A thread on the summary points of webinar by @ishmohit1 at @ias_summit last week on Navin Fluorine moderated by @MashraniVivek & @cautkarshpandey

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Overview of Fluorine Industry:

Fluorine is made out of raw material which is known as Fluorspar. China contributes to 60% of mining of Fluorspar. Due to environmental concerns, China has cut back on fluorspar mining and processing. Fluorine is replacing toxic chemicals.

Fluorine is made out of raw material which is known as Fluorspar. China contributes to 60% of mining of Fluorspar. Due to environmental concerns, China has cut back on fluorspar mining and processing. Fluorine is replacing toxic chemicals.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Different types of products within the flourine industry:

• Fluorospeciality: Agro, Pharma, Industrial and other uses. High Margins

• Fluoropolymers: Commodity-grade and value-added. Commoditized + High Margins in VAP

•Inorganic Fluorides: steel and glass industry. Low Margins

• Fluorospeciality: Agro, Pharma, Industrial and other uses. High Margins

• Fluoropolymers: Commodity-grade and value-added. Commoditized + High Margins in VAP

•Inorganic Fluorides: steel and glass industry. Low Margins

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey • Industrial chemicals like Chloromethane.

• Pharma Propellent: used in Metered Dose Inhalers as a propellant

• Pharma Propellent: used in Metered Dose Inhalers as a propellant

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Navin Fluorine:

Navin is a business which is a backward integrated and for Fluorspar they have a tie up with Gujarat fluorochemicals and and GMDC and they source all their floors from Africa.

Navin is a business which is a backward integrated and for Fluorspar they have a tie up with Gujarat fluorochemicals and and GMDC and they source all their floors from Africa.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Navin is backwards integrated into hydrochloric acid from there it makes all types of intermediates that are possible it goes into 6 or 7 or 8 steps of reactions and from there they make all the intermediates.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Navin will be renaming its Specialty Chemicals business as Custom Synthesis Business (which PI Industries does). In Speciality chemicals they are doing CRAMS for Agro Chemicals which PI does.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey CRAMS Business:

Navin does contract manufacturing of intermediates for Pharma innovators. Currently there are 2 molecules under the commercial production. Navin is also planning to do forward integration into the API

Navin does contract manufacturing of intermediates for Pharma innovators. Currently there are 2 molecules under the commercial production. Navin is also planning to do forward integration into the API

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey (In discussion with 2 customers for whom they are already making intermediates). (Key starting material --> Intermediates --> API --> Formulation). Here EBITDA margin could be 30-35%.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Acquisition of Manchester Organics:

Manchester Organics Ltd has a strong legacy in fluorination & high special chemistry. MOL directly works with innovative pharma companies on milligram to multi-kilo research phase.

Manchester Organics Ltd has a strong legacy in fluorination & high special chemistry. MOL directly works with innovative pharma companies on milligram to multi-kilo research phase.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Navin has capabilities of CRAMS with experience in multi hundred kilos to multi ton production. MOL brings access to global innovator pharma companies and to cutting edge fluorination chemistries which enhances value-added product portfolio of CRAMS & speciality chemicals.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Many molecules which started off with Manchester Organics are now getting commercialised in Devas facility. In 2011, MOL had a catalogue of 8,000 chemicals. Fast forward to 2020, this catalogue has grown to 51,000 chemicals.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Refrigerant Gas Division:

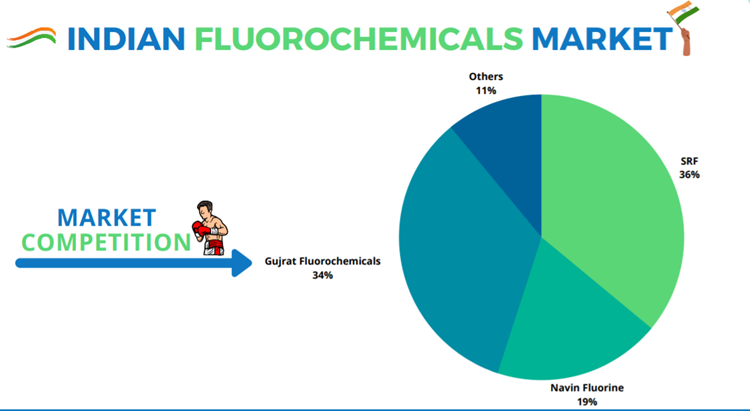

Navin Fluorine is primarily into manufacturing of R-22 with a capacity of 9,000 tonnes out of which 40% is exported to the Middle East and South Africa and balance is sold in India. Navin has 20% market share in India. This business segment is seasonal.

Navin Fluorine is primarily into manufacturing of R-22 with a capacity of 9,000 tonnes out of which 40% is exported to the Middle East and South Africa and balance is sold in India. Navin has 20% market share in India. This business segment is seasonal.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey P2P Comparison between Navin, PI Industries and Divis Labs:

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey Future Growth Triggers:

• Company’s current fixed assets is close to 550-600 hundred cr on that fixed asset base company will be adding close to 850 crores of additional fixed assets in next almost 4-5 quarters.

• Company’s current fixed assets is close to 550-600 hundred cr on that fixed asset base company will be adding close to 850 crores of additional fixed assets in next almost 4-5 quarters.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey • In Q4 of FY22 500 crore Capex will almost come in then one more Capex will come in for 195 crores that will go live in Q2-Q3 then one more Capex of 140 cr will come in.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey • Next year we are likely to see announcements cGMP 3 they are going to do debottleneck. They will be also announcing a plan for cGMP 4. Upcoming de-bottlenecking and cGMP Unit 4. Capex spend to be close to 500 crores

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey • They will be likely announcing Capex in next two to three years for new age opportunities like electric vehicles semiconductors and 5G.

• They will be likely announcing Capex for new age refrigerant gas.

• They will be likely announcing Capex for new age refrigerant gas.

@ishmohit1 @ias_summit @MashraniVivek @cautkarshpandey • NFIL has already commercialized a hexafluoro (6 atoms) platform in pharma, very few companies in the world are working on it.

• Optionality from EV and Other opportunities. Navin is working on 2 Lithium Based molecules on Hexafluoride chemistry. One of the molecule is in collaboration with a French Company. The molecule is manufactured through Organic route and is touted to replace Lithium.

End of thread, if found useful please retweet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh