Pakistan's economy is not in a good place - per capita income has not risen in 3 years (in fact down slightly)

Even over the last 20 years, income per capita has grown at a paltry 1.9%

🧵

Even over the last 20 years, income per capita has grown at a paltry 1.9%

🧵

The core problem?

A fundamental imbalance between its anemic supply (domestic productive capacity) and the exaggerated external demand driven by its rentier economy

A fundamental imbalance between its anemic supply (domestic productive capacity) and the exaggerated external demand driven by its rentier economy

The fundamental cause of the problem?

*A broken economic decision making system*

Those in charge have repeatedly failed to recognize the requirements of a coherent growth strategy for Pakistan

I'll give a few examples ...

*A broken economic decision making system*

Those in charge have repeatedly failed to recognize the requirements of a coherent growth strategy for Pakistan

I'll give a few examples ...

1) A 30 year flawed energy policy that relied on imported fossil fuels and guaranteed $-returns for producers, while the power output was largely used for domestic consumption

How is the electricity payback feasible under this policy?

*It was designed to fail*

How is the electricity payback feasible under this policy?

*It was designed to fail*

The "circular debt" is nothing more than a manifestation of the fact that Pakistan adopted an unsustainable energy policy

The same is true of many other $-funded "infrastructure" projects.

The same is true of many other $-funded "infrastructure" projects.

2) A cornerstone of current govt's economic policy was "Naya housing" - a promise to build 5M houses

Another example of a growth policy *designed to fail*

It is practically impossible to build 5M houses in 5 years

Another example of a growth policy *designed to fail*

It is practically impossible to build 5M houses in 5 years

However, deeper issue is that housing is a final good and hence does not help boost productivity, which is what Pakistan desperately needs

A credit-fueled housing policy will subtract from growth and put further pressure on bop as I explained here

A credit-fueled housing policy will subtract from growth and put further pressure on bop as I explained here

https://twitter.com/AtifRMian/status/1133430117940813828?s=20

3) Exchange rate and capital account policies continue to be at odds with Pakistan's growth needs

Earlier regimes actively kept an appreciated ER which discouraged investment in high-productivity export sectors, as i explained here herald.dawn.com/news/1398616

Earlier regimes actively kept an appreciated ER which discouraged investment in high-productivity export sectors, as i explained here herald.dawn.com/news/1398616

Unfortunately current regime has also promoted capital account policies that are detrimental for growth

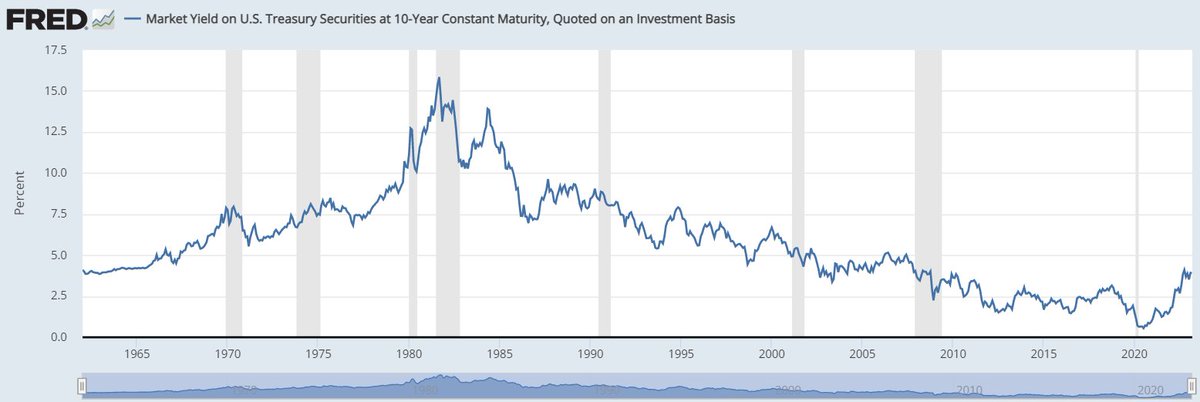

It started with opening of capital account for speculative portfolio investment in gov bonds. I took a deeper dive on this here

It started with opening of capital account for speculative portfolio investment in gov bonds. I took a deeper dive on this here

https://twitter.com/AtifRMian/status/1219105133902077954

More recently, capital account has been opened up to actively encourage ex-pat Pakistanis to buy real estate in Pakistan

What growth purpose does such a policy serve?

Pakistan already has an out-of-sync housing market with a very high urban land value to income ratio

What growth purpose does such a policy serve?

Pakistan already has an out-of-sync housing market with a very high urban land value to income ratio

Encouraging external capital flows into real estate is negative for growth because,

(i) it makes the country more expensive to live in, without providing any productivity advantage

(ii) builds speculative foreign liabilities that will further destabilize future bop position

(i) it makes the country more expensive to live in, without providing any productivity advantage

(ii) builds speculative foreign liabilities that will further destabilize future bop position

I'll stop at these three examples, but there are many more. For example, regressive taxation system, implementation of IMF conditions, a rent-seeking industrial structure etc. etc.

The bottom line I want to emphasize here is that Pakistan lacks a coherent macro growth strategy, and one that can be followed up by a competent institutional structure.

The country needs a functioning nervous system

• • •

Missing some Tweet in this thread? You can try to

force a refresh