Last week I added to my @DegenApeAcademy exposure with this @McDegenApes in an OTC type deal for more than 50% discount to the prior purchase price. Don't worry this Ape will stick around.

Future thread on why @McDegenApes but for now, this 🧵is why I APE'd into more #DAA...

Future thread on why @McDegenApes but for now, this 🧵is why I APE'd into more #DAA...

2/n. This thread will be a bit different as I want to share my personal investing history with #DAA. Stick around till the end because it comes full circle as history is important to the @DegenApeAcademy lore.

3/n. Like many @DegenApeAcademy was my first #SolanaNFTs as I came over from ETH. The @monoliff art was compelling and I wanted an Ape.

Wasnt the only one as demand was insane. Mint was a shitshow that etched led to Candy Machine. A foundation to #SolanaNFTs ecosystem.

Wasnt the only one as demand was insane. Mint was a shitshow that etched led to Candy Machine. A foundation to #SolanaNFTs ecosystem.

4/n I wasnt able to mint (still continue to be horrible at minting but thats another story). Ended up aping into the secondary later with a bunch of apes including this Iced out Kobe.

5/n For those who were here for the journey, DAA took the dominant #SolanaNFTs leader position. It wasn't even close. @DegenApeAcademy was 6x the marketcap and about 100 floor to SMBs 40.

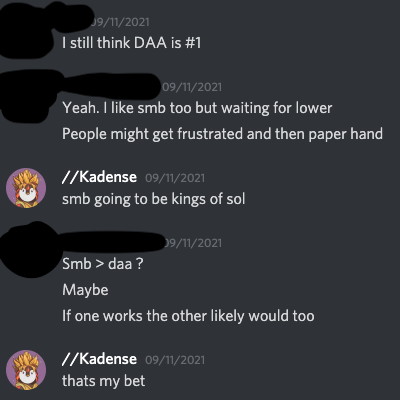

6/n Unfortunately, it was my opinion the success lead to some APES being toxic and arrogant. I noticed it in the discord and in twitter interactions. At the same, time the SMB Dao was structuring out. I made the decision to fade the crowd and bet heavily into SMBs.

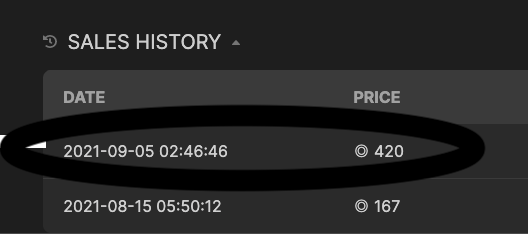

7/n I loved Kobe but sold him as well to get the liquidity to bet heavily into SMBs in early September. This in hindsight looks obvious but at the time, it was clearly not. I bet on the DAO and imo, the better community at the time. Stay with me through this, this matters.

8/n An important event took place later than month in September. The Student Council was elected for the @DegenApeAcademy which ultimately led to the breakout of the @DegenDAOO. Same DAO structure that led to the success of the SMBs. This is an important catalyst my thesis.

9/n It is my read of market that the past concerns of the @DegenApeAcademy community is one of the reasons there is gate keeping and omissions of #DAA as a blue chip of #SolanaNFTs.

This is where the potential opportunity lies in market mispricing of @DegenApeAcademy

This is where the potential opportunity lies in market mispricing of @DegenApeAcademy

10/n If you hop into the @DegenDAOO, you find it to be a different place then what it was in September. There's a support channel for parents and health and wellness. This is a community that cares and supports each other in all parts of their life, not just NFT gains.

11/n Community engagement is high and self driven. The Creape contests have been amazing. Take a look at what one community member @davemgoldman did with the brand. Please gib 6 pack now!

https://twitter.com/davemgoldman/status/1471269061208145924?s=20

12/n Community is global and importantly, significant in Asia. A large part of the market that did not participate heavily in the last August cycle #SolanaNFTs . This is bullish to me. Check out @DAA_HK and what they've done.

https://twitter.com/DAA_HK/status/1465737221722370052?s=20

13/n I'd go on about the community but the master threadster and @sainteclectic wrote it much better than I could about the #DAA community

https://twitter.com/sainteclectic/status/1471151795577577476?s=20

14/n Just recently, the power of the @DegenApeAcademy community came together and flexed in supporting the #Solana network with a record breaking amount of 90K sol validator for their DICS (continued onbrand).

https://twitter.com/Bardstocks/status/1472638278679646215?s=20

15/n Yet despite what's happening, price remains is depressed relative to historical levels. Downside here seems limited vs potential upside as price is stabilizing. Good RR bet setup.

16/n On a weekly snapshot, supply is coming down and owners are spiking up, what's driving this early signal of a snapback...

17/n @steveaoki purchase of a @DegenApeAcademy as validation of #DAA as a bluechip of the #SolanaNFTs

https://twitter.com/steveaoki/status/1473820567966916609?s=20

19/n If you believe 1) there is a market shift to #SolanaNFTs and 2) @DegenApeAcademy is a #SolanaNFTs blue chip, you can see more of this happening in the future vs a one and done event.

My thesis on why I am betting on this shift here.

My thesis on why I am betting on this shift here.

https://twitter.com/crypto_spot/status/1471380110972383234?s=20

20/n I am also a big believer on betting on talent and teams. These two are a power duo @sainteclectic and @DegenService that helps setup and get the @DegenDAOO going and will continue to insure success in transition.

Still with me? Good. Here is the TLDR:

1. Sol NFTs will see capital flows

2. Provenance of the DAA story to Sol NFTs

3. DAOO Community growing stronger and more global

4. Prices present good value entry and favorable RR here.

This is why I Aped. Will you join us? FIN

1. Sol NFTs will see capital flows

2. Provenance of the DAA story to Sol NFTs

3. DAOO Community growing stronger and more global

4. Prices present good value entry and favorable RR here.

This is why I Aped. Will you join us? FIN

PS. I didnt go into the @DegenTrashPanda, their historical significance now and benefit to entire brand of @DegenApeAcademy.

So much to cover in a future 🧵...

So much to cover in a future 🧵...

• • •

Missing some Tweet in this thread? You can try to

force a refresh