in the initial thread about how projects can prevent this.

I wrote about this in a follow up thread linked below

I wrote about this in a follow up thread linked below

https://twitter.com/Montana_Wong/status/1472302215880527872

• • •

Missing some Tweet in this thread? You can try to

force a refresh