Fundamental Analysis and Playing Options Pt. 2

Learn How to use Fundamental Analysis with @unusual_whales

- Anticipated Earnings

- Financials

- Following The Flow

To build out your Earnings watchlist/triggerlist

Learn How to use Fundamental Analysis with @unusual_whales

- Anticipated Earnings

- Financials

- Following The Flow

To build out your Earnings watchlist/triggerlist

Cont. Pt. 1

Qualitative

The business model: What exactly does the company do? This isn't as straightforward as it seems. If a company's business model is based on selling fast-food chicken, is it making its money that way? Or is it just coasting on royalty and franchise fees?

Qualitative

The business model: What exactly does the company do? This isn't as straightforward as it seems. If a company's business model is based on selling fast-food chicken, is it making its money that way? Or is it just coasting on royalty and franchise fees?

Competitive advantage: A company's long-term success is driven largely by its ability to maintain a competitive advantage—and keep it. Powerful competitive advantages, such as Coca Cola's brand name and..

And Microsoft's domination of the personal computer operating system, create a moat around a business allowing it to keep competitors at bay and enjoy growth and profits. When a company can achieve a competitive advantage, its shareholders can be well rewarded for decades.

Management: Some believe that management is the most important criterion for investing in a company. It makes sense: Even the best business model is doomed if the leaders of the company fail to properly execute the plan.

While it's hard for retail investors to meet and truly evaluate managers, you can look at the corporate website and check the resumes of the top brass and the board members. How well did they perform in prior jobs? Have they been unloading a lot of their stock shares lately?

Corporate Governance: Corporate governance describes the policies in place within an organization denoting the relationships and responsibilities between management, directors and stakeholders.

These policies are defined and determined in the company charter and its bylaws, along with corporate laws and regulations. You want to do business with a company that is run ethically, fairly, transparently, and efficiently.

Particularly note whether management respects shareholder rights and shareholder interests. Make sure their communications to shareholders are transparent, clear and understandable. If you don't get it, it's probably because they don't want you to.

It's also important to consider a company's industry: customer base, market share among firms, industry-wide growth, competition, regulation, and business cycles. Learning about how the industry works will give an investor a deeper understanding of a company's financial health.

A case example:

Take the Coca-Cola Company, for example. When examining its stock, an analyst must look at the stock's annual dividend payout, earnings per share, P/E ratio, and many other quantitative factors.

Take the Coca-Cola Company, for example. When examining its stock, an analyst must look at the stock's annual dividend payout, earnings per share, P/E ratio, and many other quantitative factors.

However, no analysis of Coca-Cola is complete without taking into account its brand recognition. Anybody can start a company that sells sugar and water, but few companies are known to billions of people.

It's tough to put a finger on exactly what the Coke brand is worth, but you can be sure that it's an essential ingredient contributing to the company's ongoing success.

When trading options, keep in mind that fundamental analysis relates to the intrinsic value of the company - which takes a long time to play out. Use fundamental analysis to aid your technical analysis when trading options over shorter expiration windows, such as months.

Fundamental analysis is a very useful tool for trading options prior to Earnings Reports. By reading the guidance of previous reports and looking at the expansion/growth of the company’s divisions - as well as other factors that affect the bottom line.

Many traders place bets on whether the company will have a positive surprise (where reported the reported revenue, net income, and EPS exceed the consensus numbers projected by analysts from major banks) that will send the stock straight up or vice versa.

There are many figures we need to understand and pay close attention to when doing fundamental analysis. Many of these key figures will vary from industry to industry but this will cover some basics to familiarize yourself with. All assets should be divided into current and non.

An asset is considered current if it can reasonably be converted into cash within one year. Cash, inventories, and net receivables are all important current assets because they offer flexibility and solvency.

Equity is equal to assets minus liabilities, and it represents how much the company's shareholders actually have claim to; investors should pay particular attention to retained earnings and paid-in capital under the equity section.

Now you know that Fundamental Analysis can be used to play earnings.

Now let me show how I use @unusual_whales along with FA to play earnings.

Now let me show how I use @unusual_whales along with FA to play earnings.

What I first do is go to Earnings found under Extra! - Reports - Earnings

This brings me to the screen you see below and the Anticipated Earnings for the upcoming week. From here I can see which companies reports I can look to play earnings.

This brings me to the screen you see below and the Anticipated Earnings for the upcoming week. From here I can see which companies reports I can look to play earnings.

Lets use $AAPL for example since it has earnings this week.

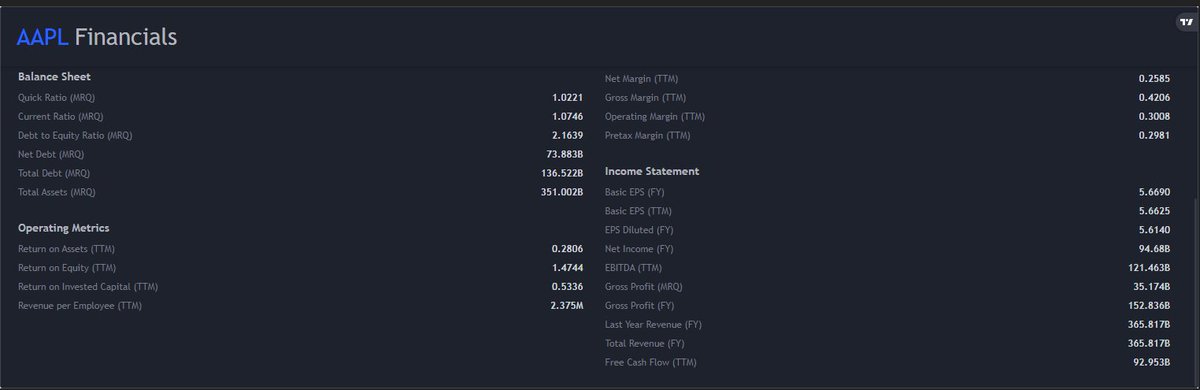

Go back to the homepage and go to "search" and type in $AAPL. After doing so you will be able to see the companies financials.

Go back to the homepage and go to "search" and type in $AAPL. After doing so you will be able to see the companies financials.

It's nice because @unusual_whales makes financials easy to read. Everything we went over earlier in the thread you can find here

- Balance Sheet

- Income Statement

- Cash Flow etc.

- Balance Sheet

- Income Statement

- Cash Flow etc.

Now lets follow the flow on it for this week. What I like to do is go to Flow - ticker search. From there I like to hit the quick view to see whats "hot".

👇

👇

I love Quick View because I get

- Top Chains,

- Floor Trades,

- Flow levels,

- Premium by exp.

- Top Day of Dark Pool Trades

This allows me to if the money is betting Bullish or if it is betting Bearish.

- Top Chains,

- Floor Trades,

- Flow levels,

- Premium by exp.

- Top Day of Dark Pool Trades

This allows me to if the money is betting Bullish or if it is betting Bearish.

• • •

Missing some Tweet in this thread? You can try to

force a refresh