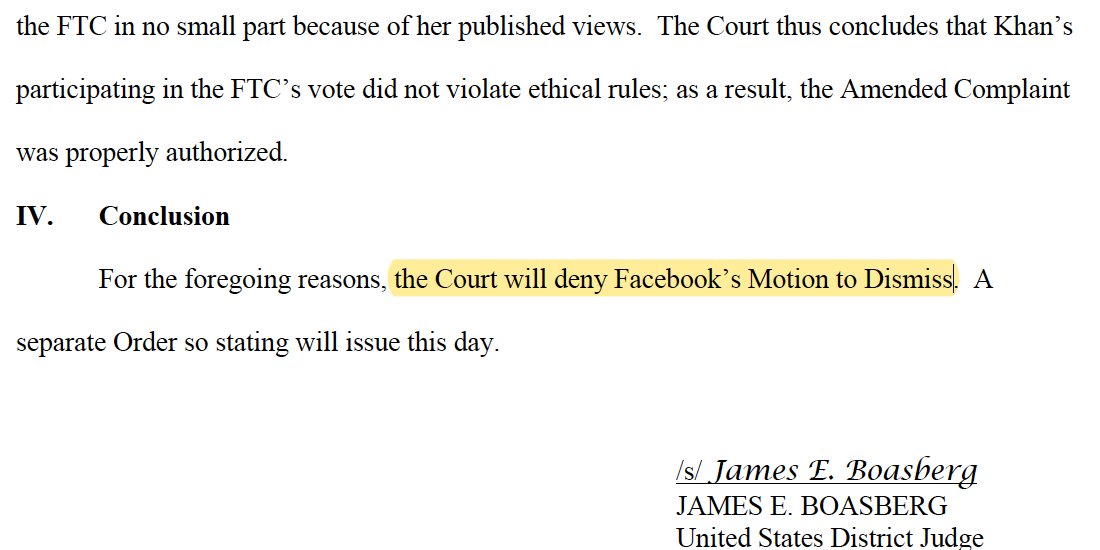

Snap! FTC amended lawsuit to break up Facebook - green light from the court! Congrats to FTC.

Rather than spend time dunking on FB's friendlies who suggested it had failed, I hope you will ignore their next round of talking points since the last ones were so damn wrong. /1

Rather than spend time dunking on FB's friendlies who suggested it had failed, I hope you will ignore their next round of talking points since the last ones were so damn wrong. /1

First, they told you the FTC failed to even define a market - their go-to line. This was entirely false, the court said they had failed to provide metrics to back it up which they added in spades to the amended complaint which had the same core theory as the Court notes. /2

The really really obviously on Facebook's payroll and influence list said things like the FTC had already "approved" the Instagram and WhatsApp deals which were sort of the rookie-league arguments and false. But again, the Judge clarified why those points were irrelevant. /3

back to actual arguments of the case, the Court had already accepted the market definition and then now tips the hat to the use of three metrics as backup. Anyone who has actually run a digital biz knows why you must look at multiple metrics holistically. So does the Judge. /4

In terms of Facebook's argument that buying Instagram and WhatsApp wasn't anticompetitive and bad for consumers, the Court throws in the compelling point of how Facebook pulled back its own investment in its own product after the deal. Point taken. /5

And love seeing the Court agree with Facebook that consumer harm also matters and that can't be proven on price (since facebook is free) but then agreeing the allegations are solid. DISCOVERY ON THIS AREA IS GOING TO BE A GOLD MINE as we all know, Facebook is a cesspool. /6

I mean one more point here on consumers. The allegation is market power allowed FB to lower its service quality for consumers. Does anyone doubt this? Do we really believe Facebook wouldn't have better addressed its problems of the past few years if it had more competition? /7

So when Facebook attempts to argue FTC re-arranged chairs on Titanic or FB's paid lobby group (hi @adamkovac) points out meaningless language in the decision (yes, Count II remains in the complaint), please return to my first tweet as they also said it should be thrown out. /8

And my threaded comments on the original amended complaint.

https://twitter.com/jason_kint/status/1461136575237140483?s=20

also, I should have pointed out the Court also threw out Facebook's weak sauce argument against the Chair's ability to file the case (google and amazon have tried similar arguments in other matters).

As background, here was my thread on the amended FTC case filed in August.

https://twitter.com/jason_kint/status/1428436960239046657

Hat tip to @techpolicypress for capturing it here.

https://twitter.com/techpolicypress/status/1430919439541800963

• • •

Missing some Tweet in this thread? You can try to

force a refresh