.@KaikoData's 2021 Year in Review just got released.

15 charts. 15 take-aways from this year's data.

Let's do this.

blog.kaiko.com/2021-year-in-r…

0/15

15 charts. 15 take-aways from this year's data.

Let's do this.

blog.kaiko.com/2021-year-in-r…

0/15

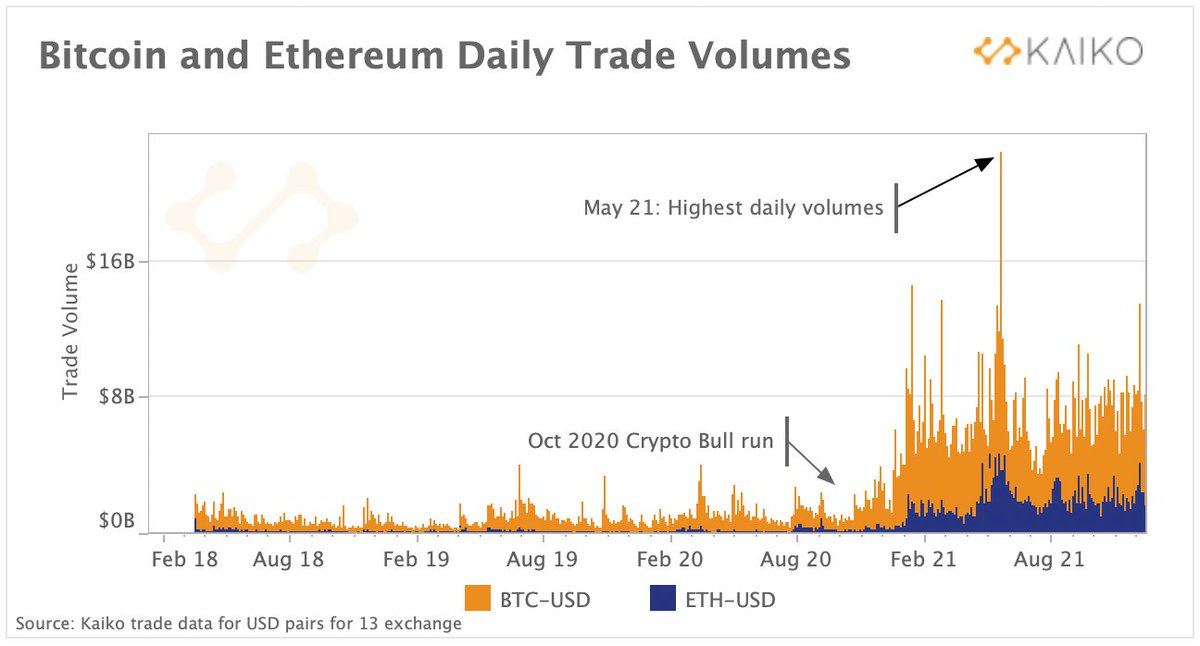

1/15: Trade volumes are way up.

This helped us to comfortably break the $1T overal crypto market cap in January. After that, we never looked back.

This helped us to comfortably break the $1T overal crypto market cap in January. After that, we never looked back.

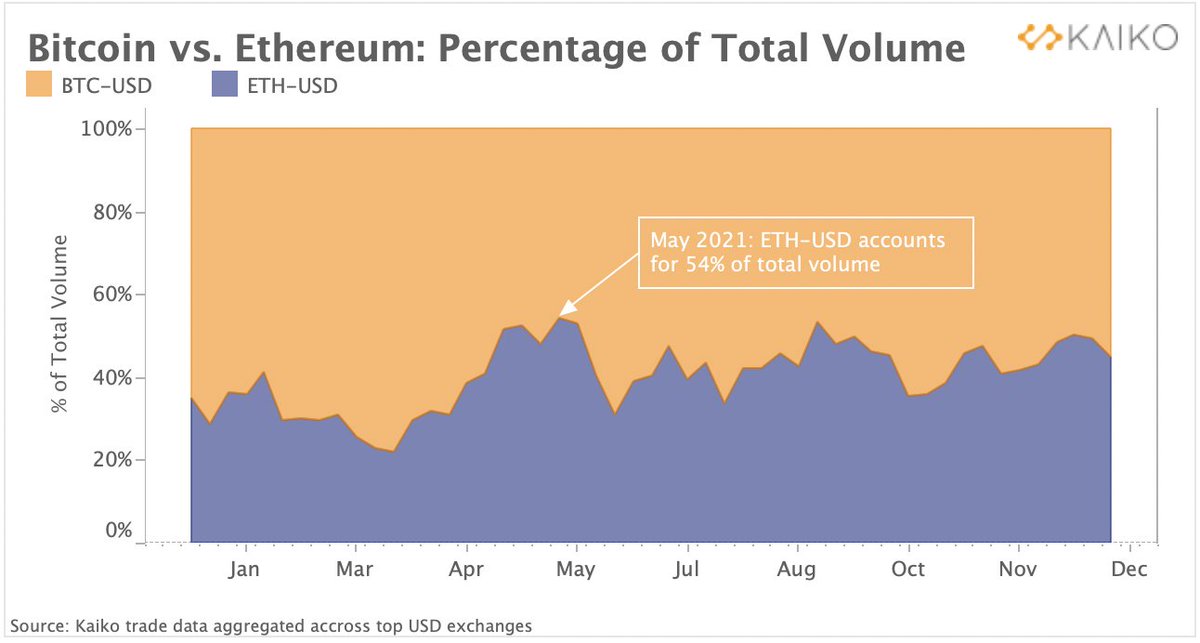

2/15: Ethereum market share surged.

The '17-'18 market cap flippening narrative might not be as present today as it was back then, but if we only take into account traded volume, ETH flipped BTC (although temporarily) on multiple occasions.

The '17-'18 market cap flippening narrative might not be as present today as it was back then, but if we only take into account traded volume, ETH flipped BTC (although temporarily) on multiple occasions.

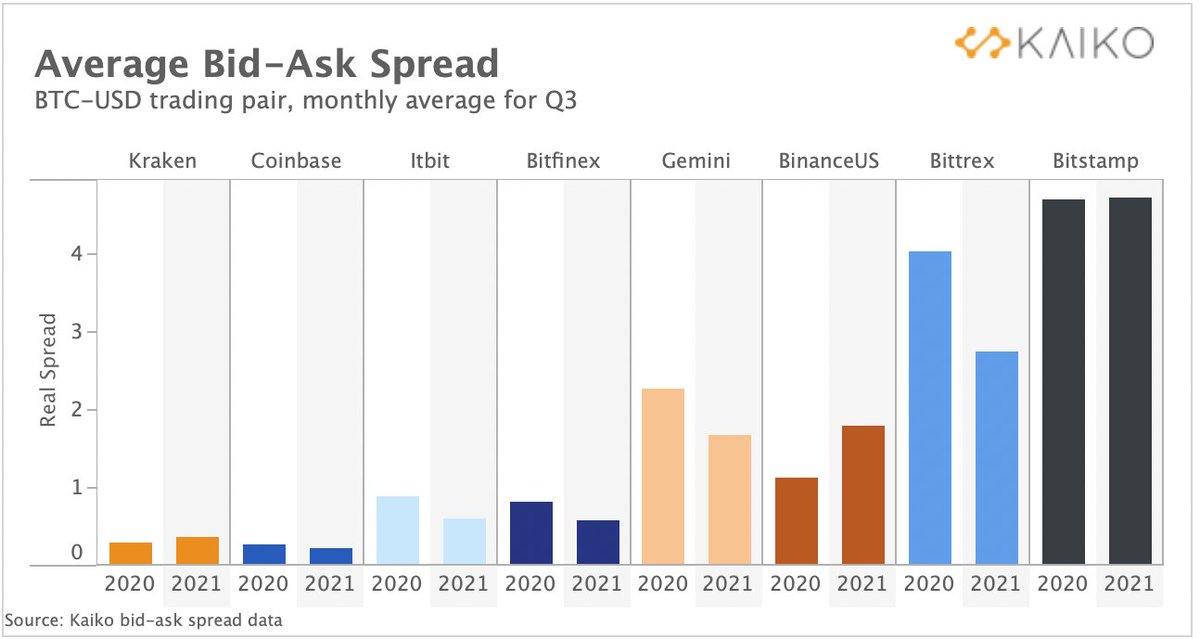

3/15: Average liquidity improved

Comparing Q3 2020 to Q3 2021, most exchanges so a decrease in average spread for BTC-USD. This indicates better liquidity and maturity of the markets.

Still a long way to go for most altcoin pairs, however.

Comparing Q3 2020 to Q3 2021, most exchanges so a decrease in average spread for BTC-USD. This indicates better liquidity and maturity of the markets.

Still a long way to go for most altcoin pairs, however.

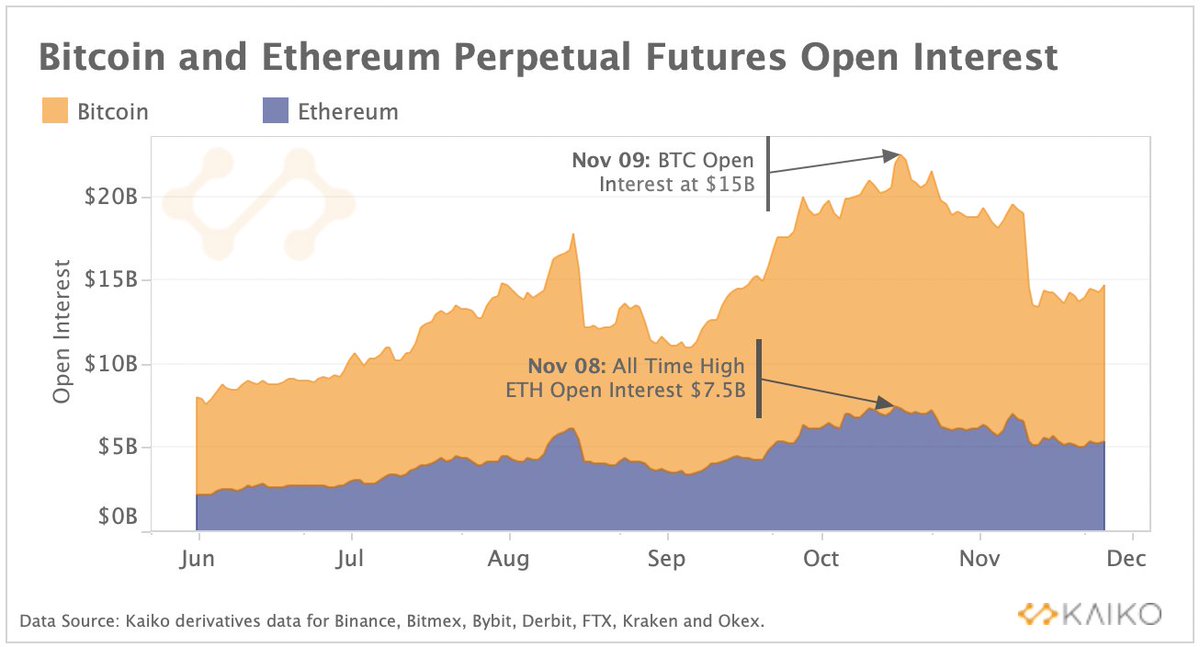

4/15: Open interest broke all time highs

More derivative products, more degenerates, higher leverage. Greed led to some of the highest levels of Open Interest.

More derivative products, more degenerates, higher leverage. Greed led to some of the highest levels of Open Interest.

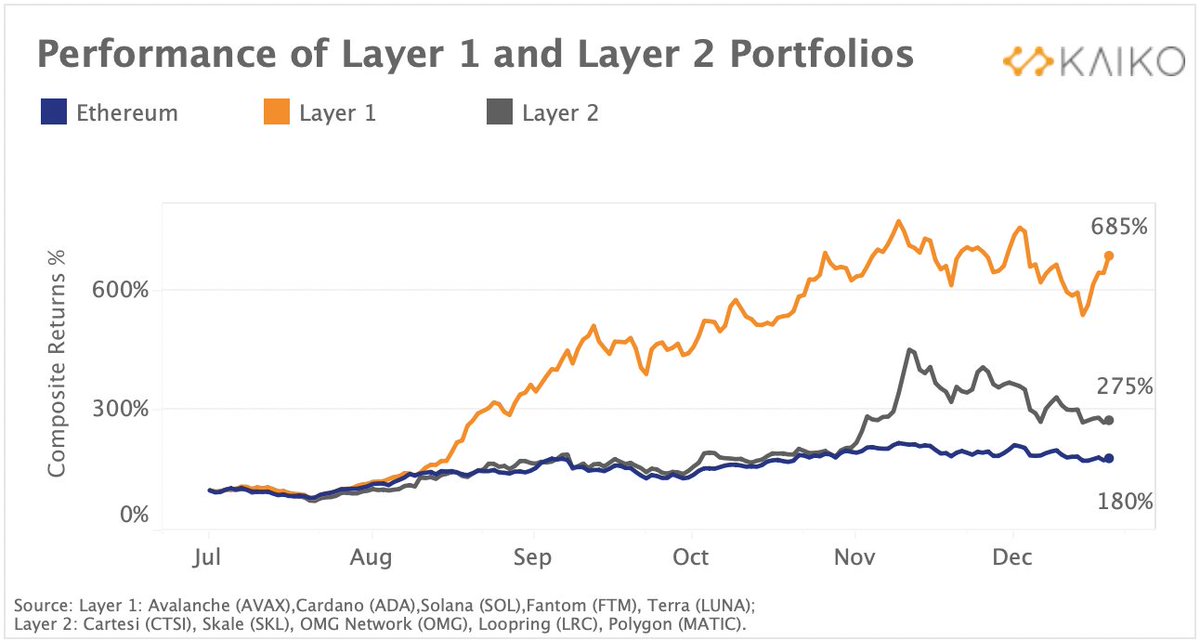

5/15: Ethereum scalability concerns propelled L1s and L2s.

This year was the year of alternative L1s and Ethereum L2s. Solana, Avalanche, Terra stole the show in the former category. Polygon was the clear winner among L2 solutions with a native token.

This year was the year of alternative L1s and Ethereum L2s. Solana, Avalanche, Terra stole the show in the former category. Polygon was the clear winner among L2 solutions with a native token.

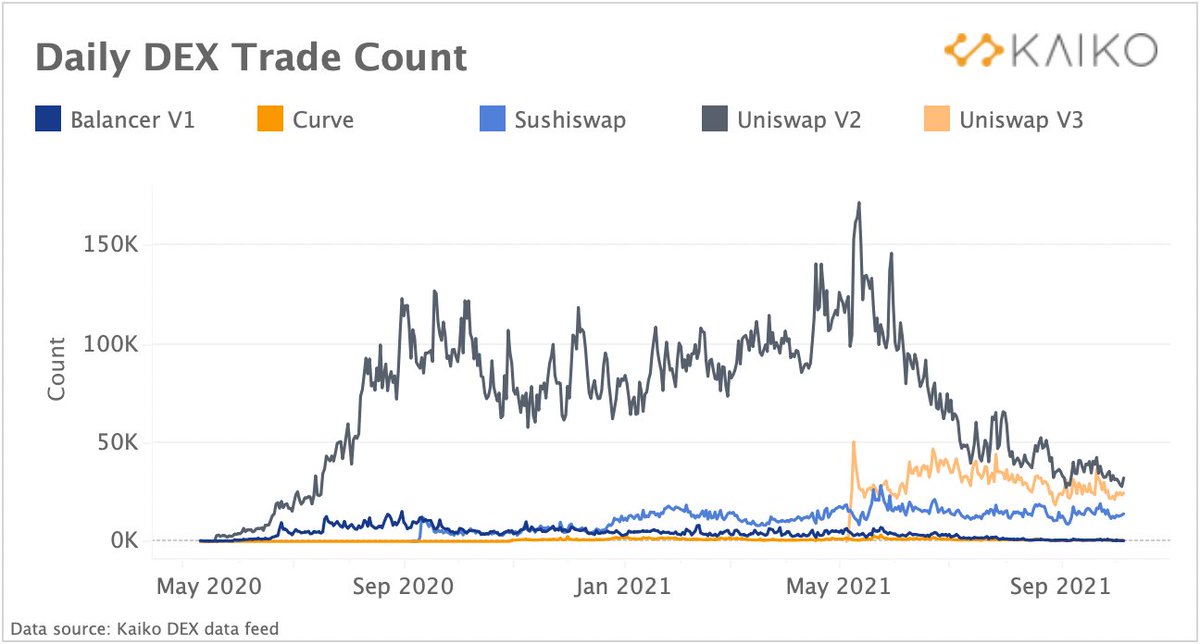

6/15: DEXs became too expensive

Volumes up. Trade counts down.

The result of the insane fees on Ethereum L1.

🦐s being priced out of the shitcoin casino. At least on Ethereum.

Volumes up. Trade counts down.

The result of the insane fees on Ethereum L1.

🦐s being priced out of the shitcoin casino. At least on Ethereum.

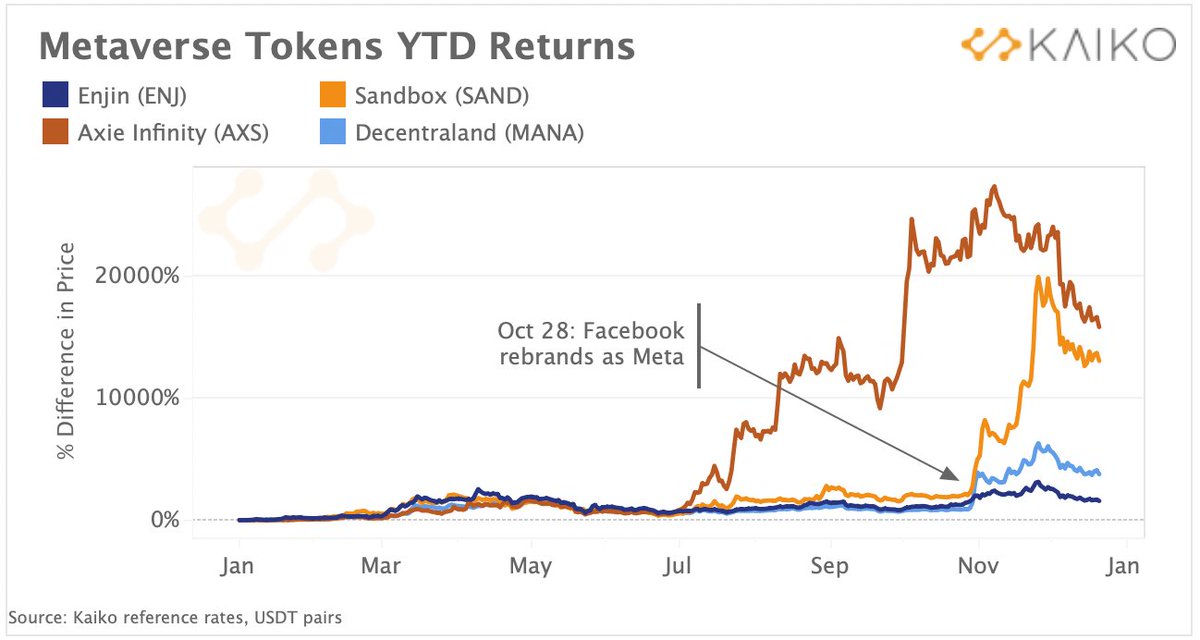

7/15: The Mateverse went mainstream

Maybe the easiest play of the year: Facebook rebrands to Meta, metaverse coins moon. The Zuck effect.

Maybe the easiest play of the year: Facebook rebrands to Meta, metaverse coins moon. The Zuck effect.

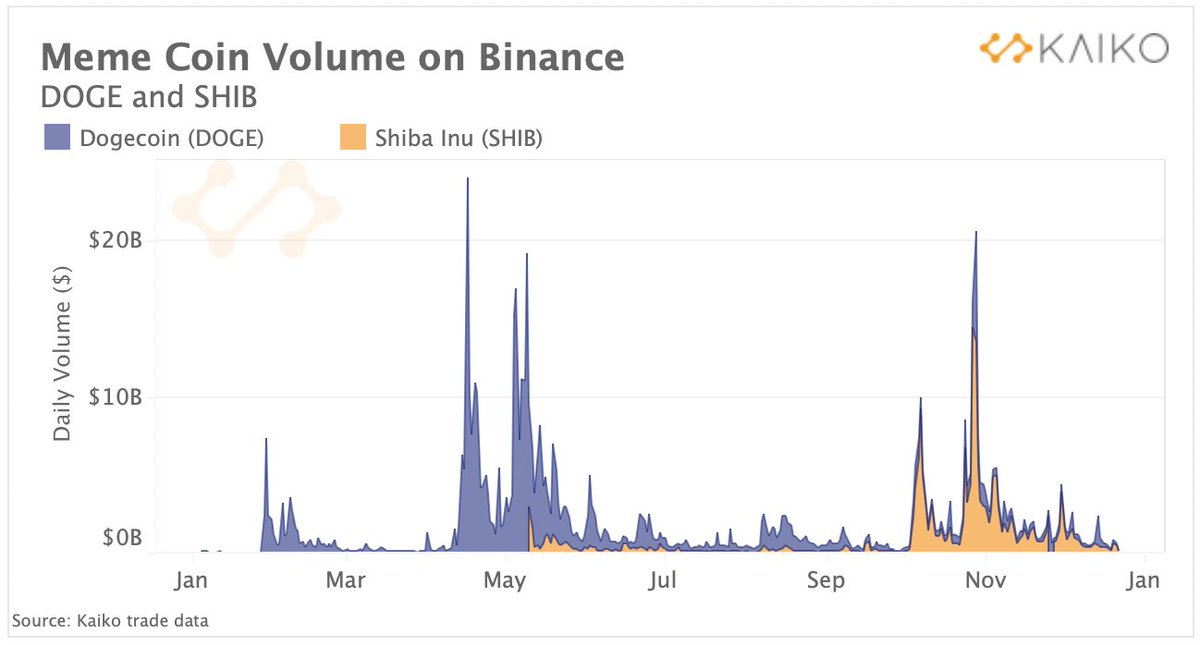

8/15: Meme coins became reality

Another cycle, another crazy $DOGE run. Elon was their hero, and arguably the instigator of the boom in one of most controversial categories in crypto: meme coins

Coins with 0 utility except "numba go up", and that's exactly what they did.

Another cycle, another crazy $DOGE run. Elon was their hero, and arguably the instigator of the boom in one of most controversial categories in crypto: meme coins

Coins with 0 utility except "numba go up", and that's exactly what they did.

9/15: The stablecoin crackdown began

Regulators finally started paying attention to stablecoins. Tether came under scrutiny, and Circle's CSO answered the US Senate's questions about USDC.

Without a doubt, to be continued in 2022.

Regulators finally started paying attention to stablecoins. Tether came under scrutiny, and Circle's CSO answered the US Senate's questions about USDC.

Without a doubt, to be continued in 2022.

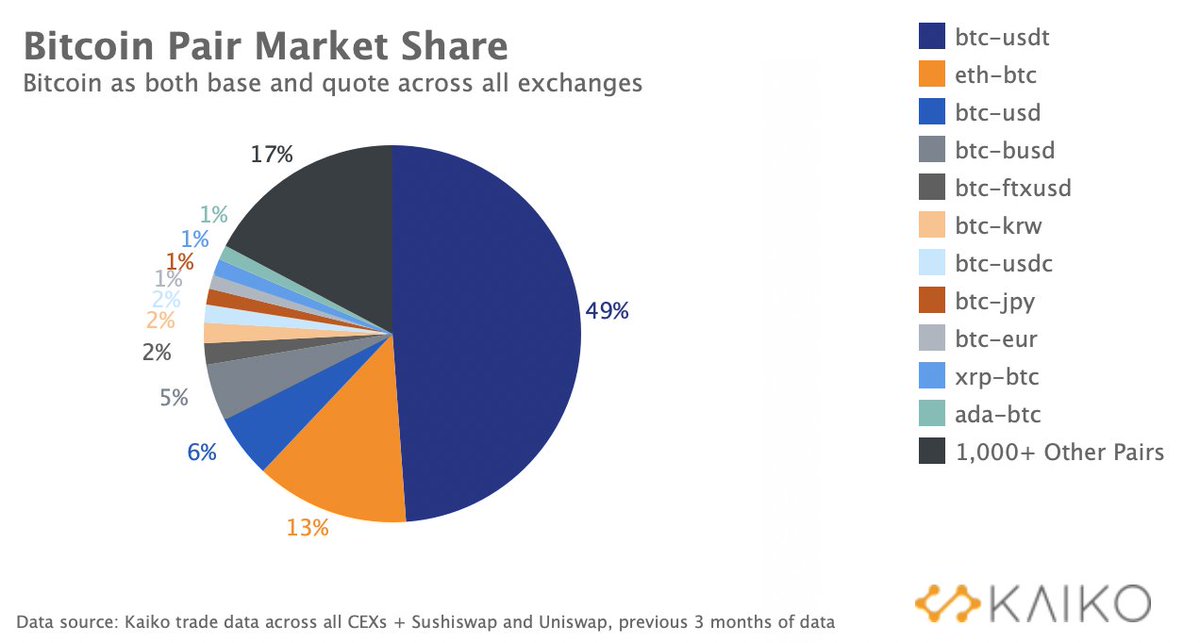

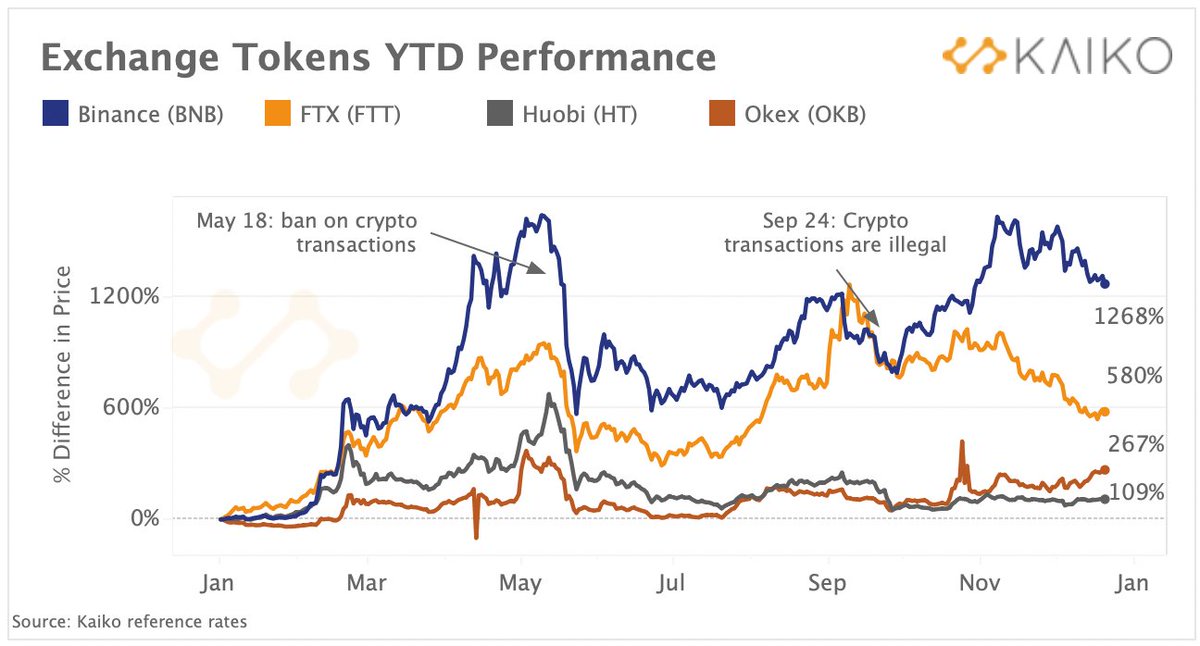

10/15: China ban threatens exchanges

China ban, part 5310? Bitcoin miners were kicked out and exchanges with a predominantly Asian user base, such as Huobi and Okex, saw their tokens plummeting (although still being very green YTD).

China bro, y so hostile?

China ban, part 5310? Bitcoin miners were kicked out and exchanges with a predominantly Asian user base, such as Huobi and Okex, saw their tokens plummeting (although still being very green YTD).

China bro, y so hostile?

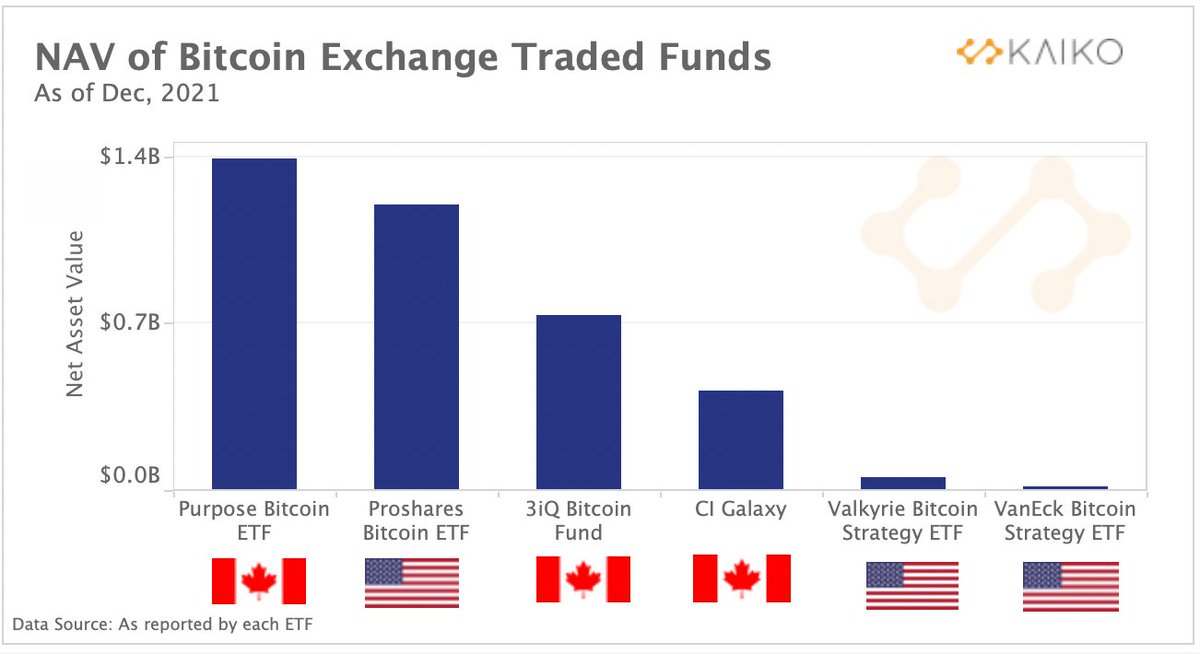

11/15: The first U.S. Bitcoin ETF was approved

That was cool. But also, it was not.

While we were all waiting for a BTC Spot ETF, the SEC approved ProShares futures ETF. A step in the right direction, with $1B in volume in the first 48h.

wen spot ETF @SECGov?

That was cool. But also, it was not.

While we were all waiting for a BTC Spot ETF, the SEC approved ProShares futures ETF. A step in the right direction, with $1B in volume in the first 48h.

wen spot ETF @SECGov?

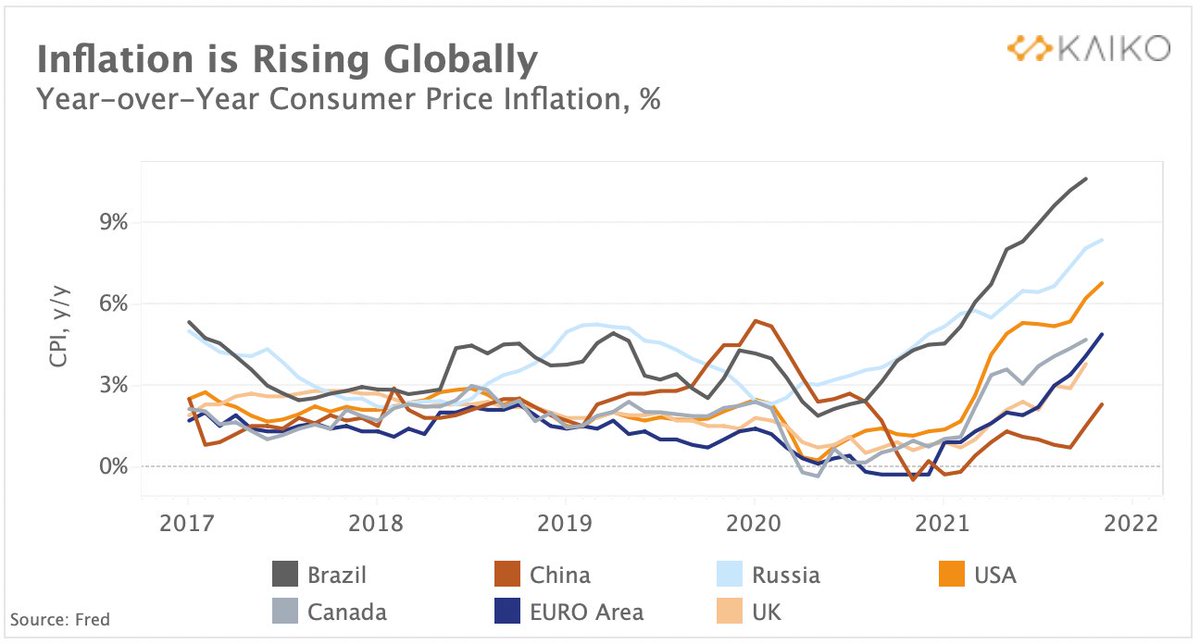

12/15 Inflation on a global rampage

Remember when inflation was transitory? I dont, but at least the FED doesn't think it is transitory anymore either

Bitcoin, the ultimate inflation hedge, is still disappointing from that perspective. When investors go risk-off, Bitcoin bleeds

Remember when inflation was transitory? I dont, but at least the FED doesn't think it is transitory anymore either

Bitcoin, the ultimate inflation hedge, is still disappointing from that perspective. When investors go risk-off, Bitcoin bleeds

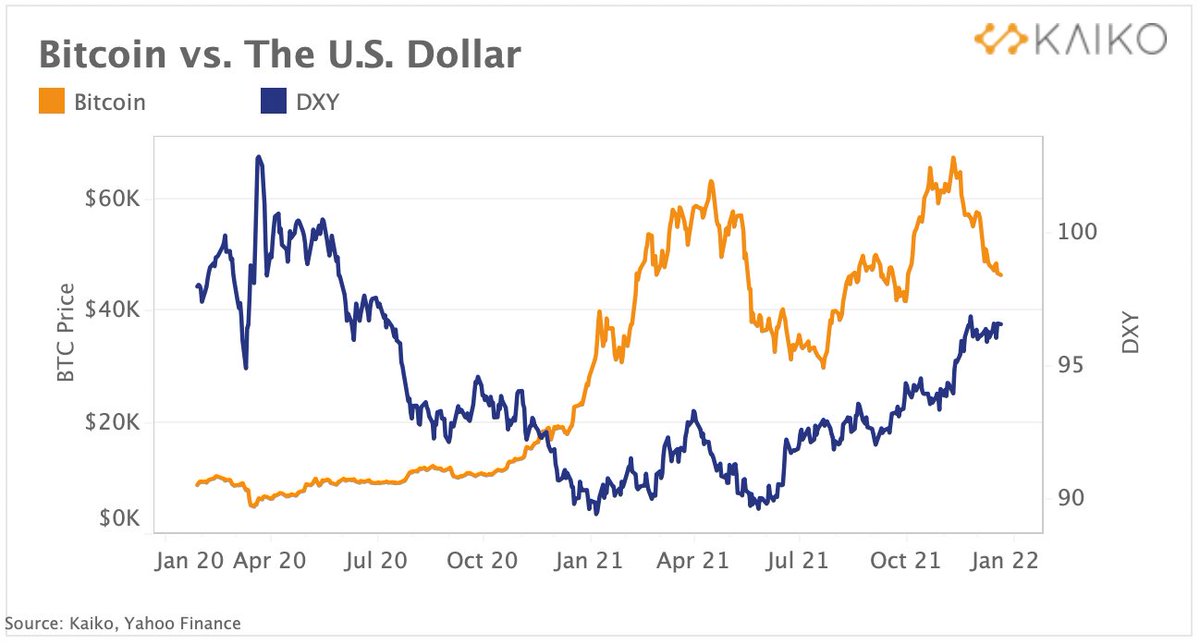

13/15: The U.S. Dollar is up

Rising inflation and the expectation of a more hawkish FED made the dollar rally, finishing at a gain of ~6.94% YTD.

Bad news, as it puts pressure on crypto, which ends 2021 on a slightly bearish note.

Rising inflation and the expectation of a more hawkish FED made the dollar rally, finishing at a gain of ~6.94% YTD.

Bad news, as it puts pressure on crypto, which ends 2021 on a slightly bearish note.

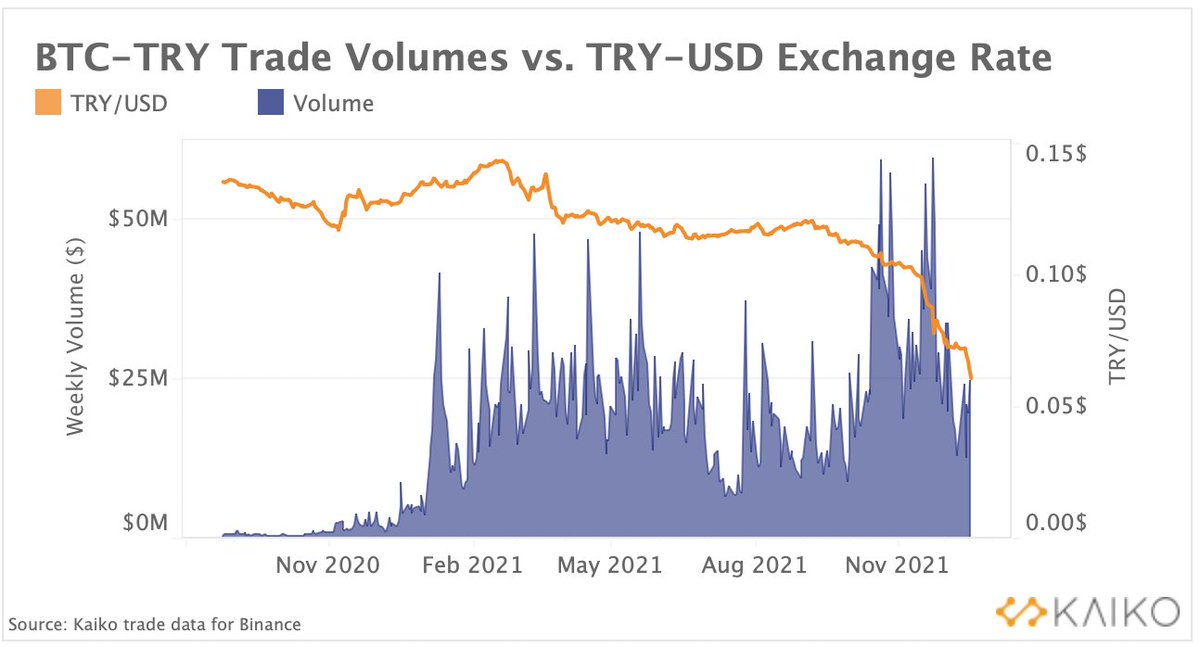

14/15: Currency crises drive crypto adoption

While the Turkish Lira saw a relentless trip to the bottom against USD, Bitcoin volumes went through the roof. This shows that, in territories where inflation has a big impact on everyday life, it DOES act as an inflation hedge

While the Turkish Lira saw a relentless trip to the bottom against USD, Bitcoin volumes went through the roof. This shows that, in territories where inflation has a big impact on everyday life, it DOES act as an inflation hedge

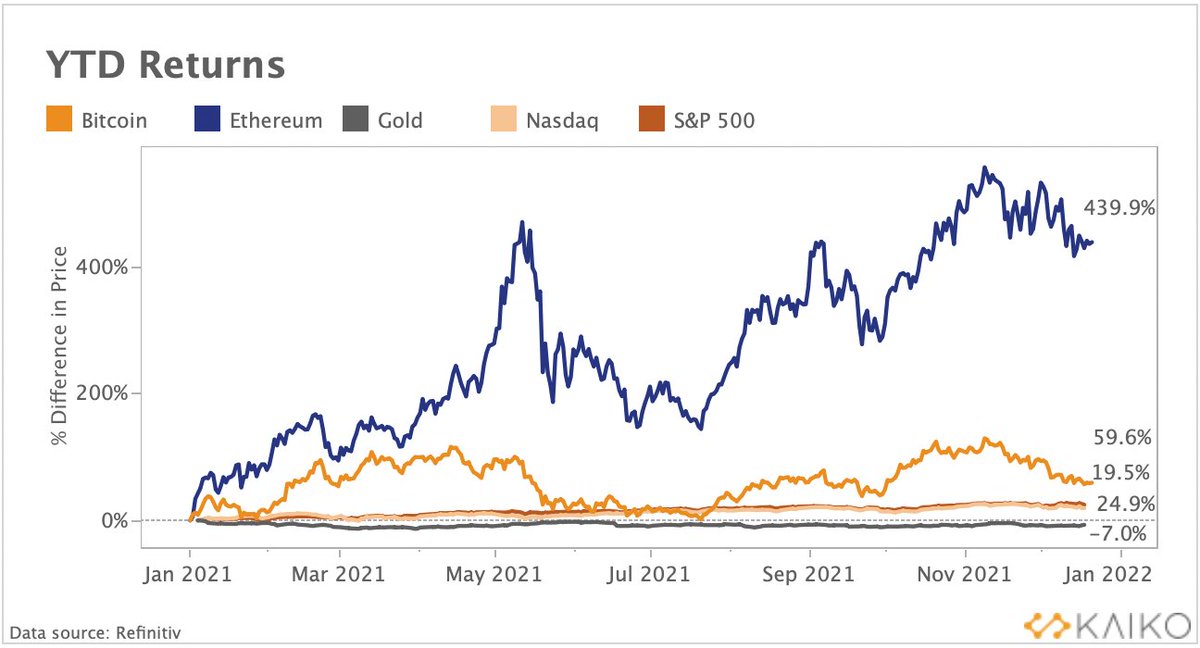

15/15: Crypto still has the best returns

🐂 or 🐻 in the last week of 2021? No matter what, crypto still has the best returns, far outperforming Gold (RIP @PeterSchiff), the Nasdaq and S&P500.

Never forget, WAGMI fam.

Happy holidays

🐂 or 🐻 in the last week of 2021? No matter what, crypto still has the best returns, far outperforming Gold (RIP @PeterSchiff), the Nasdaq and S&P500.

Never forget, WAGMI fam.

Happy holidays

Special thanks to @Clara_Medalie and the whole research team at @KaikoData for the amazing work.

Week after week, providing some of the best market insights in crypto.

👊😚

Week after week, providing some of the best market insights in crypto.

👊😚

• • •

Missing some Tweet in this thread? You can try to

force a refresh