Sheryl Sandberg, Facebook's COO, has never had to testify under oath about a major scandal but has 4 career-defining, very damaging matters hitting concurrently. *Allegations* involve #1 collusion (with Google), #2 insurrection, #3 cover-up of breach, #4 fraud. Here we go...

/1

/1

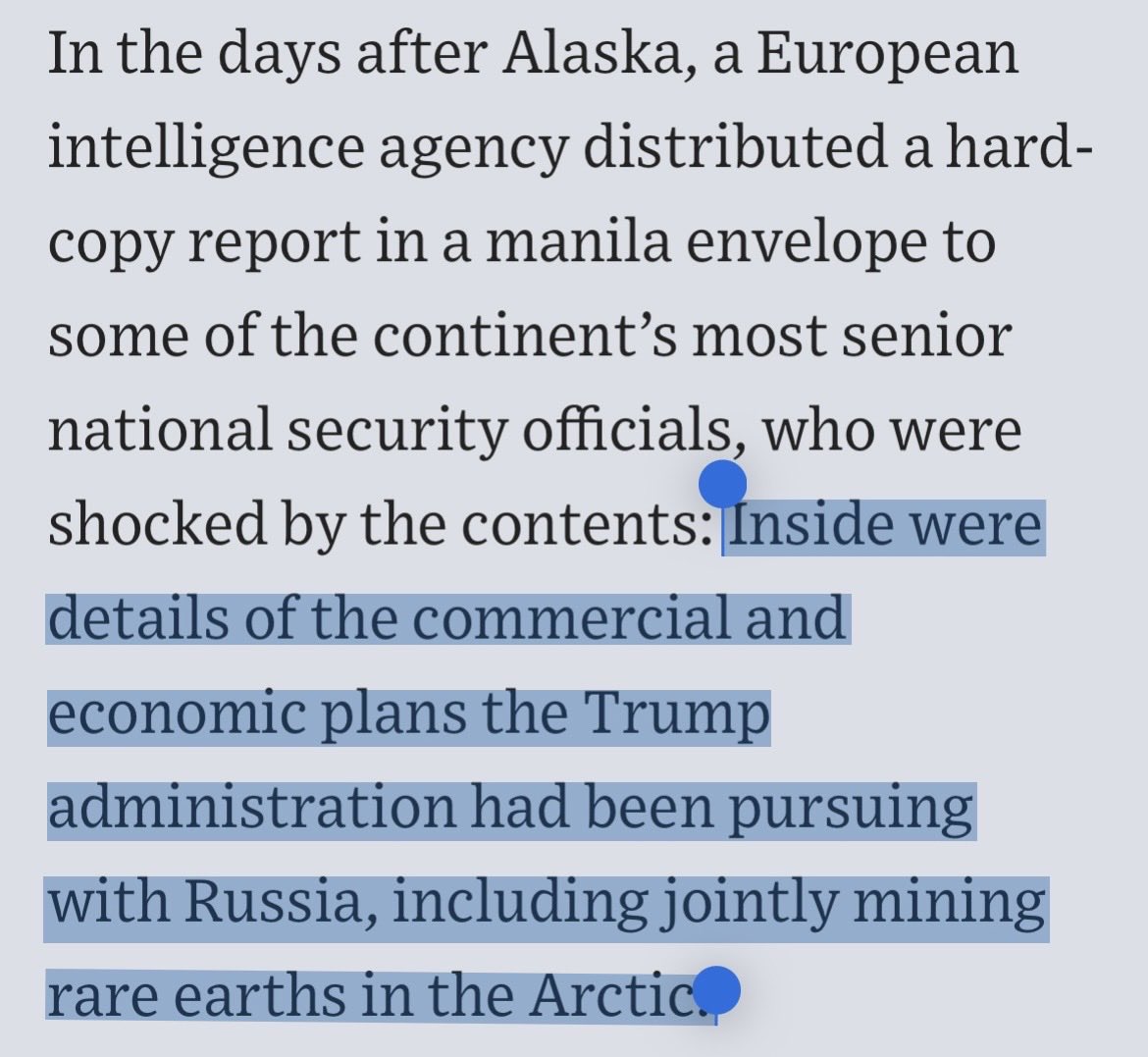

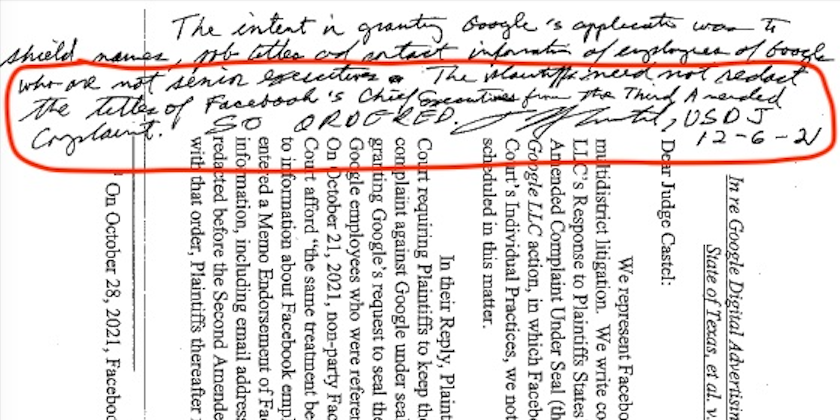

#1 State AGs amended complaint vs Google was ordered filed mostly unsealed by tomorrow. And SDNY Court ruled last month two senior Facebook names involved in a market rigging allegation, a section one Sherman Act violation, can't be redacted. Sandberg is expected to be one. /2

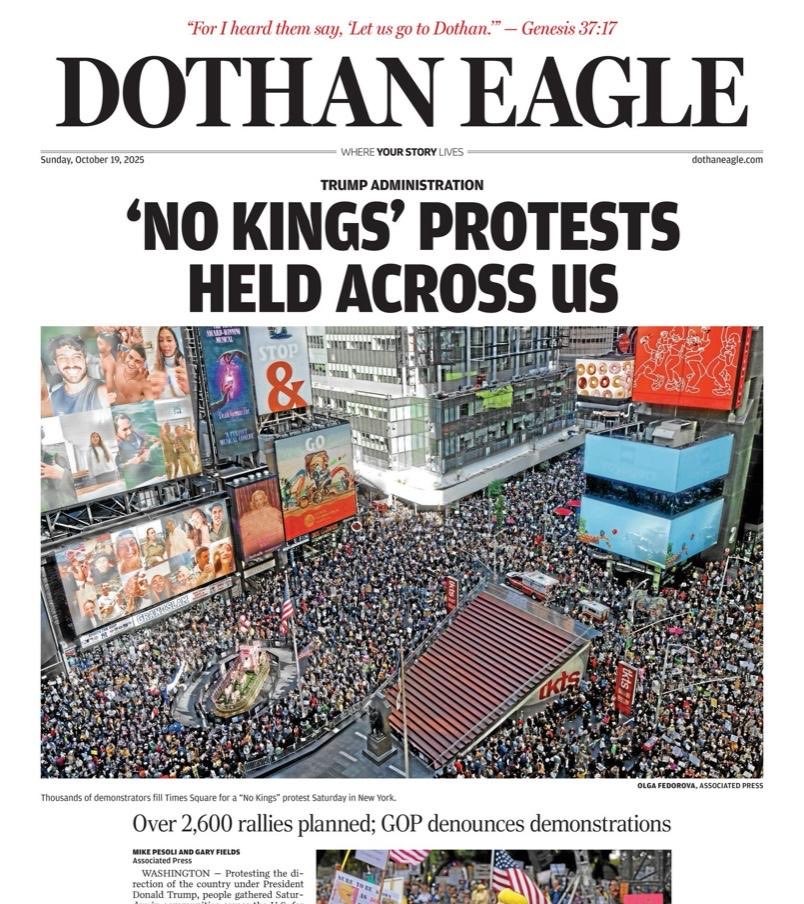

#2 Facebook received subpoena today from Jan 6th Select Committee as it reportedly has avoided turning over requested info. Facebook also showed up as a tool in today's indictments of alleged seditious conspiracy. Sandberg previously minimized its role. /3

#3 a big, under-reported one. Cambridge Analytica cover-up appears to be unraveling. DC Superior Court ordered her boss's deposition and N District of Cal Court is winning key discovery around matter - all earlier this week with their top Gibson Dunn attorneys losing motions. /4

Digging in here a bit more. Discovery of Sandberg's documents according to the plaintiffs "will shed considerable additional light on the scandal." And we learned in documents being unsealed a bit more why they may. /5

If you recall when scandal broke, Facebook went dark for 5 days (3/16/18-3/21/18). This redaction is communications between Sandberg and cybersecurity firm (aka their auditors / clean-up crew) which apparently happened the same day Sandberg broke her silence (on CNBC). But... /6

Facebook lost motions to seal 2 firms' that worked for them including the one Sheryl was messaging immediately after scandal broke. Court ruled these messages are discoverable as they're not attorney-privileged or work product as FB planned audit regardless of lawsuits. So... /7

We don't what will be in this discovery but it involves a period where Facebook was dark, Sandberg was messaging a clean-up crew, those messages are discoverable and allegations she was "at the forefront of [their response] as she very much led monetization of user data. /8

Speaking of that business model, Facebook also lost a motion fighting discovery of the nearly 150 sources of data they have on each of the plaintiffs. First step is to describe each of these sources at a high-level and how they're used. This must be very uncomfortable for FB. /9

#4 Fraud. Over the holidays, a ton of evidence was unsealed in a N District of Cal case which added fraud allegations (knowledge of inflated potential reach metrics). The evidence is damning considering FB whistleblower also filed SEC complaint related to this matter. /10

If you want to go deeper on any of these, here is a thread on #1. Again, Google-Facebook collusion allegations should have some redactions removed tomorrow sometime on the docket. /11

https://twitter.com/jason_kint/status/1468269224032407564?s=20

here is a thread on #3 leading into a bunch of information on the Cambridge Analytica cover-up which is also the subject of massive shareholder suits, too, in Delaware. /12

https://twitter.com/jason_kint/status/1473172762311237633?s=20

And a thread on #4 including the documents which were unsealed over the holiday, they're quite something to read through carefully. I wouldn't be surprised if the SEC is digging into this complaint by the whistleblower at this point. /13

https://twitter.com/jason_kint/status/1474228220350377992?s=20

by the way, this is the first interview Sandberg did (with @JBoorstin) referenced in tweet 6. On the very same day, she was involved in messages with FB's clean-up firm reportedly booted out of Cambridge Analytica UK offices on March 19th by regulator. /14 cnbc.com/video/2018/03/…

I'll stop there, bracing for my mentions to be full of "lean in" quips... in all seriousness, back to my first tweet, these are significant issues and as far as anyone knows, she has never had to answer on any of them under oath. That's INSANE. /14

• • •

Missing some Tweet in this thread? You can try to

force a refresh