Why we CoinJoin, a thread.

First we need to look at the existing fiat system we are hoping to ultimately replace, the privacy expectations of that fiat system, and how we can achieve a similar outcome when using the Bitcoin network.

First we need to look at the existing fiat system we are hoping to ultimately replace, the privacy expectations of that fiat system, and how we can achieve a similar outcome when using the Bitcoin network.

Let's examine physical cash. You go to an ATM and withdraw cash from your bank account. Your bank knows you used an ATM, they know how much you took out, but that's where their vision ends.

Physical cash is fungible and private.

Physical cash is fungible and private.

Likewise, even when spending non physical cash the merchant you are buying from cannot peer into your bank account. All they know is you have enough money to afford what you're buying. They have no other insight into your finances.

The fiat system has basic transactional privacy

The fiat system has basic transactional privacy

The fiat system has various laws that enforce basic and fundamental privacy when using their money.

Relying on legislators to uphold your privacy is playing a dangerous game though, as we have seen with a weakening of fundamental rights and privacy over the years.

Relying on legislators to uphold your privacy is playing a dangerous game though, as we have seen with a weakening of fundamental rights and privacy over the years.

In the Bitcoin system we cannot and should not look to politicians and legislation to provide basic transactional privacy.

Fiat means 'by decree'. We do not want money by decree nor do we want privacy by decree. Instead we need to rely on code to enforce our rights to privacy.

Fiat means 'by decree'. We do not want money by decree nor do we want privacy by decree. Instead we need to rely on code to enforce our rights to privacy.

Bitcoin is fundamentally a public and transparent system. Every single transaction is recorded in perpetuity on the blockchain.

As such, spending bitcoin in a basic private way - the same way you would spend in the fiat system - can be a challenge

As such, spending bitcoin in a basic private way - the same way you would spend in the fiat system - can be a challenge

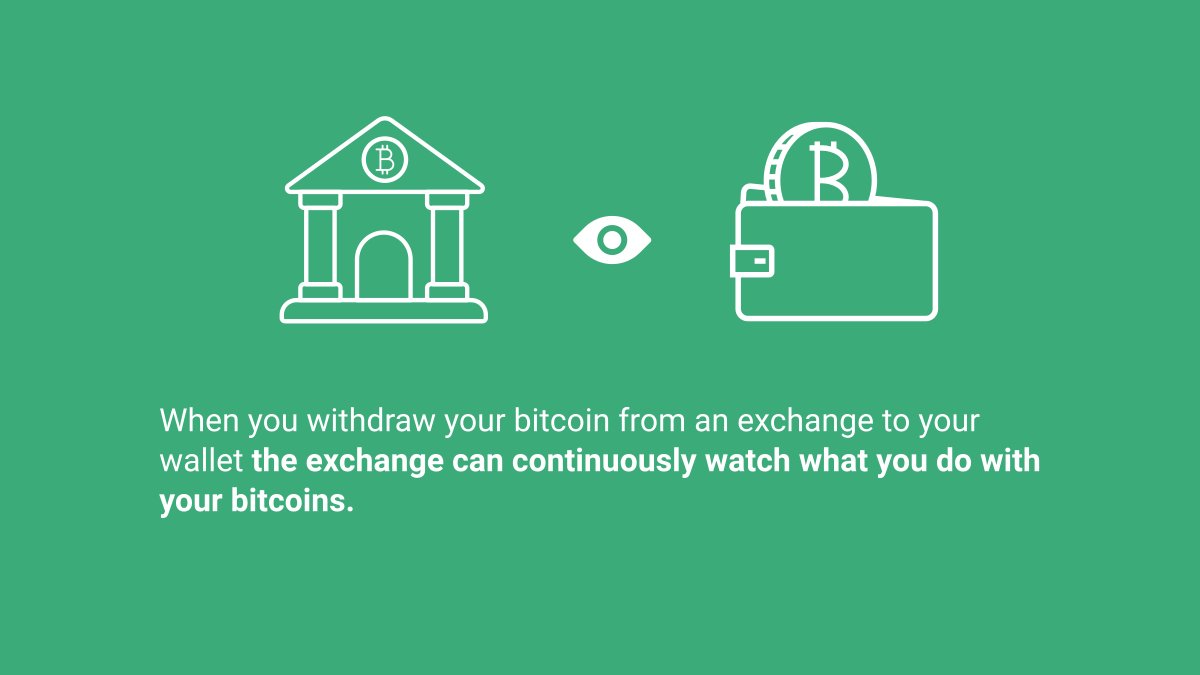

Compounding on the privacy challenge is that the vast majority of bitcoin users are getting their coins through centralized bitcoin exchanges.

They provide the exchange their KYC information which is from that point then tied to their coins.

They provide the exchange their KYC information which is from that point then tied to their coins.

When you withdraw from your exchange it isn't like withdrawing physical cash from an ATM. The exchange is able to watch what you do with those coins going forward.

A good analogy would be if every bill you withdrew from an ATM had your name and account number printed on them.

A good analogy would be if every bill you withdrew from an ATM had your name and account number printed on them.

Likewise, when spending to third parties you are opening the door to sharing information about past and future spending activity to that party.

Imagine if your church pastor was able to see your OnlyFans subscription when you place a dollar bill into the offering plate.

Imagine if your church pastor was able to see your OnlyFans subscription when you place a dollar bill into the offering plate.

This is where CoinJoin comes in. A software solution to help solve the basic transactional privacy challenges in Bitcoin.

A good analogy is to think of your bitcoins as gold ingots and CoinJoin as a smelting process. Any markings on your ingots are gone when smelted and recast.

A good analogy is to think of your bitcoins as gold ingots and CoinJoin as a smelting process. Any markings on your ingots are gone when smelted and recast.

Performing a CoinJoin after buying on a centralized exchange with your KYC information can be seen as obtaining a similar level of privacy from your exchange as withdrawing cash from an ATM provides from your bank.

CoinJoin is not a silver bullet. There are still plenty of privacy challenges a new user will face, but it is the most important action one can take to reclaim privacy when transacting & we are doing all we can to lower the barrier to entry.

Get Started

samouraiwallet.com/lp/whirlpool

Get Started

samouraiwallet.com/lp/whirlpool

• • •

Missing some Tweet in this thread? You can try to

force a refresh