Some days have gone by since the #BOOTSWAP event from @WhiteWhaleTerra has ended.

I think it is time to make a retrospective analysis of how it went. Ready?

Let me show you 🧵👇

I think it is time to make a retrospective analysis of how it went. Ready?

Let me show you 🧵👇

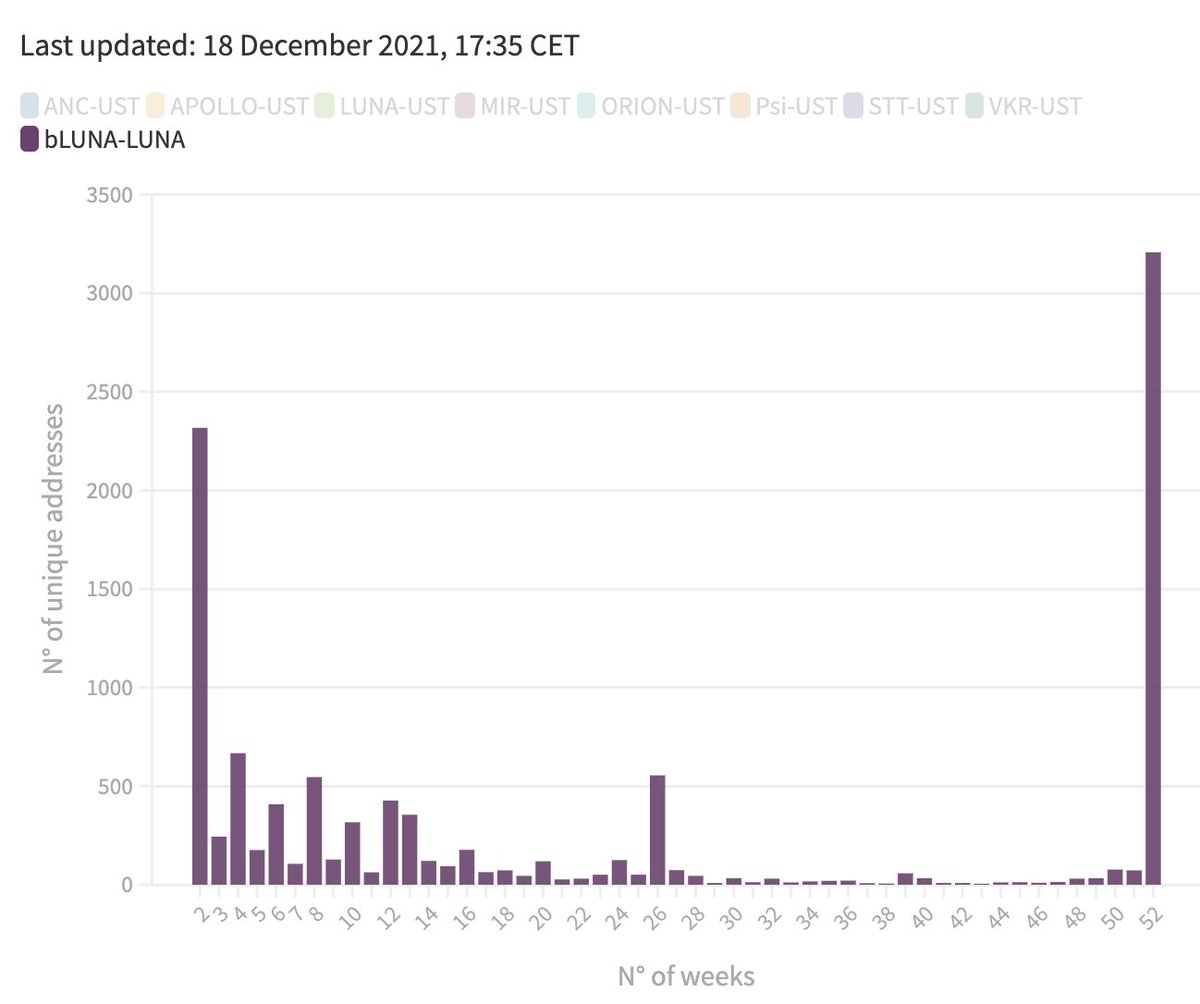

N° users: 7215

When was their first interaction?

- Almost 300 users have bid right at the start, at an average price of $0.96

- The second wave happened after 9 hours. This was triggered by the price dropping below $0.20 and the buying pressure raised the average price to $0.32

When was their first interaction?

- Almost 300 users have bid right at the start, at an average price of $0.96

- The second wave happened after 9 hours. This was triggered by the price dropping below $0.20 and the buying pressure raised the average price to $0.32

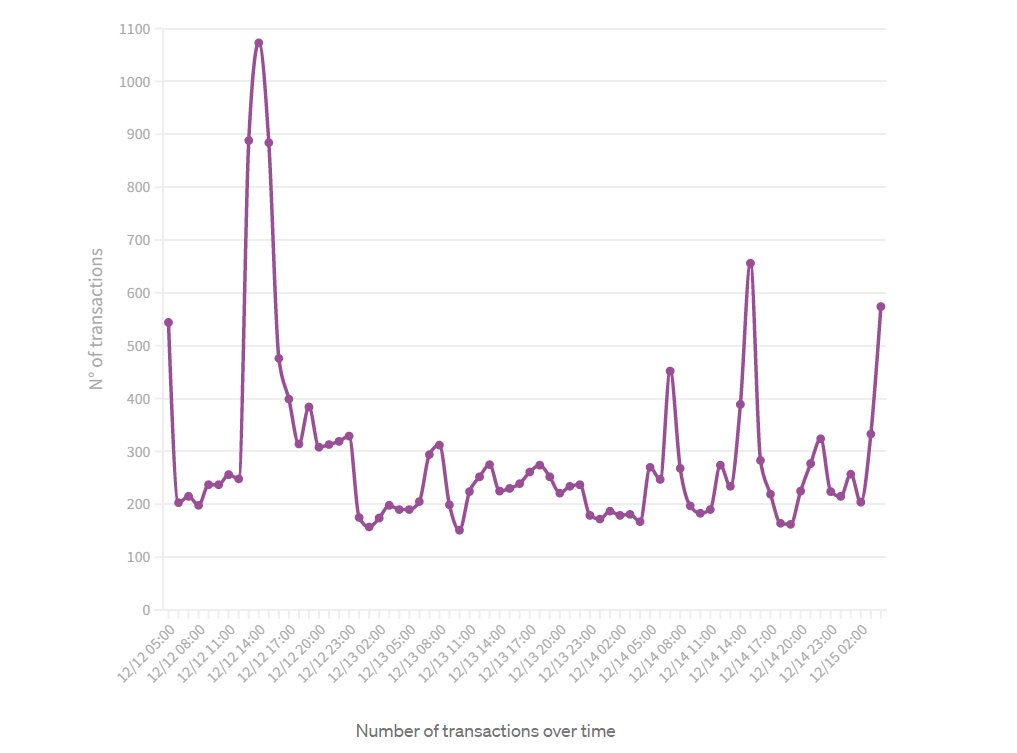

What about the n° of tx over time?

- Peak/hr: ~1100

- Compared to the chart of new users, we can see a couple of more spikes, such as around 8:00 of the 14/12. This is a spike matches with the time when the price fell below $0.14

- Peak/hr: ~1100

- Compared to the chart of new users, we can see a couple of more spikes, such as around 8:00 of the 14/12. This is a spike matches with the time when the price fell below $0.14

- The price which saw the highest amount of $UST spent and gained was $0.19, with a total of $3.87m bought and $1.44m sold of tokens.

- If we look outside the cluster, $0.14 appears to be a popular price with $1.7m of bought tokens

- If we look outside the cluster, $0.14 appears to be a popular price with $1.7m of bought tokens

At how many different prices have users bought?

- 56% of all users have only bought at one price

- 1 user has bought at 22 different prices

- 56% of all users have only bought at one price

- 1 user has bought at 22 different prices

Amount of UST per bid

- The average amount of UST per bid has been $1147 UST

- 75% had an amount of $500 or less

- Highest bid: $462k

- The average amount of UST per bid has been $1147 UST

- 75% had an amount of $500 or less

- Highest bid: $462k

I personally hope to see more of these launches in the future. It looks like a fair way of launching the tokens and it would be interesting to compare users behaviour with the one in the BOOTSWAP.

For a more complete analysis and interacting with the viz: medium.com/@incioman/whit…

For a more complete analysis and interacting with the viz: medium.com/@incioman/whit…

• • •

Missing some Tweet in this thread? You can try to

force a refresh