Route Mobile conducted the conference call for Q3 FY22.

Here are the conference call highlights

🧵👇

Here are the conference call highlights

🧵👇

Business Updates:

• Rasied 867.5cr from marque investor for organic & inorganic expansion.

• Acquired Masivian in LATAM and InterTeleco in Kuwait

• Rapid has been launched in Q1, for which 7k developers has participated in it.

• Launched payment app service for customer.

• Rasied 867.5cr from marque investor for organic & inorganic expansion.

• Acquired Masivian in LATAM and InterTeleco in Kuwait

• Rapid has been launched in Q1, for which 7k developers has participated in it.

• Launched payment app service for customer.

Unit Economics:

• Organic growth in Q3 was 22% on QoQ basis.

• Average billable transaction decrease from 0.4 Rs in Q2 to 0.35Rs in Q3.

• Billable transaction increase to 16.29 Million in Q3.

• Organic growth in Q3 was 22% on QoQ basis.

• Average billable transaction decrease from 0.4 Rs in Q2 to 0.35Rs in Q3.

• Billable transaction increase to 16.29 Million in Q3.

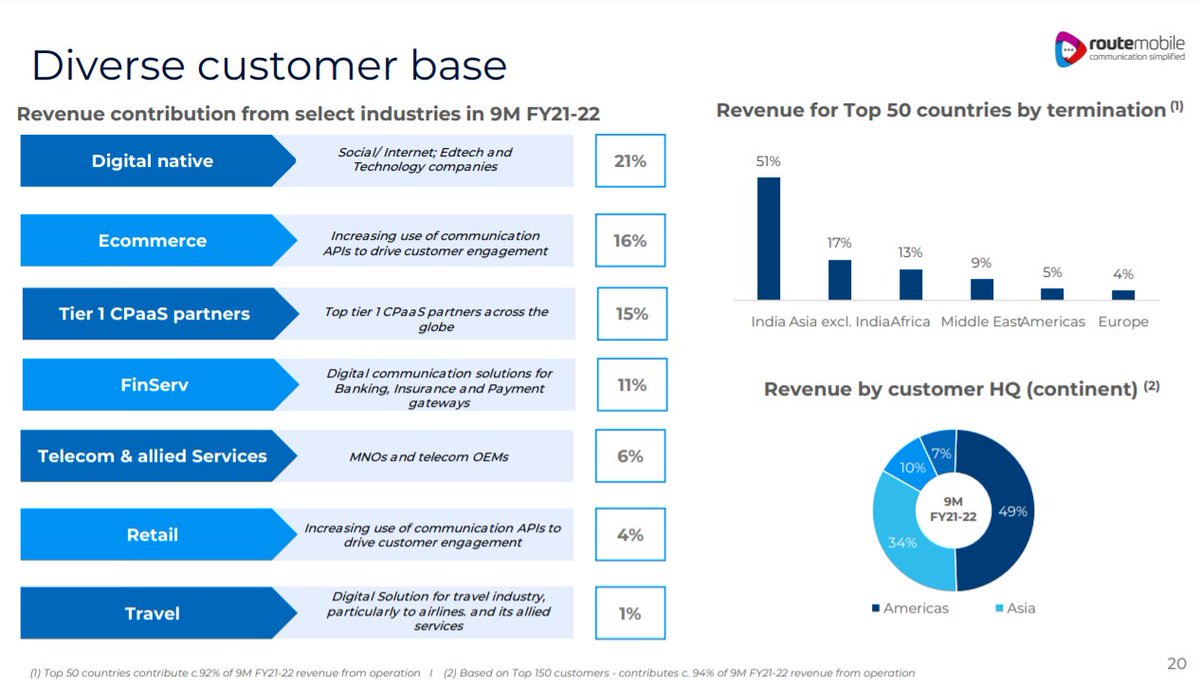

Revenue Share:

• India continuous to share highest pie & co. has added 2 countries with acquisition mentioned above.

• Revenue from new products are also increasing.

• E-Mail is starting to gain traction and Masivian has good delivery in it.

• India continuous to share highest pie & co. has added 2 countries with acquisition mentioned above.

• Revenue from new products are also increasing.

• E-Mail is starting to gain traction and Masivian has good delivery in it.

Organic Market:

• ILD prices are already increase, hence the growth has come from volume increase (which is increase in market share).

• Volume growth has remain 13%.

• ILD prices are already increase, hence the growth has come from volume increase (which is increase in market share).

• Volume growth has remain 13%.

Acquisition:

• For Masivian, Gross Margins are 40% and there is room for improvement. Monthly Run Rate is 1.8-2 Million$.

• For InterTeleco GM are around portfolio margins of 20%.

• Post the sell off in IT market, mgmt has seen certain IT to be available at good valuation.

• For Masivian, Gross Margins are 40% and there is room for improvement. Monthly Run Rate is 1.8-2 Million$.

• For InterTeleco GM are around portfolio margins of 20%.

• Post the sell off in IT market, mgmt has seen certain IT to be available at good valuation.

Other:

• Effective Tax Rate: 15.7% for 9 months was 17.6%.

• Attrition rate increased from 11% to 20%.

• Net Cash was 110.3cr.

• Average Receivable days increased from 55 days to 59 days.

• Cash CAPEX was 12cr in Q3

• Effective Tax Rate: 15.7% for 9 months was 17.6%.

• Attrition rate increased from 11% to 20%.

• Net Cash was 110.3cr.

• Average Receivable days increased from 55 days to 59 days.

• Cash CAPEX was 12cr in Q3

• • •

Missing some Tweet in this thread? You can try to

force a refresh