0/ Will Fantom be the next big L1?

In today’s Delphi Daily, we examine @FantomFDN’s TVL, @paraswap’s recent activity, on chain $BTC data of long-term holders, and how BTC responded to latest CPI data.

For more 🧵👇

In today’s Delphi Daily, we examine @FantomFDN’s TVL, @paraswap’s recent activity, on chain $BTC data of long-term holders, and how BTC responded to latest CPI data.

For more 🧵👇

1/ While the TVLs across crypto have stagnated, @FantomFDN’s ecosystem has been vibrant. Fantom has gained $1.2B (+20%) in TVL over the past week.

This comes as @AndreCronjeTech and @danielesesta, two prominent builders, have shown interest in developing the Fantom ecosystem.

This comes as @AndreCronjeTech and @danielesesta, two prominent builders, have shown interest in developing the Fantom ecosystem.

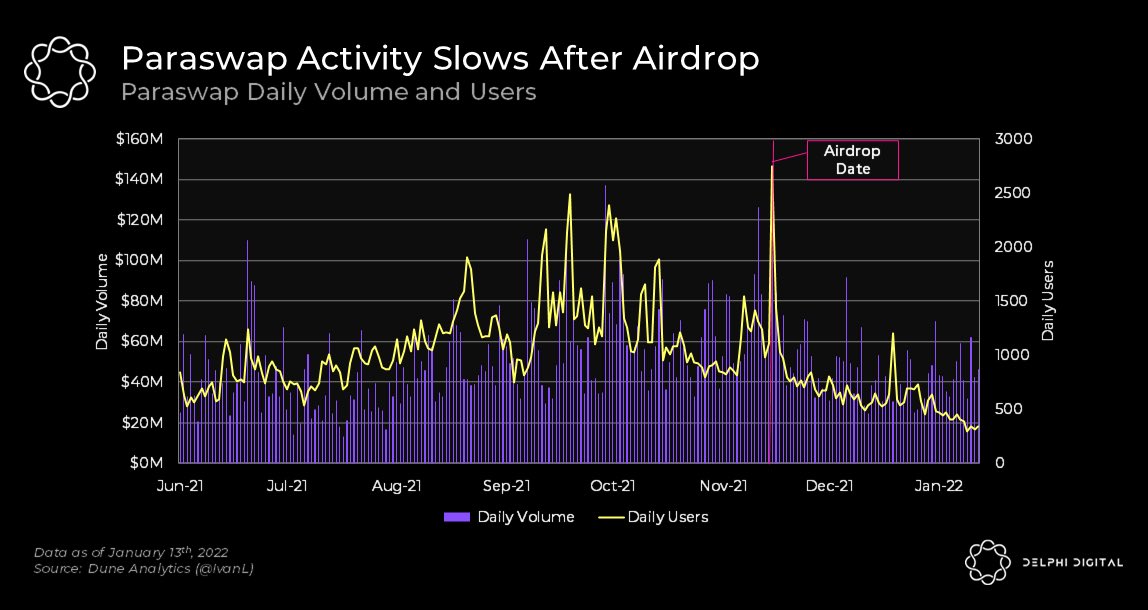

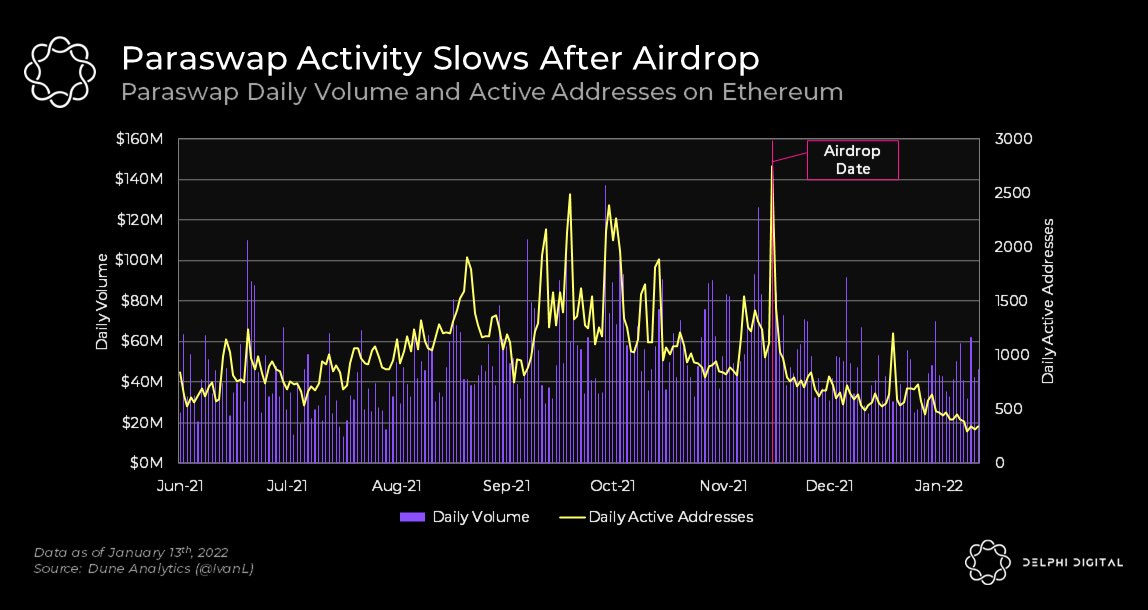

2/ Since @paraswap’s airdrop on Nov 15th, activity on the DEX aggregator has stagnated.

Before the airdrop, many people speculated and used Paraswap in hopes of receiving a piece of the airdrop.

Paraswap’s downfall can be a lesson to other protocols to better design airdrops.

Before the airdrop, many people speculated and used Paraswap in hopes of receiving a piece of the airdrop.

Paraswap’s downfall can be a lesson to other protocols to better design airdrops.

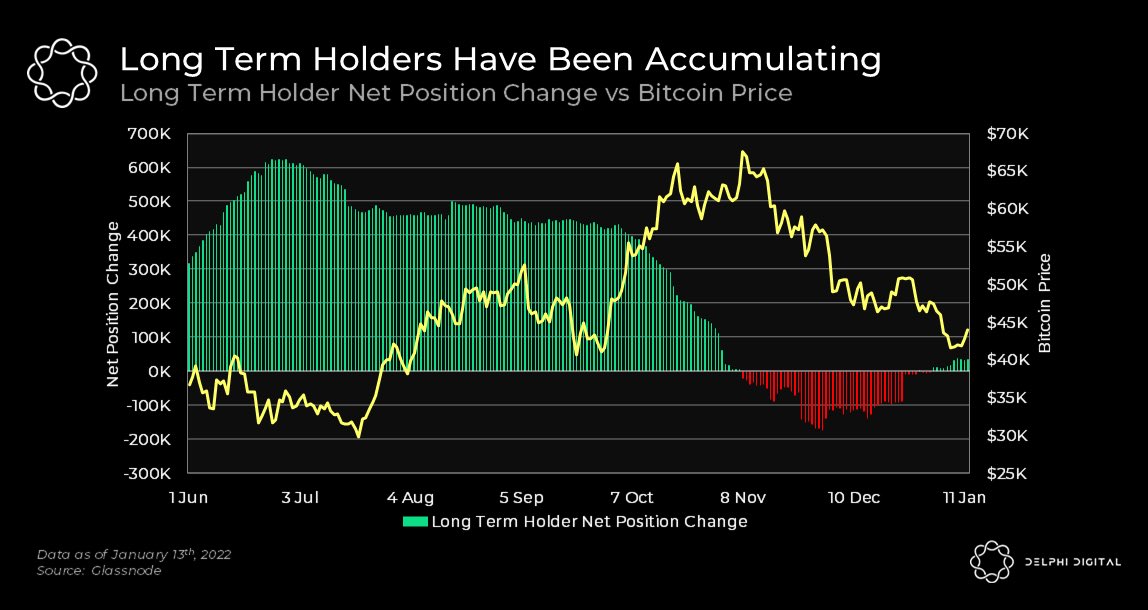

3/ On-chain data shows that throughout January’s price slump, long-term holders have accumulated bitcoin after months of offloading bitcoin at the end of last year.

A rise in long-term holder accumulation could be a positive indicator for bitcoin price.

A rise in long-term holder accumulation could be a positive indicator for bitcoin price.

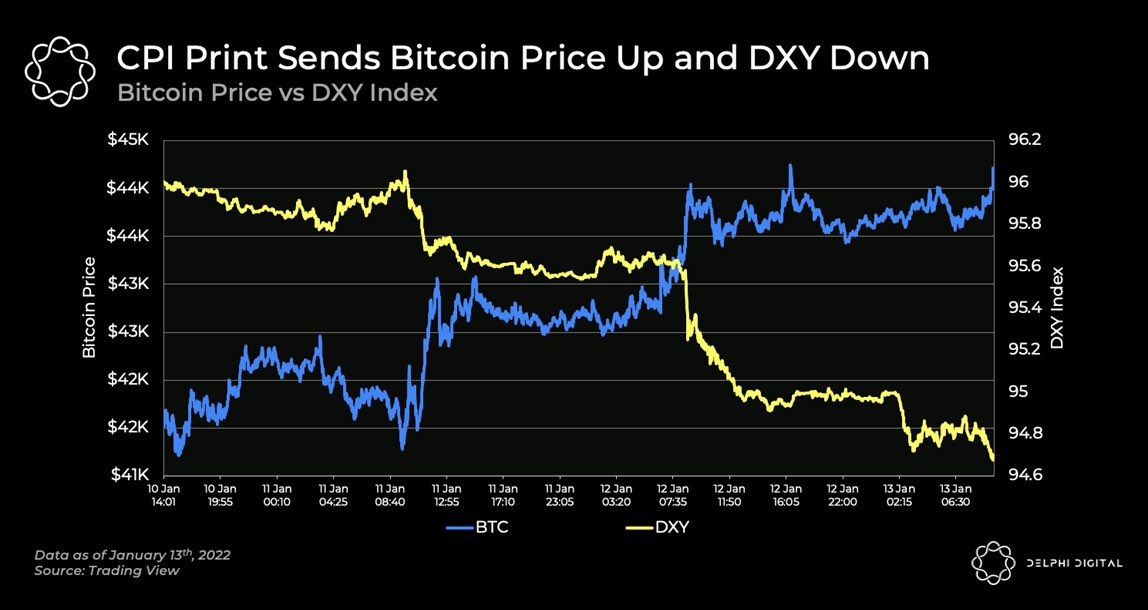

4/ After being spooked by hawkish Fed minutes, investors were expecting a high inflation print yesterday. However, the CPI print came within market expectations at 7% YoY and 0.5% MoM.

Bitcoin price rallied on the news, and the dollar index slumped to a 2 month low.

Bitcoin price rallied on the news, and the dollar index slumped to a 2 month low.

5/ Tweets of the day!

BTC ETF in India Soon

BTC ETF in India Soon

https://twitter.com/BTC_Archive/status/1481615200910520320

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

Clarification: Active addresses, not individual users, using Paraswap have contracted in recent weeks. The data in the chart also pertains only to Ethereum, and not other chains where Paraswap is deployed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh