Get a cup of coffee.

Let's kickstart 2022!

To that end, here are 22 key concepts to help you appreciate and achieve Financial Independence.

Let's kickstart 2022!

To that end, here are 22 key concepts to help you appreciate and achieve Financial Independence.

Concept #1.

What is Financial Independence?

It's a state of *self-sufficiency*. It's when you have enough money, and enough income-producing assets, that you and your family can live comfortably for the rest of your lives -- WITHOUT needing a job.

What is Financial Independence?

It's a state of *self-sufficiency*. It's when you have enough money, and enough income-producing assets, that you and your family can live comfortably for the rest of your lives -- WITHOUT needing a job.

Concept #2.

Financial Independence is not really about spending MONEY how we like -- although, to an extent, that becomes possible.

It's about being FREE to spend our TIME how we like.

Financial Independence is not really about spending MONEY how we like -- although, to an extent, that becomes possible.

It's about being FREE to spend our TIME how we like.

Concept #3.

Financial Independence is not really about quitting our jobs and retiring from work -- although that's possible.

It's about being FREE to pursue *whatever* kind of work we find most fulfilling. Things we love to do. Things the world benefits from. Etc.

Financial Independence is not really about quitting our jobs and retiring from work -- although that's possible.

It's about being FREE to pursue *whatever* kind of work we find most fulfilling. Things we love to do. Things the world benefits from. Etc.

Concept #4.

For most of us, the path to Financial Independence consists of:

- Starting Early,

- Saving Diligently, and

- Investing Responsibly.

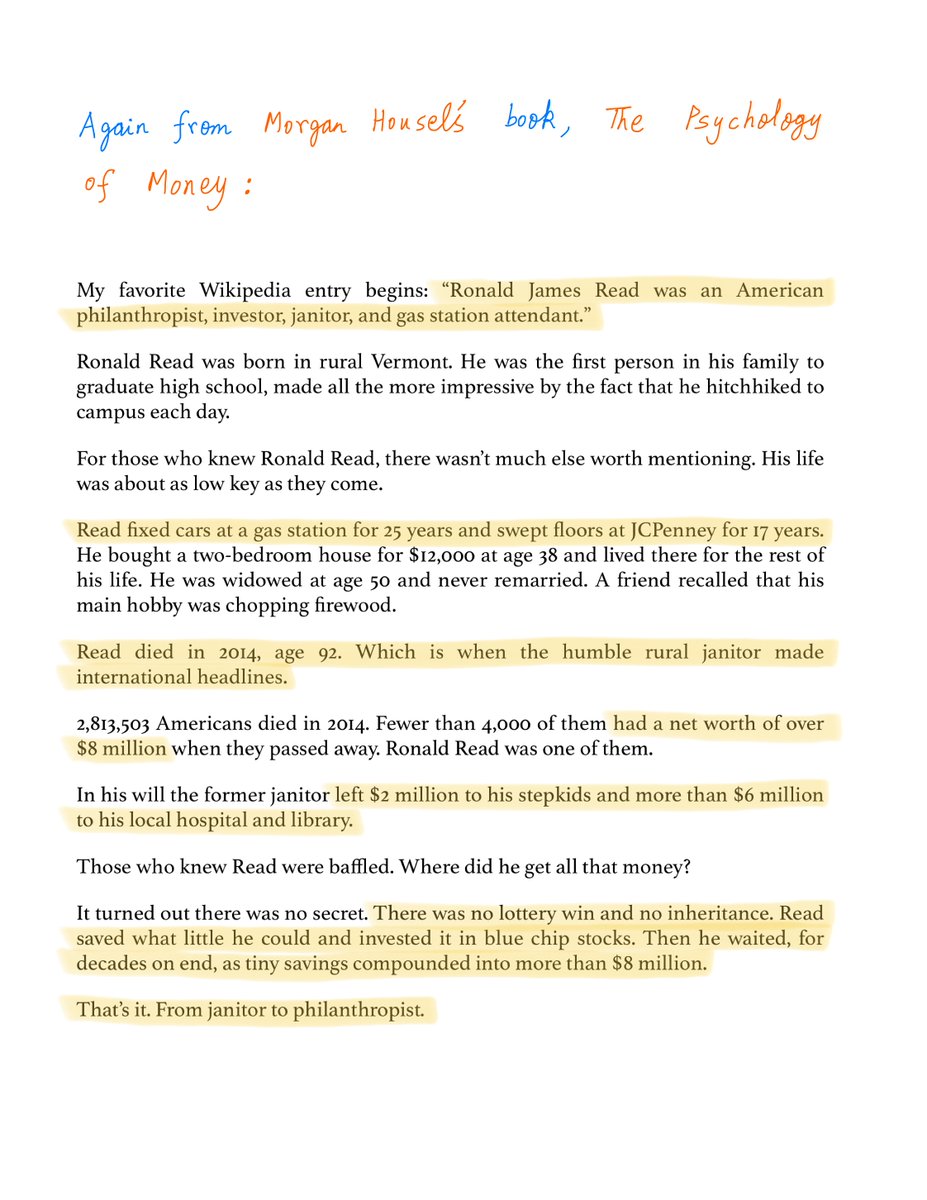

Here's an inspiring story of a janitor who amassed an $8M fortune by following this very playbook:

For most of us, the path to Financial Independence consists of:

- Starting Early,

- Saving Diligently, and

- Investing Responsibly.

Here's an inspiring story of a janitor who amassed an $8M fortune by following this very playbook:

Concept #5.

The importance of Starting Early is often overlooked.

But even if "Starting Early" is not an option, "Starting NOW" is.

The best time to plant a tree was 20 years ago. The next best time is now.

A journey of a thousand miles begins with a single step.

The importance of Starting Early is often overlooked.

But even if "Starting Early" is not an option, "Starting NOW" is.

The best time to plant a tree was 20 years ago. The next best time is now.

A journey of a thousand miles begins with a single step.

Concept #6.

With some effort, we can set up a system that guides us towards Financial Independence -- almost via autopilot.

We spend less than we make. We invest the difference intelligently. We let time and compounding take care of the rest.

With some effort, we can set up a system that guides us towards Financial Independence -- almost via autopilot.

We spend less than we make. We invest the difference intelligently. We let time and compounding take care of the rest.

Concept #7.

Every part of this autopilot system -- income, expenses, savings, investments -- can be optimized.

One of the best ways to optimize "Income" is to cultivate multiple diverse income streams. This creates resilience, reduces stress, etc.

Every part of this autopilot system -- income, expenses, savings, investments -- can be optimized.

One of the best ways to optimize "Income" is to cultivate multiple diverse income streams. This creates resilience, reduces stress, etc.

Concept #8.

It's hard for most of us to become Financially Independent on just a salary.

We have to find *leverage* -- ie, ONE TIME effort on our part that keeps paying us FOR LIFE.

Business ownership -- either outright or via stocks -- is the way to go.

It's hard for most of us to become Financially Independent on just a salary.

We have to find *leverage* -- ie, ONE TIME effort on our part that keeps paying us FOR LIFE.

Business ownership -- either outright or via stocks -- is the way to go.

Concept #9.

Frugality is a virtue. We should strive to keep our expenses modest relative to our income.

Frugality is NOT cheapness.

Frugal people want *value* for money. Cheap people just don't want to spend money.

Frugal people can be generous. Cheap people seldom are.

Frugality is a virtue. We should strive to keep our expenses modest relative to our income.

Frugality is NOT cheapness.

Frugal people want *value* for money. Cheap people just don't want to spend money.

Frugal people can be generous. Cheap people seldom are.

Concept #10.

Saving a high proportion of our income is a great hedge against inflation.

The less we need to buy, the less worried we are when prices go up.

Saving a high proportion of our income is a great hedge against inflation.

The less we need to buy, the less worried we are when prices go up.

Concept #11.

A dollar saved can be MORE than a dollar earned.

For example, if our marginal tax rate is 30%, $1 saved is about $1.43 earned.

A dollar saved can be MORE than a dollar earned.

For example, if our marginal tax rate is 30%, $1 saved is about $1.43 earned.

Concept #12.

Lifestyle Creep.

As we MAKE more money, we increase our standard of life, and thus SPEND more.

This is a double whammy. The MORE we *spend*, the LESS we have to *invest* and *compound* with. Also, the MORE our portfolio has to provide, so the BIGGER it has to be.

Lifestyle Creep.

As we MAKE more money, we increase our standard of life, and thus SPEND more.

This is a double whammy. The MORE we *spend*, the LESS we have to *invest* and *compound* with. Also, the MORE our portfolio has to provide, so the BIGGER it has to be.

Concept #13.

The Hedonic Treadmill.

The world around us is always trying to get us to buy more stuff than we really need.

We can resist this by remembering that, usually, the pleasure we get from buying new stuff is only temporary.

The Hedonic Treadmill.

The world around us is always trying to get us to buy more stuff than we really need.

We can resist this by remembering that, usually, the pleasure we get from buying new stuff is only temporary.

Concept #14.

Mimetic Desire.

Often, we want to buy things because we see *others* around us buying similar things. In this way, we drive each others' wants up, and savings down.

To combat this tendency, we should develop and protect our ability to think independently.

Mimetic Desire.

Often, we want to buy things because we see *others* around us buying similar things. In this way, we drive each others' wants up, and savings down.

To combat this tendency, we should develop and protect our ability to think independently.

Concept #15.

With interest rates and inflation being where they are, most of us cannot hope to become Financially Independent by saving alone.

We MUST learn how to *invest*.

With interest rates and inflation being where they are, most of us cannot hope to become Financially Independent by saving alone.

We MUST learn how to *invest*.

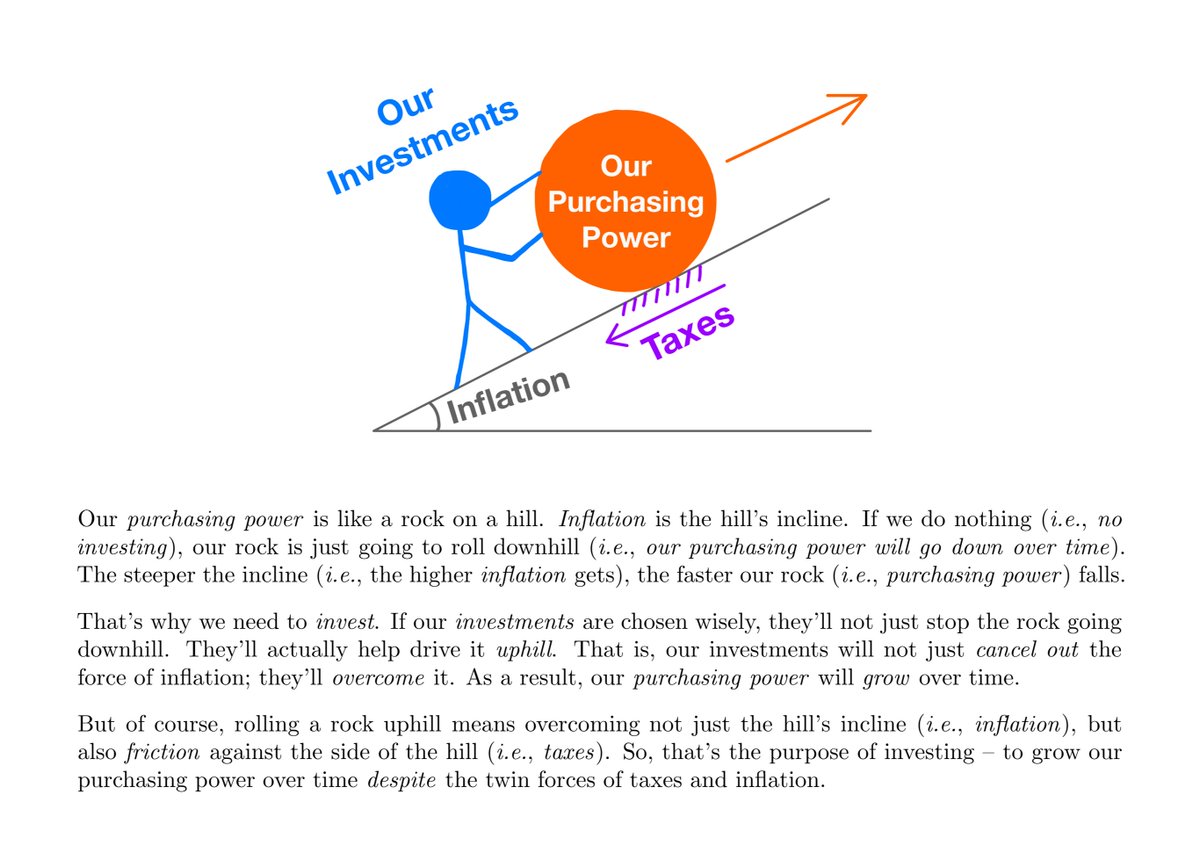

Concept #16.

The purpose of investing is NOT just to grow our *money*.

It is to grow our *after tax purchasing power*.

When inflation is a major factor, it pays to think in *purchasing power* terms, rather than in *dollar* terms.

The purpose of investing is NOT just to grow our *money*.

It is to grow our *after tax purchasing power*.

When inflation is a major factor, it pays to think in *purchasing power* terms, rather than in *dollar* terms.

Concept #17.

Investing is naturally multi-disciplinary.

Familiarity with a large number of ideas and concepts drawn from different disciplines can be very valuable.

This is Charlie Munger's "latticework of mental models".

Here are 5 sets of models that I recommend:

Investing is naturally multi-disciplinary.

Familiarity with a large number of ideas and concepts drawn from different disciplines can be very valuable.

This is Charlie Munger's "latticework of mental models".

Here are 5 sets of models that I recommend:

Concept #18.

Financial Goal Setting.

When would we consider ourselves Financially Independent? We should think about this, and set appropriate goals/milestones.

One way to do this is via the 4% Rule, the 3% Rule, etc.

For more:

Financial Goal Setting.

When would we consider ourselves Financially Independent? We should think about this, and set appropriate goals/milestones.

One way to do this is via the 4% Rule, the 3% Rule, etc.

For more:

https://twitter.com/10kdiver/status/1287043526153273344

Concept #19.

What Gets Measured Gets Fixed.

We need to dedicate some time every now and then to go over our progress towards Financial Independence, make course corrections as necessary, etc.

For example, I try to do a review of my family's finances about once a month.

What Gets Measured Gets Fixed.

We need to dedicate some time every now and then to go over our progress towards Financial Independence, make course corrections as necessary, etc.

For example, I try to do a review of my family's finances about once a month.

Concept #20.

We only need to get rich ONCE.

If we're fortunate enough to come close to our goal, we should try to be careful not to lose it all.

That means adequate diversification. Good risk management with a focus on downside protection. Avoiding margin loans. Etc.

We only need to get rich ONCE.

If we're fortunate enough to come close to our goal, we should try to be careful not to lose it all.

That means adequate diversification. Good risk management with a focus on downside protection. Avoiding margin loans. Etc.

Concept #21.

Survivorship Bias.

As the saying goes, dead men tell no tales.

But alive men and women -- who may have taken huge risks but gotten lucky -- often shout from the rooftops.

Following in their footsteps may be injurious to our financial health.

Survivorship Bias.

As the saying goes, dead men tell no tales.

But alive men and women -- who may have taken huge risks but gotten lucky -- often shout from the rooftops.

Following in their footsteps may be injurious to our financial health.

Concept #22.

Humility.

Luck plays a BIG role in investing. We should acknowledge this when things go well -- and NOT take all the credit for ourselves.

As the saying goes, there are only 2 kinds of investors: those who are humble, and those who will be *humbled* by the market.

Humility.

Luck plays a BIG role in investing. We should acknowledge this when things go well -- and NOT take all the credit for ourselves.

As the saying goes, there are only 2 kinds of investors: those who are humble, and those who will be *humbled* by the market.

So, there you have it. 22 very old concepts to usher in this very new year.

For more, please join me tomorrow (Sun, Jan 02) at 1pm ET on Money Concepts.

We'll discuss some of these concepts in more detail, you can ask questions, etc.

Link: callin.com/?link=swiMRsqK…

For more, please join me tomorrow (Sun, Jan 02) at 1pm ET on Money Concepts.

We'll discuss some of these concepts in more detail, you can ask questions, etc.

Link: callin.com/?link=swiMRsqK…

Wish you the very best in 2022!

/End

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh