In the standard today, the story of Alnoor K. titled "Confessions of a rogue, shrewd exiled banker":

1. The Trade Bank guy:

"He was behind one of the country’s most innovative & popular banks in the 1980s & 1990s – Trade Bank...one of Kenya’s most infamous “political banks”"

1. The Trade Bank guy:

"He was behind one of the country’s most innovative & popular banks in the 1980s & 1990s – Trade Bank...one of Kenya’s most infamous “political banks”"

4. Funny thing is Trade Bank was housed at what is now Integrity Centre, the headquarters of the Ethics and Anti-Corruption Commission (EACC).

The building used to be known as Trade Bank Centre.

The Bank was used to loan politicians on an unsecured basis.

The building used to be known as Trade Bank Centre.

The Bank was used to loan politicians on an unsecured basis.

5. Equity Bank's James Mwangi used to work at Trade Bank. Here he is speaking on:

"I had risen up to be a director at Trade Bank by the age of 28 and my bold decision making packaged me in the eyes of Munga and other EBS executives"

"I had risen up to be a director at Trade Bank by the age of 28 and my bold decision making packaged me in the eyes of Munga and other EBS executives"

6. Kassam is in a tell-all mood today. He should write a book!

"Kassam also reveals the mega deals of those sleazy days including how he bribed top officials with “briefcases of cash” to protect his budding empire"

"Kassam also reveals the mega deals of those sleazy days including how he bribed top officials with “briefcases of cash” to protect his budding empire"

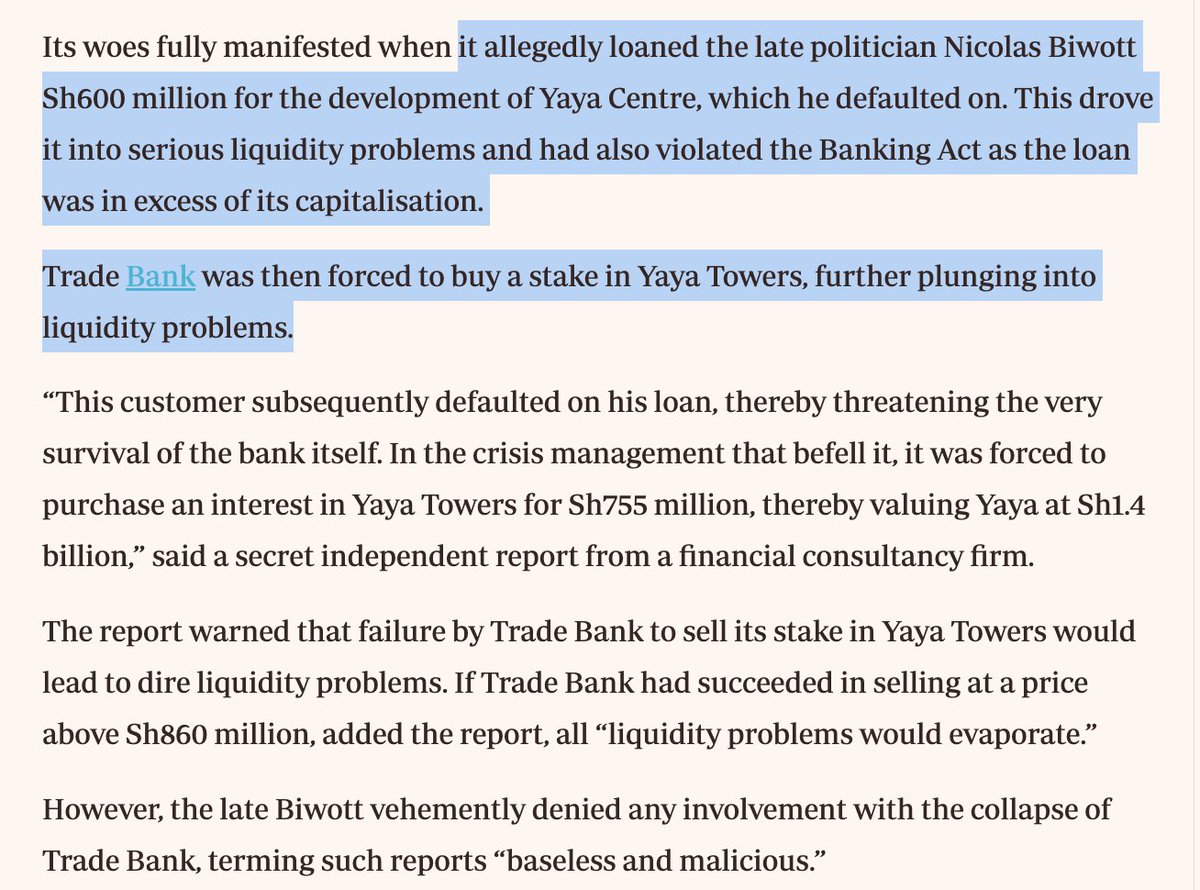

7. Now he turns to the Yaya Cente scandal:

The collapse of Trade Bank was partly due to loans owed by Yaya Centre and Biwott.

Kassam insists that Yaya Centre belongs to the depositors who lost money at Trade Bank.

The collapse of Trade Bank was partly due to loans owed by Yaya Centre and Biwott.

Kassam insists that Yaya Centre belongs to the depositors who lost money at Trade Bank.

8. From a separate article:

"Customers would make a beeline for their deposits, resulting in bitter exchanges with bank tellers. The maximum amount one could withdraw in a day had been reduced from KES 20K to KES 1K"

The finance minister back then was @MusaliaMudavadi.

"Customers would make a beeline for their deposits, resulting in bitter exchanges with bank tellers. The maximum amount one could withdraw in a day had been reduced from KES 20K to KES 1K"

The finance minister back then was @MusaliaMudavadi.

9. The man was rich and adventurous:

"Moneyed and gifted in the art of the deal from his young days, Kassam has led an adventurous life including from his student days in London, selling matchboxes in Kenyan slums and running for mayor of his adopted home in...Canada"

"Moneyed and gifted in the art of the deal from his young days, Kassam has led an adventurous life including from his student days in London, selling matchboxes in Kenyan slums and running for mayor of his adopted home in...Canada"

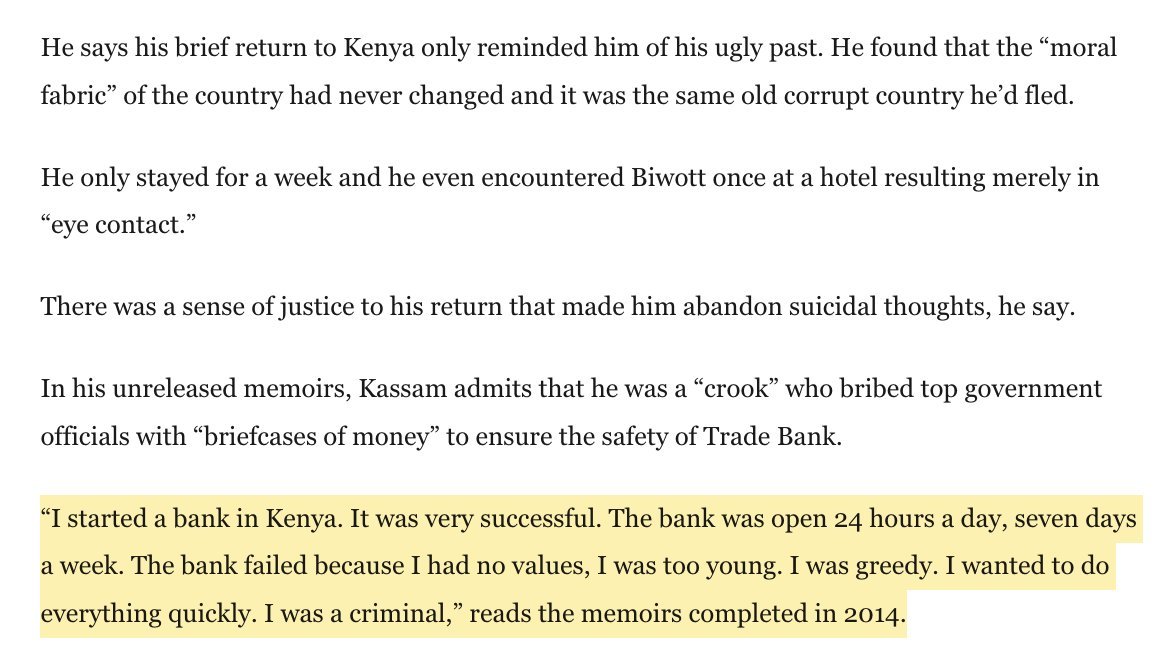

10. He has deep regrets:

"I’ve now realised that...my biggest mistake then was to flee Kenya. I should have stayed & faced whatever was coming to me...I created a lot of pain & anguish for a lot of those depositors... I am telling my story in part because I want to heal"

"I’ve now realised that...my biggest mistake then was to flee Kenya. I should have stayed & faced whatever was coming to me...I created a lot of pain & anguish for a lot of those depositors... I am telling my story in part because I want to heal"

11. He summarises his younger years:

"I started a bank in Kenya. It was very successful. The bank was open 24/7....The bank failed because I had no values, I was too young. I was greedy. I wanted to do everything quickly. I was a criminal"

Lesson: Values are very important.

"I started a bank in Kenya. It was very successful. The bank was open 24/7....The bank failed because I had no values, I was too young. I was greedy. I wanted to do everything quickly. I was a criminal"

Lesson: Values are very important.

12. Well that's the sad story of Kassam who is trying to make amends later in life after a recklessly lived younger life.

Teaches us to value others and develop strong values even as we do business.

For the full story, check the @StandardKenya.

standardmedia.co.ke/national/artic…

Teaches us to value others and develop strong values even as we do business.

For the full story, check the @StandardKenya.

standardmedia.co.ke/national/artic…

• • •

Missing some Tweet in this thread? You can try to

force a refresh