What a wild ride this year has been!

Throughout the year, the team has been working at full tilt to ship high-quality updates for the protocol. With DeFi’s frenetic pace, it's easy to lose sight of the big picture.

So, without further ado, here’s Pendle Wrapped 2021!

Throughout the year, the team has been working at full tilt to ship high-quality updates for the protocol. With DeFi’s frenetic pace, it's easy to lose sight of the big picture.

So, without further ado, here’s Pendle Wrapped 2021!

Let’s start with some Pendle numbers.

- We now support 9 assets from 6 protocols on 2 chains

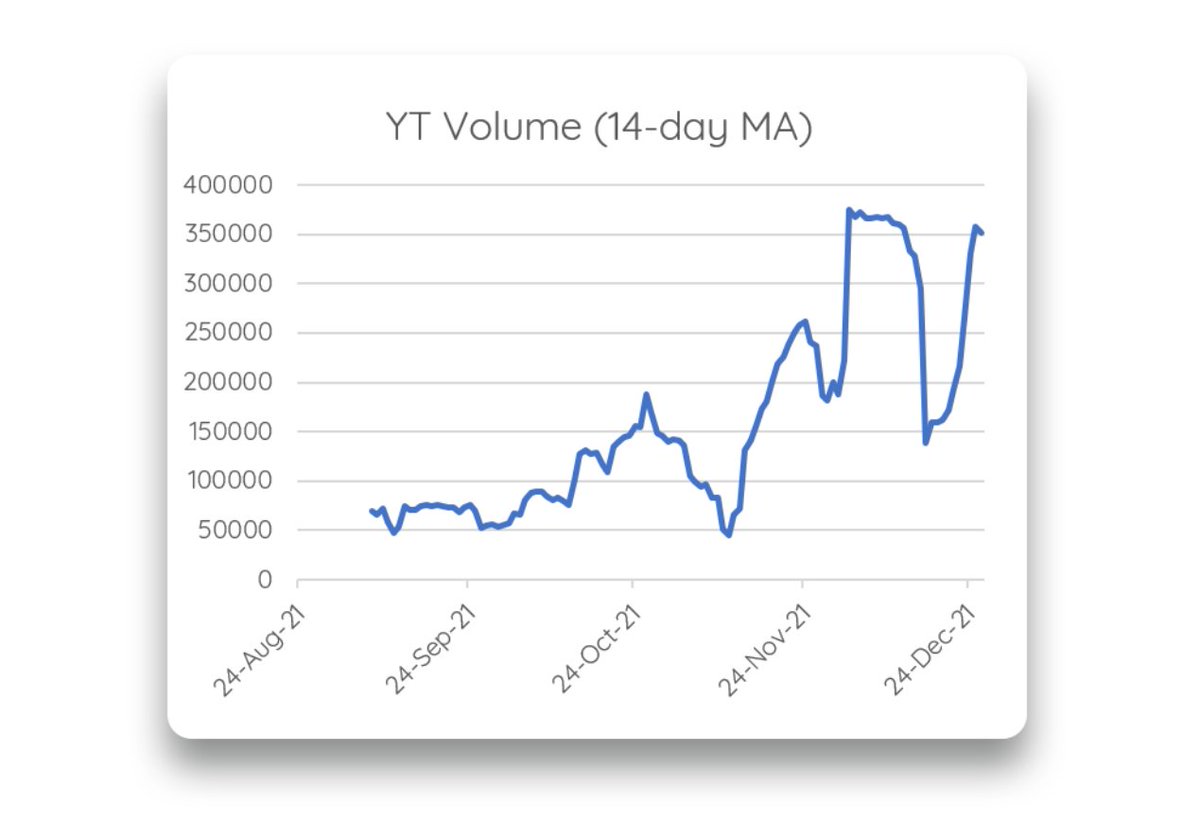

- Steady increase in average daily trading volume

- Locked value across all pools topped $110M in November

- Team size up from 6 to 20 (>200% APY!!)

- We now support 9 assets from 6 protocols on 2 chains

- Steady increase in average daily trading volume

- Locked value across all pools topped $110M in November

- Team size up from 6 to 20 (>200% APY!!)

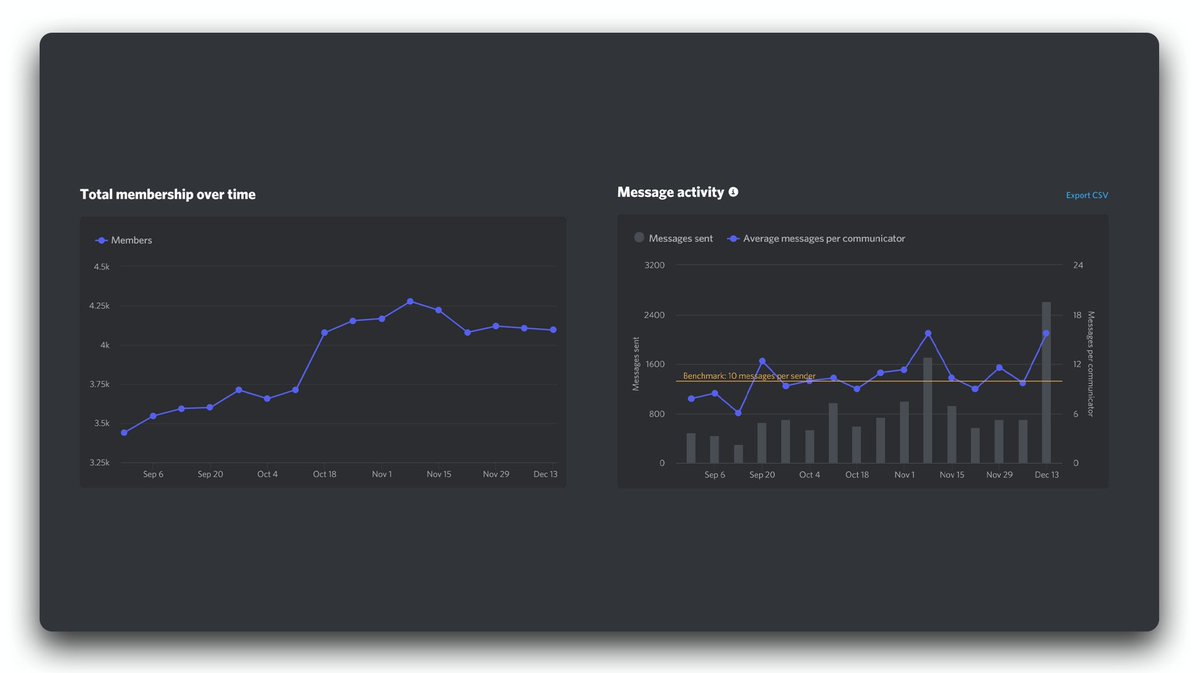

That’s impressive growth, but we could have never achieved it without our awesome community.

With >4K members sending >2K messages every week, there’s never a boring day on the Pendle Discord.

Don’t miss out on the excitement and the alpha, join us now! (link in bio)

With >4K members sending >2K messages every week, there’s never a boring day on the Pendle Discord.

Don’t miss out on the excitement and the alpha, join us now! (link in bio)

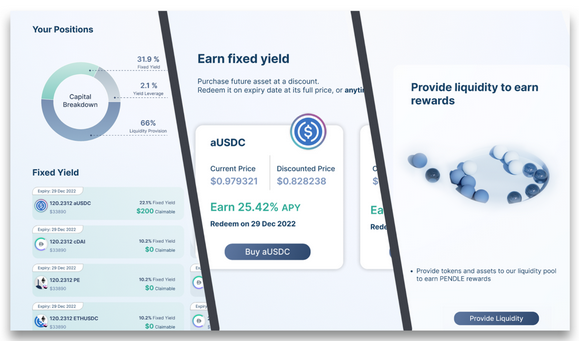

Expect much more to come in 2022! We’ll be releasing a roadmap soon for the year ahead, but for now, here’s a sneak peek into our upcoming UI upgrade!

Before we dive headfirst into the new year, let’s rewind and take a look at our exciting journey through the year 2021.

MARCH marked the start of Pendle’s public journey. We piloted Pendle on Kovan for your feedback and criticism, which we took into great consideration.

APRIL

Pendle became the first protocol to utilize Flashbots for liquidity bootstrapping to prevent price sniping, making the bootstrapping process fairer to all users.

Pendle became the first protocol to utilize Flashbots for liquidity bootstrapping to prevent price sniping, making the bootstrapping process fairer to all users.

MAY saw Pendle getting listed on SushiSwap’s Onsen, and we were also the first protocols on the dual incentive program.

At the same time, we did a thorough audit of our protocol, both internally and independently. The reports can be found at github.com/pendle-finance….

At the same time, we did a thorough audit of our protocol, both internally and independently. The reports can be found at github.com/pendle-finance….

JUNE

Launch! Pendle became the first AMM-based yield trading protocol on the Ethereum mainnet, starting off with support for Aave and Compound assets.

Launch! Pendle became the first AMM-based yield trading protocol on the Ethereum mainnet, starting off with support for Aave and Compound assets.

JULY saw the creation of Pendle’s Rari Fuse pool, enabling OTs to be used as collateral, freeing up capital locked in OT and permitting a leveraged fixed yield position. Learn more medium.com/pendle/pendle-…

AUGUST

Pendle launched support for ETH / USDC SLP tokens, becoming the first to enable yield trading of LP fees.

We also created (Pe,P), an offering that incentivizes $PENDLE liquidity and provides liquidity for the protocol in a single pool.

Pendle launched support for ETH / USDC SLP tokens, becoming the first to enable yield trading of LP fees.

We also created (Pe,P), an offering that incentivizes $PENDLE liquidity and provides liquidity for the protocol in a single pool.

SEPTEMBER marked our launch with Olympus Pro! We partnered with the Ohmies to accumulate protocol owned liquidity, achieving over $1.3M liquidity in the process.

OCTOBER

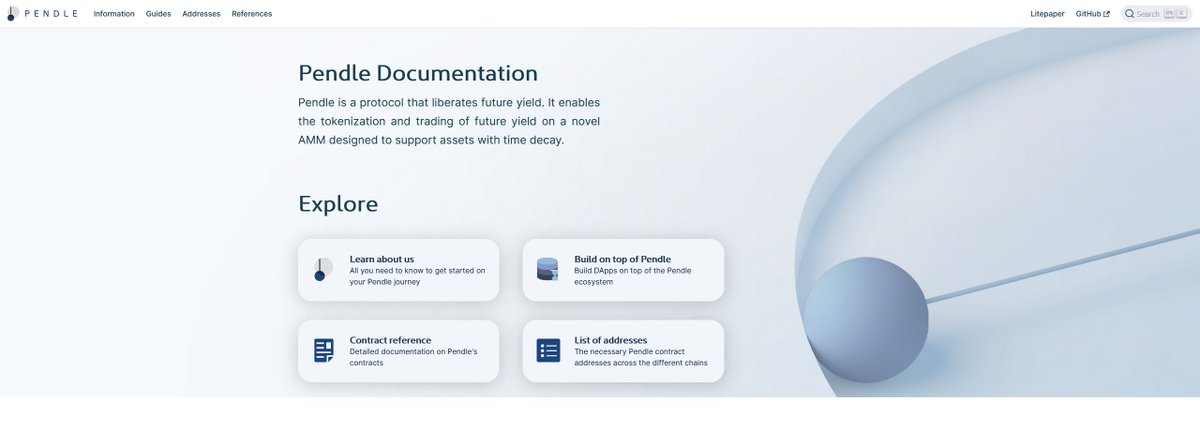

Docs revamp! We freshened up our docs, and made some QOL improvements for devs, take a look: docs.pendle.finance

Our Avalanche contracts were also audited in preparation for the launch.

Docs revamp! We freshened up our docs, and made some QOL improvements for devs, take a look: docs.pendle.finance

Our Avalanche contracts were also audited in preparation for the launch.

NOVEMBER saw Pendle becoming the first yield trading protocol to join the Avalanche party!

We amassed over $30M in TVL within a week while introducing some QOL improvements for users, such as 1-click Zap farming and single asset claims.

We amassed over $30M in TVL within a week while introducing some QOL improvements for users, such as 1-click Zap farming and single asset claims.

DECEMBER was spent in Wonderland, where Pendle launched wMEMO support!

wMEMO has easily become the most popular asset on Pendle - our Discord is filled with trading strategies for this unique asset, and we can’t help but be impressed with how big some of your brains are!

wMEMO has easily become the most popular asset on Pendle - our Discord is filled with trading strategies for this unique asset, and we can’t help but be impressed with how big some of your brains are!

Thanks to all of you for an amazing 2021, and we can’t wait to see what 2022 has in store for us! Wishing all of you a wonderful New Year!

Read more: link.medium.com/xUOLgQbdrmb

Read more: link.medium.com/xUOLgQbdrmb

• • •

Missing some Tweet in this thread? You can try to

force a refresh