MapMyIndia (MMI - C.E. Info Systems Ltd)

Let’s deep dive and understand what makes MMI special. A thread .........

#mapmyindia #Mapmyindiaipo #mmi

DRHP - investmentbank.kotak.com/downloads/ce-i…

Let’s deep dive and understand what makes MMI special. A thread .........

#mapmyindia #Mapmyindiaipo #mmi

DRHP - investmentbank.kotak.com/downloads/ce-i…

1/ Key Metrics

Current Price: ₹1,675

52WH / 52WL: ₹1,777 / 1,282

P/E: 185

Book Value: ₹64.7

ROCE: ~20%

ROE: ~15%

Market Cap: ₹8,922cr

Enterprise Value: ₹ 8,879 Cr.

Debt to equity: 0.06

Sales growth 3Yrs: 0.68 %

The company raised 1039cr through IPO, entire issue was OFS

Current Price: ₹1,675

52WH / 52WL: ₹1,777 / 1,282

P/E: 185

Book Value: ₹64.7

ROCE: ~20%

ROE: ~15%

Market Cap: ₹8,922cr

Enterprise Value: ₹ 8,879 Cr.

Debt to equity: 0.06

Sales growth 3Yrs: 0.68 %

The company raised 1039cr through IPO, entire issue was OFS

2/ Who is MMI?

The husband and wife duo, Rakesh and Rashmi Verma, faced the decision of whether to take on Google Maps, but they decided to focus on enterprise segment (B2B and B2B2C) instead of taking on the tech giant & burning cash.

The husband and wife duo, Rakesh and Rashmi Verma, faced the decision of whether to take on Google Maps, but they decided to focus on enterprise segment (B2B and B2B2C) instead of taking on the tech giant & burning cash.

3/ What does MMI do?

Data and technology products and platforms company, offering:

- digital maps as a service (“MaaS”)

- software as a service (“SaaS”)

- platform as a service (“PaaS”)

Providing:

- digital maps

- geospatial software

- location-based IoT technologies

Data and technology products and platforms company, offering:

- digital maps as a service (“MaaS”)

- software as a service (“SaaS”)

- platform as a service (“PaaS”)

Providing:

- digital maps

- geospatial software

- location-based IoT technologies

4/ How does MMI Compare to Google Maps in India?

# Google Maps has global market share of 65%+

# MMI mapping is deeper & more accurate than Google

# MMI has 80% of the market share in location intelligence and 95% in GPS navigation in India

# Google Maps has global market share of 65%+

# MMI mapping is deeper & more accurate than Google

# MMI has 80% of the market share in location intelligence and 95% in GPS navigation in India

5/ Who are the competitors of MMI?

MMI has acquired expertise within one specific geographic region, India.

For mapping services, the concept of localization plays a vital role, enabling acquisition of quality map data, helping provide rich map experience to its users.

MMI has acquired expertise within one specific geographic region, India.

For mapping services, the concept of localization plays a vital role, enabling acquisition of quality map data, helping provide rich map experience to its users.

6/ How does MMI compare on its breadth of offerings?

MMI competes with Google Maps, Trimble, ESRI, MapBox, Here Tech and TomTom.

MMI offers the most comprehensive, detailed, and accurate digital map database for India, with widest range of location-powered s/w and IoT-tech

MMI competes with Google Maps, Trimble, ESRI, MapBox, Here Tech and TomTom.

MMI offers the most comprehensive, detailed, and accurate digital map database for India, with widest range of location-powered s/w and IoT-tech

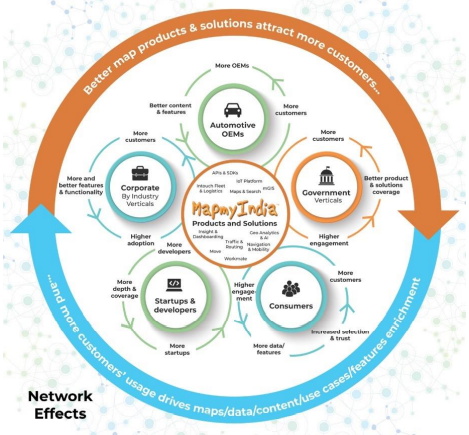

7/ MOAT

MMI has a market position built around prop tech and network effect resulting in strong entry barriers.

MMI has marquee customers (Hyundai, BMW, PhonePe, Flipkart, AVIS, Airtel, HDFC Bank) across sectors with strong relationships and capability to up sell and x-sell

MMI has a market position built around prop tech and network effect resulting in strong entry barriers.

MMI has marquee customers (Hyundai, BMW, PhonePe, Flipkart, AVIS, Airtel, HDFC Bank) across sectors with strong relationships and capability to up sell and x-sell

8/ Usecases

Maps, navigation solutions, geospatial tech, h/w, IoT and telematics have seen tremendous adoption by all kinds of consumers, in all walks of life and at all

points in time, to attain a more productive and efficient outcome of day-to-day tasks.

Maps, navigation solutions, geospatial tech, h/w, IoT and telematics have seen tremendous adoption by all kinds of consumers, in all walks of life and at all

points in time, to attain a more productive and efficient outcome of day-to-day tasks.

9/ Profitable business model with

- consistent financial track record

- high operating leverage (spent ₹0.89 to earn ₹1ee of revenue)

- strong cash flows

# EBITDA margin: 27%

# B2B business drives growth. Has over 5k+ clients and 90% share in automotive space

- consistent financial track record

- high operating leverage (spent ₹0.89 to earn ₹1ee of revenue)

- strong cash flows

# EBITDA margin: 27%

# B2B business drives growth. Has over 5k+ clients and 90% share in automotive space

10/ Shareholding

# PhonePe is the biggest shareholder @ 36% of @MapmyIndia

# Other key shareholders are Qualcomm and Zenrin

# IPO’s primary objective was to give its shareholders a partial exit

Source: @entrackr

# PhonePe is the biggest shareholder @ 36% of @MapmyIndia

# Other key shareholders are Qualcomm and Zenrin

# IPO’s primary objective was to give its shareholders a partial exit

Source: @entrackr

11/ Key strengths:

1. Focus: Market leader in B2B & B2B2C in India

2. Infinite usecases

3. Prestigious customers

4. First mover advantage

5. Product offering and tech platform

1. Focus: Market leader in B2B & B2B2C in India

2. Infinite usecases

3. Prestigious customers

4. First mover advantage

5. Product offering and tech platform

12/ Key risks

- Regulatory: SaaS business partially dependent on regulation

- Increasing competition creates the need for continuous innovation

- International expansion could be a challenge

- Regulatory: SaaS business partially dependent on regulation

- Increasing competition creates the need for continuous innovation

- International expansion could be a challenge

13/ Investment thesis:

1. Market leader with comprehensive product suite

2. Independent nature

3. Market positioning and MOATs

4. Long Standing Customer relationships

5. Large number of use cases expanding the TAM

6. Founder led SaaS play that is profitable

1. Market leader with comprehensive product suite

2. Independent nature

3. Market positioning and MOATs

4. Long Standing Customer relationships

5. Large number of use cases expanding the TAM

6. Founder led SaaS play that is profitable

14/ Research sources:

# mosaic51.com/featured/india…

# tickertape.in/blog/mapmyindi…

# @abhymurarka @MultipieSocial

# DRHP -bseindia.com/corporates/dow…

# entrackr.com/2021/09/the-ke…

# mosaic51.com/featured/india…

# tickertape.in/blog/mapmyindi…

# @abhymurarka @MultipieSocial

https://twitter.com/MultipieSocial/status/1468160216994705411?s=20

# DRHP -bseindia.com/corporates/dow…

# entrackr.com/2021/09/the-ke…

14/ Research sources:

# mosaic51.com/featured/india…

# tickertape.in/blog/mapmyindi…

# @abhymurarka @MultipieSocial

# entrackr.com/2021/09/the-ke…

# mosaic51.com/featured/india…

# tickertape.in/blog/mapmyindi…

# @abhymurarka @MultipieSocial

https://twitter.com/MultipieSocial/status/1468160216994705411?s=20

# entrackr.com/2021/09/the-ke…

Your feedback appreciated

@Delhi_Investors @rohan_investor @BahirwaniKrish @JstInvestments @AimInvestments @Investor_Mohit @StocktwitsIndia @StocksResearch @insharebazaar

@Delhi_Investors @rohan_investor @BahirwaniKrish @JstInvestments @AimInvestments @Investor_Mohit @StocktwitsIndia @StocksResearch @insharebazaar

@Vivek_Investor @vetris_stocks @ValueEducator @Gautam__Baid @InvestorAyush @dmuthuk @NeilBahal @Finstor85

# Fidelity bought 3.1 lac shares

# Goldman Sachs India Equity fund bought 3.8 lac shares

And many other institutional buys on 21st Dec.

# Goldman Sachs India Equity fund bought 3.8 lac shares

And many other institutional buys on 21st Dec.

• • •

Missing some Tweet in this thread? You can try to

force a refresh