⏩ Thank You for 25,000 Subscribers on YouTube!

🎉 To celebrate here are our Top 25 videos 👇⏬

🏁 To Subscribe 👉 bit.ly/3pyAsLW

🧵

🎉 To celebrate here are our Top 25 videos 👇⏬

🏁 To Subscribe 👉 bit.ly/3pyAsLW

🧵

To kick things off, check out our Interview with Stan Weinstein the Author of "Secrets for Profiting in Bull and Bear Markets". It was an honor to have him on the first episode of the TraderLion Podcast where we discussed many topics! 👇👇👇

/1

/1

The TraderLion Conference Day 1!

It was amazing to have @LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ for our first conference ever!

Combined 250+ Years of Experience 🔥

/2

It was amazing to have @LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ for our first conference ever!

Combined 250+ Years of Experience 🔥

/2

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ The TraderLion Conference Day 2! 🔥

Day 2 lineup was equally amazing! Including Hedge Fund Managers, Investing Champions, Portfolio Managers 👇

@1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 Charles Harris

/3

Day 2 lineup was equally amazing! Including Hedge Fund Managers, Investing Champions, Portfolio Managers 👇

@1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 Charles Harris

/3

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 Over his career Market Wizard, Mark Minervini, @markminervini has achieved incredible performance including a 5 year period where he achieved an average annual return of 220% for a total 5 year return of 33,554%❗🔥

Don't miss this interview 👇

/4

Don't miss this interview 👇

/4

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini For the third episode of The TraderLion Podcast, we sat down to talk with David Ryan, @dryan310 , a 3X US Investing champion who won the contest in 1985, 1986, and 1987 posting a compounded 3-year performance of 1,379% ❗

/5

/5

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 A Crash Course on CANSLIM 📈🔥

Former William O'Neil Portfolio Manager, Ross Haber, @RossHaber_ presents the CANSLIM Stock Trading method. 👇

/6

Former William O'Neil Portfolio Manager, Ross Haber, @RossHaber_ presents the CANSLIM Stock Trading method. 👇

/6

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 Anish, @anishsikri, is an extremely experienced trader who was a top contender in the 2020 US Investing Championship. He covered Position Sizing in this webinar which is one of the keys to profitable trading. 👇🔥

/7

/7

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri In our interview with Market Wizard, Mark Ritchie II, we covered his Early Mistakes, Developing his Style, Post Trade Analysis, Risk Management, and Stock Selection. 💯👇🔥

/8

/8

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri Jack Schwager, the author of the fantastic Market Wizards Series. @jackschwager has had the opportunity to interview countless phenomenal traders over the years including names like Ray Dalio, Marty Schwartz, and William O'Neil. 🔥🧠

/9

/9

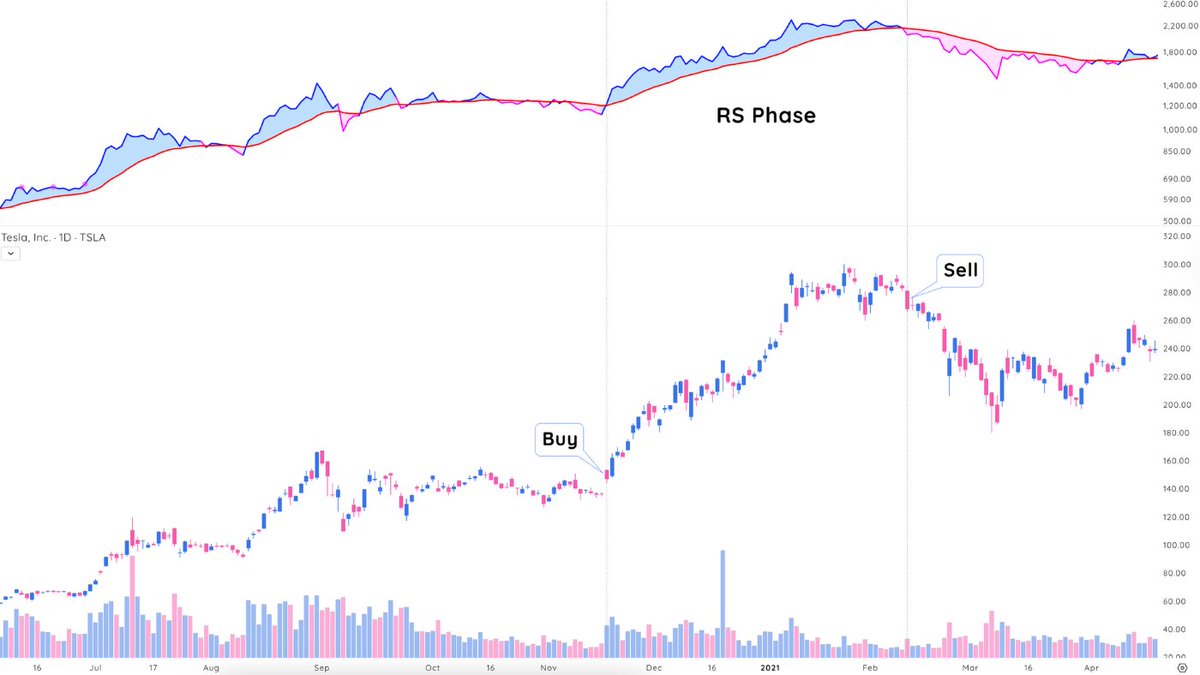

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager 2020 US Investing Champion Oliver Kell came in first place with an incredible 941% return. In this episode @1charts6 discussed his background as well as the years leading up to the record-breaking performance. 👇💯🔥

/10

/10

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager Market Wizard Tom Basso, @basso_tom, was the founder and President of Trendstat Capital Management where he developed effective trend following systems which produced extremely consistent returns over many market cycles. 👇💯🔥

/11

/11

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom .@RayTL_ and @RichardMoglen discuss how to create a comprehensive ruleset. Rules pertaining to 👇

Market Conditions

Stock Selection

Entry Setups

Stop Loss Management

Position management sell rules

Mindset

Post Analysis

Routines

/12

Market Conditions

Stock Selection

Entry Setups

Stop Loss Management

Position management sell rules

Mindset

Post Analysis

Routines

/12

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen Ben Bennett @PatternProfits gives an excellent presentation on how to trade earnings reports using the AVWAP indicator. He discusses Power Earnings Gaps, how to enter, manage the position, and manage risk. 👇💯🔥

/13

/13

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen In this video Charles Harris, Portfolio Manager at O'Neil Capital Management walks through his process of How to Buy Pullbacks. Charles provides an amazing crash course into his pullback strategy and techniques and how to buy the dip correctly.

/14

/14

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen Brian Shannon, @alphatrends, author, trading veteran, and founder of AlphaTrends discusses his favorite trading strategy as well as how he approaches risk management. 👇💯🔥

/15

/15

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen Building on his background from competitive golf, Jared, @jaredtendler, has developed systems to track emotional states and prevent many of the mistakes Trader's make with regards to FOMO, TILT, etc. 👇💯🔥

/16

/16

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler Dr. Eric Wish, @WishingWealth, shares lessons from trading part-time for over 50 years. He covered his investing background, how he assesses the market health and trend, as well as his entry setup criteria. 👇🧠

/17

/17

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler 🧐What size account do you need to trade full time?

In this video @RichardMoglen and @NickSchmidt_ discussed this topic as well as what phase of trading you need to be in before making the transition to trading full-time. 👍

/18

In this video @RichardMoglen and @NickSchmidt_ discussed this topic as well as what phase of trading you need to be in before making the transition to trading full-time. 👍

/18

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ .@richardmoglen_ and @RayTL_ discussed how to analyze market conditions. 👇💯🔥

Progressive Exposure

Managing Risk and Taking Profits in Choppy Markets

How to Identify when Conditions Change for the Better

/19

Progressive Exposure

Managing Risk and Taking Profits in Choppy Markets

How to Identify when Conditions Change for the Better

/19

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ Matt, @Trader_mcaruso, was one of the top performers in the 2020 US Investing Championship and in this video discusses the 3ema shakeout and kicker candle patterns. 👇💯🔥

/20

/20

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ TraderLion Animations by @NickSchmidt_ 🔥👇

Taking a Loss the Right Way

Find Your Why

What is an Edge

/21

Taking a Loss the Right Way

Find Your Why

What is an Edge

/21

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ TraderLion Tuesday Tutorials by @RichardMoglen $STUDY 👇💯🔥

Moving Averages

Weekend Routines

Inside Bars

VCP

How to Buy Reversals

/22

Moving Averages

Weekend Routines

Inside Bars

VCP

How to Buy Reversals

/22

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ Larry Williams is a veteran and influential trader and author with over 60 years of experience. He is well known for willing the 1987 World Cup Championship of Futures trading with an incredible 11,300% in one year. 👇💯🔥

/23

/23

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ Interview with Hedge Fund Manager Jim Roppel @Upticken as he discussed the current economy, choppy markets, hedging strategies, crypto, current market leaders and more!

Jim's enthusiasm for the markets is infectious. 👇💯🔥

/24

Jim's enthusiasm for the markets is infectious. 👇💯🔥

/24

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ Kathy Donnelly shares insights & lessons she's learned while trading Super Growth Stocks and IPOs as well as her Lifecycle Trade research on the subject. She presents on the different types of IPO patterns and Trading Rules to maximize performance.

/25

/25

@LeifSoreide @AnthonyCrudele @alphatrends @WishingWealth @KGD_Investor @PatrickWalker56 @PatternProfits @RossHaber_ @1charts6 @Upticken @cperruna @irusha @Trader_mcaruso @jfahmy @alphacharts365 @markminervini @dryan310 @anishsikri @jackschwager @basso_tom @RayTL_ @RichardMoglen @jaredtendler @NickSchmidt_ @richardmoglen_ Thank you all for your continuous support! We are looking forward to the next 25,000 subscribers.

🏁 To Subscribe 👉 bit.ly/3pyAsLW

Thank you from the TL Team!

🏁 To Subscribe 👉 bit.ly/3pyAsLW

Thank you from the TL Team!

• • •

Missing some Tweet in this thread? You can try to

force a refresh