S. Finance is underway. They're taking a look at the revenue forecast with DoR's Chief Economist Dan Stickel. Stedman prefaces by saying investments have surpassed oil, but "that might be switching around."

#akleg

Watch: w3.akleg.gov/includes/_play…

Docs: akleg.gov/basis/Meeting/…

#akleg

Watch: w3.akleg.gov/includes/_play…

Docs: akleg.gov/basis/Meeting/…

Stedman says they all need to start settling into a base number for oil price. The state has started to update it more regularly, which Stedman suggests is not particularly helpful because it can make for big swings in the budget outlook.

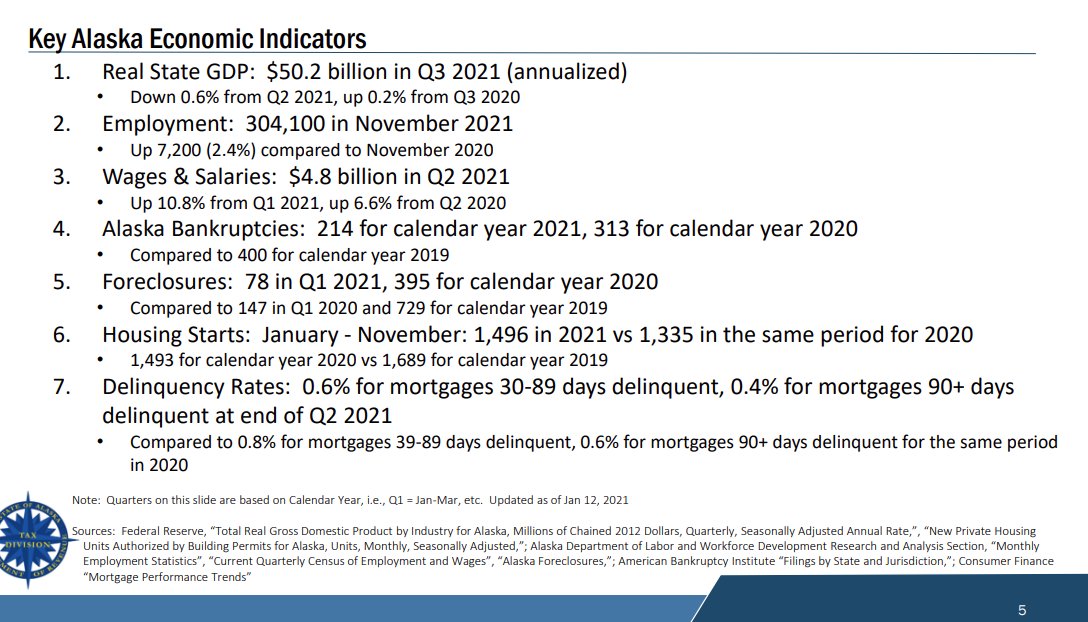

Here's the basics of the state's forecast assumptions with the key being who really knows with this whole pandemic. Most sectors are recovered or close to recovered, Stickel stays, except for tourism. State expects 1.5M visitors in the next year.

Stedman says he wants to get a more realistic oil price projection. He says he's concerned "some in the building" might think that it's more stable and certain than it really is and therefore "want to budget on numerics that may never materialize."

Getting into the inflation talk.

Revenue's banking on 2% annual inflation.

Stickel says there's debate right now whether the 7% inflation seen last year is a trend or transitory.

Stedman says he believes it'll be "substantially" higher.

Revenue's banking on 2% annual inflation.

Stickel says there's debate right now whether the 7% inflation seen last year is a trend or transitory.

Stedman says he believes it'll be "substantially" higher.

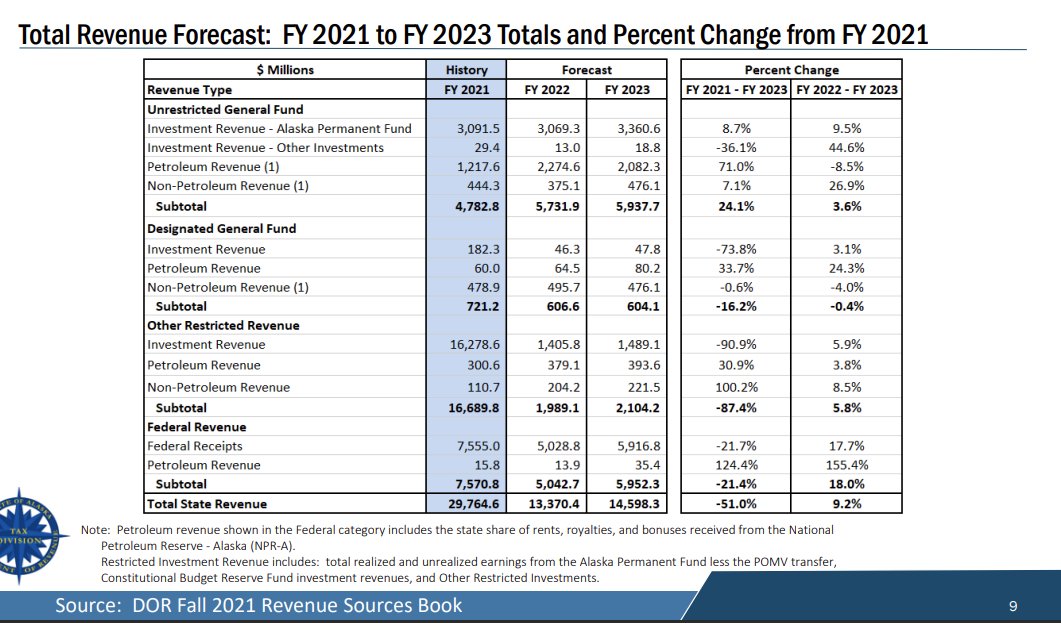

For the visual folks, here's a handy chart for different revenue sources. Stickel says the state had two windfalls in 2021, "the unusually and exceptionally high return on the Permanent Fund" and federal stimulus packages. Both are one-time impacts.

Petroleum is 5.3% of revenue.

Petroleum is 5.3% of revenue.

Stedman notes that the Legislature can't actually spend the Permanent Fund's one-year windfall because the payout is based on a 5-year average. Says a look at the undesignated general fund revenue will be more useful.

Stickel agrees.

Stickel agrees.

Alaska hit record revenue in 2021... with the caveat that most of it is in the Alaska Permanent Fund and therefore not available to be spent (under non-binding rules).

Stedman notes legislators shouldn't be "euphoric" about spending that $16B.

Stedman notes legislators shouldn't be "euphoric" about spending that $16B.

Stedman makes the point that just as the market can return +30% in one year, it can also return negative returns. He says the state should brace for potential very low returns and asks that Stickel keep that in mind when talking to other legislators.

Says it can be misleading.

Says it can be misleading.

Wielechowski, through some questioning, pokes some holes in this presentation. He notes the forecasted $1.5B in investment revenue would be something like a 1.5-2% return for the Perm. Fund.

Stickel seems to suggest that is filtered through the POMV... yet the boom year isn't.

Stickel seems to suggest that is filtered through the POMV... yet the boom year isn't.

They touch briefly on the sweep issues the Dunleavy administration approached with a "novel" reinterpretation that's resulted in several legal challenges and sweeping upheavals of the process.

Stedman says they'll need to work to untangle it all: "It's kind of a mess, frankly."

Stedman says they'll need to work to untangle it all: "It's kind of a mess, frankly."

On the corporate income tax issue created by CARES Act allowing companies to carry losses. The state's taxes are automatically linked to the feds, would take a bill to change.

Sen. Wilson asks if the state's working on one.

Stickel punts to deputy commissioner, who has hung up.

Sen. Wilson asks if the state's working on one.

Stickel punts to deputy commissioner, who has hung up.

Sens. Wielechowski and Stedman both recall that the administration SAID it would be looking at legislation to sever the connection on that point, thereby protecting the state corporate income tax rate.

They'll keep pressure up.

They'll keep pressure up.

Onto oil price forecasts.

Sen. Stedman asks for a look at the deficit "so we don't get caught in a state of euphoria of high oil prices and put in a fiscal structure in the state that can't be maintained, and we end up blowing a big deficit in our budgets going forward."

Sen. Stedman asks for a look at the deficit "so we don't get caught in a state of euphoria of high oil prices and put in a fiscal structure in the state that can't be maintained, and we end up blowing a big deficit in our budgets going forward."

Sen. Wielechowski on changes since oil tax changes: "We've got less jobs, less investment, less revenue to the state, a PFD that's a third of what it should be. ... There should be some accountability here. ... We're giving away money and not getting what we were promised."

Sen. von Imhof says that they should keep in mind that oil prices fell, and oil companies had a couple tough years: "There's a lot of factors that affect capital investment decisions and jobs."

There's been a long and mostly technical look at oil tax credits.

Sen. Wielechowski connects credits, PFD: "I want the people of Alaska to understand the connection. We're allowing 1.24B in deductible oil credits, the governor is seeking $199M in refundable tax credits, $785M in net operating losses ... We're giving away money left and right."

Wielechowski says all these concerns about not having enough money for a PFD is a direct result of the "massive corporate welfare" to the oil companies.

Wielechowski notes that the state is running up against the 15-year deadline to complete some oil and gas audits: Are you 100% sure you're going to meet it and not blow the statutory deadline?

Glover of the tax division: 100% sure we'll make it.

Glover of the tax division: 100% sure we'll make it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh