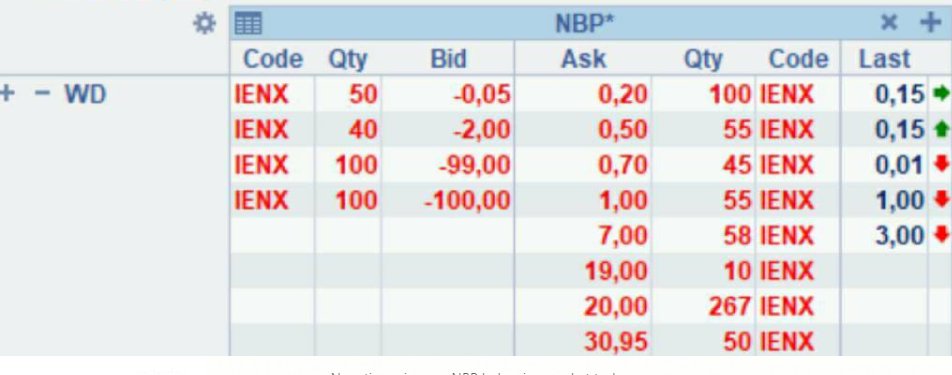

On New Year’s Day, the price of Within-day gas at the GB market (NBP) dropped below zero. An extremely rare event made rarer by the fact that prices were at all-time highs weeks prior.

So how did the market get negative prices in the middle of its largest ever price spike?

1/

So how did the market get negative prices in the middle of its largest ever price spike?

1/

As an aside: It’s not uncommon to see negative prices in power markets but with gas – because we can effectively store it – it extremely unlikely that we get to a point where suppliers are prepared to pay others to accept volumes.

2/

2/

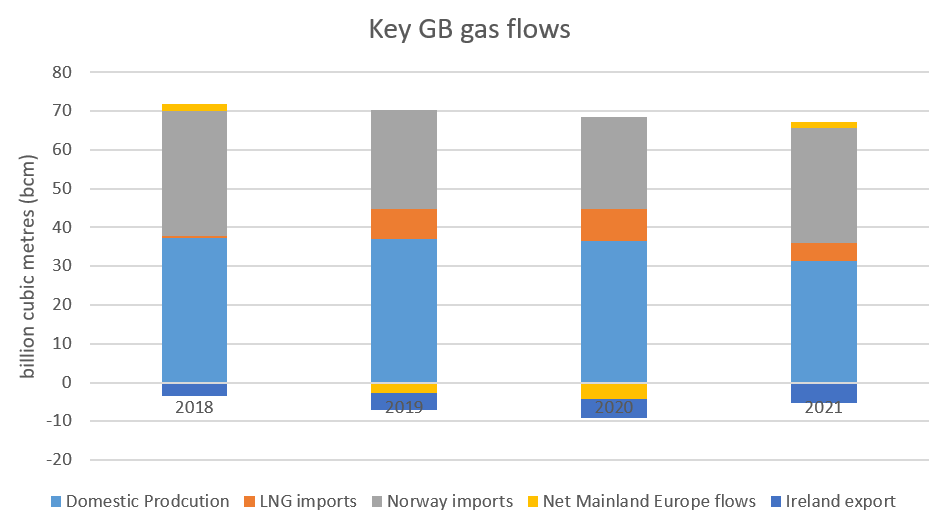

Essentially, the UK gas market on that day was unable to effectively handle a large amount of supply coming onto the system amid extremely low demand.

3/

3/

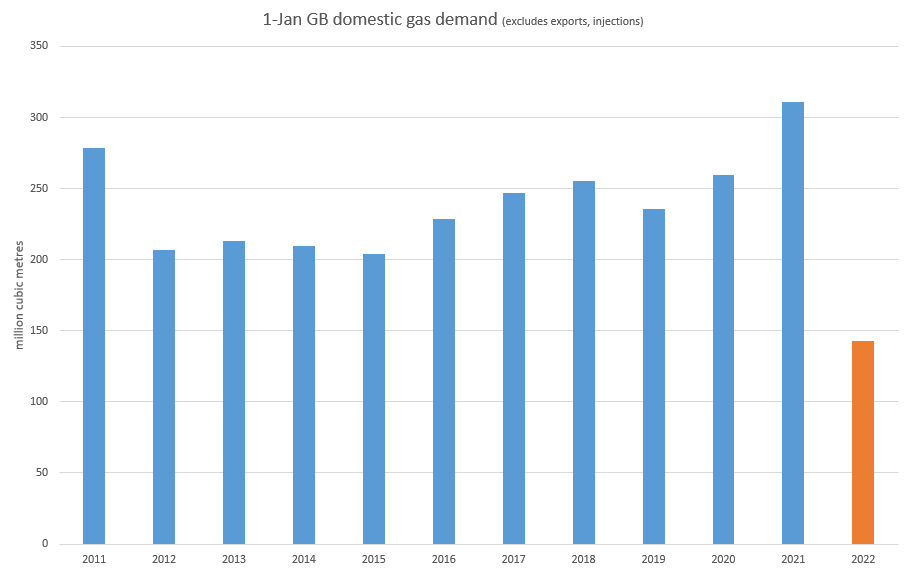

Gas (and power) consumption typically drops over the Christmas/New Year period as commercial and industrial users shut or slow down.

This time it was coupled with record warm temperatures (plus a good amount of wind) which absolutely CRUSHED demand.

4/

This time it was coupled with record warm temperatures (plus a good amount of wind) which absolutely CRUSHED demand.

4/

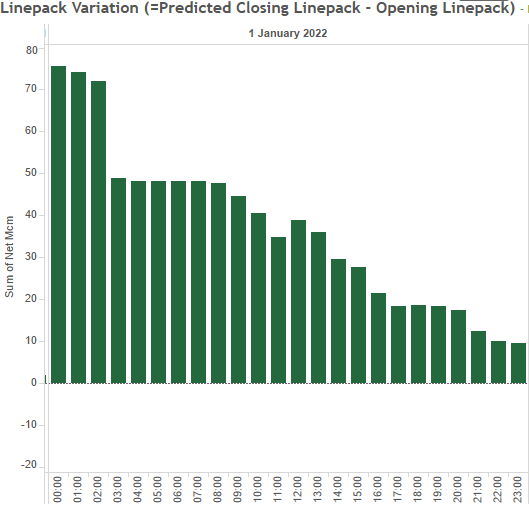

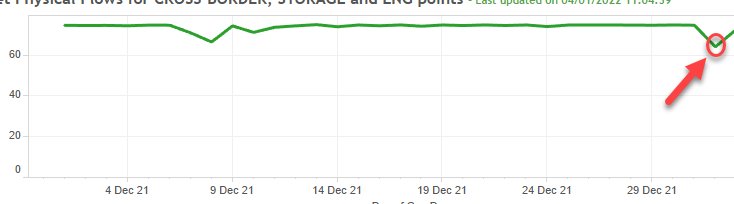

This left the system with a huge oversupply which crushed prices, this drove shippers to ramp up injections into storage (already 90+% full) and exports to mainland Europe via two pipelines. But even with these two sources of flex maxed out, the system was still running long.

5/

5/

So prices kept falling, and with demand-side flex effectively exhausted, it was up to suppliers to turn down. Sendout from LNG terminals, boosted because of the recent spike in forward prices (tinyurl.com/42cyv9hw), had to come off.

6/

6/

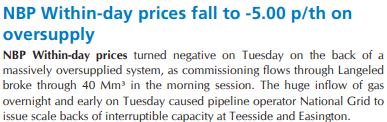

But it was not until the low prices finally convinced Norwegian supply via the Langeled pipe, running at full blast throughout winter, to reduce did the market start of find some balance on the day. By then we have traded below zero.

7/

7/

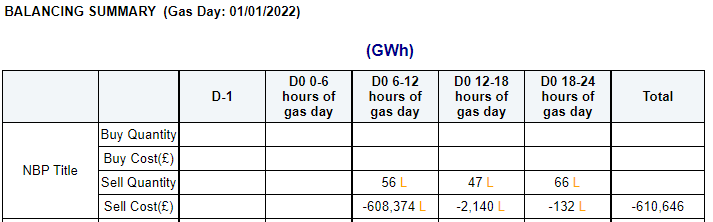

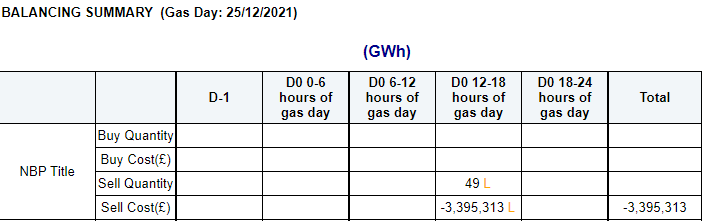

National Grid had to enter the market multiple times to encourage these responses, selling by far their highest amount (16.9mcm) over a single gas day in the past year – recouping £0.6m. (On Xmas day they sold 4.41mcm for £3.4m.)

8/

8/

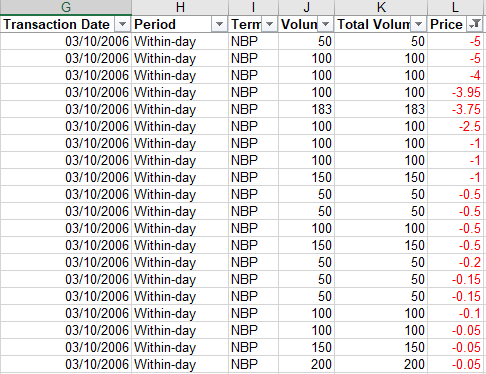

Our last evidence of negative NBP prices (on a working day - NatGrid would need to confirm otherwise) date back to Oct-06 – when the aforementioned Langeled pipe was starting up and delivering commissioning flows into an already oversupplied system.

9/

9/

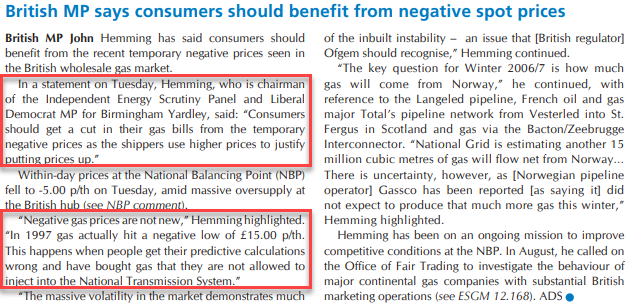

In that day’s report, we had a story about how negative prices would feed into lower customer bills. And how in ’97 the price went to -1,500p/th!

In 2022, I would not expect such filter through to retail from this one-day event amid a global, long-running shortage of gas.

10/

In 2022, I would not expect such filter through to retail from this one-day event amid a global, long-running shortage of gas.

10/

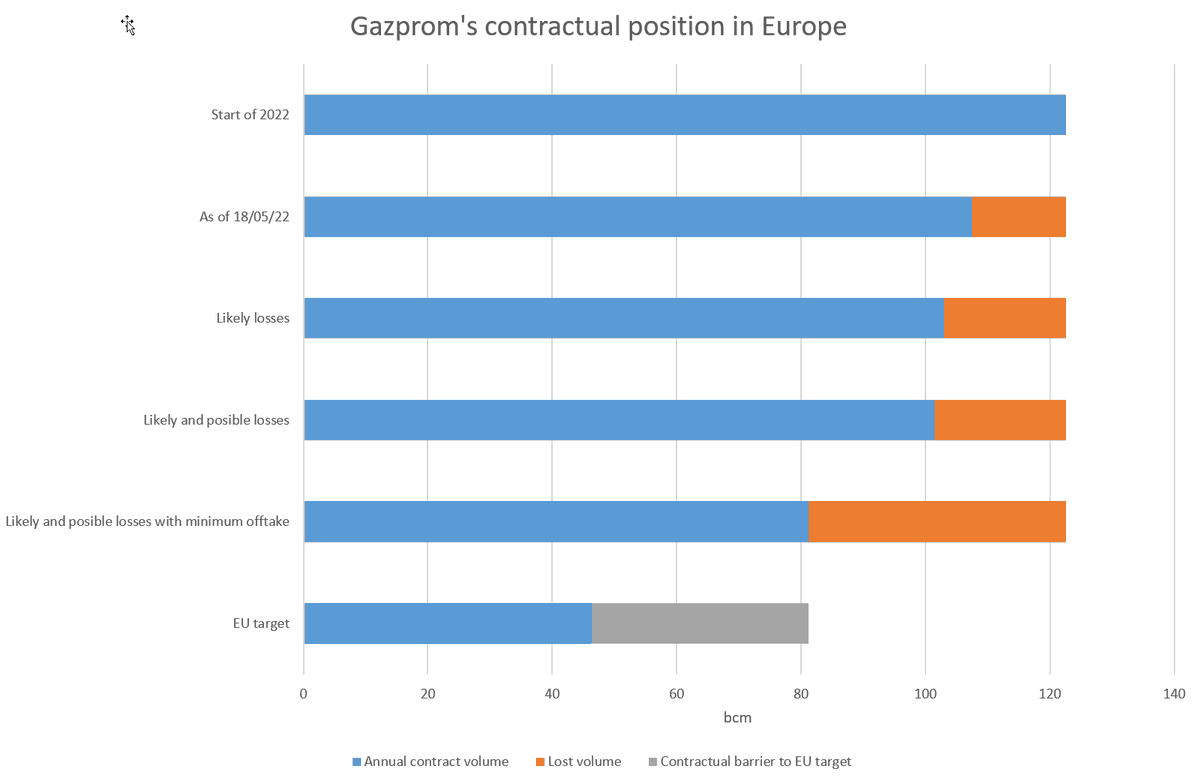

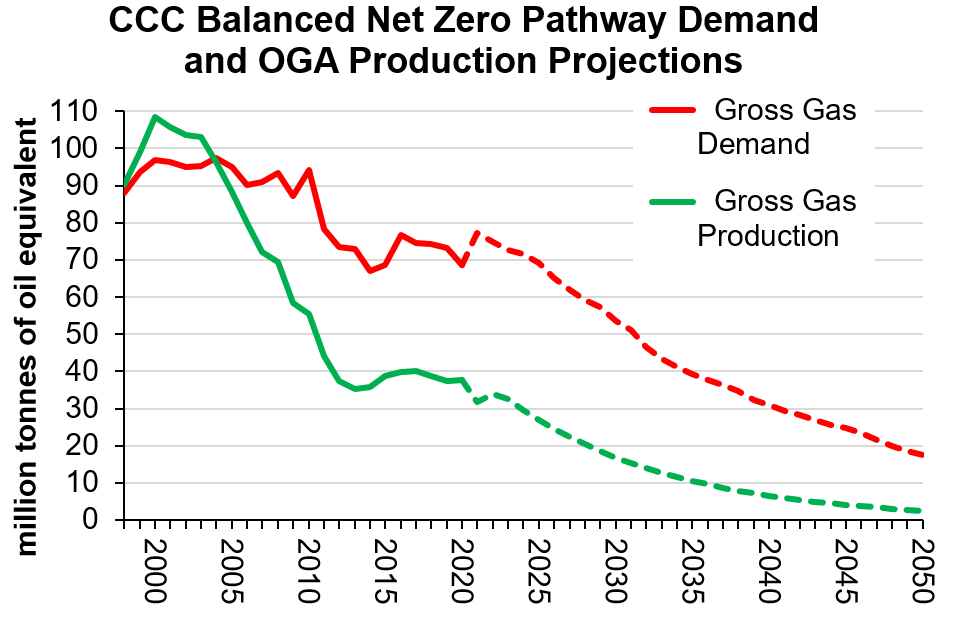

As to the underlying issues that would cause this event in one of the most liberalised and open gas markets in the world?

Low storage capacity? Import reliance? Underinvestment? Holiday trading? All of the above?

That’s probably a whole thread in itself.

11/11

Low storage capacity? Import reliance? Underinvestment? Holiday trading? All of the above?

That’s probably a whole thread in itself.

11/11

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh