#ChelseaFC publish accounts for year ended 30 June 2021: Key Numbers

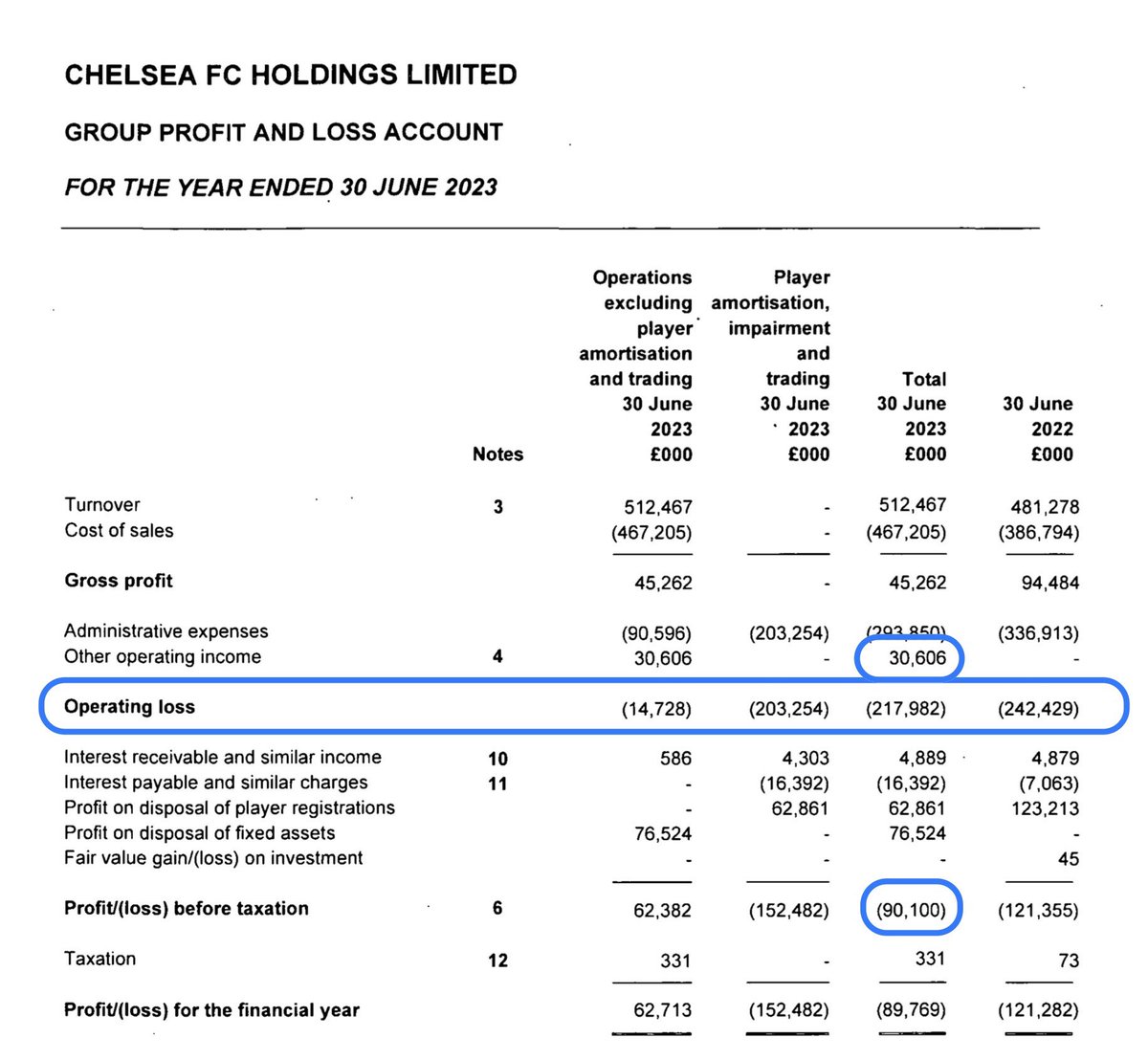

Operating loss £155m (£32m profit in 2020)

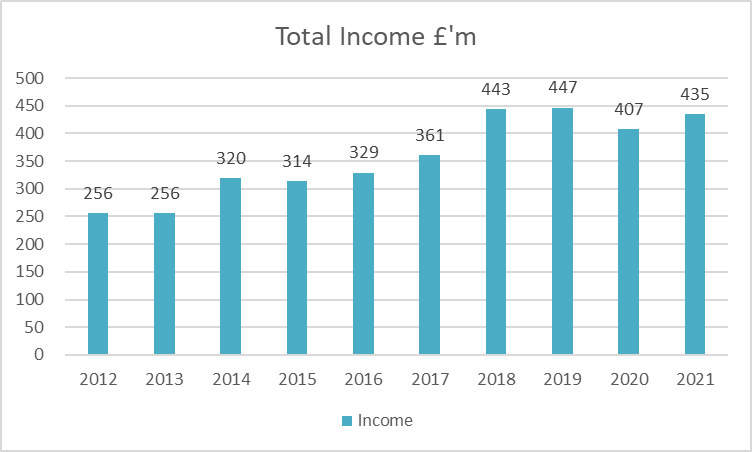

Income up 7% to £435m

Wages up 17% to £333m

Ave Weekly wage £155k

Squad cost £959m

Owed to Abramovich £1.4 billion

Operating loss £155m (£32m profit in 2020)

Income up 7% to £435m

Wages up 17% to £333m

Ave Weekly wage £155k

Squad cost £959m

Owed to Abramovich £1.4 billion

Income increased despite season BCD due to more matches taking place as end of 2019/20 season was partially in year to 30 June 2020 following Project Restart.

Broadcast income up 69% due to more matches being played and success in winning the Champions League

Commercial income fell by 19% to £154m due to loss of pre-season tours, non-match day income (such as John Terry showing fans around the training facilities) and fewer players out on loan.

Wages up £50m due to recruitment, new contracts and bonuses for winning the CL. Average wage over £155k a week, wages £77 for every £100 of income.

Transfer fee amortisation (transfer fees spread over contract life) up to £163m following significant recruitment in 2020/21.

As a result of costs rising faster than income Chelsea went from an operating profit of £32m to a loss of £155m. These figures have been very erotic in recent years due to the volatile one off costs and income streams.

Player sale profits fell from £143m to £28m as only main sales were Victor Moses and fan favourite Nathan De Souza

Chelsea also had player write downs of £17m and a legal claim of £24m (may be related to a manager compensation case)

Chelsea spend £221m on new players in 2020/21 taking total spend to over £1.5 billion in last decade.

Chelsea's squad cost £959m by 30 June 2021, signing of Lukaku will have taken that beyond £1 billion, which possibly explains why they had to put out a threadbare team last night against Brighton.

Excluding player sales and one-off costs Chelsea's EBIT losses (Earnings before interest and tax) were a record £141m in 2020/21, taking the total to £731m in last decade, which explains why player sales and RA are so important to the club.

Only three clubs have published (Man Utd, Spurs and Chelsea) have published results for 2020/21 to date, but Chelsea are inbetween those two clubs, both of whom in a normal year would generate £40-50m mroe from matchday income

Chelsea's wage bill higher than that of Manchester United, but they did win a trophy in 2020/21 which will have triggered bonuses. Substantially highest wages of London clubs.

Again difficult to get a full picture as so few clubs have reported yet for 2020/21 but Chelsea's day to day losses of £141m contribute to overall PL losses of over £1.4bn

Chelsea have second highest squad cost in the PL, just behind that of Manchester City. This may have helped those clubs reach the Champions League final earlier this year

• • •

Missing some Tweet in this thread? You can try to

force a refresh