I know many of you are scared to invest in the US markets. That's okay. It is very overwhelming.

The JSE has 462 listed companies

The US has 16 366 listed companies

Let me try to make it a little easier with a short 🧵

The JSE has 462 listed companies

The US has 16 366 listed companies

Let me try to make it a little easier with a short 🧵

One huge difference between the JSE and the NYSE/NASDAQ is the Securities and Exchange Commission (SEC)

Who da heck is the SEC?

The SEC is a U.S. government oversight agency responsible for regulating the securities markets and protecting investors.

Who da heck is the SEC?

The SEC is a U.S. government oversight agency responsible for regulating the securities markets and protecting investors.

The SEC was established by the passage of the U.S. Securities Act of 1933 and the Securities and Exchange Act of 1934, largely in response to the stock market crash of 1929 that led to the Great Depression.

The SEC can itself bring civil actions against lawbreakers

That's cool

The SEC can itself bring civil actions against lawbreakers

That's cool

Another thing that really frustrates & scares investors are the SEC Forms. They don't need to be scary. They are there to protect investors, I promise.

I'm gonna highlight the Forms you need to read when you do research

Form 4

Form 8-K

Form 10-K

Form 10-Q

Form S-1

I'm gonna highlight the Forms you need to read when you do research

Form 4

Form 8-K

Form 10-K

Form 10-Q

Form S-1

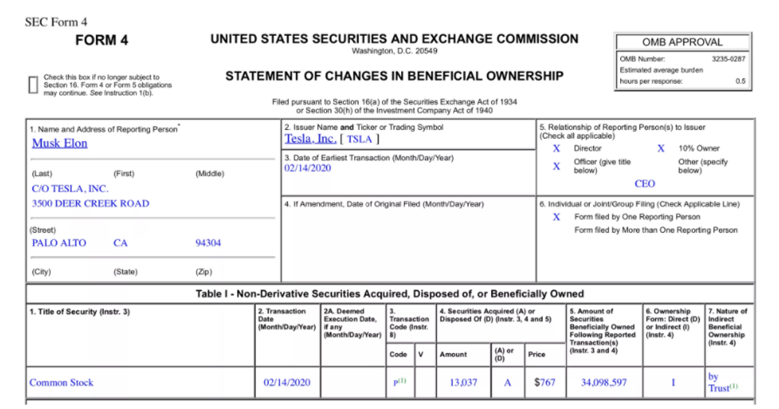

Form 4

Remember when Elon pulled his Twitter poll stunt and sold billions worth of Tesla shares?

That's where the Form 4 comes in💡

Form 4 must be filed with the SEC whenever there is a material change in the holdings of company insiders. That's it.

Looks like this📚

Remember when Elon pulled his Twitter poll stunt and sold billions worth of Tesla shares?

That's where the Form 4 comes in💡

Form 4 must be filed with the SEC whenever there is a material change in the holdings of company insiders. That's it.

Looks like this📚

Form 8-K

I love this one because it can move markets guys💡

The SEC requires companies to file an 8-K to announce significant events relevant to shareholders.

Companies have four business days to file an 8-K for most specified items.

It looks like this📚

I love this one because it can move markets guys💡

The SEC requires companies to file an 8-K to announce significant events relevant to shareholders.

Companies have four business days to file an 8-K for most specified items.

It looks like this📚

Form 10-K

Now listen to me VERY CAREFULLY!!!

If you own any US stock & you have not read it's 10-K YOU ARE GAMBLING!!!

What is this & why is Soul being a troll again?

A 10-K is a comprehensive report filed annually by public companies about their performance.

Now listen to me VERY CAREFULLY!!!

If you own any US stock & you have not read it's 10-K YOU ARE GAMBLING!!!

What is this & why is Soul being a troll again?

A 10-K is a comprehensive report filed annually by public companies about their performance.

Form 10-K

This form has 5 Sections

1. The business

This provides an overview of the company’s main operations, including its products and services (i.e., how it makes money).

This form has 5 Sections

1. The business

This provides an overview of the company’s main operations, including its products and services (i.e., how it makes money).

Form 10-K

2. Risk factors

These outline any & all risks the company faces or may face in the future.

The risks are typically listed in order of importance. I normally read the first 5 risks. The rest are just to appease the auditors and boring. LOL

2. Risk factors

These outline any & all risks the company faces or may face in the future.

The risks are typically listed in order of importance. I normally read the first 5 risks. The rest are just to appease the auditors and boring. LOL

Form 10-K

3. Selected financial data.

This section details specific financial information about the company over the last five years.

This section presents more of a near-term view of the company’s recent performance

3. Selected financial data.

This section details specific financial information about the company over the last five years.

This section presents more of a near-term view of the company’s recent performance

Form 10-K

4. Management’s discussion & analysis of financial conditions.

Also known as MD&A, this gives the company an opportunity to explain its business results from the previous fiscal year.

This IS THE ONLY section where the company can tell its story in its own words📚

4. Management’s discussion & analysis of financial conditions.

Also known as MD&A, this gives the company an opportunity to explain its business results from the previous fiscal year.

This IS THE ONLY section where the company can tell its story in its own words📚

Form 10-K

5. Financial statements

This includes the company’s audited financial statements including the income statement, balance sheets & statement of cash flows.

A letter from the company’s auditor certifying the scope of their review is also included in this section.

5. Financial statements

This includes the company’s audited financial statements including the income statement, balance sheets & statement of cash flows.

A letter from the company’s auditor certifying the scope of their review is also included in this section.

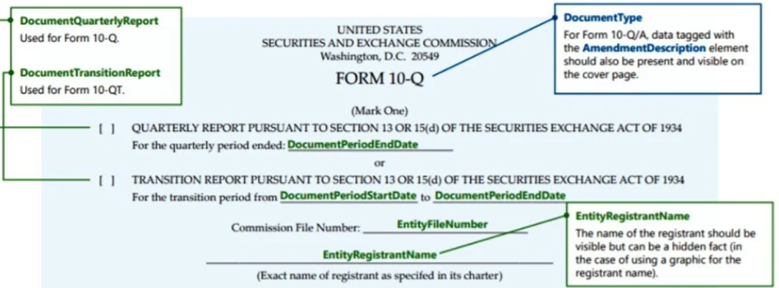

Form 10-Q

SEC Form 10-Q is a comprehensive report of financial performance submitted quarterly by all public companies to the Securities and Exchange Commission.

Q is for Quarterly

K is for Annual

SEC Form 10-Q is a comprehensive report of financial performance submitted quarterly by all public companies to the Securities and Exchange Commission.

Q is for Quarterly

K is for Annual

Form S-1

SEC Form S-1 is an SEC registration required for U.S. companies that want to be listed on a national exchange.

It is basically a registration statement for a company that is usually filed in connection with an initial public offering.

SEC Form S-1 is an SEC registration required for U.S. companies that want to be listed on a national exchange.

It is basically a registration statement for a company that is usually filed in connection with an initial public offering.

Where do you find all this nice stuff?

Every listed company have this on their Investor Relations section on their websites.

Also please register for investor alerts and you will get these first.

Every listed company have this on their Investor Relations section on their websites.

Also please register for investor alerts and you will get these first.

I spend most of my time on the 10-Q. You should too.

Love y'all crazy people

Now go do research 📚

Love y'all crazy people

Now go do research 📚

• • •

Missing some Tweet in this thread? You can try to

force a refresh