$FTM is probably the most degen ecosystem for DeFi right now.

It is also the most undervalued. No other chain has a lower mcap/TVL.

mcap $5.9b/TVL $5.45b = 1.09

There are so many opportunities to earn yield here.

Let's look at how you can make it in 2022 with $FTM 👻

/THREAD

It is also the most undervalued. No other chain has a lower mcap/TVL.

mcap $5.9b/TVL $5.45b = 1.09

There are so many opportunities to earn yield here.

Let's look at how you can make it in 2022 with $FTM 👻

/THREAD

We will go through the following opportunities to earn yield on $FTM:

1. $FTM / $TOMB

2. Spiritswap

3. Liquiddriver

4. Beethoven

5. Spookyswap

6. Abracadabra

7. Creditum:

8. ve(3,3)

/1

1. $FTM / $TOMB

2. Spiritswap

3. Liquiddriver

4. Beethoven

5. Spookyswap

6. Abracadabra

7. Creditum:

8. ve(3,3)

/1

If you're not familiar with FTM at all, I recommend you to take a look at this thread that I made about $FTM in November:

I made the last $FTM thread in November, but as we all know, 2 months in DeFi is like 2 years IRL.

/2

https://twitter.com/Route2FI/status/1463816031026176001?s=20

I made the last $FTM thread in November, but as we all know, 2 months in DeFi is like 2 years IRL.

/2

In other words, a lot has happened with $FTM since then.

Fantom has 111 DeFi protocols at the moment, most of them with low volume.

Tbh, I think people are a little scared to use Fantom protocols because of the "scary" UX/interface image.

3/

Fantom has 111 DeFi protocols at the moment, most of them with low volume.

Tbh, I think people are a little scared to use Fantom protocols because of the "scary" UX/interface image.

3/

If you're not familiar with DeFi, it can be a little hard to navigate and understand Fantom.

But that is also the point. Because Fantom is built by degens for degens.

The fewer people that know about the craziest yield farms, the better for the people who are in it.

/4

But that is also the point. Because Fantom is built by degens for degens.

The fewer people that know about the craziest yield farms, the better for the people who are in it.

/4

But DeFi is for everyone, and I believe that more people should discover this ecosystem. It offers some of the best opportunities right now.

In this thread we're going to focus on DeFi, but if you want to read more about why $FTM is undervalued, I recommend you to check...

/5

In this thread we're going to focus on DeFi, but if you want to read more about why $FTM is undervalued, I recommend you to check...

/5

out this thread by brother @JackNiewold :

You should also check out this thread by @AustinBarack to understand more about what $FTM is and its growth potential:

/6

https://twitter.com/JackNiewold/status/1473758246712270850?s=20

You should also check out this thread by @AustinBarack to understand more about what $FTM is and its growth potential:

https://twitter.com/AustinBarack/status/1478206147756711938?s=20

/6

So our overall goal is to earn the most money possible, right?

Let's start with my all-time favorite $FTM - $TOMB:

$TOMB is a cross-chain algorithmic stablecoin, pegged to the price of 1 FTM via seigniorage.

Okay, let's explain that quickly.

/7

Let's start with my all-time favorite $FTM - $TOMB:

$TOMB is a cross-chain algorithmic stablecoin, pegged to the price of 1 FTM via seigniorage.

Okay, let's explain that quickly.

/7

$TOMB is in other words pegged to the price of FTM, so farming $FTM - $TOMB should net no impermanent loss (IL)!

A unique concept IMO, because all farmers' worst nightmare is IL.

/8

A unique concept IMO, because all farmers' worst nightmare is IL.

/8

If you want to play the $FTM - $TOMB opportunity you have 5 options:

1) At @tombfinance 132% APR on $FTM - $TOMB (942% APR on $TSHARES)

2) At @beefyfinance 260% APY

3) At @Reaper_Farm 255% APY

4) At @TarotFinance (leverage) 134-195% APR = (280-600% APY)

9/

1) At @tombfinance 132% APR on $FTM - $TOMB (942% APR on $TSHARES)

2) At @beefyfinance 260% APY

3) At @Reaper_Farm 255% APY

4) At @TarotFinance (leverage) 134-195% APR = (280-600% APY)

9/

5) At @GrimFinance 282% APY (PS! The platform was exploited on Dec. 21, be careful)

I've made a guide for how to do play $FTM - $TOMB step by step with @Reaper_Farm here:

10/

I've made a guide for how to do play $FTM - $TOMB step by step with @Reaper_Farm here:

https://twitter.com/Route2FI/status/1469645405445140480?s=20

10/

If you want to try the original $FTM - $TOMB with $TSHARES you can check out my step-by-step here:

If you want to try $FTM - $TOMB on Tarot check out this tweet:

11/

https://twitter.com/Route2FI/status/1463814731433717763?s=20

If you want to try $FTM - $TOMB on Tarot check out this tweet:

https://twitter.com/Route2FI/status/1478848340653752321?s=20

11/

I have $FTM - $TOMB on all of the sites, but not @GrimFinance atm.

So why is this play on $TOMB one of my favorites?

If you think about it, how sick isn't it to get 250% on one of your favorite tokens? Just compare it to normal staking (9-14%) or most yield farms which...

/12

So why is this play on $TOMB one of my favorites?

If you think about it, how sick isn't it to get 250% on one of your favorite tokens? Just compare it to normal staking (9-14%) or most yield farms which...

/12

don't give you over 100% APY, and here you have an opportunity to get over 250% APY without IL. I don't think most people understand how sick this is.

Btw, if you're not familiar with Impermanent loss, please check out this short video here:

academy.binance.com/en/articles/im…

/13

Btw, if you're not familiar with Impermanent loss, please check out this short video here:

academy.binance.com/en/articles/im…

/13

It's important to understand what you should look out for when trying yield farming (LP), eg. impermanent loss (IL).

Let's move on to the next opportunities: Liquiddriver and Spiritswap.

I'm sure you've heard about the Curve War on $ETH with $CRV & $CVX, but...

14/

Let's move on to the next opportunities: Liquiddriver and Spiritswap.

I'm sure you've heard about the Curve War on $ETH with $CRV & $CVX, but...

14/

are you familiar with the Spirit War with $SPIRIT & $LQDR?

Check out this thread to understand it and why it's important for Fantom:

This is some of the most interesting stuff going on in DeFi atm IMO!

/15

Check out this thread to understand it and why it's important for Fantom:

https://twitter.com/crypto_klay/status/1477346893680185346?s=20

This is some of the most interesting stuff going on in DeFi atm IMO!

/15

Let's look at some ways you can profit from this:

Liquiddriver:

LiquidDriver is a High-Yield liquidity mining app launched on Fantom.

One way you can use Liquiddriver to generate yield:

See this tweet:

/16

Liquiddriver:

LiquidDriver is a High-Yield liquidity mining app launched on Fantom.

One way you can use Liquiddriver to generate yield:

See this tweet:

https://twitter.com/Route2FI/status/1477741574427709444?s=20

/16

Also, see some great strategies from brother @milesdeutscher to use at Liquiddriver here:

/17

https://twitter.com/milesdeutscher/status/1479257726521724928?s=20

/17

Spiritswap:

Spiritswap is a new AMM, and I'm sure this will grow into becoming one of the biggest ones this year.

To benefit from the Spiritwar you can play different options.

$SPIRIT is a undervalued token IMO, and if you want to have some small caps in...

/18

Spiritswap is a new AMM, and I'm sure this will grow into becoming one of the biggest ones this year.

To benefit from the Spiritwar you can play different options.

$SPIRIT is a undervalued token IMO, and if you want to have some small caps in...

/18

the $FTM ecosystem, you can eg:

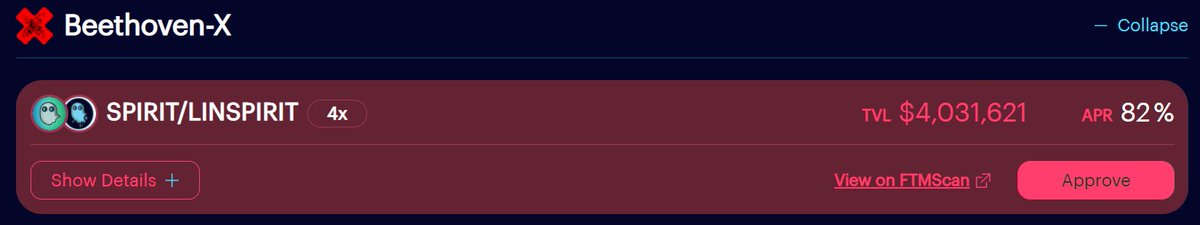

1) Stake linSPIRIT here: liquiddriver.finance/linspirit (58% APR)

2) LP SPIRIT/LINSPIRIT here: liquiddriver.finance/farms 82% APR (see below)

/19

1) Stake linSPIRIT here: liquiddriver.finance/linspirit (58% APR)

2) LP SPIRIT/LINSPIRIT here: liquiddriver.finance/farms 82% APR (see below)

/19

Beethoven

Beethoven X is the first next-generation AMM protocol on Fantom (think Balancer on $ETH).

Some opportunities:

1) Investing in the Fidelio Duetto pool:

Step 1: Go to: beets.fi/#/pools

Step 2: Find the Fidelio Duetto pool (142% APR)

20/

Beethoven X is the first next-generation AMM protocol on Fantom (think Balancer on $ETH).

Some opportunities:

1) Investing in the Fidelio Duetto pool:

Step 1: Go to: beets.fi/#/pools

Step 2: Find the Fidelio Duetto pool (142% APR)

20/

Step 3: The reward are paid out in $BEETS, you reinvest them here: beets.fi/#/stake

Step 4: You get 139% APR in fBEETS as rewards

Step 5: Reinvest your fBEETS at an autocompounder, eg. reaper.farm to 312% APY here: reaper.farm

21/

Step 4: You get 139% APR in fBEETS as rewards

Step 5: Reinvest your fBEETS at an autocompounder, eg. reaper.farm to 312% APY here: reaper.farm

21/

2) Stablecoin Pool: Daniele And Do's Double Dollar Fugue

The pool is named after the legends @dokwon and @danielesesta

Step 1) Put in $UST, $MIM and $USDC and get a 22,5% APR paid out in $BEETS.

/22

The pool is named after the legends @dokwon and @danielesesta

Step 1) Put in $UST, $MIM and $USDC and get a 22,5% APR paid out in $BEETS.

/22

Step 2) Either convert the $BEETS rewards to a stablecoin at Spookyswap/Spiritswap or go into step 3 as described in the Fidelio Duetto pool above.

A great way to get some stablecoin yields if you want to spread your risk a little bit.

/23

A great way to get some stablecoin yields if you want to spread your risk a little bit.

/23

Spookyswap

It's on Spookyswap I create most of my LP's that I use in different yield farm strategies.

Some Spookyswap strategies:

Yearn + Spooky

1- Exchange all your $FTM into $WFTM @SpookySwap

2 - Put in $WFTM Vault (10.5% APY) on @iearnfinance

cont.

/24

It's on Spookyswap I create most of my LP's that I use in different yield farm strategies.

Some Spookyswap strategies:

Yearn + Spooky

1- Exchange all your $FTM into $WFTM @SpookySwap

2 - Put in $WFTM Vault (10.5% APY) on @iearnfinance

cont.

/24

Tweet nr. 25 - nr. 45 continues in this thread below:

👇

👇

https://twitter.com/Route2FI/status/1480944165181706242?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh