0/ The CRV wars are heating up.

In todays Delphi Daily, we explore important metrics of Curve, @ConvexFinance’s role as a key battleground for bribes, and the protocols vying for voting power.

For more 🧵👇

In todays Delphi Daily, we explore important metrics of Curve, @ConvexFinance’s role as a key battleground for bribes, and the protocols vying for voting power.

For more 🧵👇

1/ @convexfinance has grown to have great sway on @Curvefinance’s valuable governance vote: 85% of Curve TVL is now routed and staked via Convex.

Nearly half of all veCRV supply is owned by Convex.

Nearly half of all veCRV supply is owned by Convex.

2/ @Convexfinance is now the single largest owner of veCRV at 47% of total supply.

This gives them the most governance power to decide where $CRV incentives should be distributed.

This gives them the most governance power to decide where $CRV incentives should be distributed.

3/ Besides bribing, protocols looking to incentivize liquidity can also buy CVX, lock it up, and delegate their votes to their own pools.

Protocols have also been accumulating CVX, chief of all @FraxFinance which owns the most CVX at the moment.

Protocols have also been accumulating CVX, chief of all @FraxFinance which owns the most CVX at the moment.

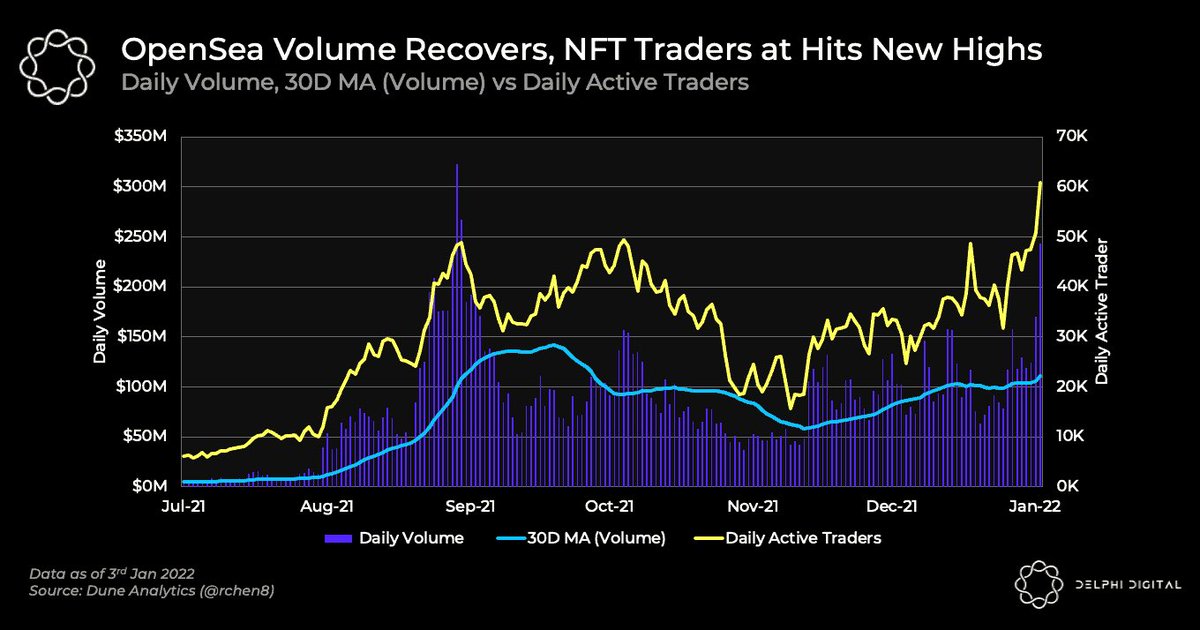

4/ @OpenSea volume is showing recovery signs as volume starts to trend upwards.

Yesterday, daily volumes hit near $250M, the highest it has been since the peaks of Sep. 2021.

It was also the most actively traded day yet in terms of users with 60K daily active traders.

Yesterday, daily volumes hit near $250M, the highest it has been since the peaks of Sep. 2021.

It was also the most actively traded day yet in terms of users with 60K daily active traders.

5/ While it might have looked gloomy for the wider crypto markets, the NFT market had it good the past month.

Large brands and famous celebrities have been getting involved, @adidas, @nike, and @eminem to name a few.

Large brands and famous celebrities have been getting involved, @adidas, @nike, and @eminem to name a few.

6/ Tweets of the day!

Decade in review by Vitalik

Decade in review by Vitalik

https://twitter.com/VitalikButerin/status/1477404670058500107

10/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh