Welcome to On a Date with a listed company on the Zimbabwe Stock Exchange (ZSE).

Dating is a critical stage to any investor considering to take a position on any asset class even shares.

THREAD: On a Date with National Foods Holdings Limited

Dating is a critical stage to any investor considering to take a position on any asset class even shares.

THREAD: On a Date with National Foods Holdings Limited

#1. History,

1908, Joseph Palte a native of Lithuania a country in Europe starts J. Palte & Co in Bulawayo.

J. Palte & Co is an independent grain and general merchant business. Mark Harris works with Joseph Palte.

1908, Joseph Palte a native of Lithuania a country in Europe starts J. Palte & Co in Bulawayo.

J. Palte & Co is an independent grain and general merchant business. Mark Harris works with Joseph Palte.

1915, Mark Harris moves to Harare and sets up Mark Harris Manufacturing (MHM).

Establish the first roller maize and flour mill in Zimbabwe operating as Atlas Mill.

1920, British South Africa Company (BSAC) buys a stake in MHM.

Establish the first roller maize and flour mill in Zimbabwe operating as Atlas Mill.

1920, British South Africa Company (BSAC) buys a stake in MHM.

The Gloria flour brand is launched by MHM.

1924, BSAC rename MHM to Rhodesia Milling and Manufacturing Company (RMMC) after Mark Harris' offloads his entire holding.

1928, Mark Harris joins Cessey Harris in Bulawayo and form Harris Bros & Co.

1924, BSAC rename MHM to Rhodesia Milling and Manufacturing Company (RMMC) after Mark Harris' offloads his entire holding.

1928, Mark Harris joins Cessey Harris in Bulawayo and form Harris Bros & Co.

1934, Joseph Palte commits suicide by self administering of cyanide and his son Jack Palte takes over J. Palte & Co operations.

1952, Tiger Brands formerly Tiger Oats acquires a significant stake in J. Palte & Co to become a major shareholder.

1952, Tiger Brands formerly Tiger Oats acquires a significant stake in J. Palte & Co to become a major shareholder.

1956, RMMC acquires Harris Bros & Co and a 10 year non competition clause is signed to deter the Harris brothers from flour trade.

Harris Maize Milling is formed.

1964, J.Palte & Co, Harris Maize Milling, Meadows Milling merge to form Palte Harris.

Harris Maize Milling is formed.

1964, J.Palte & Co, Harris Maize Milling, Meadows Milling merge to form Palte Harris.

1965, Anglo American Corporation absorb RMMC which was now Rhodesia Milling Company (RMC).

1969, Palte Harris changed name to Palte Harris Industrial Holdings (PHIH) and listed on the ZSE 1 year later.

1975, The merge of PHIH and RMC form National Foods.

1969, Palte Harris changed name to Palte Harris Industrial Holdings (PHIH) and listed on the ZSE 1 year later.

1975, The merge of PHIH and RMC form National Foods.

#2 Operations,

National Foods is the largest manufacturer and marketer of,

Stockfeeds

Snacks

Treats

Cereals

Edible Oils

Basic foods

It is also heavily involved in contract farming initiatives contributing to its raw materials needs.

National Foods is the largest manufacturer and marketer of,

Stockfeeds

Snacks

Treats

Cereals

Edible Oils

Basic foods

It is also heavily involved in contract farming initiatives contributing to its raw materials needs.

National Foods has manufacturing sites in Harare, Bulawayo and Mutare.

It has 40% stake in Pure Oil Industries the maker of Zimgold brand of edible oil.

50% stake in a logistics joint venture with Equity Distribution Services.

It has 40% stake in Pure Oil Industries the maker of Zimgold brand of edible oil.

50% stake in a logistics joint venture with Equity Distribution Services.

#3. Competitors,

National Foods has a competitive advantage in the supply of FMCG due to its size.

Key rivals

1. Mega Market

2. Blue Ribbon Foods

3. Probrands

4. United Refineries

5. Cairns Foods

6. Surface Wilmar

7. Agrifoods

8. Victoria Foods

National Foods has a competitive advantage in the supply of FMCG due to its size.

Key rivals

1. Mega Market

2. Blue Ribbon Foods

3. Probrands

4. United Refineries

5. Cairns Foods

6. Surface Wilmar

7. Agrifoods

8. Victoria Foods

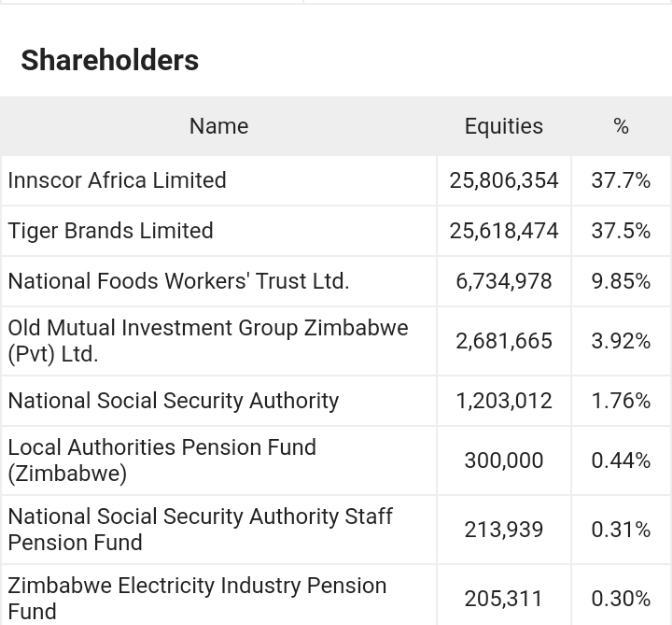

#4. Shareholding,

1. Innscor Africa Limited

A diversified ZSE listed Investment holding company with interests in FMCGs

2. Tiger Brands Limited

Listed on the JSE with a number of leading brands in the FMCGs category.

1. Innscor Africa Limited

A diversified ZSE listed Investment holding company with interests in FMCGs

2. Tiger Brands Limited

Listed on the JSE with a number of leading brands in the FMCGs category.

#5. Share Price

1,385 ZWL per share as of the 7th of January 2022.

1,374 ZWL per share on the 3rd of January 2022.

0.74% gained from the beginning of 2022.

20th on ZSE ranking according to performance to date

755,648,101 issued shares

1,385 ZWL per share as of the 7th of January 2022.

1,374 ZWL per share on the 3rd of January 2022.

0.74% gained from the beginning of 2022.

20th on ZSE ranking according to performance to date

755,648,101 issued shares

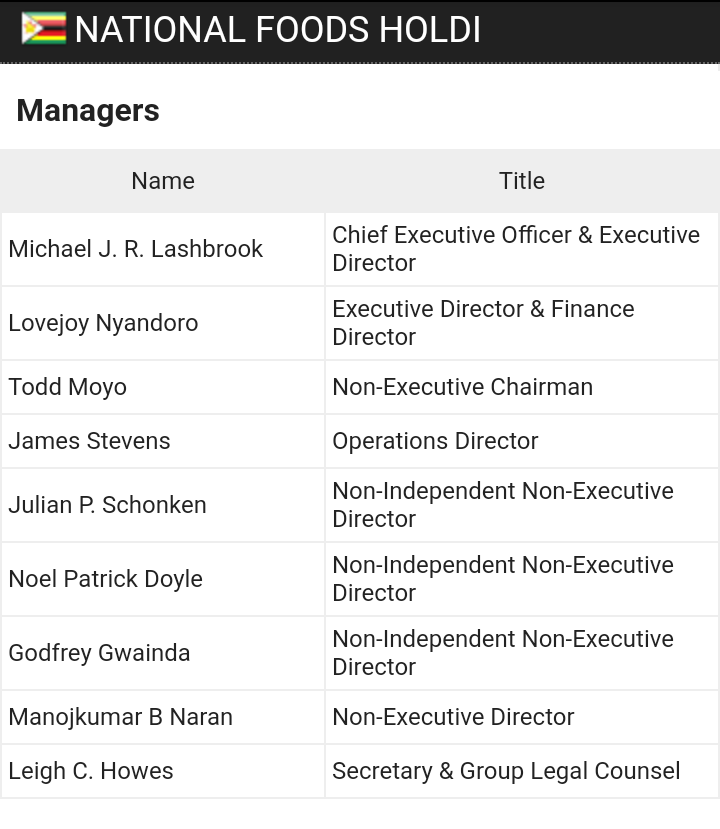

#6. Management

Michael Lashbrook

Appointed CEO on the 1st of January 2015

Appointed COO of NFHL in August of 2008

Successful grew an export agri business

Holds a BSc in Agriculture from University of Natal and MBA from University of Southern Queensland

Michael Lashbrook

Appointed CEO on the 1st of January 2015

Appointed COO of NFHL in August of 2008

Successful grew an export agri business

Holds a BSc in Agriculture from University of Natal and MBA from University of Southern Queensland

#7. Pitch

1. The business is investing in building its efficiencies

° Through plant upgrade at the flour mill in Bulawayo,

° Expanding the breakfast cereal plant in Harare.

2. A dividend declaring company 43 times in its 50 years of listing on the ZSE.

1. The business is investing in building its efficiencies

° Through plant upgrade at the flour mill in Bulawayo,

° Expanding the breakfast cereal plant in Harare.

2. A dividend declaring company 43 times in its 50 years of listing on the ZSE.

3. An aggressive import substitution plan through local contract farming thereby reduce the future foreign currency needs of the group.

4. A good defensive stock which continues to perform well in troubled economies due to the nature of products.

4. A good defensive stock which continues to perform well in troubled economies due to the nature of products.

5. A recently proposed share buyback program which if actioned will increase the value of the stock.

6. Strong major shareholders in two geographical locations who have been invested for a number of years.

7. A proven management that has managed to deliver.

6. Strong major shareholders in two geographical locations who have been invested for a number of years.

7. A proven management that has managed to deliver.

Each week will be on a DATE with a company listed on the ZSE.

The purpose of this thread is to have a minimum appreciation of listed firms.

Disclaimer: Do not misconstrue this thread as investment advise DATE companies before you buy its shares.

The purpose of this thread is to have a minimum appreciation of listed firms.

Disclaimer: Do not misconstrue this thread as investment advise DATE companies before you buy its shares.

• • •

Missing some Tweet in this thread? You can try to

force a refresh