Laurus Labs conducted the conference call today at 11:00 AM.

Here are the conference call highlights.

🧵👇

Here are the conference call highlights.

🧵👇

Business Updates:

• Supply Chain Issue and Raw Material issues continuous to impact in Q3. Most of the solvent prices were at all time high.

• All the verticals are in line with expectation and demand is expected to increase in CDMO & Non ARV.

• Filed 4 DMF this quarter.

• Supply Chain Issue and Raw Material issues continuous to impact in Q3. Most of the solvent prices were at all time high.

• All the verticals are in line with expectation and demand is expected to increase in CDMO & Non ARV.

• Filed 4 DMF this quarter.

Segmental Result:

• FDF business impacted due to ARV business. Mgmt expect demand to stabilize.

• Oncology segment has shown good recovery.

• Synthesis business has shown solid growth, but mgmt expects the result are not that good with respect to global cos.

• FDF business impacted due to ARV business. Mgmt expect demand to stabilize.

• Oncology segment has shown good recovery.

• Synthesis business has shown solid growth, but mgmt expects the result are not that good with respect to global cos.

API Business:

• API business shown de-growth because of weakness in ARV business.

• Other APIs and Oncology business has shown good revoery.

• Mgmt expect total reactor volume from ~4600KL to 5600KL by the end of FY22.

• API business shown de-growth because of weakness in ARV business.

• Other APIs and Oncology business has shown good revoery.

• Mgmt expect total reactor volume from ~4600KL to 5600KL by the end of FY22.

CAPEX:

• 246cr in Q3 total of 779cr in 9 months.

• Most of the expansion project is on track.

• Brownfield capacity expansion at Unit 2 (to add 4bn units) is on track

• 25% of Gross Block is currently no generating revenue, which is new capacity & will generate revenue soon.

• 246cr in Q3 total of 779cr in 9 months.

• Most of the expansion project is on track.

• Brownfield capacity expansion at Unit 2 (to add 4bn units) is on track

• 25% of Gross Block is currently no generating revenue, which is new capacity & will generate revenue soon.

ARV Business:

• In Q4 mgmt dont expect any sudden jump and come back to normal. However in coming few quarter (Q1 23), mgmt expect back to normal.

• Mgmt expect ARV business to have bottom out.

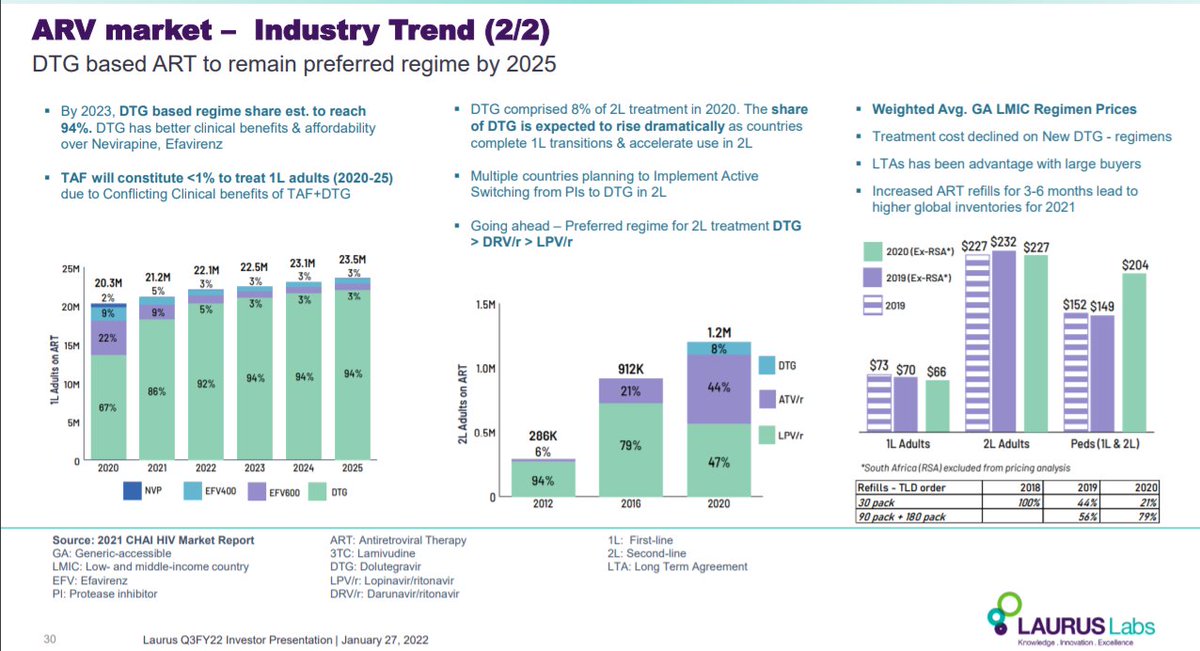

Detail Industry Information on ARV business in the image. (Soruce IP)

• In Q4 mgmt dont expect any sudden jump and come back to normal. However in coming few quarter (Q1 23), mgmt expect back to normal.

• Mgmt expect ARV business to have bottom out.

Detail Industry Information on ARV business in the image. (Soruce IP)

ARV Industry:

• ARV business has seen declining in overall industry level.

• Laurus is not loosing the market share. Hence this doesn't remain major concern for the co.

• ARV business has seen declining in overall industry level.

• Laurus is not loosing the market share. Hence this doesn't remain major concern for the co.

Synthesis:

• Synthesis business is expected to growth at higher rate than as of now. Mgmt expect by FY25, synthesis to share almost 20% of the revenue topline.

• Mgmt expect existing client to generate increasing revenue.

• 90 lac of revenue supported from new client addition

• Synthesis business is expected to growth at higher rate than as of now. Mgmt expect by FY25, synthesis to share almost 20% of the revenue topline.

• Mgmt expect existing client to generate increasing revenue.

• 90 lac of revenue supported from new client addition

Manufacturing:

• Formulation capacity is going to double in coming quarter, while there are already customers who are ready to to buy the product (especially existing customer). Hence the segment is expected to generate good revenue.

• Formulation capacity is going to double in coming quarter, while there are already customers who are ready to to buy the product (especially existing customer). Hence the segment is expected to generate good revenue.

Laurus Bio:

• Sales remain at 25cr in Q3.

• Commissioned two Fermenters of 45KL, taking the total capacity to 180KL as on Q3.

• In Process to acquire additional land to create ~1 million liters fermentation capacity in Phase 1

• Sales remain at 25cr in Q3.

• Commissioned two Fermenters of 45KL, taking the total capacity to 180KL as on Q3.

• In Process to acquire additional land to create ~1 million liters fermentation capacity in Phase 1

Other:

• 1 Inspection came in Q3, but it was resolved. Mgmt expect now inspection to be regular, but co. is taking full precaution.

• With CAPEX, debt is ~1750cr, as indicated by mgmt. Next year, mgmt would target to reduce the debt

• Fy 23 CAPEX is expected to be 1500-1700cr

• 1 Inspection came in Q3, but it was resolved. Mgmt expect now inspection to be regular, but co. is taking full precaution.

• With CAPEX, debt is ~1750cr, as indicated by mgmt. Next year, mgmt would target to reduce the debt

• Fy 23 CAPEX is expected to be 1500-1700cr

• • •

Missing some Tweet in this thread? You can try to

force a refresh