0/ The Bitcoin Fear & Greed Index just hit lowest level since last July.

In today’s Delphi Daily, we analyzed how December’s Fed meeting minutes impacted global markets, recent liquidations, market fear, and gas spikes on @0xpolygon.

For more 🧵👇

In today’s Delphi Daily, we analyzed how December’s Fed meeting minutes impacted global markets, recent liquidations, market fear, and gas spikes on @0xpolygon.

For more 🧵👇

1/ December’s Fed meeting minutes released yesterday pointed towards quicker and more aggressive rate hikes than expected.

Risk assets like equities and crypto assets reacted swiftly to the news, tumbling after the minutes were released.

Risk assets like equities and crypto assets reacted swiftly to the news, tumbling after the minutes were released.

2/ The risk-off sentiment was present as well in crypto markets, and leveraged long traders were liquidated on downward price movements; $850M of positions got liquidated in the past 18 hrs.

The FOMC minutes were released at 2pm EST yesterday, triggering the initial sell-off.

The FOMC minutes were released at 2pm EST yesterday, triggering the initial sell-off.

3/ The Bitcoin Fear & Greed Index is now at its lowest level since July last year when Bitcoin was trading around $30k.

Bitcoin is currently down nearly 40% from its all time high of ~$69k in November.

Bitcoin is currently down nearly 40% from its all time high of ~$69k in November.

4/ Gas costs on @0xPolygon Network have spiked more than 10 fold to over 500 gwei.

The main culprit of the congestion is an NFT game called @SunflowerFarmz, which is now the largest “gas guzzler” on the network, consuming over 30% of the gas on Polygon.

The main culprit of the congestion is an NFT game called @SunflowerFarmz, which is now the largest “gas guzzler” on the network, consuming over 30% of the gas on Polygon.

5/ Tweets of the day!

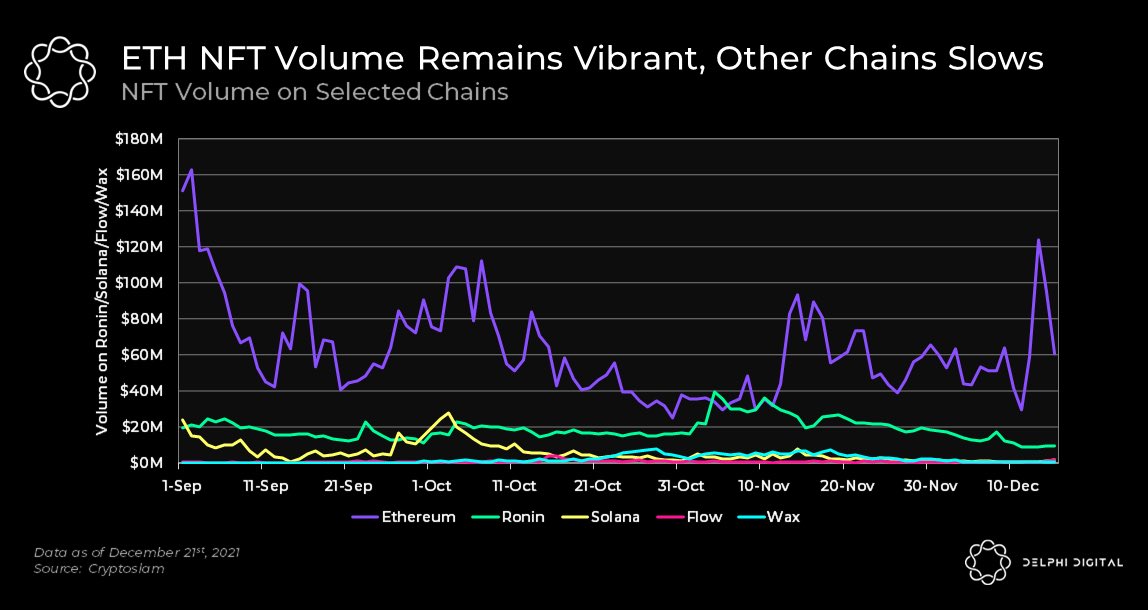

A Thread on the 1st Edition of Delphi’s NFT Newsletter

A Thread on the 1st Edition of Delphi’s NFT Newsletter

https://twitter.com/0xPrismatic/status/1479128082023804930

6/ How an Emission Based Token Can Balance Ecosystem Participants

https://twitter.com/AndreCronjeTech/status/1479043842766745601

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh