Today's tweet thread is about startup valuations at pre-seed / seed that we're seeing in the mkt.

This is a lagging indicator so the next 6 months will be interesting to reflect back upon.

Thank you @will_bricker for pulling this data together! (Follow him!)

Read on >>

This is a lagging indicator so the next 6 months will be interesting to reflect back upon.

Thank you @will_bricker for pulling this data together! (Follow him!)

Read on >>

1) Quick recap -- there's been this pandemic that you may have heard a little something about.

Here's the valuation analysis for pre-seed/seed @will_bricker did on 2020-2021 that we tweeted out last year:

Here's the valuation analysis for pre-seed/seed @will_bricker did on 2020-2021 that we tweeted out last year:

https://twitter.com/dunkhippo33/status/1408136523292184581?s=20

2) Will did a deeper dive on a subset of our data (n=3000 startups) who got the biggest lift in 2021 here:

https://mobile.twitter.com/will_bricker/status/1422994341681901571

3) We thought it might be good to revisit the valuation data again now that another few months have passed.

Quick recap on what this data means: these valuations aren't what companies are necessarily getting in deals. These valuations are what companies are looking for.

Quick recap on what this data means: these valuations aren't what companies are necessarily getting in deals. These valuations are what companies are looking for.

4) In some cases, companies already had other investors set the terms. In many other cases, founders' asks were based on what they thought they could get. Either way, we think this is a good proxy for the mkt.

We get this valuation data from our application form @HustleFundVC

We get this valuation data from our application form @HustleFundVC

5) Let's compare the first half of 2021 w/ the second half in the US. You can see clearly that the median valuations are higher in the second half. But not as much as you might think.

$2.5m post vs $4m for nothing built

$7m post vs $7.5m post for $5k+ per mo in traction

$2.5m post vs $4m for nothing built

$7m post vs $7.5m post for $5k+ per mo in traction

6) Also interesting is where you get bumps up in valuation.

If you have nothing built, your valuation is much lower than if you have an MVP.

However, on the net, if you have an MVP & have a bit of traction, you don't get a bump up in valuation unless it's significant ($5k+)

If you have nothing built, your valuation is much lower than if you have an MVP.

However, on the net, if you have an MVP & have a bit of traction, you don't get a bump up in valuation unless it's significant ($5k+)

7) This resonates with data I've seen for years. (although it used to be a $10k/mo delineation)

In other words, ideal times to raise a pre-seed / seed are

a) when you have a basic MVP done

b) AND/OR after you get a fair bit of traction over $5k/mo

In other words, ideal times to raise a pre-seed / seed are

a) when you have a basic MVP done

b) AND/OR after you get a fair bit of traction over $5k/mo

8) Intuitively this makes sense. The first conviction gate you have to de-risk w/ investors is that you know how to build product w/ your current team, you can build a seemingly good product, and the product you built can solve a meaningful problem

9) The next conviction gate is around getting "enough traction" to suggest that a bunch of ppl like your product.

Anything in between -- such as getting your neighbors or mom to try out your product is fine, but investors won't give you "credit" for that in your valuation.

Anything in between -- such as getting your neighbors or mom to try out your product is fine, but investors won't give you "credit" for that in your valuation.

10) Let's look at intl vs US valuations w a box & whisker plot.

For example: this graph shows that the 25 percentile valuation to the 75th percentile valuation is $1m-$5m post.

The median is the line in the box which in this case looks to be about $2.5m post.

For example: this graph shows that the 25 percentile valuation to the 75th percentile valuation is $1m-$5m post.

The median is the line in the box which in this case looks to be about $2.5m post.

10) So, here's the valuation data across intl vs the US. If we just focus on the median line (the line in each box) you can see that the US (which is on the right half) continues to be higher than intl valuations.

11) You can see for int'l companies, the Q2 downturn in 2020 didn't impact the median valuation at all! This was strictly a US phenomenon.

But, int'l cos have seen a bump up in the median valuation more recently. Probably because US investors are now willing to invest abroad.

But, int'l cos have seen a bump up in the median valuation more recently. Probably because US investors are now willing to invest abroad.

12) Also interestingly, valuations felt crazy last year in the US, because there was more bifurcation.

You can see the far right box which represents Q4 of 2021, the 75% valuation was $10m post in the US. That means the top 25% valued companies were *higher* than $10m post.

You can see the far right box which represents Q4 of 2021, the 75% valuation was $10m post in the US. That means the top 25% valued companies were *higher* than $10m post.

13) So the reality is that the US is just way more bifurcated in valuations than people realize. This doesn't make the news.

For every story we read last year about how a high flying company did a $5m pre-seed at $25m post, there were many who did theirs at $2m post.

For every story we read last year about how a high flying company did a $5m pre-seed at $25m post, there were many who did theirs at $2m post.

14) Now, there's a myth that valuation is correlated w "quality". But from the data I've seen across thousands of cos - that my current/past firm or I have invested in - this isn't the case. That assertion just doesn't hold across large amounts of data.

That's another tweetstorm

That's another tweetstorm

15) So as the stock and crypto markets crash all around us and investors are wondering if there'll be pull-backs or changes in valuation, I think the answer is yes - on the net.

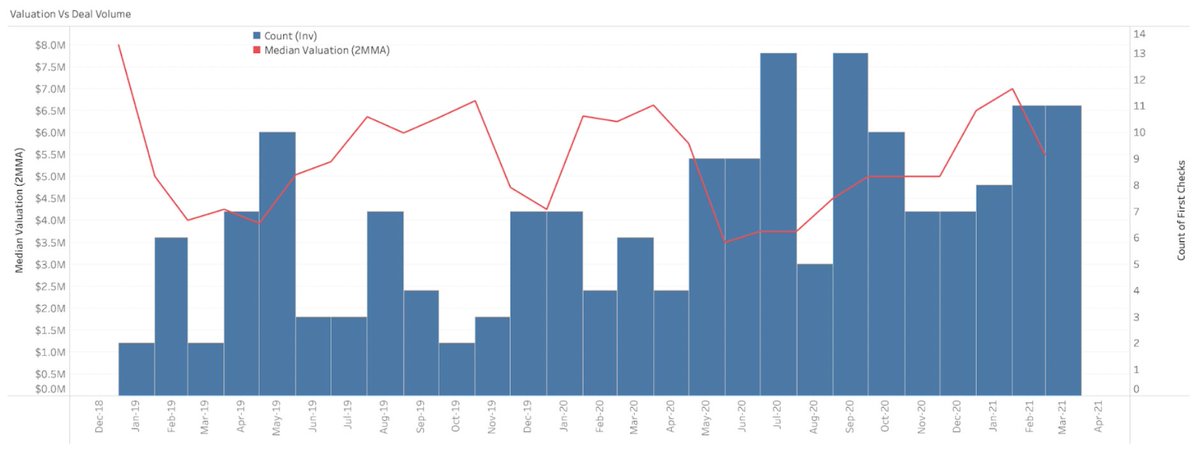

We saw it in 2020 when the mkts crashed (startup valuations represented by the red line here):

We saw it in 2020 when the mkts crashed (startup valuations represented by the red line here):

16) But, for startups, what we've seen this whole time is there's just a range in valuations - always.

For many, the frothy market never even affected them in the positive direction.

In the downturn of 2020, valuations on the net were a bit lower, but deals still got done.

For many, the frothy market never even affected them in the positive direction.

In the downturn of 2020, valuations on the net were a bit lower, but deals still got done.

17) Extrapolating here (and we'll see if this is true in 6 mo), I think we'll see pullbacks on the 75th+ percentile valuations.

I doubt we will see much change in the valuations below that.

I doubt we will see much change in the valuations below that.

18) Lastly, so many pre-seed/seed funds have fresh capital that they *must* deploy.

And the angel scene continues to be robust. There were many IPOs in '21 w ppl coming out of lockups this yr.

I expect we will continue to see a strong pre-seed/seed investment landscape this yr.

And the angel scene continues to be robust. There were many IPOs in '21 w ppl coming out of lockups this yr.

I expect we will continue to see a strong pre-seed/seed investment landscape this yr.

• • •

Missing some Tweet in this thread? You can try to

force a refresh