A thought provoking thread.

I am going to write this out without using the word synthetic shares or manipulation and put my tinfoil hat on the ground. I want you to look at all the tangible evidence and tell me what you see from the data that MM and SHF can’t report on.

I am going to write this out without using the word synthetic shares or manipulation and put my tinfoil hat on the ground. I want you to look at all the tangible evidence and tell me what you see from the data that MM and SHF can’t report on.

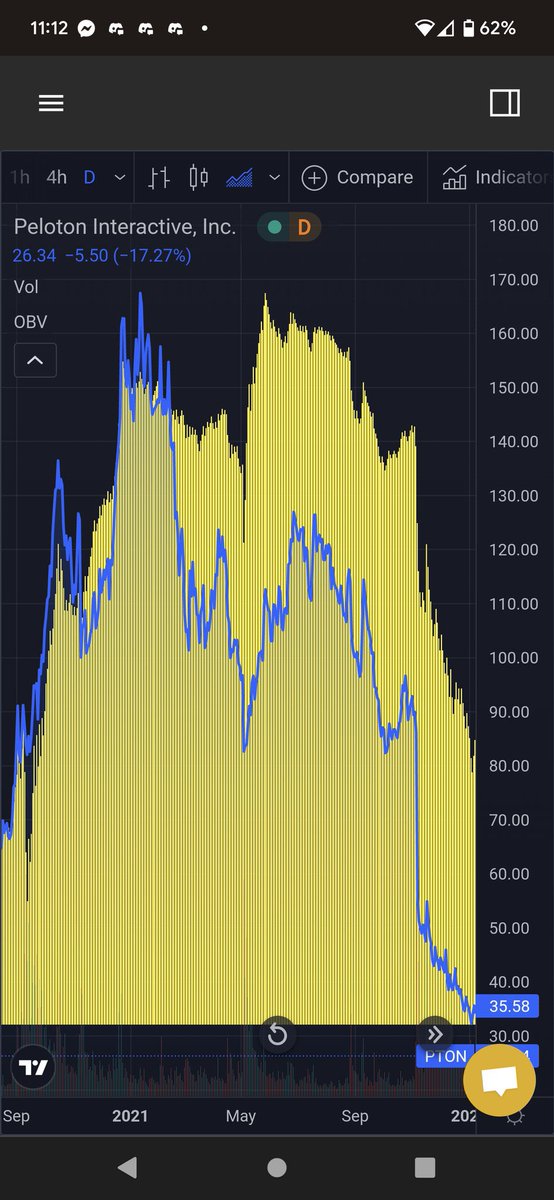

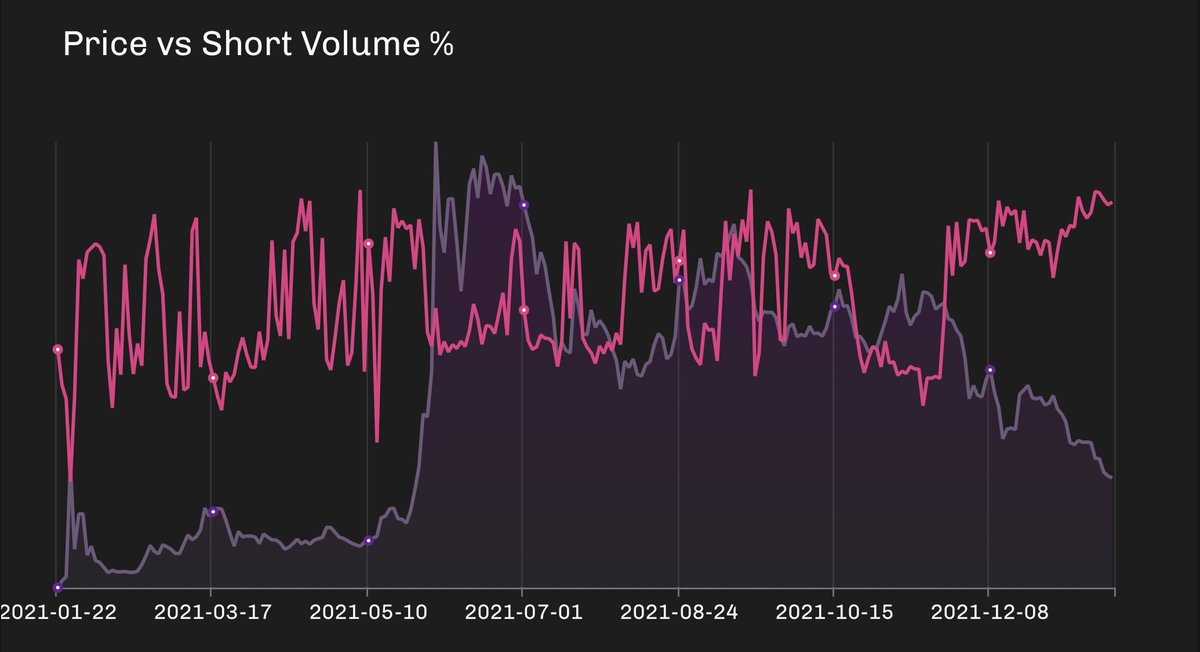

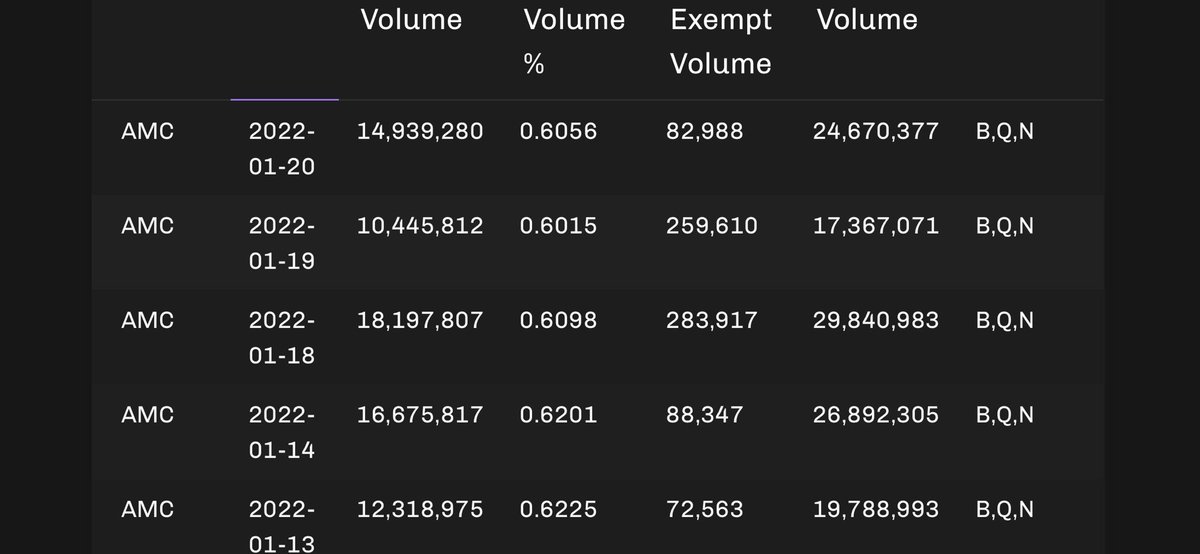

I’m going to start by discussing November onwards because that’s when the options chain for Jan 21st started to grow. Since November the daily short/ Darkpool volume has been 57-64% daily yet the reported SI% is roughly 19.8-20%

Since they are trying to avoid naked short selling they are using shared loans and trading to each other in blocks of 100 day in and day out (as witnessed on level II’s daily that is not human) meaning they are shorting and covering walking the price down.

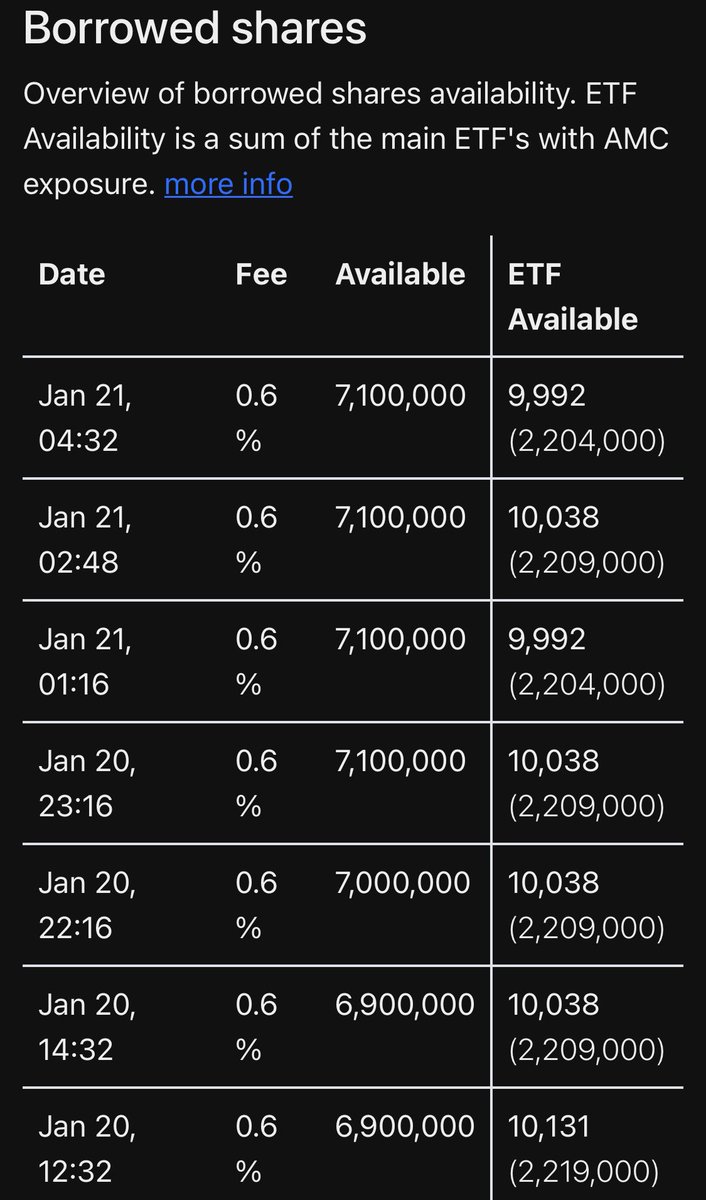

This technique is expensive but it is also lowering the price against their shorts on loan. By returning the shares after each trading day they keep the CTB low. While analysts and other “people” are telling us it’s not bullish that these shares are available (psy-ops)

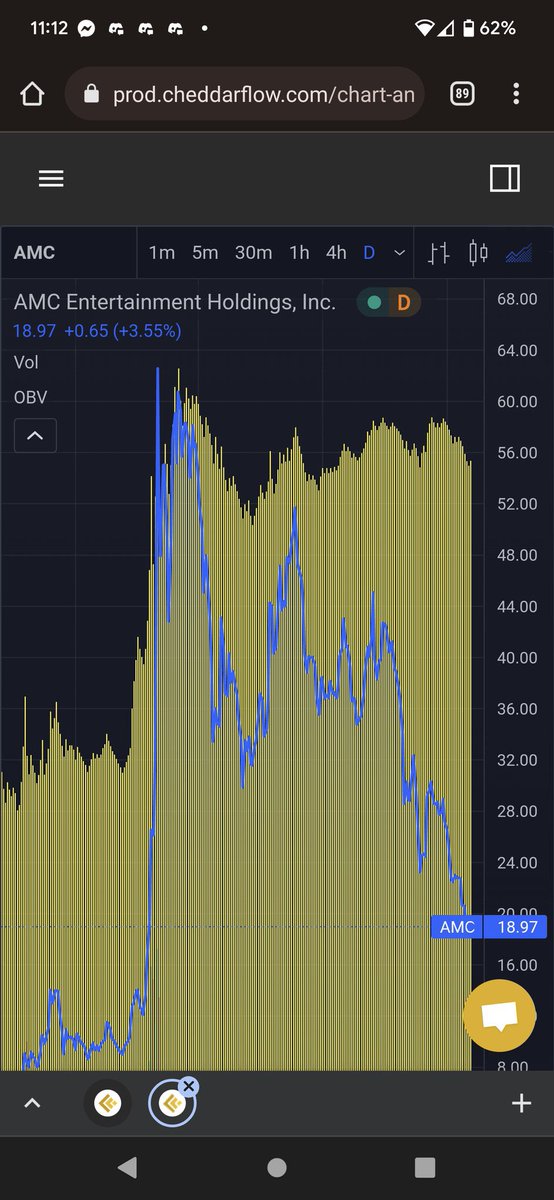

Yet the OBV is climbing and the inflow has been greater than the outflow daily. Meaning retail and institutions are still buying yet the price is declining. It took them 11 months to figure out how to do this and it’s blatant.

The yellow is indicative that investors are holding and that this is a carefully formulated sell off. That’s why they won’t dump those 7M shorts at once because they would lose control once the CTB starts to climb.

At the beginning of November AMC had a total market cap of around 20B and through this HFT tactic they have managed to siphon 10B away from AMC’s total market cap while keeping the reported SI around 18% I’ve heard many “investors” say short laddering is impossible

But it’s happening before our very eyes. This is how they walk down the price daily. Once they are done they simply return the shares to IBKR and start again the next day rinse and repeat. I have a feeling after today the brakes will be let off.

There’s no point in tagging the SEC because they are in on this. The Jan 21st options chain was a threat to the market so they allowed them to continue to bypass the SSR with short exempts. Notice the spike on the days the SSR was triggered.

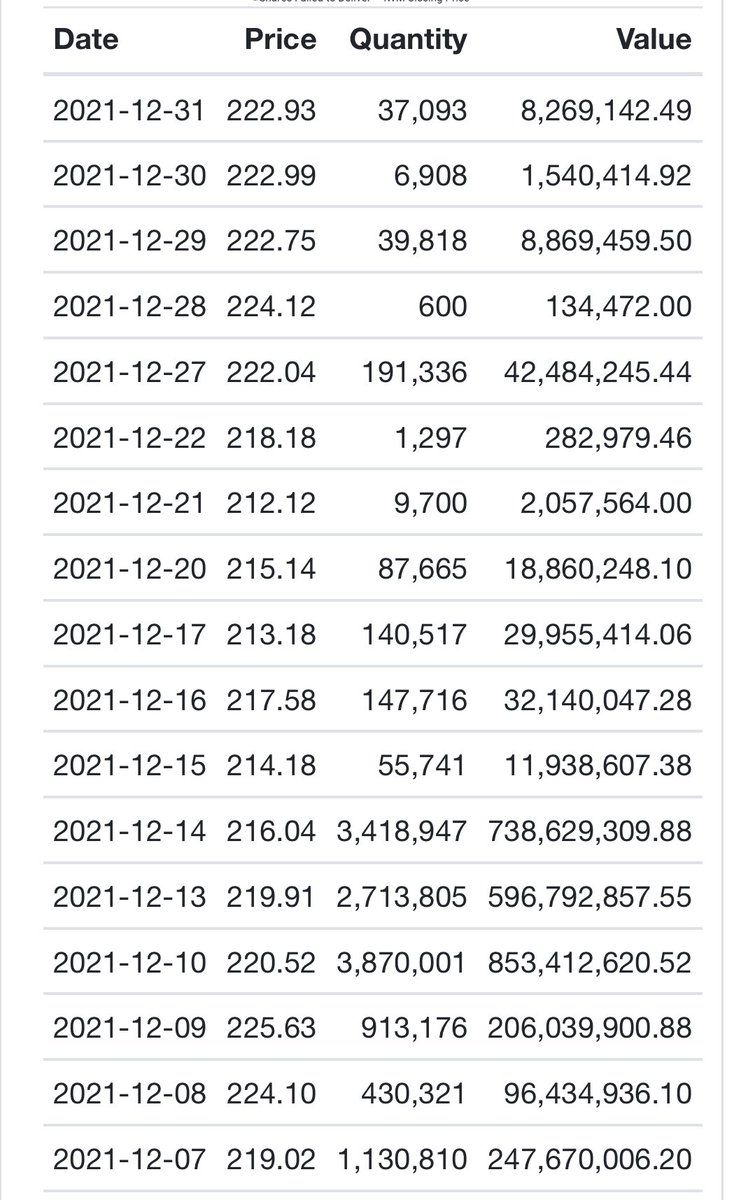

All eyes are on AMC so while everyone is looking over here they are aggressively shorting IWM where the reported SI is currently at 40% and the FTD’s were through the roof mid December.

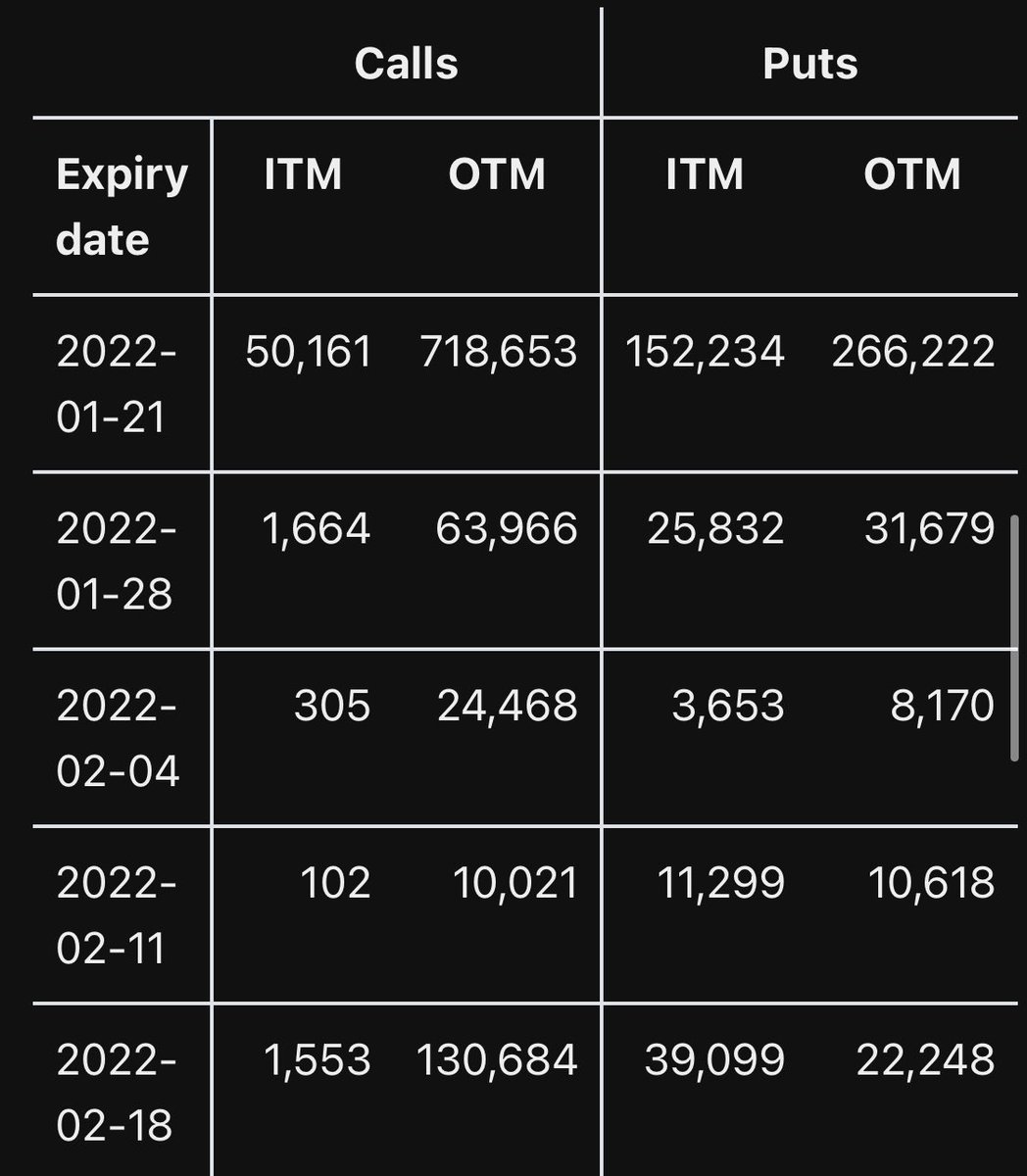

This was a formulated attack in order to make sure 90% of calls were pushed OTM so they didn’t have to delta hedge and any contracts ITM were hedged against making them delta neutral. They were allowed by Reg SHO and the SEC partnered with Blackrock.

They may have weaselled their way out of this gamma squeeze. But I hope you can take this information with a grain of salt and realize no one has sold, this is HFT to mitigate risk to the system. It’s us vs them. This isn’t over. It’s far from it. No one is selling GME either.

P.S. trust me bro

Big shout out to @LegParade for giving me the missing pieces that I needed for this

https://twitter.com/LegParade/status/1484242974426816513

“HiGh FrEqUeNcY TrAdInG DoEsN’T ExIsT”

Okay so then how did the float (which was 100M at the time) trade 10X over when on January 27th was Position Close Only meaning people could ONLY sell.

Think about it and HODL for dear fucking life.

Okay so then how did the float (which was 100M at the time) trade 10X over when on January 27th was Position Close Only meaning people could ONLY sell.

Think about it and HODL for dear fucking life.

• • •

Missing some Tweet in this thread? You can try to

force a refresh