1/ The good folks at @chainalysis recently released a comprehensive report on investing in the NFT market.

Want the TLDR? Onramp Academy has you covered in this thread.👇

Want the TLDR? Onramp Academy has you covered in this thread.👇

2/ In 2021, users spent at least $26.9 billion on Ethereum based NFTs. While a number of other blockchains support NFTs, Ethereum is by far the most widely used. OpenSea is the most popular marketplace by a wide margin, with over $16 billion worth of volume.

3/ Furthermore, we see significant increases in average transaction size, suggesting that NFTs as an asset category are gaining value as they attract new users.

4/ The original NFT project, CryptoPunks, which was first established in 2017 is still the most popular while some collections experience brief but large spikes in transaction activity without ever gaining consistent popularity.

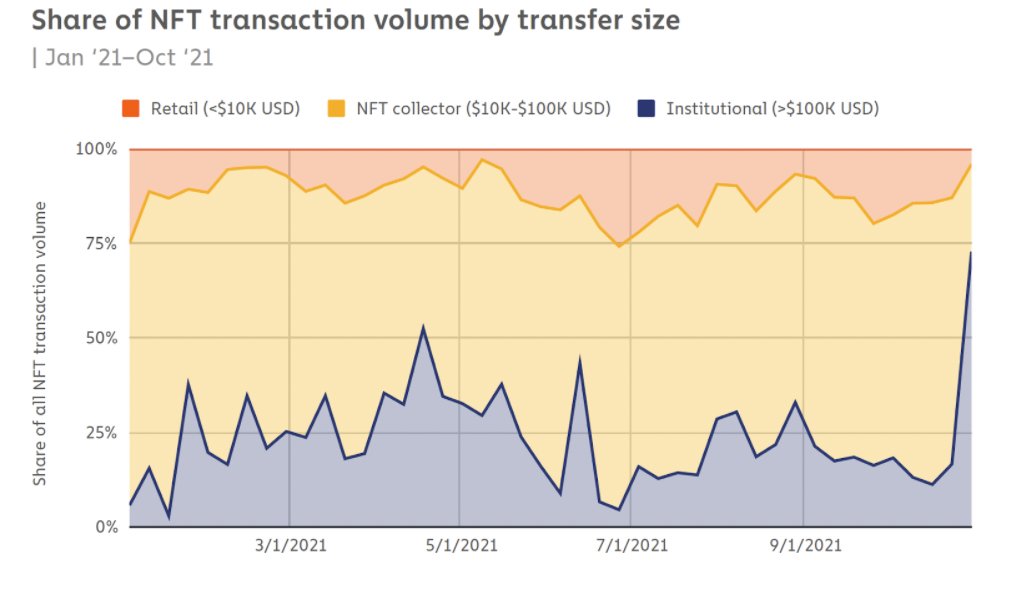

5/ The vast majority of NFT transactions are still in smaller amounts (less than $10,000 per transaction) suggesting retail investors make up the majority of the transactions.

6/ However, institutional investors willing to invest $100k or more make up a much larger percentage of total dollar volume in the NFT market.

7/ In other words, there are only a small number of high quality NFT projects that go on to accrue substantial value, but the projects that do make it into this category are worth significantly more.

8/ So, how does one go about making money from investing in the NFT market?

Two approaches: minting and flipping.

Two approaches: minting and flipping.

9/ With regard to investing in newly minted NFTs, whitelisting is the key to producing good returns.

10/ NFT creators try to build interest long before the NFTs are released. Those early, dedicated followers may be rewarded by being added to a “whitelist,” which allows them to purchase new NFTs at a much lower price than other users during minting events.

11/ Transaction data from OpenSea shows that users who make the whitelist and later sell their newly-minted NFT gain a profit 75.7% of the time, versus just 20.8% for users who do so without being whitelisted.

12/ Compared to trying to get in early on the minting of new NFTs, buying NFTs on the secondary market from other users and flipping has a much higher success rate.

In fact, flipping leads to profit 65.1% of the time.

In fact, flipping leads to profit 65.1% of the time.

13/ However, NFT flipping activity is quite concentrated.

Over 2,000 individual NFT collections on OpenSea have had a secondary sale, but just 250 collections account for 80% of those secondary sales.

Over 2,000 individual NFT collections on OpenSea have had a secondary sale, but just 250 collections account for 80% of those secondary sales.

14/ In other words, the data suggests the best strategy is to simply buy blue chip NFT assets.

15/ However, the blue chip assets are the most expensive which is why we saw earlier that the total dollar value is skewed towards institutional capital.

This is supported by the fact that only 5% of all addresses account for 80% of profits made on secondary sales.

This is supported by the fact that only 5% of all addresses account for 80% of profits made on secondary sales.

16/ Not surprisingly, the more you buy and flip, the better you become at spotting market inefficiencies and finding NFTs that are likely to increase in value.

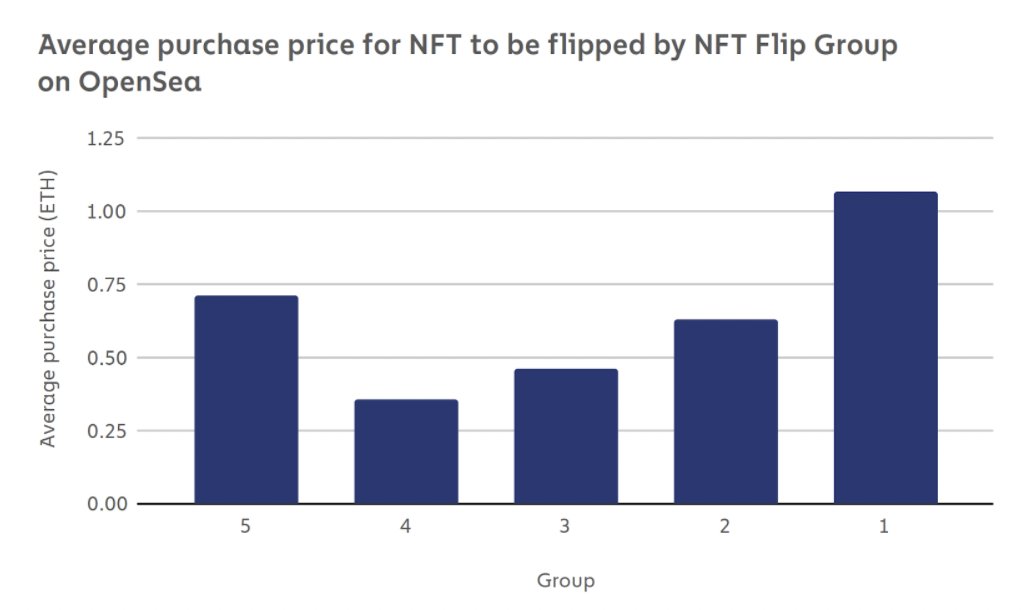

17/ The most successful NFT flippers buy and sell significantly more NFTs than other investors. Group 1 have bought and resold 105 NFTs on average, more than double the average for Group 2 at 39.

18/ Counter intuitively, the most successful NFT flippers pay significantly more on average for their initial purchase before selling. This is probably because they are investing in the blue chip (ie: most expensive) assets.

19/ The key takeaway is that while there is a lot of alpha to be had, unless you have significant capital and are willing to invest a lot of time and money into the NFT market, you're probably not going to make much money on NFTs.

20/ If you would like to read the report in its entirety, you can download it using the link below.

go.chainalysis.com/nft-market-rep…

go.chainalysis.com/nft-market-rep…

21/ For more timely updates on the cryptoasset markets, follow us at @OnrampAcademy and check out academy.onrampinvest.com to #EducateBeforeYouAllocate

Did you find this thread useful? We encourage you to like and RT to share with your network!

Did you find this thread useful? We encourage you to like and RT to share with your network!

• • •

Missing some Tweet in this thread? You can try to

force a refresh