$ARCH $AMR $HCC $METC #CoalTwitter

Here's a stupid 🧵 on Met Coal:

Ordinarily, steel px leads coking coal indexes, and I’d run as far as I could from the ferrous supply chain while HRC/EHR fall of a cliff (which they are).

However… 1/n

Here's a stupid 🧵 on Met Coal:

Ordinarily, steel px leads coking coal indexes, and I’d run as far as I could from the ferrous supply chain while HRC/EHR fall of a cliff (which they are).

However… 1/n

FOB AUS coking coal is trading above $430/tn (ATH’s) in the middle of china’s seasonal crude steel slump. 2/n

This is pure, unadulterated pirate booty for Met producers with the opportunity to sell into the seaborne market.

Now, I’m an idiot, and truly don’t know why seaborne met is so high right now, but it probably has something to do with this chart:

3/n

Now, I’m an idiot, and truly don’t know why seaborne met is so high right now, but it probably has something to do with this chart:

3/n

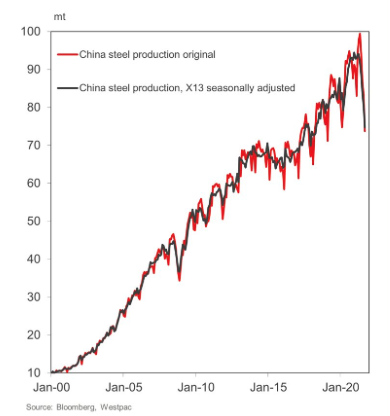

China’s crude steel output is predictably seasonal, with a ramp in the spring and a drop off in autumn. This is normal, and not the kind of thing that overtly spikes met prices -buyers are well aware of this seasonality and how to navigate it. What’s diff about this year?

4/n

4/n

See that particularly vicious drop and climb in '08? In a month’s time, blue skies production cuts for the Olympics will be lifted in Hebei province, and the snap back on China steel production will be particularly…. snappy.

5/n

5/n

“Industrial #’s are going to be poor, property bubble isn’t sustainable & is already popping!” Sure, but theres been a bubble for a decade and the cracks just showed up last year - without contagion to the financial sector, this one will take time.

6/n

6/n

China’s credit impulse is turning up and the CCP seems intent on preventing growth from falling off a cliff. For them, that largely means build stuff. Rising tides lift all boats ( $METC, $HCC, $ARCH, $AMR); I think the latter two are particularly interesting.

7/n

7/n

$ARCH sits low on the cost curve ( ~$70/tn with current steel, labor and fuel px inflation), has most of this year’s operating costs covered by their PRB thermal production, and management has the delicious tendency to avoid over-hedging.

8/n

8/n

They left 1.1m tons (roughly 1/7th their ’21 prod) unpriced for the seaborne market in Q4: FOB AUS never dropped below $300/ton in Q4. Fortuitously timed CapEx decisions in their Leer South mine will increase their met production by 40% y/y for ’22.

9/n

9/n

$AMR ’s costs are 10-15% higher, but they move 40% more product annually than $ARCH. Also have 30+ years of reserves to ARCH’s 10~ish. Debt profiles are similar, and they also have new supply coming online. In a longterm bull market for Met (doubt it, but I’m a Roach), $AMR is 🌶️

• • •

Missing some Tweet in this thread? You can try to

force a refresh