Before you read this thread, I’d suggest you learn the basics first 👇🏽

https://twitter.com/talkcentss/status/1483326568449855491

Let’s take a look at more of my favorite patterns when it comes to trading 👇🏽

1. Falling Window

2. Marubozu Pattern

3. Bull Flag

4. Bear Flag

5. Tri-star Bullish

6. Tri-star Bearish

7. Dark Cloud Cover

1. Falling Window

2. Marubozu Pattern

3. Bull Flag

4. Bear Flag

5. Tri-star Bullish

6. Tri-star Bearish

7. Dark Cloud Cover

1/

Falling window

Ever see those gaps in a share price?

It usually happens in a downtrend

It happens when yesterday's low is above today's high, leaving a hole on the daily price chart.

This is a bearish continuation pattern

Falling window

Ever see those gaps in a share price?

It usually happens in a downtrend

It happens when yesterday's low is above today's high, leaving a hole on the daily price chart.

This is a bearish continuation pattern

Example:

PayPal Holdings, on the 4th of November 2021, there was a clear gap in the price.

The stock fell very quickly and signaled this was going to continue moving down further. It was a good time to start cutting exposure.

$PYPL

PayPal Holdings, on the 4th of November 2021, there was a clear gap in the price.

The stock fell very quickly and signaled this was going to continue moving down further. It was a good time to start cutting exposure.

$PYPL

2/

Marubozu pattern

Marubozu means ‘dominance’

The close of the day is equal to the high of the day.

It’s a strong bullish sign, the stock opened and kept rising for the day.

Vice versa for a bearish trend, I use it as a signal that the uptrend is going to continue.

Marubozu pattern

Marubozu means ‘dominance’

The close of the day is equal to the high of the day.

It’s a strong bullish sign, the stock opened and kept rising for the day.

Vice versa for a bearish trend, I use it as a signal that the uptrend is going to continue.

Example:

On the 4th of November 2021,

$MTN closed at R147.52, the Marubozu signaled that there was strong movement in this continued uptrend.

On the 5th of November MTN reached a high of R174.82.

R147.52 to R174.82 (18% return).

Subsequently, profit taking occurred

On the 4th of November 2021,

$MTN closed at R147.52, the Marubozu signaled that there was strong movement in this continued uptrend.

On the 5th of November MTN reached a high of R174.82.

R147.52 to R174.82 (18% return).

Subsequently, profit taking occurred

MTN continued to sell off, which I initially thought was a bull flag (yellow channel) but the correction seemed deeper than 50% of the breakout.

Price seems to have stalled recently and I don’t see any setups, price must hold otherwise there might be some pain ahead.

Price seems to have stalled recently and I don’t see any setups, price must hold otherwise there might be some pain ahead.

3/

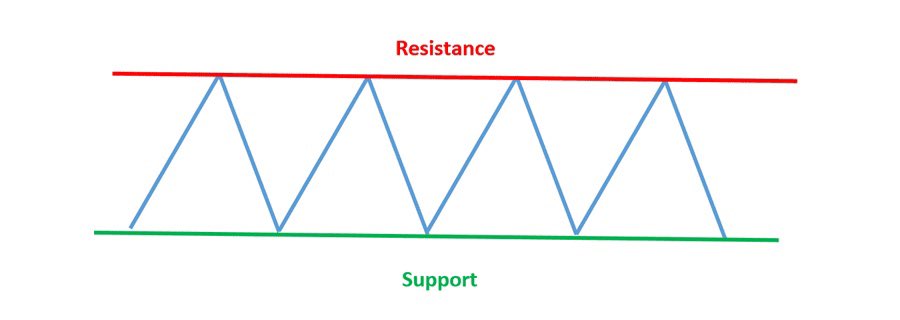

Bull Flag

What’s a bull flag?

Glad you asked😊

It’s one of my favorite patterns.

It literally looks like a flag poll and the flag.

It is a continuation pattern of an existing uptrend, it consolidates in the opposite direction of the trend and then breaks out.

Bull Flag

What’s a bull flag?

Glad you asked😊

It’s one of my favorite patterns.

It literally looks like a flag poll and the flag.

It is a continuation pattern of an existing uptrend, it consolidates in the opposite direction of the trend and then breaks out.

Example:

Sasol ( $SOL )

Had a clear bull flag set up

It is why I tried to let the world know that there was money to be made 👇🏽

Sasol ( $SOL )

Had a clear bull flag set up

It is why I tried to let the world know that there was money to be made 👇🏽

4/

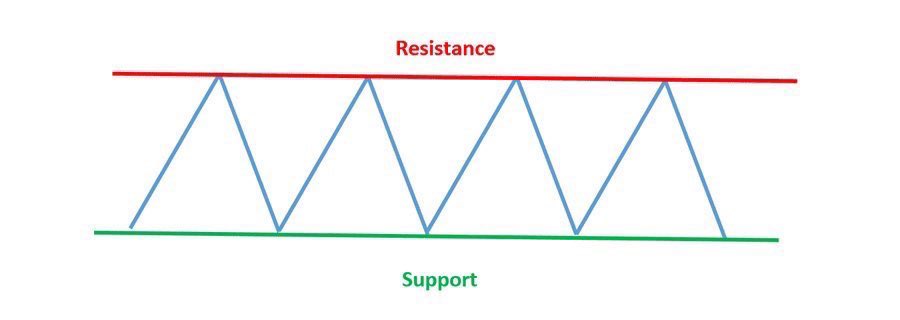

Bear Flag

A bear flag is the opposite of a bull flag. It is the continuation pattern of an existing down trend.

This formation is a strong move down and then followed by consolidation channel upwards before breaking lower again.

Bear Flag

A bear flag is the opposite of a bull flag. It is the continuation pattern of an existing down trend.

This formation is a strong move down and then followed by consolidation channel upwards before breaking lower again.

Example:

PayPal Holdings $PYPL

PayPal has been in free fall, like most of the US stocks, but PayPal gave a clear sign that it was going to continue falling, clear bear flag pattern that took place.

Meaning, now is probably still not the best time to buy.

PayPal Holdings $PYPL

PayPal has been in free fall, like most of the US stocks, but PayPal gave a clear sign that it was going to continue falling, clear bear flag pattern that took place.

Meaning, now is probably still not the best time to buy.

5/

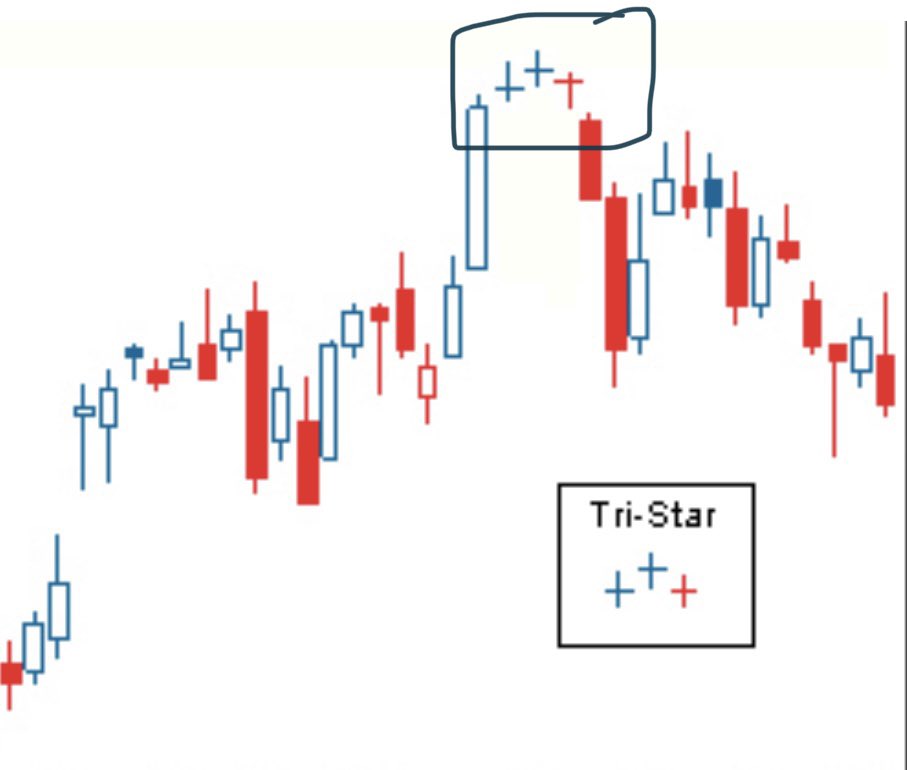

Tri-Star Bullish Pattern

It consists of 3 candles stick lines. All 3 are doji candles. The middle doji is below the other two

A tri-star pattern near a significant support level gives a better confirmation of a reversal of a prolonged downtrend.

Example 👇🏽

Tri-Star Bullish Pattern

It consists of 3 candles stick lines. All 3 are doji candles. The middle doji is below the other two

A tri-star pattern near a significant support level gives a better confirmation of a reversal of a prolonged downtrend.

Example 👇🏽

6/

Tri-Star Bearish Pattern

This is the opposite of a Tri-Star bullish pattern.

It signals a reversal in the current trend.

A tri-star pattern near a significant resistance level increases your chances of a successful trade.

Tri-Star Bearish Pattern

This is the opposite of a Tri-Star bullish pattern.

It signals a reversal in the current trend.

A tri-star pattern near a significant resistance level increases your chances of a successful trade.

7/

Dark Cloud Cover

There is a storm coming, this is a bearish reversal pattern,

It opens above the close of the prior candle and then closes below the midpoint of the green candle.

Dark Cloud Cover

There is a storm coming, this is a bearish reversal pattern,

It opens above the close of the prior candle and then closes below the midpoint of the green candle.

That’s the tweet, follow me @talkcentss for more trading education.

You can also get your weekly dose of in-depth stock analysis by simply subscribing to my YouTube channel 😊

Click here 👇🏽

youtube.com/channel/UCrI_7…

You can also get your weekly dose of in-depth stock analysis by simply subscribing to my YouTube channel 😊

Click here 👇🏽

youtube.com/channel/UCrI_7…

• • •

Missing some Tweet in this thread? You can try to

force a refresh