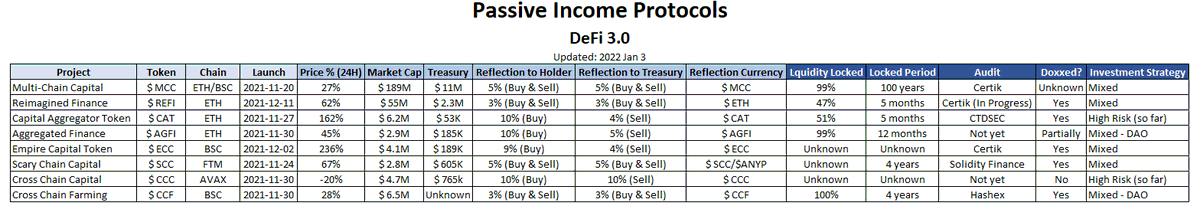

A summary and comparison of DeFi 3.0 protocols, and why they are on fire 🔥 rn

$MCC $REFI $CAT $AGFI $ECC $SCC $CCC $CCF

$MCC $REFI $CAT $AGFI $ECC $SCC $CCC $CCF

1/ What is DeFi 3.0?

The treasury invests in 100s of DeFi protocols for you, like an active management fund, and you receive the profit passively by simply holding the token, aka DaaS/FaaS.

Another feature is reflection, i.e. every txn ppl makes on the token, you earn a share

The treasury invests in 100s of DeFi protocols for you, like an active management fund, and you receive the profit passively by simply holding the token, aka DaaS/FaaS.

Another feature is reflection, i.e. every txn ppl makes on the token, you earn a share

2/ How do they sustain?

Normally, the profit from treasury investment are used to buying back their tokens, some may have airdrops.

In addition, the reflection incentivizes ppl to hold in order to earn from each txn, while at the same time strengthening the treasury investment.

Normally, the profit from treasury investment are used to buying back their tokens, some may have airdrops.

In addition, the reflection incentivizes ppl to hold in order to earn from each txn, while at the same time strengthening the treasury investment.

3/ Are they sustainable?

Tokenomics wise, yes, it does not do crazy inflation and many projects burn tokens in different ways.

Reflection provides a good way to benefit both the holders and the treasury.

But they have their own risk (check 4/ 👇👇👇)

Tokenomics wise, yes, it does not do crazy inflation and many projects burn tokens in different ways.

Reflection provides a good way to benefit both the holders and the treasury.

But they have their own risk (check 4/ 👇👇👇)

4/ Any risks?

- Risks of price fluctuations/rugs/hacks, like in any crypto investments

- While earning shares, tokens are not required to be staked, meaning they are easier to get sold

- The buyback power maybe weak if profit is low

- US gov. may regulate DeFi anytime

- Risks of price fluctuations/rugs/hacks, like in any crypto investments

- While earning shares, tokens are not required to be staked, meaning they are easier to get sold

- The buyback power maybe weak if profit is low

- US gov. may regulate DeFi anytime

5/ How are they compared to DAOs and Nodes

- Compared to nodes: more sustainable/similar DaaS concept as Ring forks/reflection/no need to spend tokens upfront

- Compared to DAOs: many DAOs do DaaS now so it's similar/DAOs use game theories to hold the token value/Pro traders

- Compared to nodes: more sustainable/similar DaaS concept as Ring forks/reflection/no need to spend tokens upfront

- Compared to DAOs: many DAOs do DaaS now so it's similar/DAOs use game theories to hold the token value/Pro traders

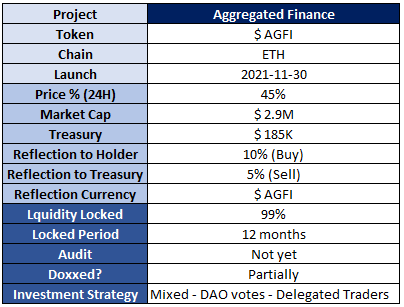

6.1/ $MCC

@MulChainCapital

- The OG and Blue Chip in this space

- Biggest MC and Treasury

- 100 yrs LP lock 🔥

- Most investments made

- Both ETH/BSC chains

- Audited

@MulChainCapital

- The OG and Blue Chip in this space

- Biggest MC and Treasury

- 100 yrs LP lock 🔥

- Most investments made

- Both ETH/BSC chains

- Audited

6.2/ $REFI

@ReimaginedFi

- 2nd MC and Treasury

- Youngest in the space (huge potential🚀)

- The trader has a good track of records

- Reflections are paid in ETH

- Audited/Doxxed/LP locked

@ReimaginedFi

- 2nd MC and Treasury

- Youngest in the space (huge potential🚀)

- The trader has a good track of records

- Reflections are paid in ETH

- Audited/Doxxed/LP locked

6.3/ $CAT

@Aggregatorcoin

- 3rd MC

- 10% Buy reflection

- High risk investments so far (High risk high reward 🤔)

- Audited/Doxxed/LP locked

@Aggregatorcoin

- 3rd MC

- 10% Buy reflection

- High risk investments so far (High risk high reward 🤔)

- Audited/Doxxed/LP locked

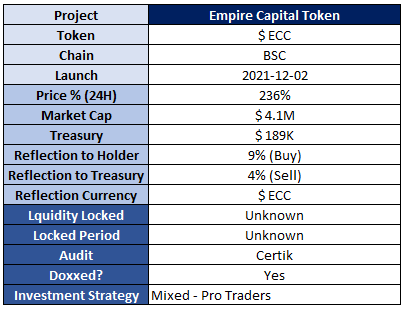

6.4/ $AGFI

@Aggregatorcoin

- 10% Buy reflection

- Investments are driven by DAO votes

- Partially doxxed/LP locked

@Aggregatorcoin

- 10% Buy reflection

- Investments are driven by DAO votes

- Partially doxxed/LP locked

6.6/ $SCC

@SChainCapital

- FTM chain 🚀

- Airdrop

- Same team behind $ANYP 🚀

- Audited/Doxxed/LP locked

@SChainCapital

- FTM chain 🚀

- Airdrop

- Same team behind $ANYP 🚀

- Audited/Doxxed/LP locked

6.8/ $CCF

@Crosschainfarm

- BSC chain

- Launchpad

- DAO

- Has D3 protocol (an $OHM fork)

- Audited/Doxxed/LP locked

@Crosschainfarm

- BSC chain

- Launchpad

- DAO

- Has D3 protocol (an $OHM fork)

- Audited/Doxxed/LP locked

7/ Why are they on fire 🔥rn?

- Autopilot DeFi: So many DeFi protocols out there, giving these projects a fantastic as they lower the bar for new DeFi investors.

- Thanks to other passive income protocols: DAOs and Nodes are not doing well these days

- DeFi 3.0: the name

- Autopilot DeFi: So many DeFi protocols out there, giving these projects a fantastic as they lower the bar for new DeFi investors.

- Thanks to other passive income protocols: DAOs and Nodes are not doing well these days

- DeFi 3.0: the name

8/ Should I invest?

- They do have their niche and the marketing on DeFi 3.0 could be huge in a few days

- All of them had a bit of downtime before the current hype, meaning still they are improving

- Now they are at ATH, so not the best entry point (wait for a better entry)

- They do have their niche and the marketing on DeFi 3.0 could be huge in a few days

- All of them had a bit of downtime before the current hype, meaning still they are improving

- Now they are at ATH, so not the best entry point (wait for a better entry)

• • •

Missing some Tweet in this thread? You can try to

force a refresh