1/n

ADANI WILMAR - IPO Analysis

Adani Wilmar Will be the 7th Adani group company that will be listed on the domestic bourses.

#adaniwilmaripo #IPO @AdaniOnline

ADANI WILMAR - IPO Analysis

Adani Wilmar Will be the 7th Adani group company that will be listed on the domestic bourses.

#adaniwilmaripo #IPO @AdaniOnline

2/n

Issue Details:-

IPO Date - Jan 27 to Jan 31, 2022

Issue Size – 3600 cores (Fresh Issue )

QIB – 50% of the NET OFFER

NIB - 15% of the NET OFFER

RETAIL - 35% of the NET OFFER

IPO Price - Rs 218 - Rs 230

LOT - 65 Shares (Rs 14950 )

LISTING – BSE & NSE

Issue Details:-

IPO Date - Jan 27 to Jan 31, 2022

Issue Size – 3600 cores (Fresh Issue )

QIB – 50% of the NET OFFER

NIB - 15% of the NET OFFER

RETAIL - 35% of the NET OFFER

IPO Price - Rs 218 - Rs 230

LOT - 65 Shares (Rs 14950 )

LISTING – BSE & NSE

3/n

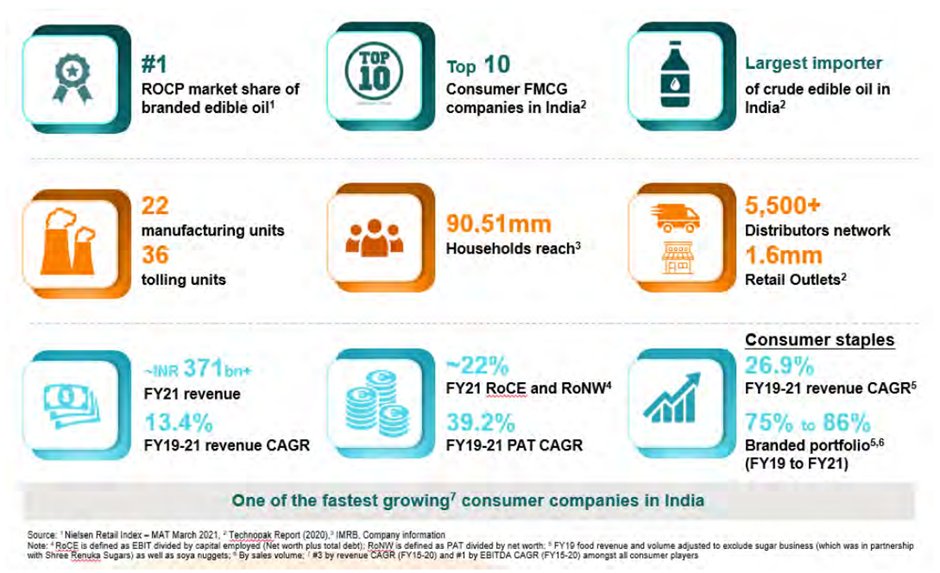

About the Company:-

Adani Wilmar is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses, and sugar.

About the Company:-

Adani Wilmar is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses, and sugar.

4/n

It is a joint venture incorporated in Jan 1999 between the Adani Group and the Wilmar Group (Singaporean food processing, investment holding company and one of Asia’s leading agribusiness groups).

It is a joint venture incorporated in Jan 1999 between the Adani Group and the Wilmar Group (Singaporean food processing, investment holding company and one of Asia’s leading agribusiness groups).

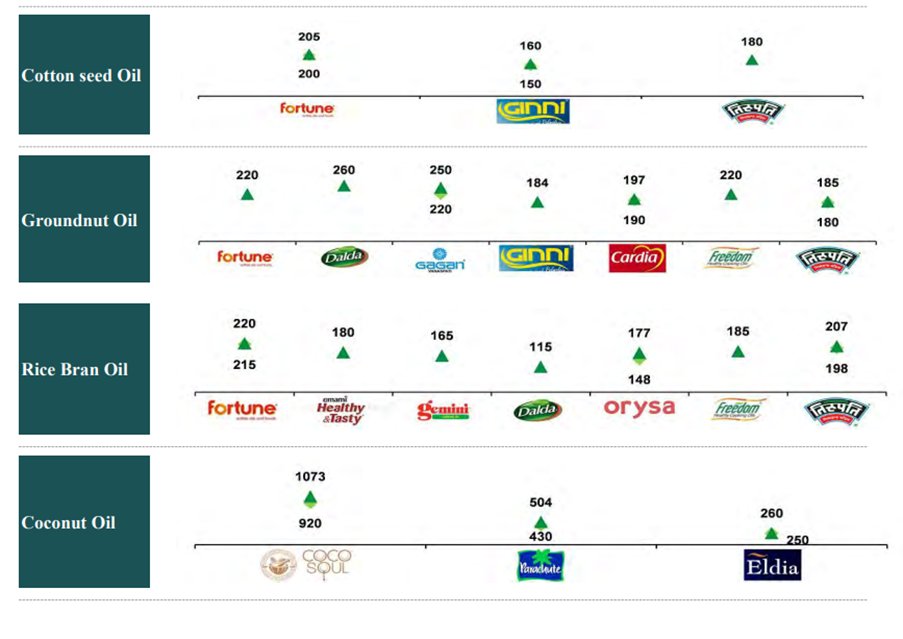

6/n

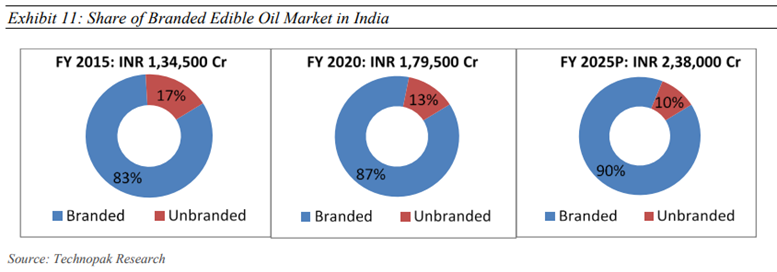

MACROECONOMIC-

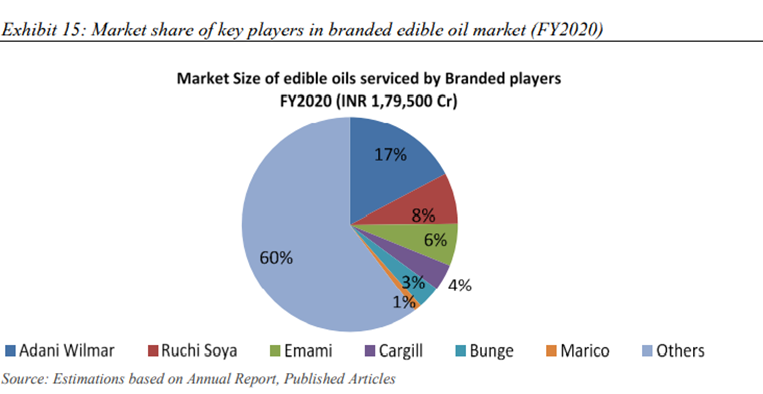

The edible oil retail market is estimated to be ~INR 2,38,500Cr in FY2025 i.e. is expected to grow at a CAGR of 6% in the coming 5 years.

MACROECONOMIC-

The edible oil retail market is estimated to be ~INR 2,38,500Cr in FY2025 i.e. is expected to grow at a CAGR of 6% in the coming 5 years.

7/n

The branded edible oil market is expected to grow faster than the overall category gaining a lion’s share of close to 90% of the total market in terms of value in the coming five years.

The branded edible oil market is expected to grow faster than the overall category gaining a lion’s share of close to 90% of the total market in terms of value in the coming five years.

8/n

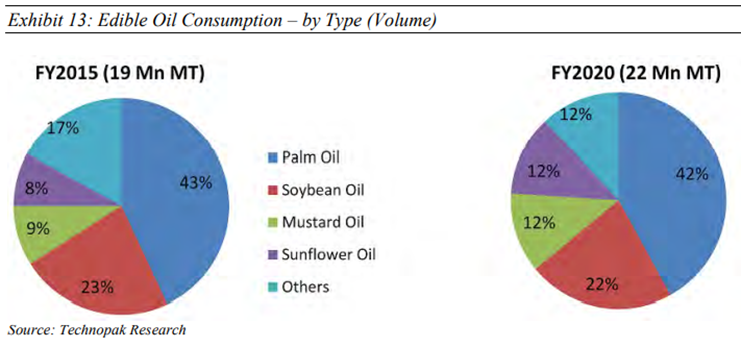

A gradual shift is being witnessed in favor of soft oils such as soyabean oil, sunflower oil, mustard oil, Palm oil witnessed a marginal decrease in FY 2021 with the pandemic-induced national lockdown shutting the HoReCa (hotels, restaurants, catering) segment.

A gradual shift is being witnessed in favor of soft oils such as soyabean oil, sunflower oil, mustard oil, Palm oil witnessed a marginal decrease in FY 2021 with the pandemic-induced national lockdown shutting the HoReCa (hotels, restaurants, catering) segment.

9/n

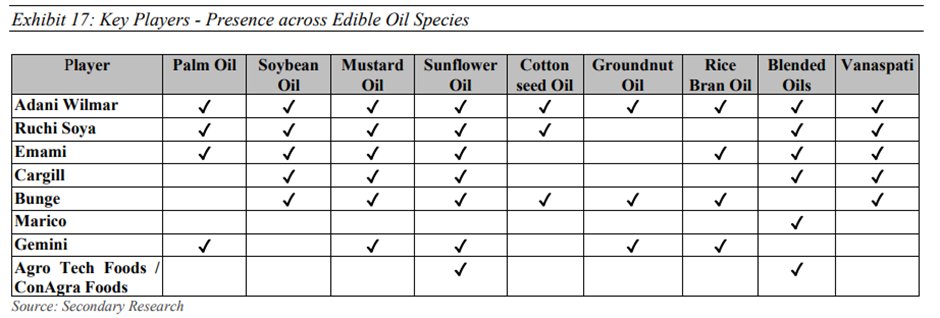

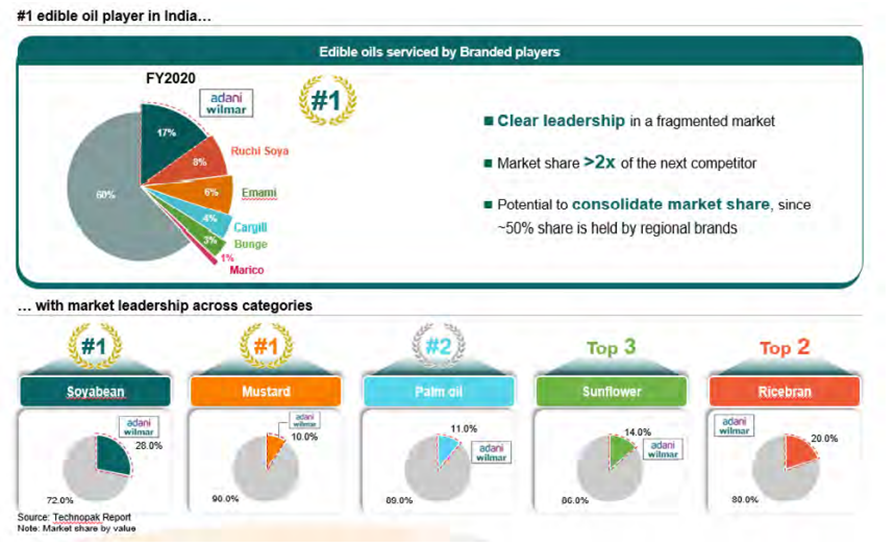

Adani Wilmar and Ruchi Soya are a few of the largest suppliers of edible oil with outputs of 2.8 and 1.4 Mn MT respectively in FY 2020.

Adani Wilmar is the largest player in branded refined soyabean oil having a market share of 28% followed by Ruchi Soya with a share of 11%.

Adani Wilmar and Ruchi Soya are a few of the largest suppliers of edible oil with outputs of 2.8 and 1.4 Mn MT respectively in FY 2020.

Adani Wilmar is the largest player in branded refined soyabean oil having a market share of 28% followed by Ruchi Soya with a share of 11%.

11/n

ADANI WILMAR’s PRODUCTS-

Leading Business categories.

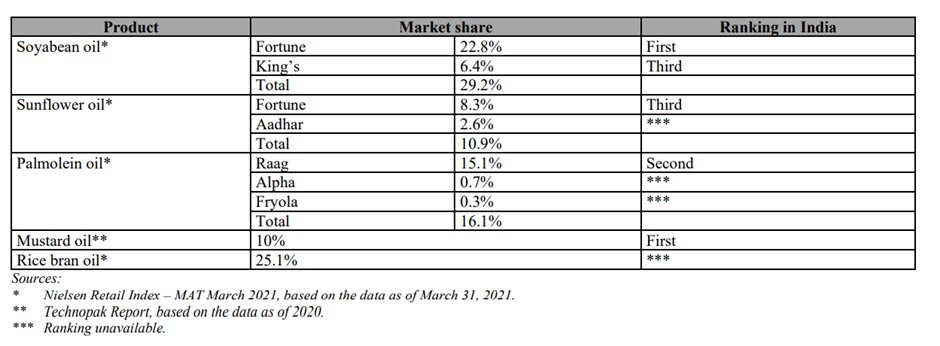

#1 No. 1 edible oil brand in India / “Fortune”, the flagship brand, is the largest selling edible oil brand in India.

ADANI WILMAR’s PRODUCTS-

Leading Business categories.

#1 No. 1 edible oil brand in India / “Fortune”, the flagship brand, is the largest selling edible oil brand in India.

12/n

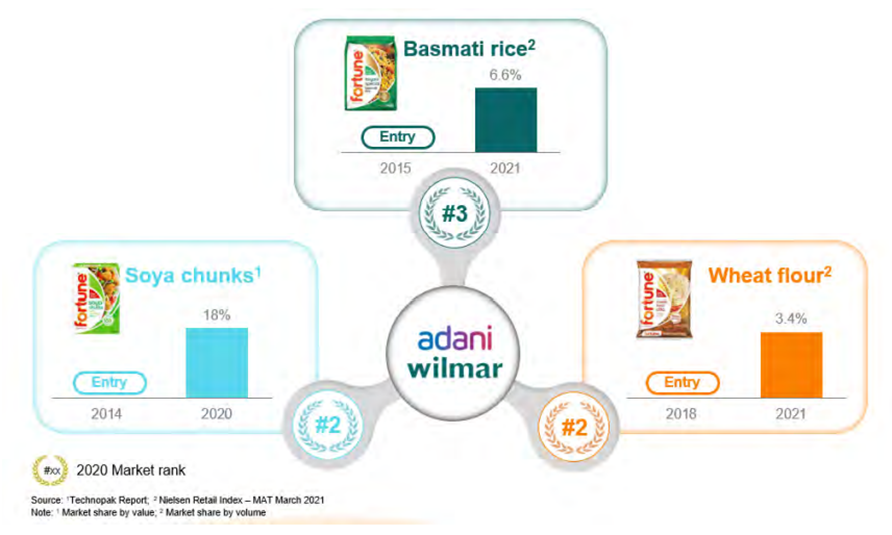

#2 Packaged Food & Non-Food(wheat flour, basmati rice, soya nuggets, pulses, besan, etc.)

#3 Industry Essential (Castrol oil, Oleochemicals).

#2 Packaged Food & Non-Food(wheat flour, basmati rice, soya nuggets, pulses, besan, etc.)

#3 Industry Essential (Castrol oil, Oleochemicals).

13/n

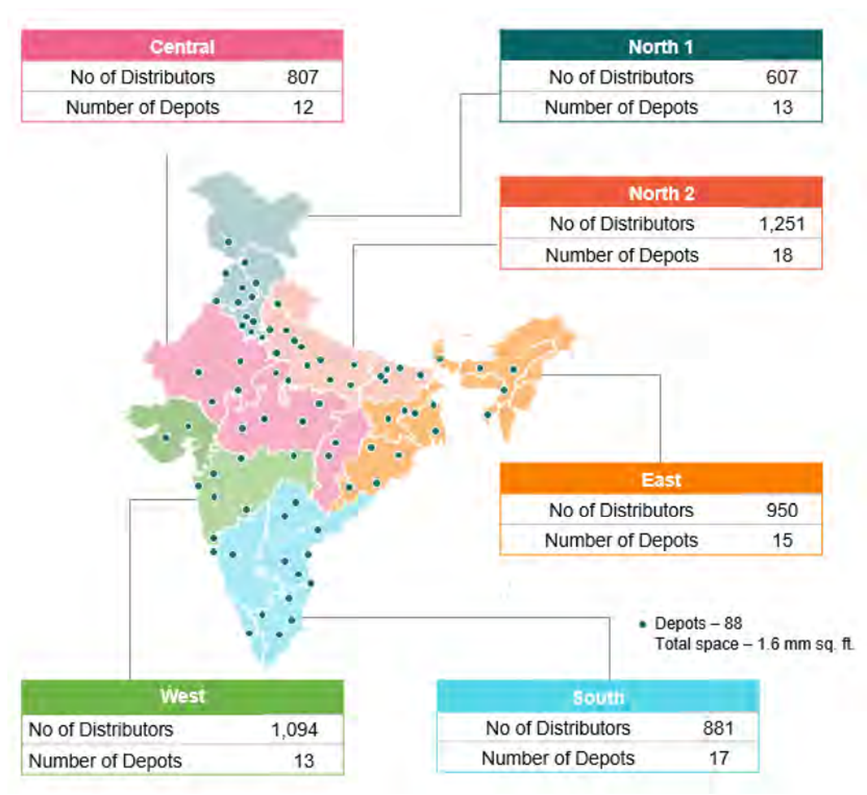

OPERATIONS-

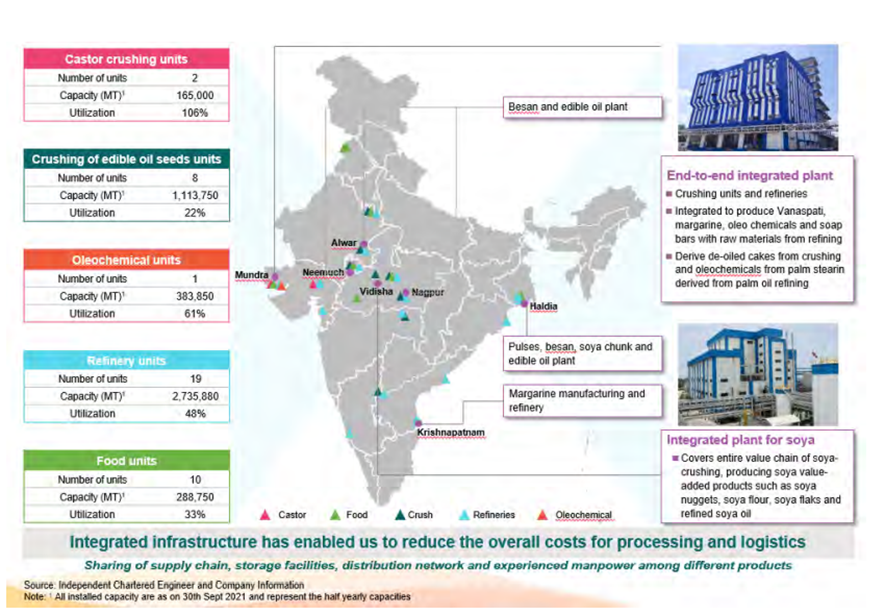

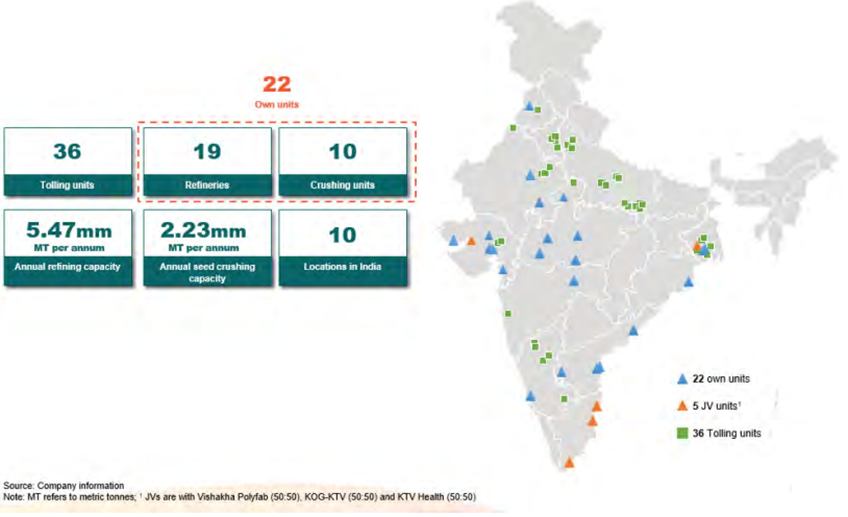

The company has 22 plants across 10 states, comprising 10 crushing units and 19 refineries. Of the 19 refineries, 10 are port-based to facilitate the use of imported crude edible oil and reduce transportation costs.

OPERATIONS-

The company has 22 plants across 10 states, comprising 10 crushing units and 19 refineries. Of the 19 refineries, 10 are port-based to facilitate the use of imported crude edible oil and reduce transportation costs.

14/n

And the rest are in the hinterland in proximity to raw material production bases to reduce storage costs. They also have 36 leased tolling units as of September 2021.

And the rest are in the hinterland in proximity to raw material production bases to reduce storage costs. They also have 36 leased tolling units as of September 2021.

15/n

The largest distribution network among all branded edible oil companies in India with 5,590 distributors in India as of September 30, 2021, is located in 28 states and eight union territories.

The largest distribution network among all branded edible oil companies in India with 5,590 distributors in India as of September 30, 2021, is located in 28 states and eight union territories.

16/n

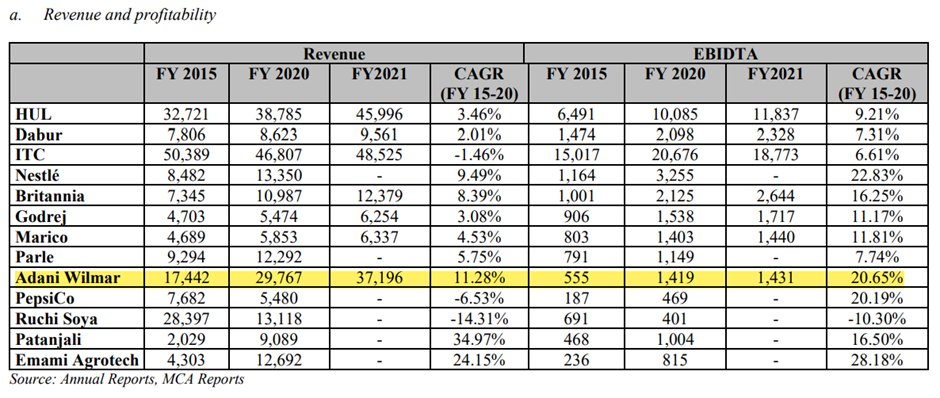

FINANCIAL-

Revenue grew by 13.5 percent annually between FY19 and FY21(Due to inflation, especially in the edible oil business, which grew by 19 percent during the period.)

Net profit during the period grew by 39 percent annually to Rs 728 crore.

FINANCIAL-

Revenue grew by 13.5 percent annually between FY19 and FY21(Due to inflation, especially in the edible oil business, which grew by 19 percent during the period.)

Net profit during the period grew by 39 percent annually to Rs 728 crore.

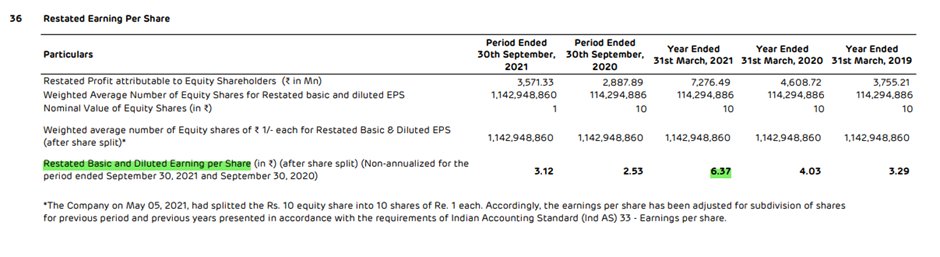

17/n

Valuations

FY21 – EPS Rs 3.12 (6MFY22) and Rs 6.24 annualized

ROE – 22.056% (FY21)

BV – 31.95 (as of Sept 2021)

P/E – 36

P/S – 0.7067(FY21)

Valuations

FY21 – EPS Rs 3.12 (6MFY22) and Rs 6.24 annualized

ROE – 22.056% (FY21)

BV – 31.95 (as of Sept 2021)

P/E – 36

P/S – 0.7067(FY21)

19/n

It does not have a direct peer. Other listed companies in the food commodity business such as Marico and Tata Consumer Products command FY22 estimated price-earnings (P/E) multiples of over 50 and 61, respectively.

It does not have a direct peer. Other listed companies in the food commodity business such as Marico and Tata Consumer Products command FY22 estimated price-earnings (P/E) multiples of over 50 and 61, respectively.

20/n

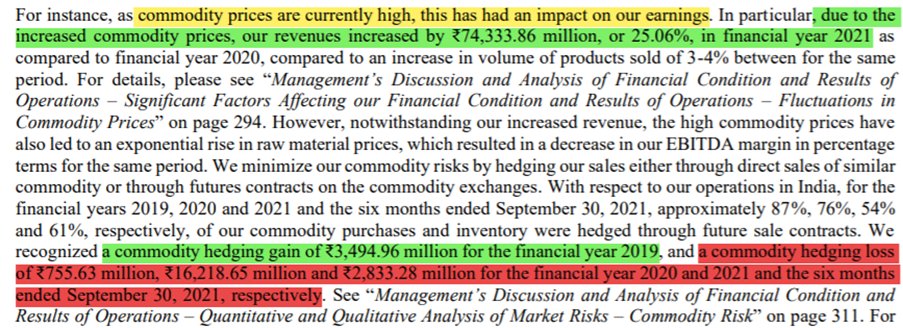

RISK FACTORS-

Operations are dependent on the supply of large amounts of raw materials.

Unrefined soybean oil is imported from Argentina and Brazil,

Unrefined sunflower oil from Ukraine and Russia,

And palm oil from Indonesia and Malaysia.

RISK FACTORS-

Operations are dependent on the supply of large amounts of raw materials.

Unrefined soybean oil is imported from Argentina and Brazil,

Unrefined sunflower oil from Ukraine and Russia,

And palm oil from Indonesia and Malaysia.

21/n

Products in the nature of commodities and their prices are subject to fluctuations that may affect profitability.

Import restrictions by other countries on products may have a material adverse impact on the business, financial condition, and result of operations.

Products in the nature of commodities and their prices are subject to fluctuations that may affect profitability.

Import restrictions by other countries on products may have a material adverse impact on the business, financial condition, and result of operations.

22/n

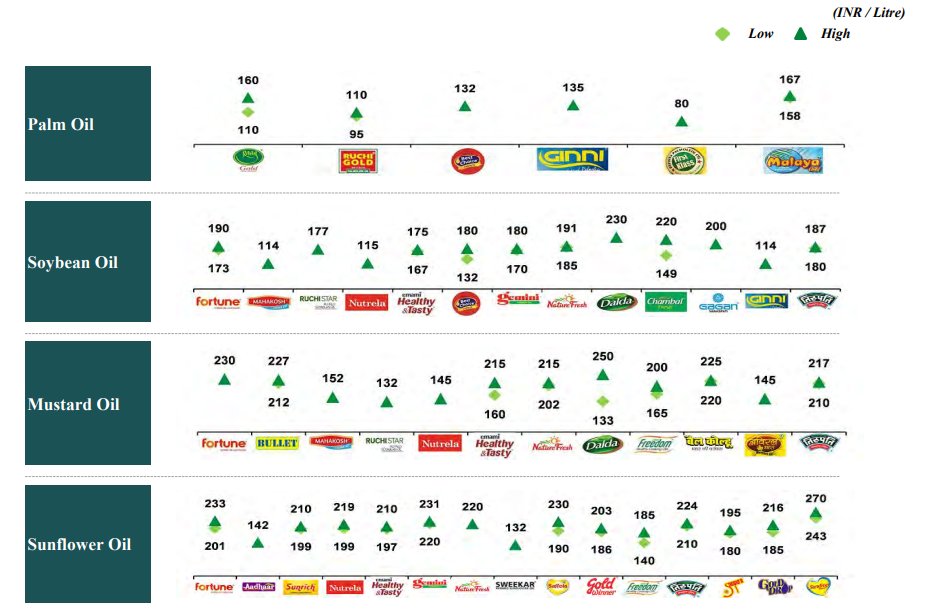

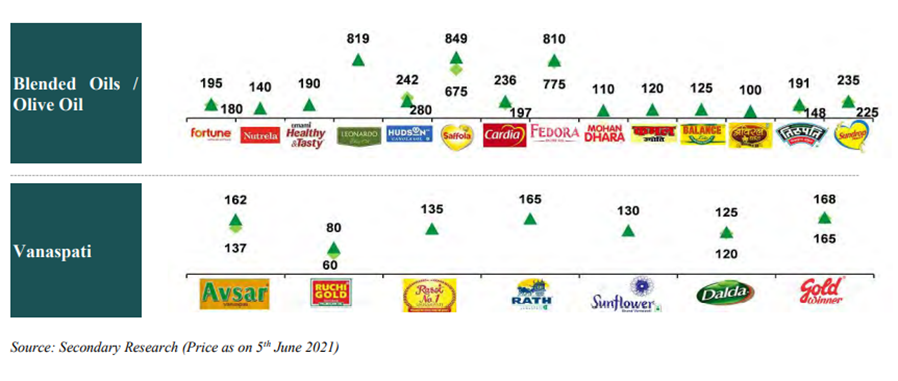

The industries in which Adani Wilmar operates are intensely competitive (Monopolistic). Due to low entry barriers, it competes with several regional, local as well as MNCs concerning Price, Marketing, and Features.

The industries in which Adani Wilmar operates are intensely competitive (Monopolistic). Due to low entry barriers, it competes with several regional, local as well as MNCs concerning Price, Marketing, and Features.

23/n

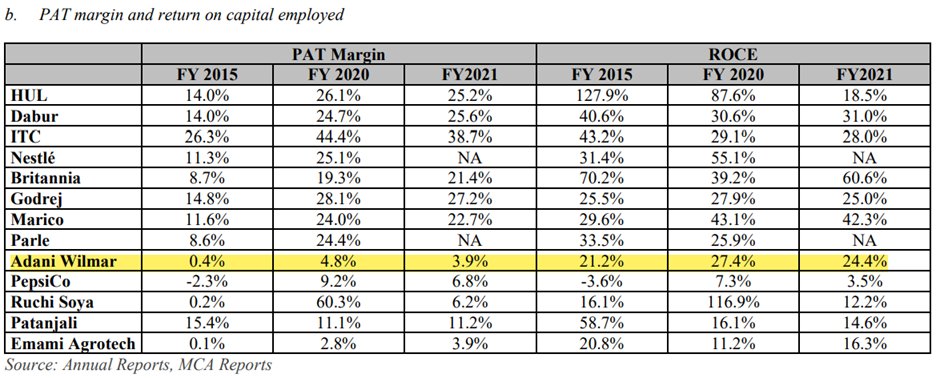

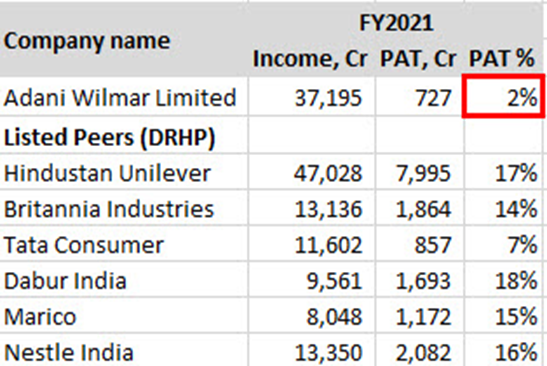

TAILPIECE-

Adani Wilmar does have a low PAT% Compared to its closest peers. By Analyzing the nature of its operation, the Company’s earnings will be volatile.

TAILPIECE-

Adani Wilmar does have a low PAT% Compared to its closest peers. By Analyzing the nature of its operation, the Company’s earnings will be volatile.

24/n

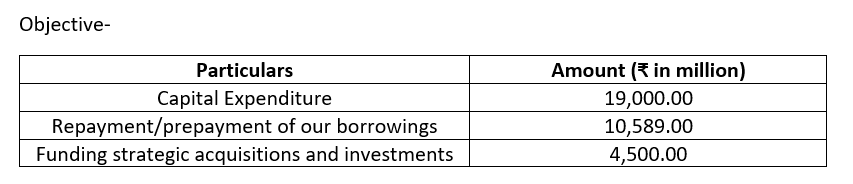

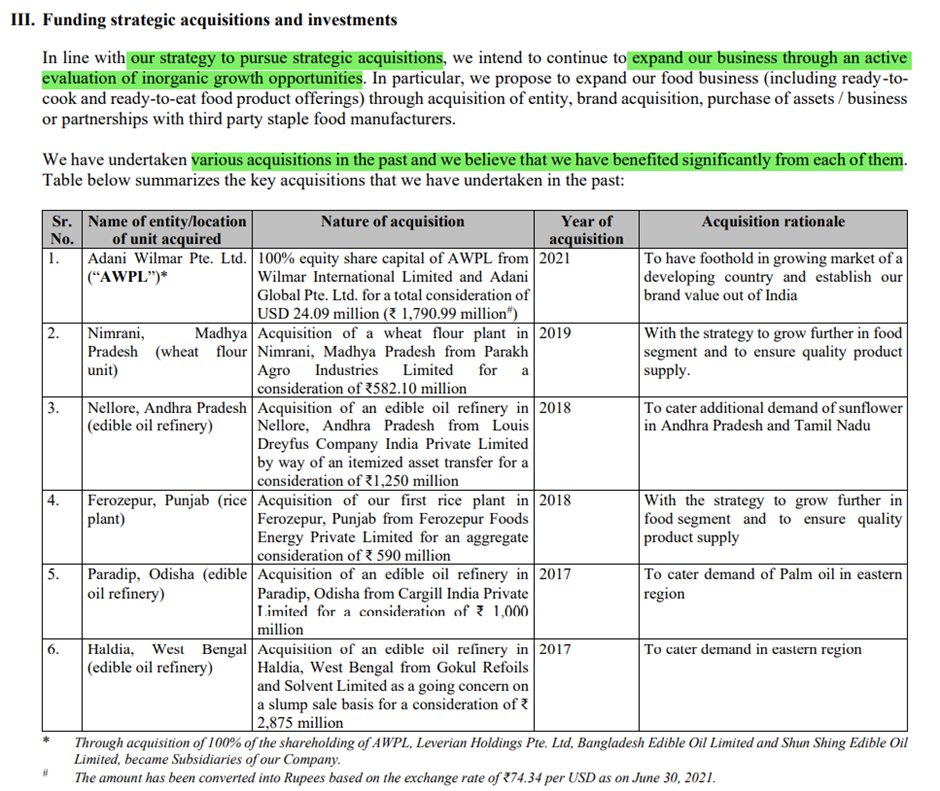

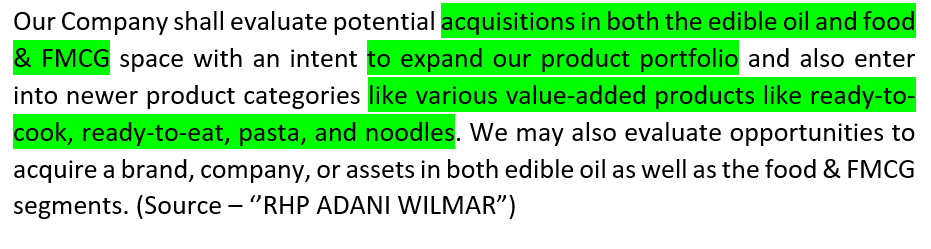

The Investment in the IPO is very much suited for the long-term Investor as the company is looking forward to building on Inorganic growth i.e., mergers and acquisitions. Which will reflect in the company’s financial in the long term.

The Investment in the IPO is very much suited for the long-term Investor as the company is looking forward to building on Inorganic growth i.e., mergers and acquisitions. Which will reflect in the company’s financial in the long term.

25/n

Disclaimer - Do not depend solely on the information of the above thread, do consider the material from other sources and consult your financial advisor before acting.

Reference – RHP (Red Herring Prospectus) of Adani Wilmar.

END OF THREAD.

THANK YOU FOR READING.

Disclaimer - Do not depend solely on the information of the above thread, do consider the material from other sources and consult your financial advisor before acting.

Reference – RHP (Red Herring Prospectus) of Adani Wilmar.

END OF THREAD.

THANK YOU FOR READING.

• • •

Missing some Tweet in this thread? You can try to

force a refresh