1/ With @NEARProtocol and @auroraisnear popping up time for another bridge thread as you don't want to miss out on the next capital rotation!

2/ TLDR

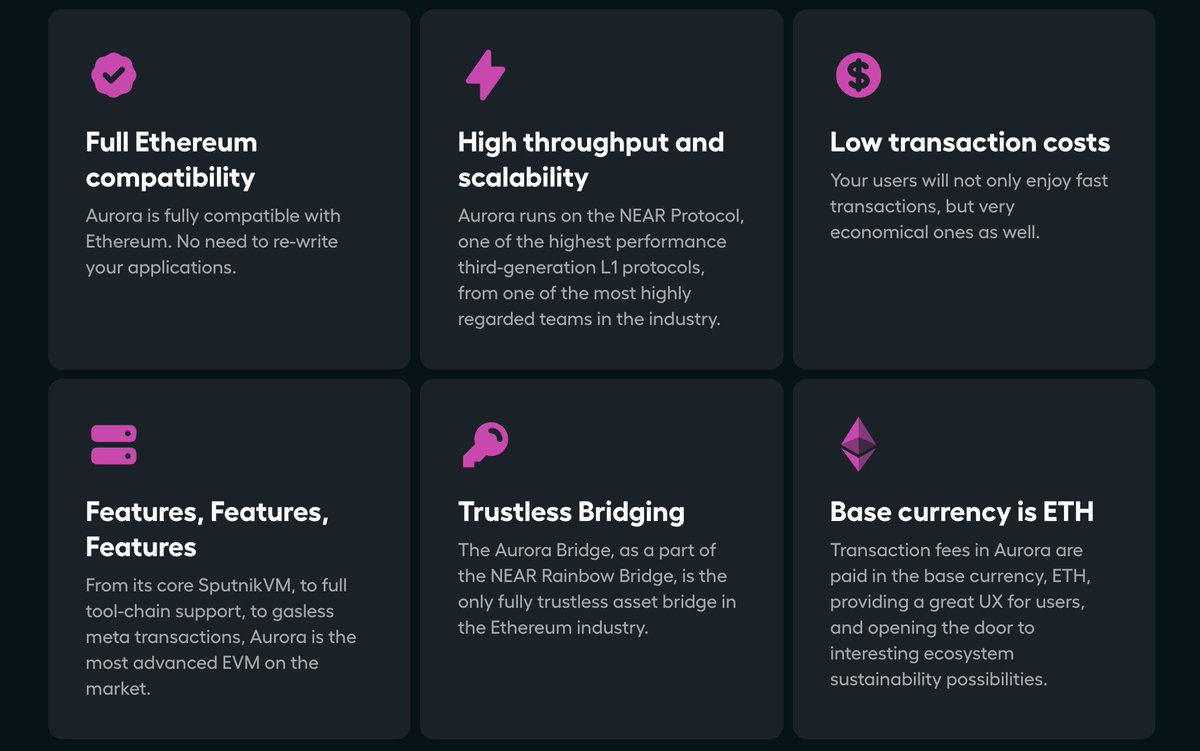

Aurora is an L2 EVM compatible scaling solution built on the NEAR protocol. It also offers high-throughput with low transaction costs for users.

Some of the interesting highlights are summarised below:

Aurora is an L2 EVM compatible scaling solution built on the NEAR protocol. It also offers high-throughput with low transaction costs for users.

Some of the interesting highlights are summarised below:

3/ Adding Aurora to Metamask

a) Manual input

Network Name: Aurora

New RPC URL: mainnet.aurora.dev

Chain ID: 1313161554

Currency Symbol: aETH

Block Explorer: explorer.mainnet.aurora.dev

or

b) Visit chainlist.xyz to add the Aurora Mainnet network directly to Metamask

a) Manual input

Network Name: Aurora

New RPC URL: mainnet.aurora.dev

Chain ID: 1313161554

Currency Symbol: aETH

Block Explorer: explorer.mainnet.aurora.dev

or

b) Visit chainlist.xyz to add the Aurora Mainnet network directly to Metamask

4/ Bridging Funds

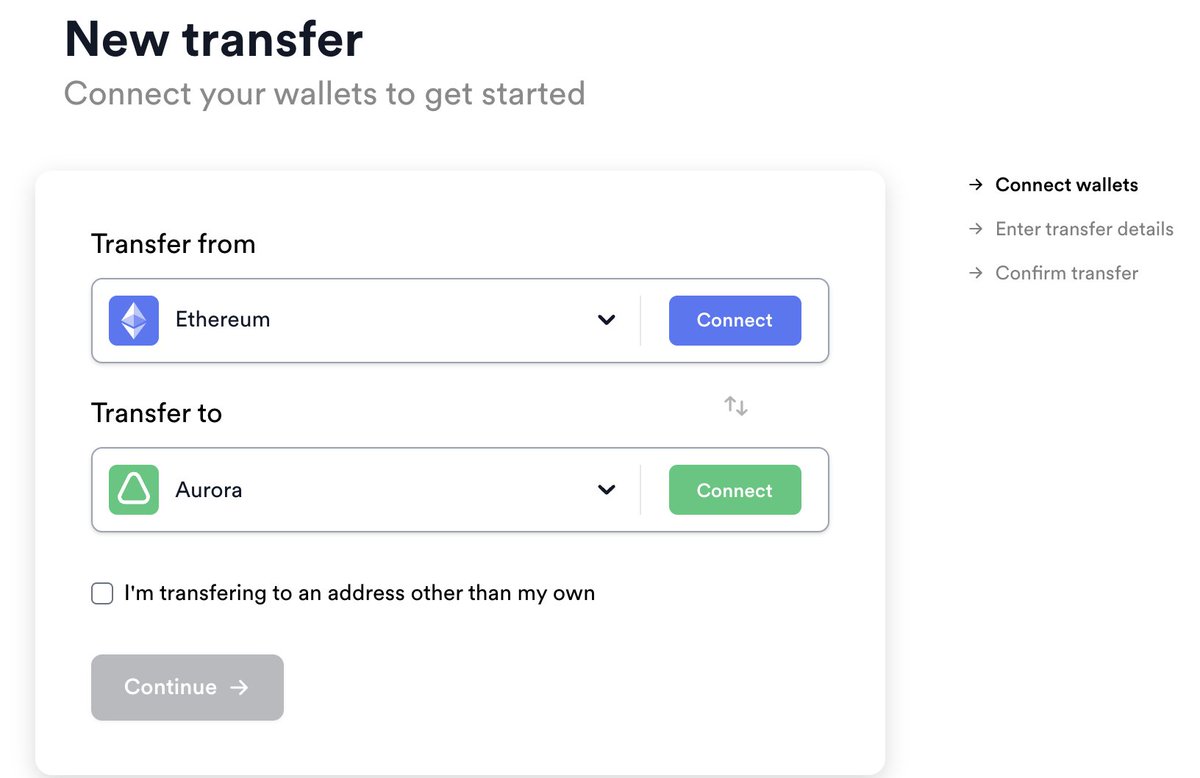

a) From Ethereum

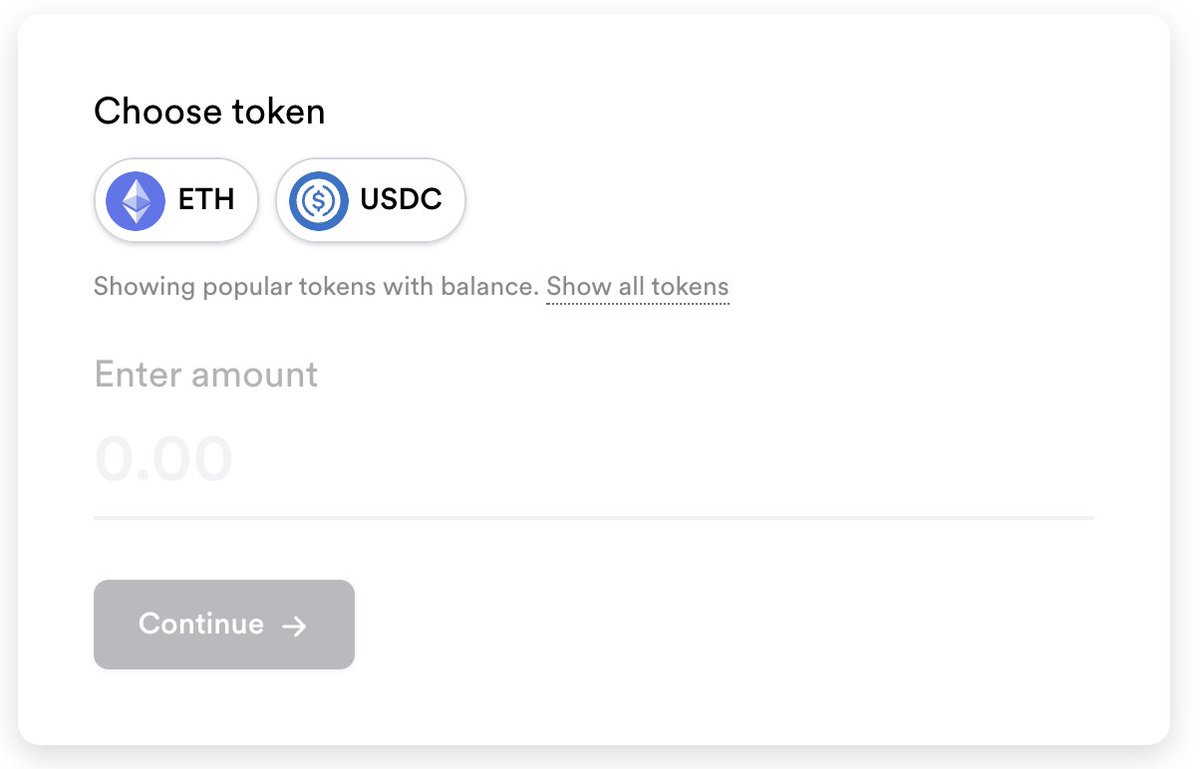

Using Rainbow Bridge (rainbowbridge.app):

• Connect your wallet to Ethereum mainnet

• Enter the token to transfer (currently only supports $ETH and $USDC)

• Confirm the transfer and wait about 10-20 mins

a) From Ethereum

Using Rainbow Bridge (rainbowbridge.app):

• Connect your wallet to Ethereum mainnet

• Enter the token to transfer (currently only supports $ETH and $USDC)

• Confirm the transfer and wait about 10-20 mins

5/

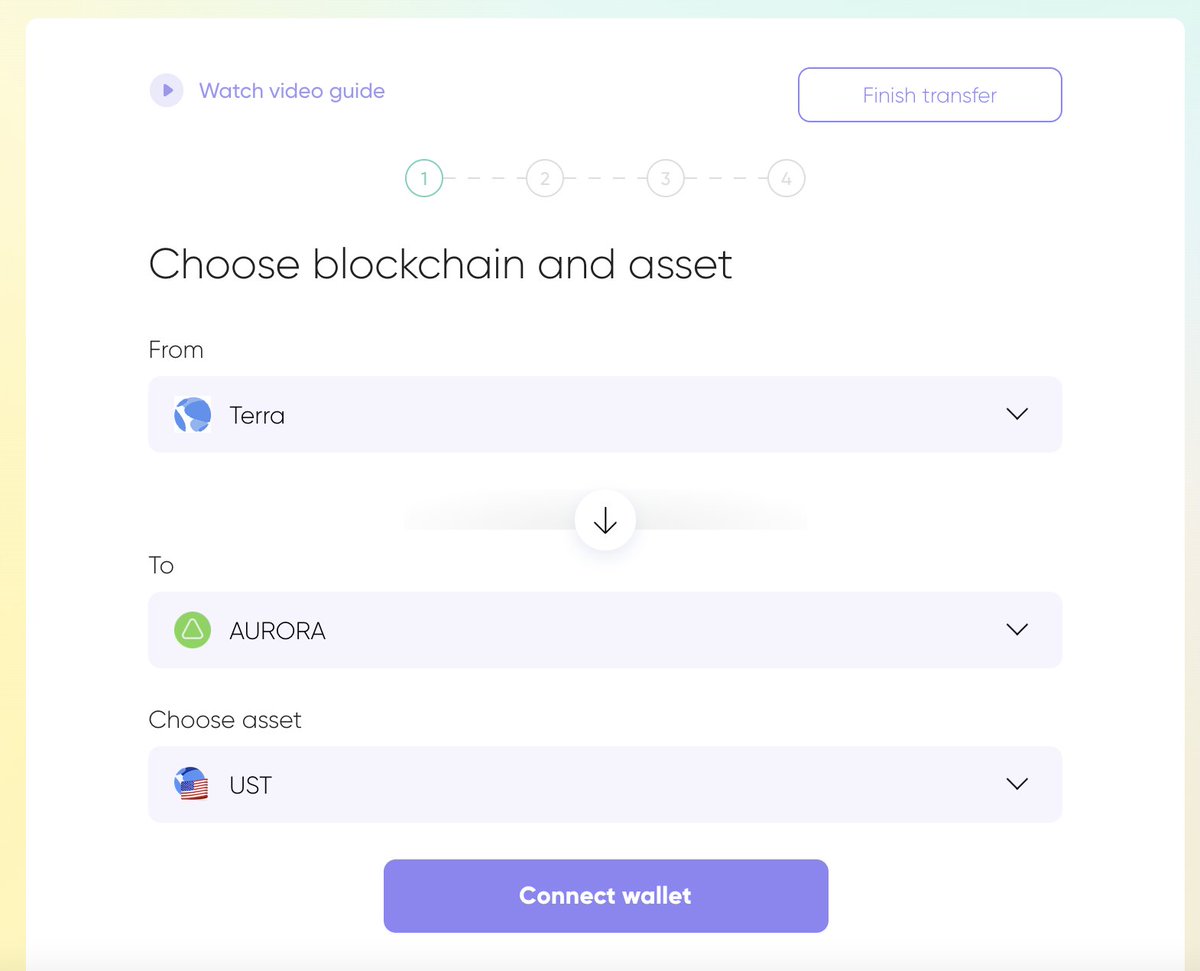

b) From Terra

Using @Allbridge_io (allbridge.io):

• Connect to Terra via Terra Station wallet

• Paste your Metamask address and amount of $UST to bridge over

• Confirm transactions in Terra Station + Metamask and the funds will be ported over <5mins

b) From Terra

Using @Allbridge_io (allbridge.io):

• Connect to Terra via Terra Station wallet

• Paste your Metamask address and amount of $UST to bridge over

• Confirm transactions in Terra Station + Metamask and the funds will be ported over <5mins

6/ Bridging Tips

Use Terra if you want to avoid the high gas fees on Ethereum mainnet + it takes faster for the funds to arrive.

Also, there is no gas fees needed to be paid on Aurora and all transactions are currently free!

Use Terra if you want to avoid the high gas fees on Ethereum mainnet + it takes faster for the funds to arrive.

Also, there is no gas fees needed to be paid on Aurora and all transactions are currently free!

7/ Tools

a) Chain explorer: explorer.mainnet.aurora.dev 🔍

b) Guides: doc.aurora.dev 📚

c) Charts: dexscreener.com/aurora or geckoterminal.com/aurora/tokens 📈

d) TVL: defillama.com/chain/Aurora 💰

e) Farms: vfat.tools/aurora/ 🧑🌾

a) Chain explorer: explorer.mainnet.aurora.dev 🔍

b) Guides: doc.aurora.dev 📚

c) Charts: dexscreener.com/aurora or geckoterminal.com/aurora/tokens 📈

d) TVL: defillama.com/chain/Aurora 💰

e) Farms: vfat.tools/aurora/ 🧑🌾

8/ Dapps

a) Dexes and Farms

• @trisolarislabs (highest TVL on Aurora)

• @wannaswapamm (h/t @bobbyong)

• @RoseOnAurora (enabling deep liquidity)

• @AuroraSwap (farms launching soon)

b) Launchpad

• @NearPad

• @SmartPad_launch

*Others coming soon: aurora.dev/ecosystem

a) Dexes and Farms

• @trisolarislabs (highest TVL on Aurora)

• @wannaswapamm (h/t @bobbyong)

• @RoseOnAurora (enabling deep liquidity)

• @AuroraSwap (farms launching soon)

b) Launchpad

• @NearPad

• @SmartPad_launch

*Others coming soon: aurora.dev/ecosystem

9/ Personal thoughts

With gas completely free and easy bridging solutions, I will be expecting an influx of apes as the next capital rotation occurs.

Moreover, there are strong partnerships such as @RoseOnAurora facilitating the growth of $UST on Aurora fuelling more upside.

With gas completely free and easy bridging solutions, I will be expecting an influx of apes as the next capital rotation occurs.

Moreover, there are strong partnerships such as @RoseOnAurora facilitating the growth of $UST on Aurora fuelling more upside.

10/

Only time will tell whether this will be just be another L1/ L2 capital rotation or will Aurora experience sticky TVL.

It will need to differentiate itself from the other EVM chains and innovate on what has already been built.

For now, enjoying my 60% APR on stablecoins 😬

Only time will tell whether this will be just be another L1/ L2 capital rotation or will Aurora experience sticky TVL.

It will need to differentiate itself from the other EVM chains and innovate on what has already been built.

For now, enjoying my 60% APR on stablecoins 😬

11/ More Information

@analyticalali has a mega thread related to NEAR and Aurora

@_10delta_ was early on Aurora

@Cryptoyieldinfo @SmallCapScience @TaikiMaeda2

@analyticalali has a mega thread related to NEAR and Aurora

https://twitter.com/analyticalali/status/1473938885512151040?s=20

@_10delta_ was early on Aurora

https://twitter.com/_10delta_/status/1474257331428995103?s=20

@Cryptoyieldinfo @SmallCapScience @TaikiMaeda2

12/ Intern Squad

I'm bridgiiiiiiiing @Darrenlautf @analyticalali @M6intern @wassiecapital @The_ReadingApe @0x4C756B65 @jiminstupid @0xminion @0x_intern @delphiintern @sandraaleow @Kyros_Intern @Trudahamzik @playtern @LongHashIntern @M6intern

TY @Auroplaine for his input

I'm bridgiiiiiiiing @Darrenlautf @analyticalali @M6intern @wassiecapital @The_ReadingApe @0x4C756B65 @jiminstupid @0xminion @0x_intern @delphiintern @sandraaleow @Kyros_Intern @Trudahamzik @playtern @LongHashIntern @M6intern

TY @Auroplaine for his input

• • •

Missing some Tweet in this thread? You can try to

force a refresh