As the Russia/ NATO/US/OSCE talks didn’t make real progress, it’s important to look again at this possibility. Can they cut Russia from SWIFT & would this be Armageddon for Russia?

https://twitter.com/Billbrowder/status/1481385087690227714

Good & difficult question.

Let’s start with basics: what’s SWIFT? It’s simply a messaging system. A chat app if you want! But it only sends special messages designed for cross-border financial transactions for banks globally, for the 11k banks that are part of the network.

Let’s start with basics: what’s SWIFT? It’s simply a messaging system. A chat app if you want! But it only sends special messages designed for cross-border financial transactions for banks globally, for the 11k banks that are part of the network.

Is it possible to cut Russia from it? The US tried in 2014, and the answer they got from SWIFT was “we will not make unilateral decisions to disconnect institutions from its network as a result of political pressure”. In your face.

That’s because SWIFT is not American, of course. Actually, it’s a “cooperative society” based in

Belgium under Belgian law! Seriously! So the owners are the members of the networks, with shares reallocated on a regular basis based on flows.

Belgium under Belgian law! Seriously! So the owners are the members of the networks, with shares reallocated on a regular basis based on flows.

So, SWIFT must follow EU laws, not US ones – which doesn’t mean it can’t disconnect a country, like it did with Iran in 2018. This was driven by US sanctions, with no obligation coming from the EU, but, again, they were not forced to do it.

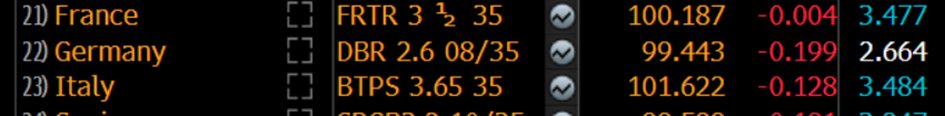

What about Russia? The 291 Russian members represent 1.5% of SWIFT flows (you gotta sell that oil!), ranked 13th globally on all SWIFT messages and 6th on payment messages!

That Is a LOT of messages that could be disrupted, on both ends, and a lot of money (prob ≈800bn$/y).

That Is a LOT of messages that could be disrupted, on both ends, and a lot of money (prob ≈800bn$/y).

Would cutting SWIFT access stop all those payments? No, but it would make significantly more difficult. There are other ways to send payments messages… including very old type stuff! (no, not carrier pigeons) but it would be difficult to convince western banks to use them.

Russia is aware of the risk and has alternative routes: SFPS (a system it designed with mostly Russian & CIS banks) and domestic payment systems that were launched after Visa & Mastercard cut them off in 2014. But Western banks would need to join.

What this suggests is that, ultimately, what matters is banning Western (US+EU+Swiss+UK) banks from dealing with Russia - cutting from SWIFT is just making those deals harder + if done only by the US, we could get the same ridiculous attempts of the EU to bypass the sanctions

Remember this?

gov.uk/government/new…

So ridiculous that it has almost never been used despite being announced with great fanfare! (the first deal was to send medical equipment to fight Covid.)

gov.uk/government/new…

So ridiculous that it has almost never been used despite being announced with great fanfare! (the first deal was to send medical equipment to fight Covid.)

What’s the bottom line here: either you have coordinated US/EU sanctions which ban banks from trading with Russia, or you get into complicated stuff that makes transactions messy and difficult, but not impossible. And can you ban all transactions with US/EU banks?

Sure, but if they do it, I suggest you buy one of those quickly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh