Are you facing difficulty to understand MARKET PROFILE?

Read this!

12 Simple Concepts of Market Profile

>>> Thread 🧵<<<

(1/N)

Read this!

12 Simple Concepts of Market Profile

>>> Thread 🧵<<<

(1/N)

Market Profile is a technical concept with a unique charting technique developed by Peter Steidlmayer in 1985.

Market profile is a style of plotting "Price" on the Y-axis and "Time" on the X-axis, which most of the time form a bell-shaped image as the body of the profile

(2/N)

Market profile is a style of plotting "Price" on the Y-axis and "Time" on the X-axis, which most of the time form a bell-shaped image as the body of the profile

(2/N)

Market Profile helps day traders identify Other Timeframe Participants (Big players) who have money and information power.

Our job as short-term traders is to follow these big sharks which give direction to markets.

(3/N)

Our job as short-term traders is to follow these big sharks which give direction to markets.

(3/N)

Each 30-min is designated by a letter, which is also called Time Price Opportunity (TPO)

We denote the first 30 min range with letter ‘A,’ next 30 min with the letter ‘B,’ and we continue this until the end

‘O’ is open price level & ‘#’ indicates the closing price level

(4/N)

We denote the first 30 min range with letter ‘A,’ next 30 min with the letter ‘B,’ and we continue this until the end

‘O’ is open price level & ‘#’ indicates the closing price level

(4/N)

The last range is denoted with ‘M’ as the Indian markets has the last session ‘M' is for only 15 minutes

This charting in Market Profile is called ‘Split’ profile, and pushing these TPOs on the left side (wherever space is present) will create the ‘Un-Split’ profile

(5/N)

This charting in Market Profile is called ‘Split’ profile, and pushing these TPOs on the left side (wherever space is present) will create the ‘Un-Split’ profile

(5/N)

Point of Control (POC) is the price level in which maximum time was spent on any day.

In this image 9980 is the point of control (POC).

Value Area (VA) is the 70% price range around POC.

Range from 9958 to 9992 is the Value Area (VA) on this day.

(6/N)

In this image 9980 is the point of control (POC).

Value Area (VA) is the 70% price range around POC.

Range from 9958 to 9992 is the Value Area (VA) on this day.

(6/N)

WHY MARKET PROFILE?

Many traders don’t understand the importance of TIME on both the price and opportunity level

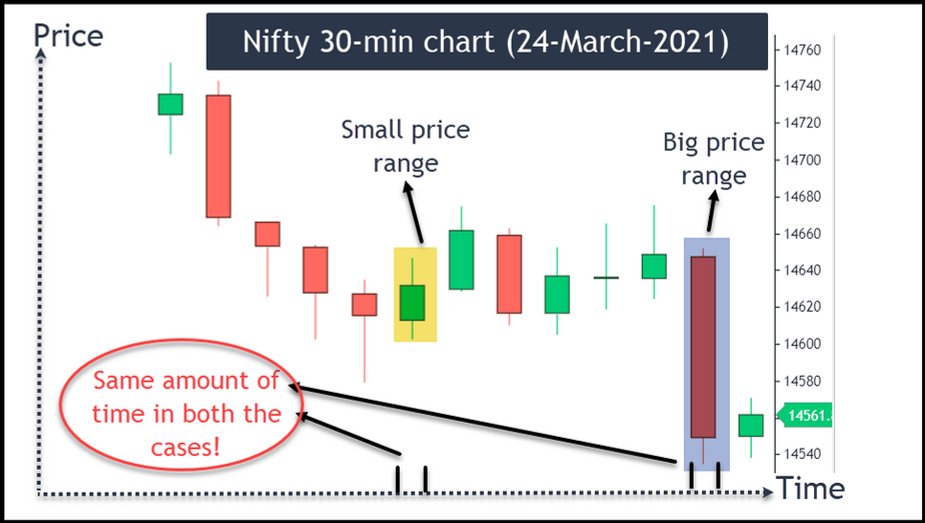

This image shows the same unit of TIME is allocated for both 42 points move and 120 points move

It indicates we are not using the time parameter effectively

(7/N)

Many traders don’t understand the importance of TIME on both the price and opportunity level

This image shows the same unit of TIME is allocated for both 42 points move and 120 points move

It indicates we are not using the time parameter effectively

(7/N)

Now, look at the same day in a market profile chart in this image.

It is evident that the TIME has been allocated effectively based on the price variations.

It gives a 3D view of the price auction with respect to time.

(8/N)

It is evident that the TIME has been allocated effectively based on the price variations.

It gives a 3D view of the price auction with respect to time.

(8/N)

DAY STRUCTURES IN MARKET PROFILE

IB Range is the first 1-hour range in the market.

Based on IB range & price variation around IB range, MP identifies 6 day structures:

Normal Day

Normal Variation Day

Trend Day

DD Day

Non-Trend Day

Neutral Day

(9/N)

IB Range is the first 1-hour range in the market.

Based on IB range & price variation around IB range, MP identifies 6 day structures:

Normal Day

Normal Variation Day

Trend Day

DD Day

Non-Trend Day

Neutral Day

(9/N)

MARKET PROFILE BOOKS:

Below are the best books on Market Profile:

1) Mind Over Markets

2) Mind Markets and Money

3) CBOT Market Profile Handbook

(10/N)

Below are the best books on Market Profile:

1) Mind Over Markets

2) Mind Markets and Money

3) CBOT Market Profile Handbook

(10/N)

MARKET PROFILE SOFTWARE

@gocharting provides free EOD #marketprofile charts

@belltpotw provides the #marketprofile software

(11/N)

@gocharting provides free EOD #marketprofile charts

@belltpotw provides the #marketprofile software

(11/N)

Market Profile vs Volume Profile

MP - Total TPOs counts will be used to calculate the Value Area of the Day. Price profile is also referred to as TPO profile

VP - It is based on the turnover (Qty x Price). POC determined through volume profile will be the same as VWAP

(12/N)

MP - Total TPOs counts will be used to calculate the Value Area of the Day. Price profile is also referred to as TPO profile

VP - It is based on the turnover (Qty x Price). POC determined through volume profile will be the same as VWAP

(12/N)

Market Profile Course

Do you want to learn more about Market Profile and how to use it in Intraday Trading?

Then you can try this course!

stockmarketcourses.in/s/store/course…

(13/N)

Do you want to learn more about Market Profile and how to use it in Intraday Trading?

Then you can try this course!

stockmarketcourses.in/s/store/course…

(13/N)

Loved the concepts?

Please like and retweet them!

Please like and retweet them!

• • •

Missing some Tweet in this thread? You can try to

force a refresh