A Thread on

ICICI Bank

MCAP: 5L Cr

Key Subisidiaries

ILom Gen Ins (51.9% Stake)

IPru Life Ins (51.37% Stake)

IPru MF (51% Stake)

ICICI Sec (75% Stake)

Almost everyone will know broadly about the bank so I won’t spend time over there.

1..

ICICI Bank

MCAP: 5L Cr

Key Subisidiaries

ILom Gen Ins (51.9% Stake)

IPru Life Ins (51.37% Stake)

IPru MF (51% Stake)

ICICI Sec (75% Stake)

Almost everyone will know broadly about the bank so I won’t spend time over there.

1..

Let’s check their financials first quickly

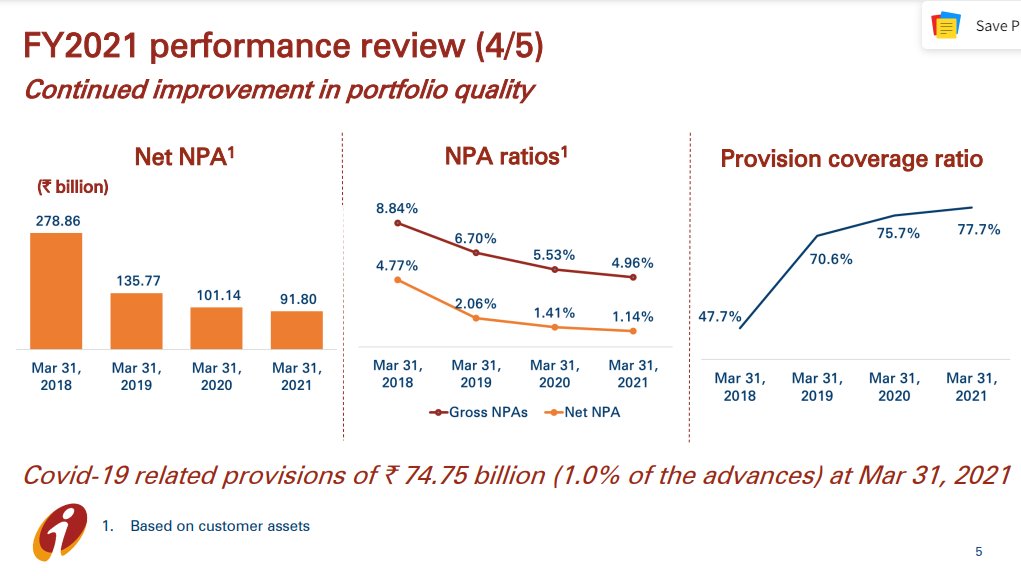

-Net NPA reduces from 4.77% in 2018 to 0.99% in sep21. (for context total adv inc from 5124 Bil to 7649 Bil yet NPA falls)

-NIM inc from 3.23% to 4.00%

-ROAA inc from 0.87% to 1.79%

2..

-Net NPA reduces from 4.77% in 2018 to 0.99% in sep21. (for context total adv inc from 5124 Bil to 7649 Bil yet NPA falls)

-NIM inc from 3.23% to 4.00%

-ROAA inc from 0.87% to 1.79%

2..

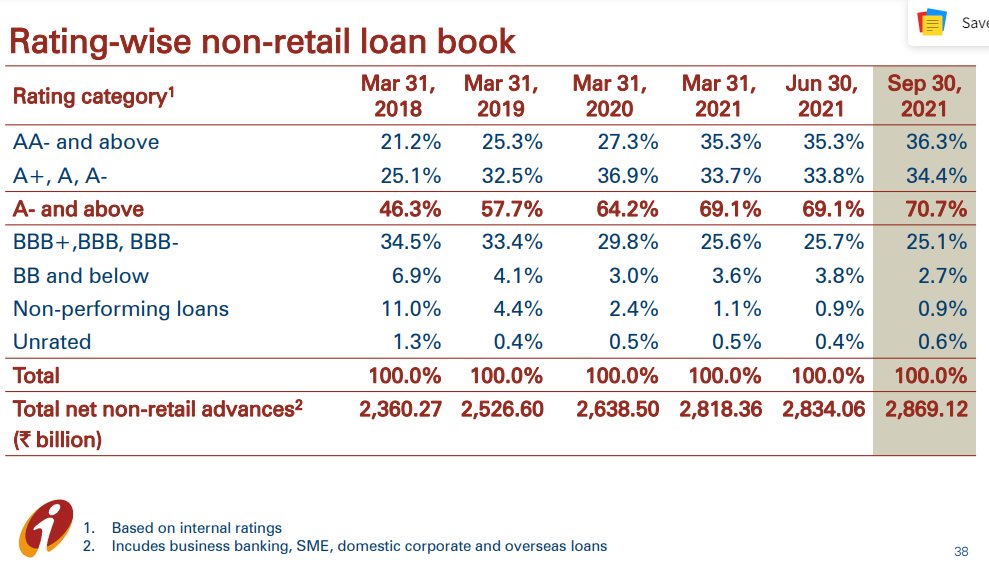

-Rating wise (non-retail): 53.7% of loans were BBB or below rated which is now just 29.30%. This shows immense strength in the book and future fresh NPA will reduce drastically

-Retail loans, which used to be 39% of total in 2014 is now at 62%

3..

-Retail loans, which used to be 39% of total in 2014 is now at 62%

3..

-LTV of HL is 60% and LTV of LAP is just 35% (was really surprised with this)

-Return on Equity (Consolidated): 14.6% (extremely good)

I will try to dig into the transformation that is happening in the bank.

4..

-Return on Equity (Consolidated): 14.6% (extremely good)

I will try to dig into the transformation that is happening in the bank.

4..

It all began with the new mgmt coming to the helm. Analyst day started to happen after that.

The focus of the new mgmt was to reduce NPA and focus on PROFITABLE growth. Their agenda was “One Bank One ROE” ,“ Fair to Customers, Fair to Bank” and “Anything, Anytime, Anywhere”

5..

The focus of the new mgmt was to reduce NPA and focus on PROFITABLE growth. Their agenda was “One Bank One ROE” ,“ Fair to Customers, Fair to Bank” and “Anything, Anytime, Anywhere”

5..

A small note on NPA before we began

GNPA reduces drastically from 8.84% in 2018 to 4.96% in 2021.

Net NPA from 4.77% to 1.14%.

This is significant because Loan book has inc & NPA reduces.

What happens when quality in loan book increases

6..

GNPA reduces drastically from 8.84% in 2018 to 4.96% in 2021.

Net NPA from 4.77% to 1.14%.

This is significant because Loan book has inc & NPA reduces.

What happens when quality in loan book increases

6..

More quality loans > Lesser prob of NPA > Lesser Prov. > Higher Bottom line > Better ratios.

Their Non-retail book consist of 46.3% in A rated loans which was increased to 70.7%. This shows mgmt is highly conservative and still growing rapidly.

7..

Their Non-retail book consist of 46.3% in A rated loans which was increased to 70.7%. This shows mgmt is highly conservative and still growing rapidly.

7..

Now lets check about their tech transformation

These were the main points of the recent Analyst day

-Platform and solutions

-Ecosystem

-Bank to Banktech

-Partner with startup

Lets go through 1 by 1

8..

These were the main points of the recent Analyst day

-Platform and solutions

-Ecosystem

-Bank to Banktech

-Partner with startup

Lets go through 1 by 1

8..

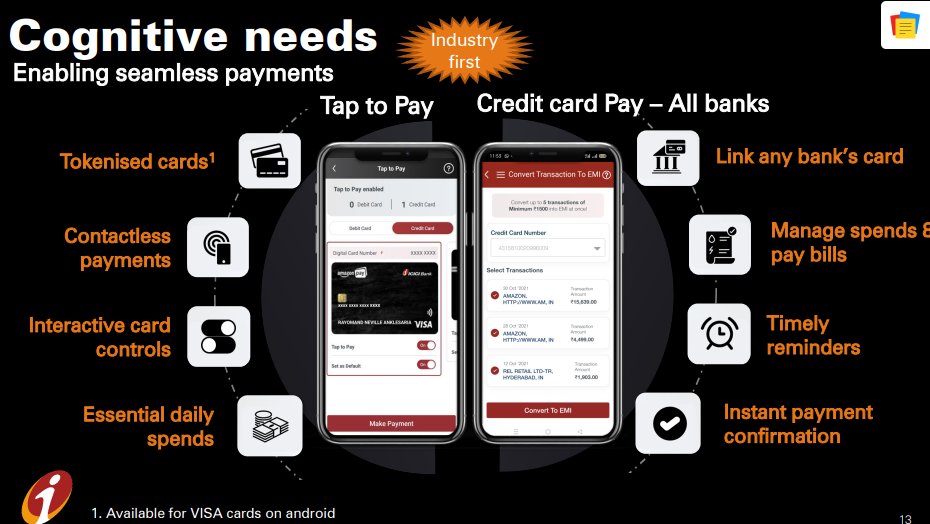

First for retail

It started from India’s first banking app to All banking needs in one app

(In an era where a startup providing multiple credit card management feature is valued close to 40K Cr, ICICI implemented the same feature in it’s app too)

9..

It started from India’s first banking app to All banking needs in one app

(In an era where a startup providing multiple credit card management feature is valued close to 40K Cr, ICICI implemented the same feature in it’s app too)

9..

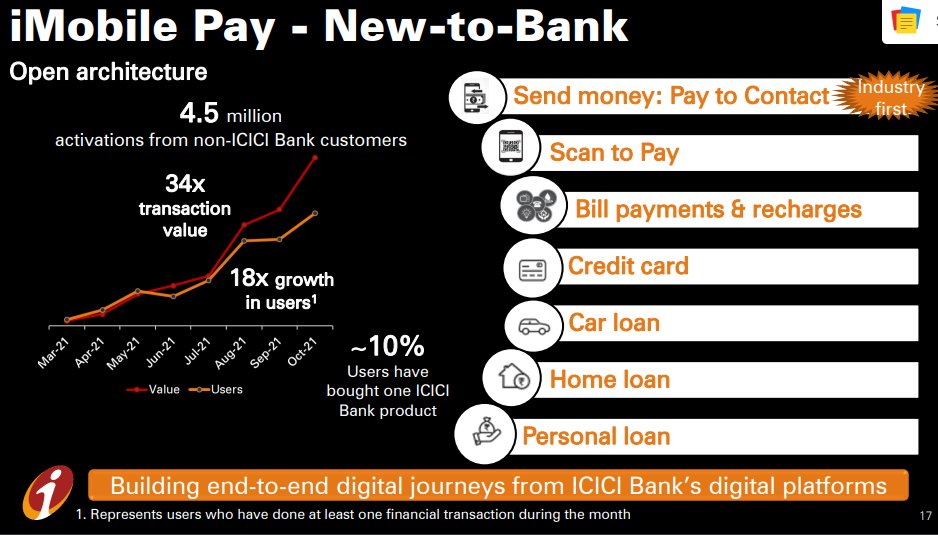

The result of this superapp is 4.5 Mil activation from NON-ICICI bank customers who is using it extensively and is being cross-sell (atleast 10% users have bought atleast 1 ICICI bank product, this is significant and nice way to convert to permanent customers)

10..

10..

Some Facts

- Credit Card is 100% digitally sourced

-55% KYC is Video KYC for CC

-Digital Sales: (Saving Ac: 28%, FD vol: 52%, FD Val:25%, Loans (HL,Auto,PL,GL) approval: 23%, Disb:16%)

11.

- Credit Card is 100% digitally sourced

-55% KYC is Video KYC for CC

-Digital Sales: (Saving Ac: 28%, FD vol: 52%, FD Val:25%, Loans (HL,Auto,PL,GL) approval: 23%, Disb:16%)

11.

-New initiativies like iplay videos, orange book blog, pockets, etc (however these are for just acquiring customers for other product)

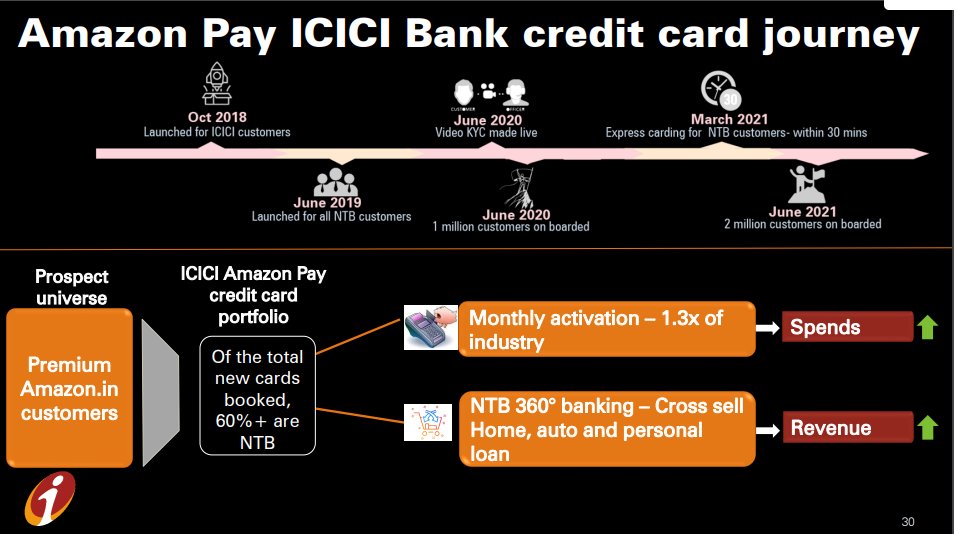

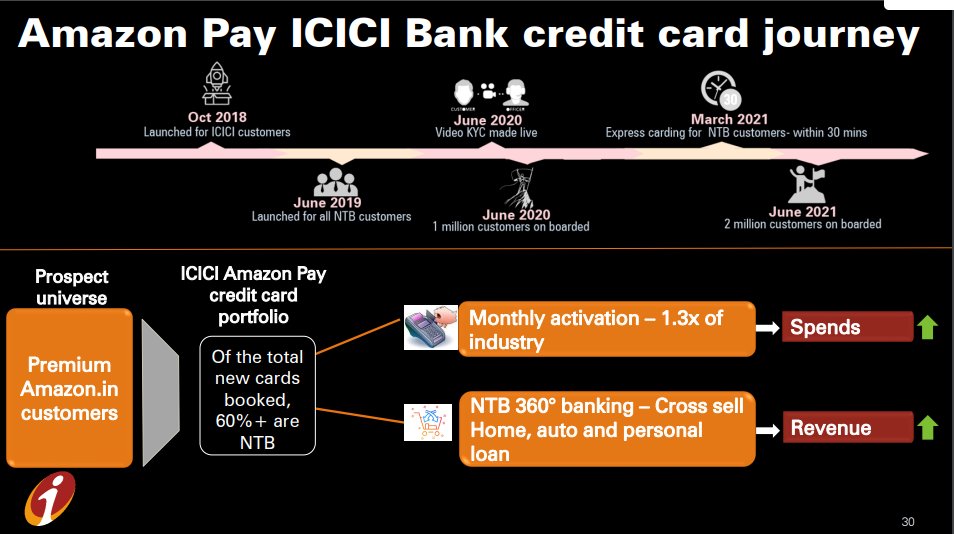

-They tied-up with Amazon for credit Card.started on Oct 2018, they onboarded 2Mil customers (60% are New to Bank)

12..

-They tied-up with Amazon for credit Card.started on Oct 2018, they onboarded 2Mil customers (60% are New to Bank)

12..

-New launches Tap to pay using mobile,

-Just look at the growth in digital sourcing in retail products

-Their market share in CC is 17.9%

Because of the tie-up with Amazon, they could provide CC to premium customers, since those customers might also be prime members.

13..

-Just look at the growth in digital sourcing in retail products

-Their market share in CC is 17.9%

Because of the tie-up with Amazon, they could provide CC to premium customers, since those customers might also be prime members.

13..

Further, they are now also providing instant OD facility to sellers registered on Amazon. Even they have similar tie-up with flipkart too.

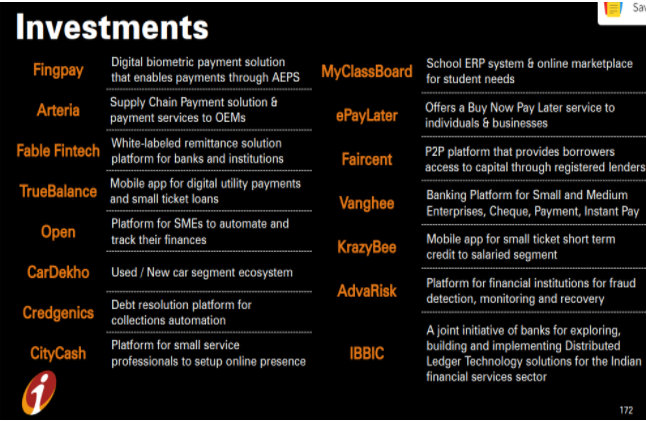

Now few interesting initiatives, partnerships and investments by them

14.

Now few interesting initiatives, partnerships and investments by them

14.

ICICI Bank Festival Bonanza

This was something interesting. They listed out almost all major e-comm website and brands alongwith the details of discounts and cashback at one place

icicibank.com/festivebonanza…

15..

This was something interesting. They listed out almost all major e-comm website and brands alongwith the details of discounts and cashback at one place

icicibank.com/festivebonanza…

15..

Home Utsav ICICI

A virtual property expo. They had showcased all major builders with special offers and ofcourse with facility of home loan.

homeutsavicici.com

16..

A virtual property expo. They had showcased all major builders with special offers and ofcourse with facility of home loan.

homeutsavicici.com

16..

Paylater

It has it’s own BNPL, which is just another form of low ticket credit facility.

icicibank.com/personal-banki…

I have written more on BNPL here.

17..

It has it’s own BNPL, which is just another form of low ticket credit facility.

icicibank.com/personal-banki…

I have written more on BNPL here.

https://twitter.com/Falak_Kalyani/status/1452263550198681602?s=20

17..

Now on SME

ICICI Eazypay (powered by Snapbizz)

Digital store management. It converts your physical store into online store and helps you buy/sell from wholesaler/retailer

icicibank.com/business-banki…?

19..

ICICI Eazypay (powered by Snapbizz)

Digital store management. It converts your physical store into online store and helps you buy/sell from wholesaler/retailer

icicibank.com/business-banki…?

19..

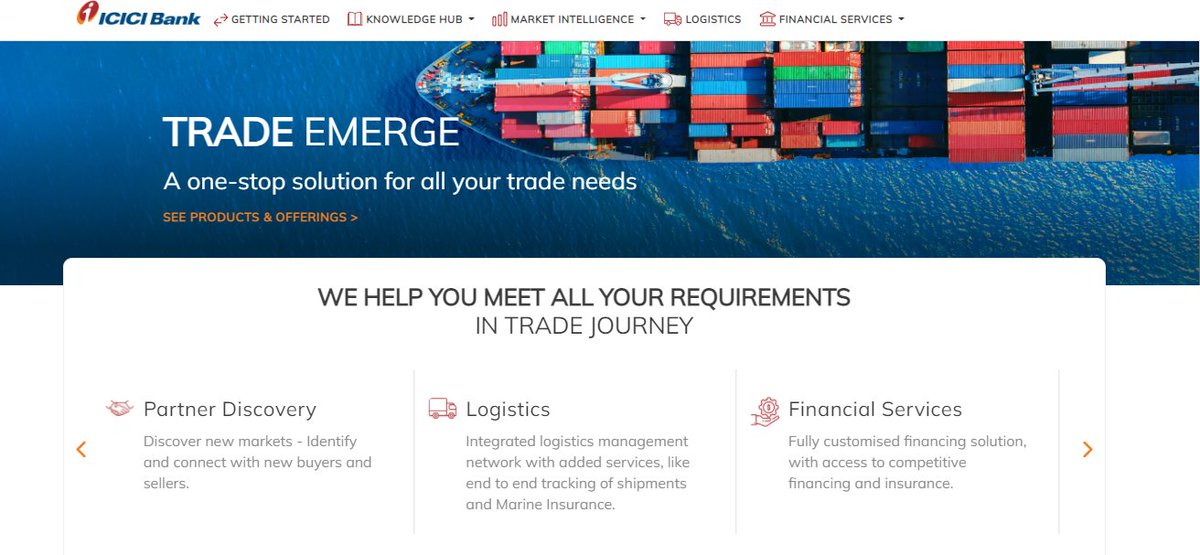

Trade Emerge

One stop shop for all trade related solutions

trade-emerge.icicibank.com/Trade/

Infinite India

One stop shop for Foreign Entities for pre-post incorporation services , , licenses, registrations, taxation, compliances, HR services, etc

infiniteindia.icicibank.com

21..

One stop shop for all trade related solutions

trade-emerge.icicibank.com/Trade/

Infinite India

One stop shop for Foreign Entities for pre-post incorporation services , , licenses, registrations, taxation, compliances, HR services, etc

infiniteindia.icicibank.com

21..

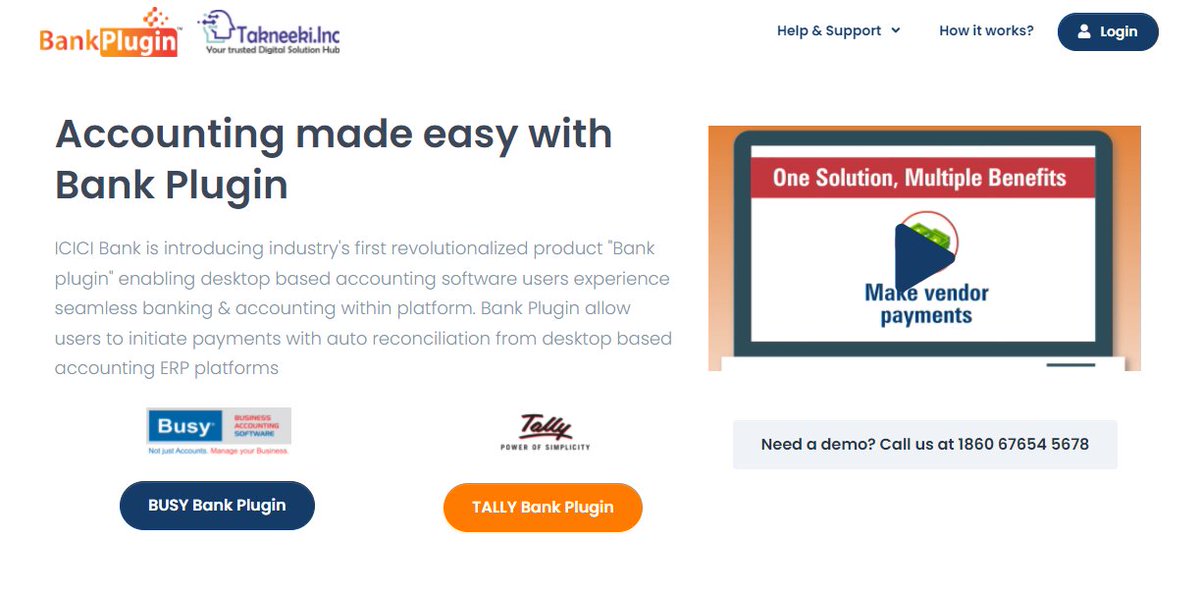

Bankplugin

Banking and accounting platform associating Tally and Busy softwares.

bankplugin.com

Bankconnect 2.0

A digital banking platform for new age MSME and micro entrepreneurs with OPEN company

bankonnect.co

22..

Banking and accounting platform associating Tally and Busy softwares.

bankplugin.com

Bankconnect 2.0

A digital banking platform for new age MSME and micro entrepreneurs with OPEN company

bankonnect.co

22..

Eazysound

Launched Paytm type of sound system for every credit received

icicibank.com/business-banki…

Complete lists of tie-up with startups

icicibank.com/business-banki…

23..

Launched Paytm type of sound system for every credit received

icicibank.com/business-banki…

Complete lists of tie-up with startups

icicibank.com/business-banki…

23..

Complete lists of tie-up with startups

icicibank.com/business-banki…

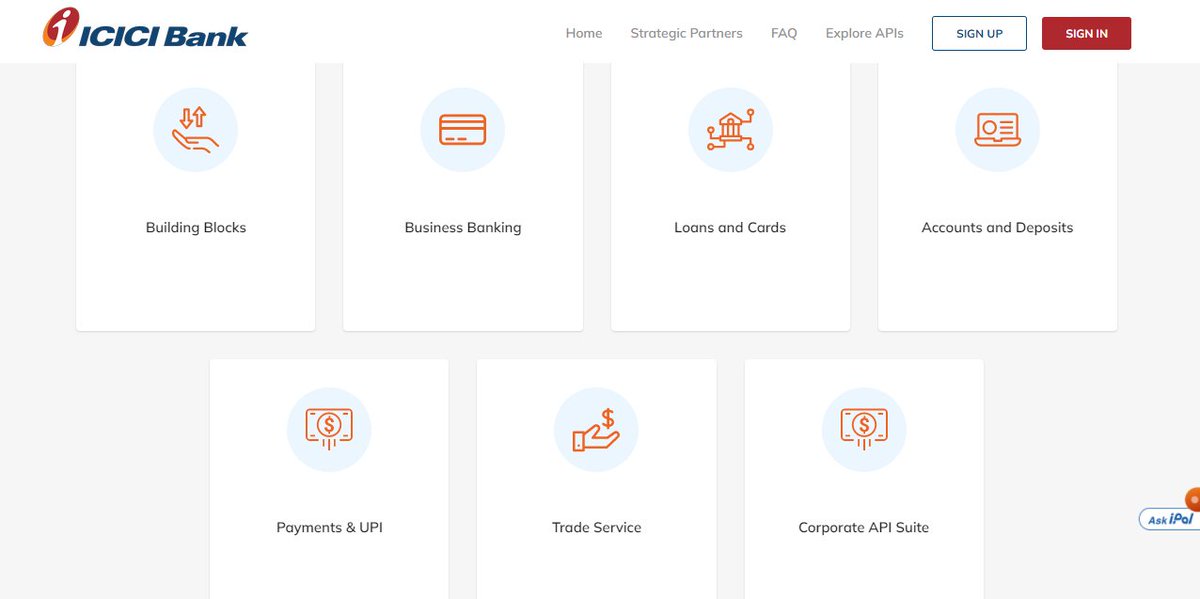

API Banking

developer.icicibank.com/#/index

Instabiz

icicibank.com/digital-bankin…

24.

icicibank.com/business-banki…

API Banking

developer.icicibank.com/#/index

Instabiz

icicibank.com/digital-bankin…

24.

Looks Like by partnering with all these startups, by integrating with them, they will be able to get transaction based information "DATAPOINTS" to lend easily. Let's see how it goes.

25..

25..

Trading at P/BV of 3.41

ROE (CON.) 14.6%

Lets just fetch values of Subsidiaries

ICICI Lom: MCAP 65K cr with 51.9% it comes to

33K cr

ICICI Pru: MCAP 81K cr with 51.37% it comes to

41K cr

ICICI Sec: MCAP 25K cr with 75% it comes to

18K cr

26..

ROE (CON.) 14.6%

Lets just fetch values of Subsidiaries

ICICI Lom: MCAP 65K cr with 51.9% it comes to

33K cr

ICICI Pru: MCAP 81K cr with 51.37% it comes to

41K cr

ICICI Sec: MCAP 25K cr with 75% it comes to

18K cr

26..

ICICI MF (unlisted): Made a pat of 1179 cr (HDFC AMC made pat of 1375 cr and is traded at 50K cr) with ICICI stake of 51% can I assume it around 20Kcr

These all translates to 112K cr.

So pretty decent valuation.

27..

These all translates to 112K cr.

So pretty decent valuation.

27..

Disclosure: I am NOT as SEBI RIA, these are my own views, pls do your dd. I have vested int at ICICI Bank , ILOM and IPRU LI.

Sry for delay thread, it took alot of time and effort to bring all these.

Thank You

Jai Shri Krishna🙏

Sry for delay thread, it took alot of time and effort to bring all these.

Thank You

Jai Shri Krishna🙏

It is expected that Int. rate will inc in 2022. Lets see its impact.

In Rate cut scenarios, On every rate cut, your income gets hit as it becomes effective immediately on loans (since they are floating)

In Rate cut scenarios, On every rate cut, your income gets hit as it becomes effective immediately on loans (since they are floating)

while it takes, say around 12 months, to reflect in FD (since they are fixed in nature and effect will be seen post rollover)

However on the positive note, lower rate will inc demand for loans and reduce rollover for FD. Since depositors look for better returns.

However on the positive note, lower rate will inc demand for loans and reduce rollover for FD. Since depositors look for better returns.

Pretty decent results declared by ICICI BANK. Adequately Capitalise, Npa reducing, ROA improving.

What I liked the most is their efforts of digital front, just look at the scale of non-icici bank customer they are serving.

Consolidated took a little hit as ins. Sector took hit.

What I liked the most is their efforts of digital front, just look at the scale of non-icici bank customer they are serving.

Consolidated took a little hit as ins. Sector took hit.

They delivered good performance across all segments, they still maintained decent Covid provision, their digital efforts will take them next level. 20% machine going forward.

A Sub-Thread on recent ICICI Bank's quarterly result.

Was studying the results/ppt of ICICI Bank, found few interesting points.

Was studying the results/ppt of ICICI Bank, found few interesting points.

Under Retails PF there is extra ordinary growth achievement in Mortgages, PL and CC of 23.3%,22.8% and 32.1% resp. How is such big jump possible?

They continued to spend on tech related exp. 8.4% of operating exp of 9M of 2022.

Their iMobile now has 5.3M activation from Non-ICICI bank customer, this is big achievement which is growing exponentially.

There is a 73% inc in value of tran. OVER LAST QUARTER (This is huge)

Their iMobile now has 5.3M activation from Non-ICICI bank customer, this is big achievement which is growing exponentially.

There is a 73% inc in value of tran. OVER LAST QUARTER (This is huge)

It has live end-to-end digital journey in products like Saving A/c, CC, PL and Home Loan

This resulted in 43% (by volume) disb in PL (up from 42% as on 03/21), 26% in CC (up from 15%) and 33% in Mortgages sanctions (up from 19%). Note that these are all FULLY SELF-SERVICED

This resulted in 43% (by volume) disb in PL (up from 42% as on 03/21), 26% in CC (up from 15%) and 33% in Mortgages sanctions (up from 19%). Note that these are all FULLY SELF-SERVICED

Let’s peel off one more layer

Mortgages:

70% of Mortgages are Home Loans and 19% LAP.

Express HL , a DIY platform has monthly traffic of 300000+

75% of customer have liability relationship with bank i.e. have CASA. (remember 5.3M point above) There could be many cus from that.

Mortgages:

70% of Mortgages are Home Loans and 19% LAP.

Express HL , a DIY platform has monthly traffic of 300000+

75% of customer have liability relationship with bank i.e. have CASA. (remember 5.3M point above) There could be many cus from that.

Does that mean they are aggressive in evaluating risk?

LTV of HL is 60%

LTV of LAP is just 35%

PRETTY CONSERVATIVE

LTV of HL is 60%

LTV of LAP is just 35%

PRETTY CONSERVATIVE

Now let's look at SME and Business Banking

Just look at the YoY growth, phenomenal

30% of the domestic loan book has FIX ROI !!! Strange.

Just look at the YoY growth, phenomenal

30% of the domestic loan book has FIX ROI !!! Strange.

One of the reason of very high YoY growth is tie-up with Flipkart and Amazon for Seller lending program.

It has quick TAT from 4 days to just 3 hours

It's efforts to bring ecosystem for merchants is bringing rewards now.

It has quick TAT from 4 days to just 3 hours

It's efforts to bring ecosystem for merchants is bringing rewards now.

All this efforts had led to reduction in cost and increase in the return ratios. Pretty good ROA and ROE, believe that it's likely to improve further.

One point to consider.

Are they taking unnecessary risks? Is there chance of NPA in future and concentration risks.

We can see that it had build strong high rated loan PF with reduction of concentration.

likely to improve over coming period

Good Impressive performance overall

Are they taking unnecessary risks? Is there chance of NPA in future and concentration risks.

We can see that it had build strong high rated loan PF with reduction of concentration.

likely to improve over coming period

Good Impressive performance overall

• • •

Missing some Tweet in this thread? You can try to

force a refresh