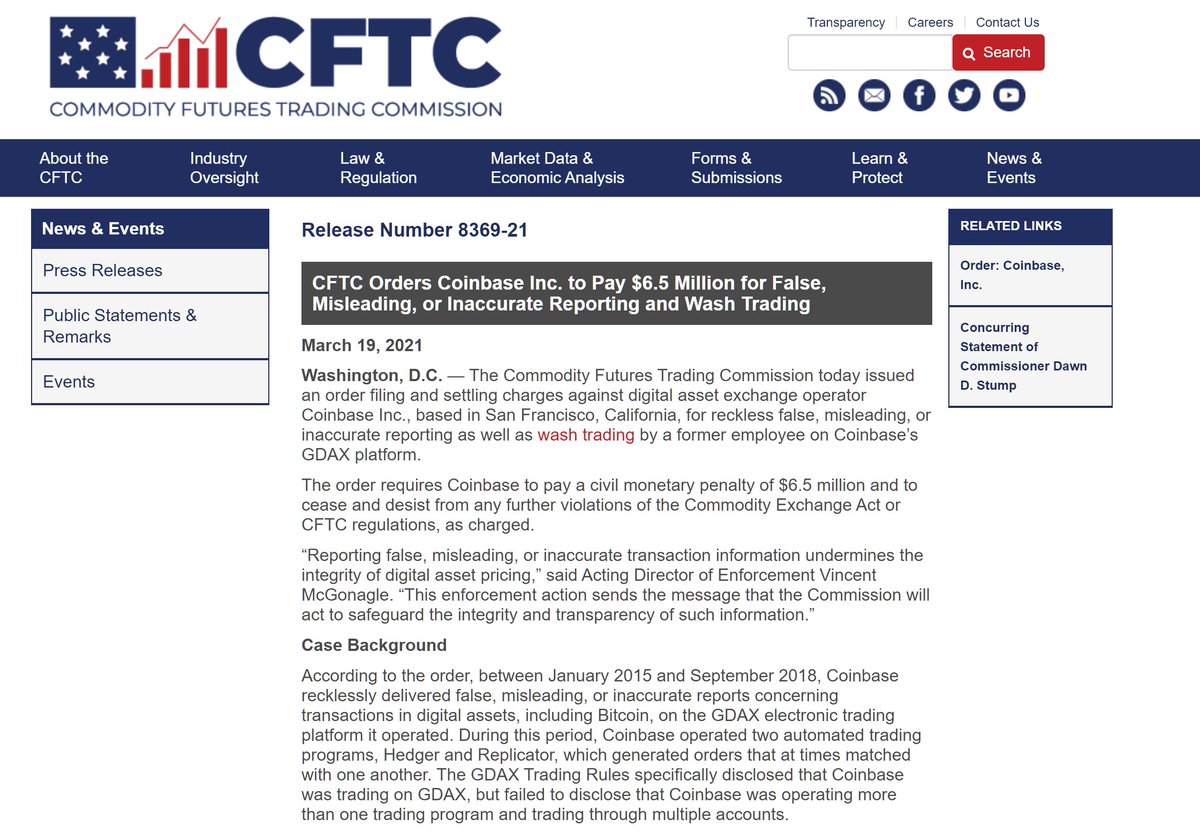

One of the primary reasons crypto exchanges are against KYC/AML is because it's makes it harder for the exchange to have plausible deniability regarding trade fraud/market manipulation/wash trading/tape painting.

With more scrutiny on crypto exchanges, these market manipulators/wash traders/tape painters still want to rip people off.

That's why NFT's took off so fast, a new useless item that they can wash trade/tape paint in order to bring in a bunch of new suckers.

That's why NFT's took off so fast, a new useless item that they can wash trade/tape paint in order to bring in a bunch of new suckers.

And the platforms that sell "art", don't comply with KYC/AML either, I mean why would they have to? It's just "art", right?

Once the NFT grift blows up, they'll launch a new one, you'll see some new bullshit token launch out of nowhere and suddenly be worth billions of dollars.

Once the NFT grift blows up, they'll launch a new one, you'll see some new bullshit token launch out of nowhere and suddenly be worth billions of dollars.

When in reality it's just three assholes that start it up, and fake the whole thing in another attempt to rip off people buying into their bullshit.

It's like marbles, spinning tops, pogs, tappy cards or clarence dollars in elementary/middle school. Once a fad wears off, the 'cool kids' just start a new fad. The cool kids trade a little bit with each other as the not-so-popular kids watch.

The not-so-popular kids want to be cool and hip, so they excitedly trade for the overvalued new cool things from the cool kids. Once all of the not-so-popular kids got into the scheme, well it's not cool anymore.

Hence the need to create a new scheme.

Hence the need to create a new scheme.

• • •

Missing some Tweet in this thread? You can try to

force a refresh