1/ Some interesting data from our AMM this week as we Step into the holiday period.

We charted the growth in # of Swaps, LPs and TVLs normalised to a common currency (USDC) over the previous 3 month period.

Heres USD volume doubling during a period of token values halving.

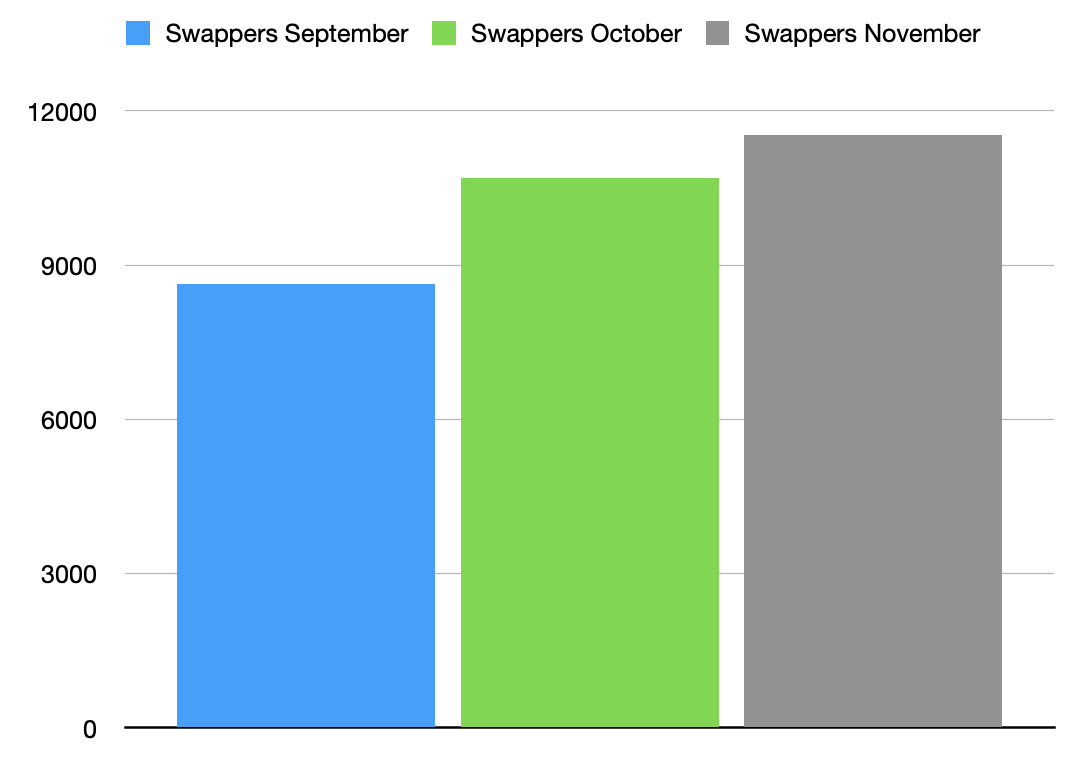

We charted the growth in # of Swaps, LPs and TVLs normalised to a common currency (USDC) over the previous 3 month period.

Heres USD volume doubling during a period of token values halving.

2/ Step's AMM a unique in Solana in that like Bancor half of all LPs are denominated in STEP token. We also were first to deploy an atomic router contract for internal AMM swaps.

Its interesting then to see such strong growth in USD vol when $STEP depreciated during that period

Its interesting then to see such strong growth in USD vol when $STEP depreciated during that period

3/ Next lets look at the number of unique addresses swapping on Step, reaching almost 12 000 in November. Continued steady growth here, this is also organic to Step as no aggregators were connected then and our SDK wasnt ready September.

So this is users swapping on Step

So this is users swapping on Step

4/ What we can take from this is that people are finding value in swapping on Step. Perhaps this is also correlated with continued growth in DAUs at Step.

There are of course improvements to be done (eg Call Options rewards we spoke about are coming soon).

There are of course improvements to be done (eg Call Options rewards we spoke about are coming soon).

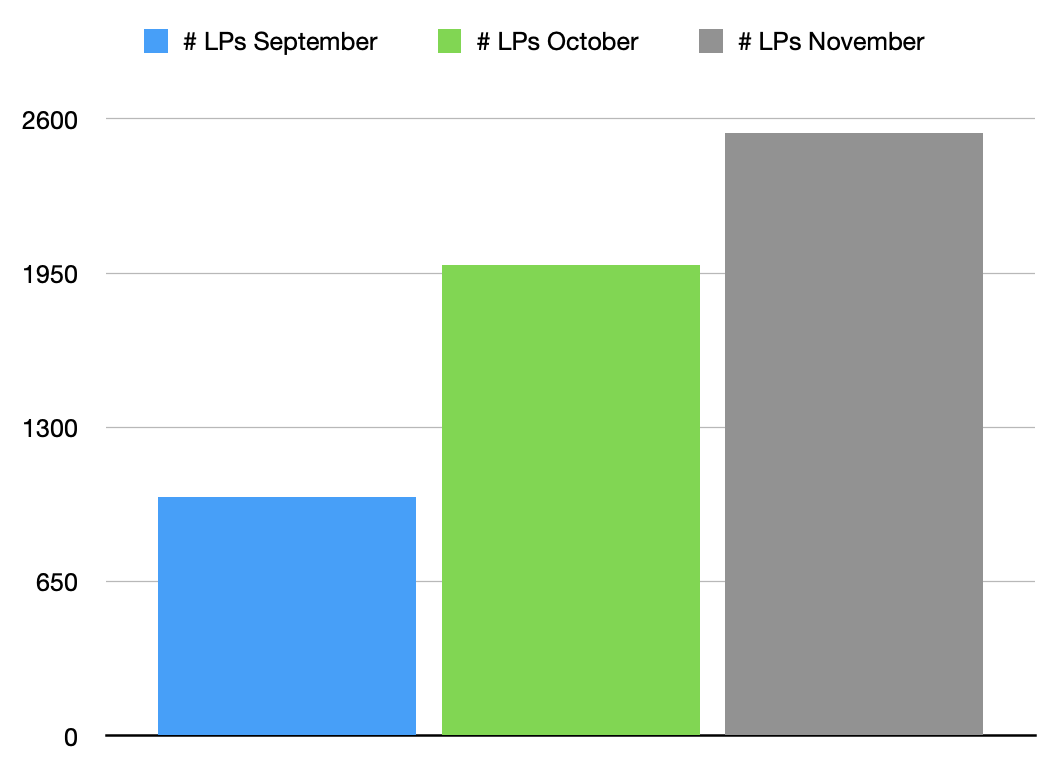

5/ Next up this is the number of unique addresses who deposited or withdrew an LP- almost 2600 uniques.

Strong growth in people becoming Step LPs. # of LPs change day to day so a snapshot in time isnt too interesting so this monthly LP interactions metric is more useful

Strong growth in people becoming Step LPs. # of LPs change day to day so a snapshot in time isnt too interesting so this monthly LP interactions metric is more useful

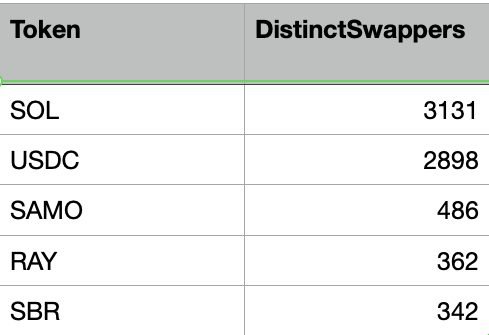

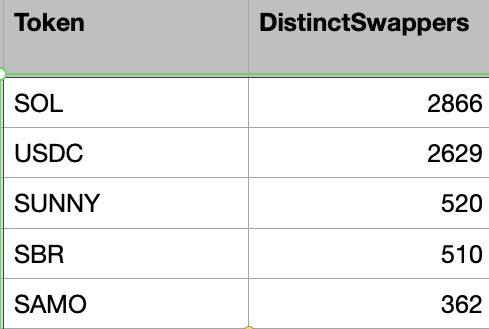

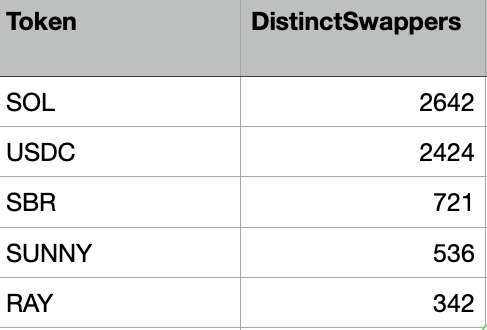

6/ Here are some of the most popular (by # of swaps) currencies during the months of September, October and November.

Common popular coins here are: $SOL, $USDC, $SAMO $RAY $SUNNY $SBR which is interesting as we only have yield farms for 3 of those

Common popular coins here are: $SOL, $USDC, $SAMO $RAY $SUNNY $SBR which is interesting as we only have yield farms for 3 of those

7/ Which might indicate that our idea of targeting long tail assets is going well if people are swapping tokens unlisted on CEXs on Step.

Clear interest for the $SOL / $USDC pairing though. We will be adding our compounding to Step AMM pools too in the new yr

Clear interest for the $SOL / $USDC pairing though. We will be adding our compounding to Step AMM pools too in the new yr

8/ Overall, many positive takeaways. Step is a niche AMM with a particular focus on Bancor style LPs denominated in STEP and an atomic router ontop.

We expect our AMM to be best catering towards new projects, DEX only listings and permissionless farms.

We expect our AMM to be best catering towards new projects, DEX only listings and permissionless farms.

9/ We will just keep building and powering ahead looking to add better capital efficiency to the AMM, new external connections / APIs, better discoverability and more.

Happy holidays!

Happy holidays!

• • •

Missing some Tweet in this thread? You can try to

force a refresh