1/14 January summary 🧵

Most metrics continued to decline.

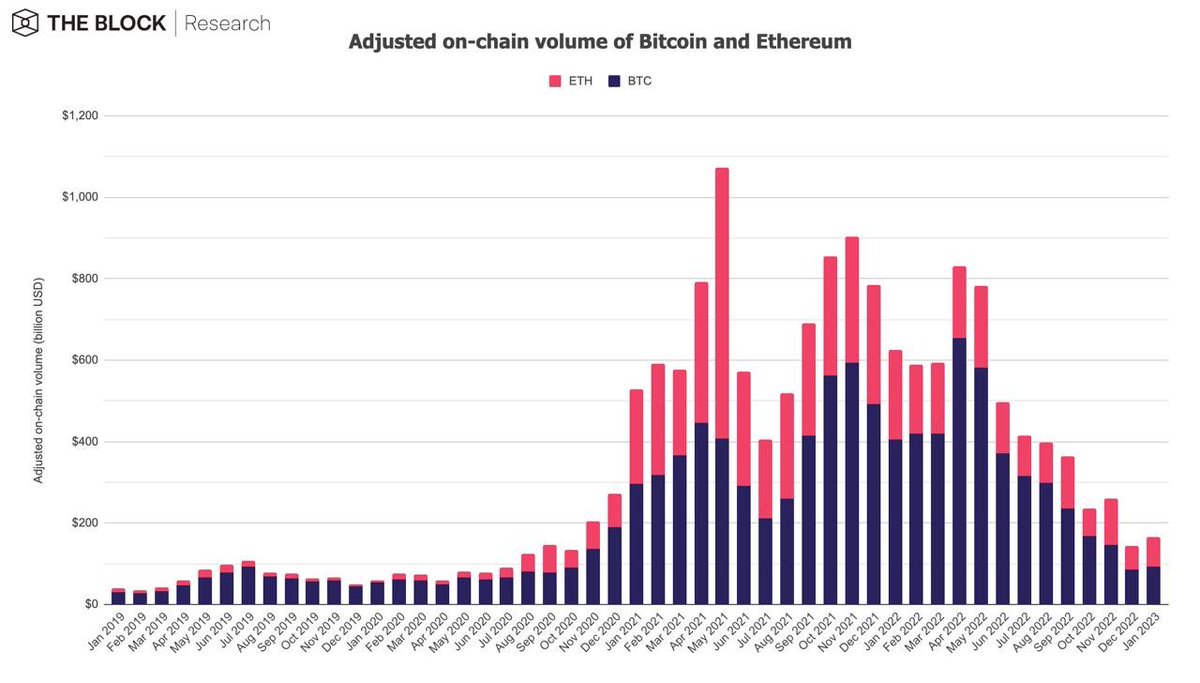

Total adjusted on-chain volume decreased by 20.3% to $626B:

Most metrics continued to decline.

Total adjusted on-chain volume decreased by 20.3% to $626B:

2/14 Adjusted on-chain volume of stablecoins decreased by 32.8% to $541B (issued supply hit a new ATH of $149.2B; with USDT decreasing to 52.3% and USDC increasing to 30.2% respective market share):

3/14 ETH miner revenue decreased by 22.8% to $1.42B, while BTC miner revenue decreased by 15.4% to $1.21B. This is the 9th consecutive month where ETH miner revenue > BTC miner revenue:

4/14 A total of 398,062 ETH, equivalent to $1.2B, was burned in January. Since the implementation of EIP-1559 in early August, a total of 1,715,775 ETH, equivalent to $6.34B, has been burned:

5/14 Monthly NFT marketplace volume on Ethereum increased by 210% to a new all-time high of $7B. Note that LooksRare’s incentive program has resulted in significant wash trading:

8/14 Daily average volume of GBTC decreased by 4.4% to $207M - still down 73.4% from its ATH in January 2021:

9/14 Open interest: BTC/ETH futures ⬇️; Trading volumes: BTC/ETH futures ⬇️. BTC monthly futures volume decreased by 3% to $1.29T:

10/14 CME's open interest of Bitcoin futures decreased by 51% to $1.42B (daily avg volume up 18.8% to $2.37B):

12/14 On the options front, open interest decreased sharply for both BTC/ETH options, while trading volume growth stagnated. ETH monthly options volume increased by 0.1% to $15.68B (BTC: -1.7% to $21.5B):

13/14 As always you can find many of these metrics, and other live metrics, on our Data Dashboard: theblockcrypto.com/data

14/14 For 2021 yearly data and 2022 predictions check our 2022 Digital Asset Outlook:

https://twitter.com/lawmaster/status/1471495403711320068

• • •

Missing some Tweet in this thread? You can try to

force a refresh