Inflation is at an all time.

Investing a part of your portfolio (5-10%) in Gold, has been an hedge for a longtime. However, does investment in gold make sense currently?

A thread 🧵

Please re-tweet to educate more people!

Investing a part of your portfolio (5-10%) in Gold, has been an hedge for a longtime. However, does investment in gold make sense currently?

A thread 🧵

Please re-tweet to educate more people!

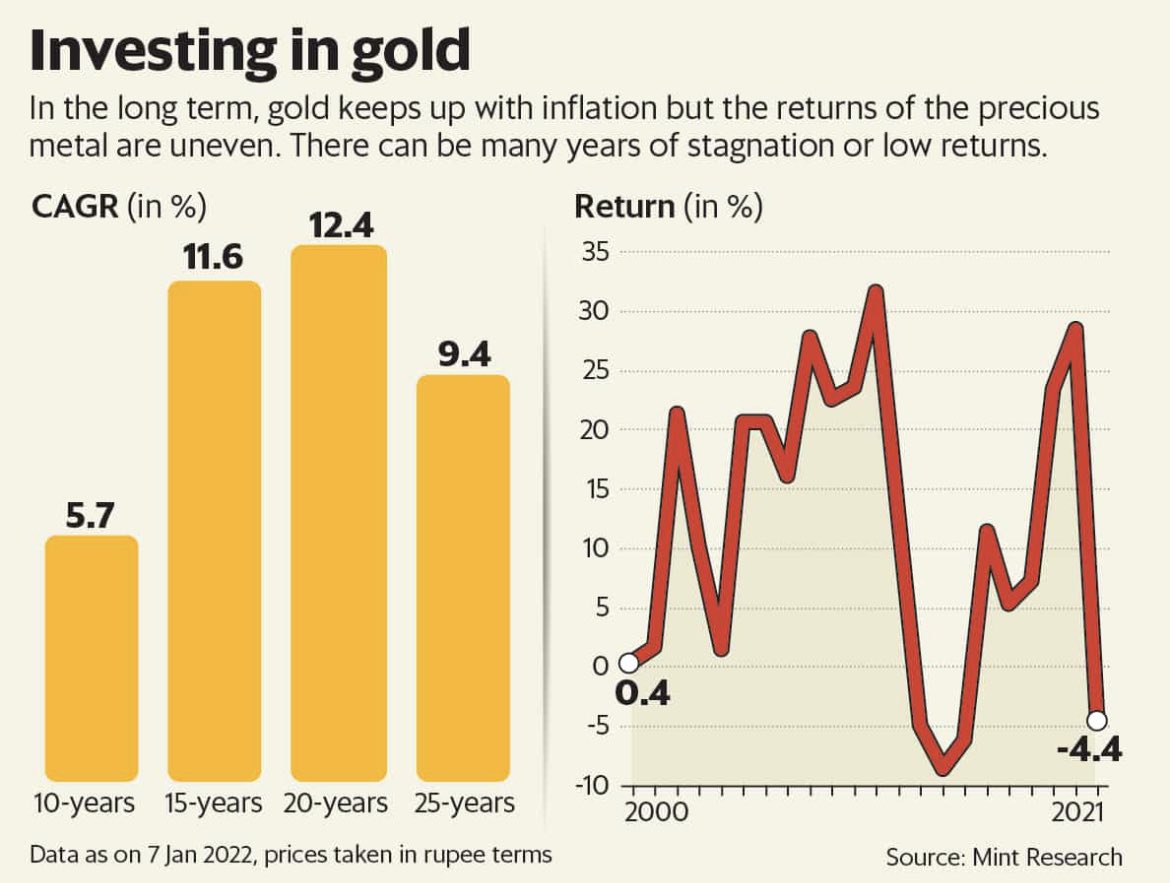

Gold as an investment vehicle has preformed negatively when considering the real rate. (Rate of Return- Inflation) over a 10year timeframe.

Here is a visual on the same by @capitalmind_in :

Here is a visual on the same by @capitalmind_in :

Gold returns are highly cyclical in nature. There are a lot of short spurts in return and years of stagnation.

In fact, since 2011, it has given a mere return of 5.3% CAGR.

One of the reasons for this is the high bull run of gold until 2012.

In fact, since 2011, it has given a mere return of 5.3% CAGR.

One of the reasons for this is the high bull run of gold until 2012.

The increase in gold price is often because of rupee depreciation, not because of the actual gold price increase.

Let's look at the following data.

From 2011 to 2021:

Gold value in INR: 26k to 48k ( Almost doubled)

INR value in USD: 46 to 73 ( 1.6 times)

Let's look at the following data.

From 2011 to 2021:

Gold value in INR: 26k to 48k ( Almost doubled)

INR value in USD: 46 to 73 ( 1.6 times)

Gold value in USD: $1550 to $1730 ( Just 1.1 times)

Surprising. Right?

So most of the gold price increase is because of rupee depreciation. Gold prices haven't increased much in the last ten years at the world level.

Surprising. Right?

So most of the gold price increase is because of rupee depreciation. Gold prices haven't increased much in the last ten years at the world level.

If you’re considering to invest in gold you can consider the following modes of investment:

1. Physical or Digital gold: Though it is most comfortable, there is 3% GST on the purchase- as good as 3% capital loss! The price also may vary across sellers. Seller A may sell at ₹ 40,000. But seller B may sell at ₹ 39,000.

2. Gold ETFs/ Mutual fund: There is no GST and pricing is super transparent. If you have Demat, ETFs are better. If not, gold mutual funds are a way to go.

3. Tax: All above are taxed similarly to debt funds. Only Gold bonds have different taxes.

3. Tax: All above are taxed similarly to debt funds. Only Gold bonds have different taxes.

4. Sovereign Gold Bonds: If you are in it for the long term, these bonds give you an additional 2.5% return per year. But it has a lock-in period of five years. If you hold it for eight years, the gains are tax-free! Also, you can take a loan against the gold bond.

If you are looking to invest in the long term, Sovereign gold bonds are a place to invest. For a short time, Gold ETFs are the right place to invest.

So is it a great investment? Data doesn't say so! To hedge risks, it makes sense to invest in gold with a small allocation ( less than 10% of the total portfolio).

If you liked this thread, you can check more of my threads on personal finance and investing here:

https://twitter.com/partha0799/status/1485876366750871554

Follow me @partha0799 for more such threads!

You can plan your finances here under ₹3000: advisoira.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh