How to buy a self storage facility -

A thread:

A thread:

First, get on google maps and search "self storage".

Make a spreadsheet of all of the mom-and-pop facilities within 2 hours of where you live.

Rural is fine. Suburbs are fine. You likely don't want to afford the ones in the big cities.

Avoid the REITs.

Make a spreadsheet of all of the mom-and-pop facilities within 2 hours of where you live.

Rural is fine. Suburbs are fine. You likely don't want to afford the ones in the big cities.

Avoid the REITs.

Call them up and say -

"My name's Nick and I'm interested in making you an offer to buy your facility. I'm not a broker and I don't need much information to make you an offer. I'm not trying to low ball you or waste your time"

"My name's Nick and I'm interested in making you an offer to buy your facility. I'm not a broker and I don't need much information to make you an offer. I'm not trying to low ball you or waste your time"

Ask them for the unit mix (how many of what size) and the current revenue per month.

This'll give you enough info to do some basic "back of the napkin" underwriting.

This'll give you enough info to do some basic "back of the napkin" underwriting.

Get pricing expectations from the seller.

If it is over 125x monthly revenue, it isn't worth your time pursuing any further unless there is a ton of opportunity to add value.

I wouldn't recommend a heavy value add deal on your first buy.

If it is over 125x monthly revenue, it isn't worth your time pursuing any further unless there is a ton of opportunity to add value.

I wouldn't recommend a heavy value add deal on your first buy.

If it's around 100x monthly revenue E.G. doing $5k per month in revenue with an asking price of $500k, it's likely a decent deal and worth your time to dig deeper.

Over $15k per month or revenue and its more valuable to more buyers (like me - send me a DM if you find one) so the sweet spot for first time buyers is around $3-5k per month of revenue and a $300-600k purchase price.

Too small for big guys and too big for small guys.

Too small for big guys and too big for small guys.

Calculate how much you can drive revenue by doing a market study.

Call the competitors and act like a customer. How hard is it to rent a unit?

Really hard? You can probably raise rents 10-20% or more.

Call the competitors and act like a customer. How hard is it to rent a unit?

Really hard? You can probably raise rents 10-20% or more.

Calculate your new property taxes after purchase (online) and get a quote for insurance.

Set $500 a month aside for capex reserves.

Budget $2-300 per month for sparefoot and google ads.

Same for onsite labor to sweep units.

Same for software / bookkeeping.

Same for lawn care

Set $500 a month aside for capex reserves.

Budget $2-300 per month for sparefoot and google ads.

Same for onsite labor to sweep units.

Same for software / bookkeeping.

Same for lawn care

Most small facilities like this operate at about a 40% expense ratio.

Meaning $2k in monthly expenses for every $5k in revenue.

Larger facilities with more revenue can operate as low as 20%.

Portfolio-wide I operate around 35%.

Meaning $2k in monthly expenses for every $5k in revenue.

Larger facilities with more revenue can operate as low as 20%.

Portfolio-wide I operate around 35%.

A local bank will probably only finance 60-70% of the purchase price.

SBA loans can go 90% (I don't recommend this approach but many have succeeded with it).

I don't believe in over-leveraging real estate - too risky if times get tough.

SBA loans can go 90% (I don't recommend this approach but many have succeeded with it).

I don't believe in over-leveraging real estate - too risky if times get tough.

Closing costs, cap reserves, operating capital will be another $50-60k on a $500k purchase.

Attorney fees, transfer taxes, appraisals, inspections, cost seg studies, new signage, gravel, repairs, etc.

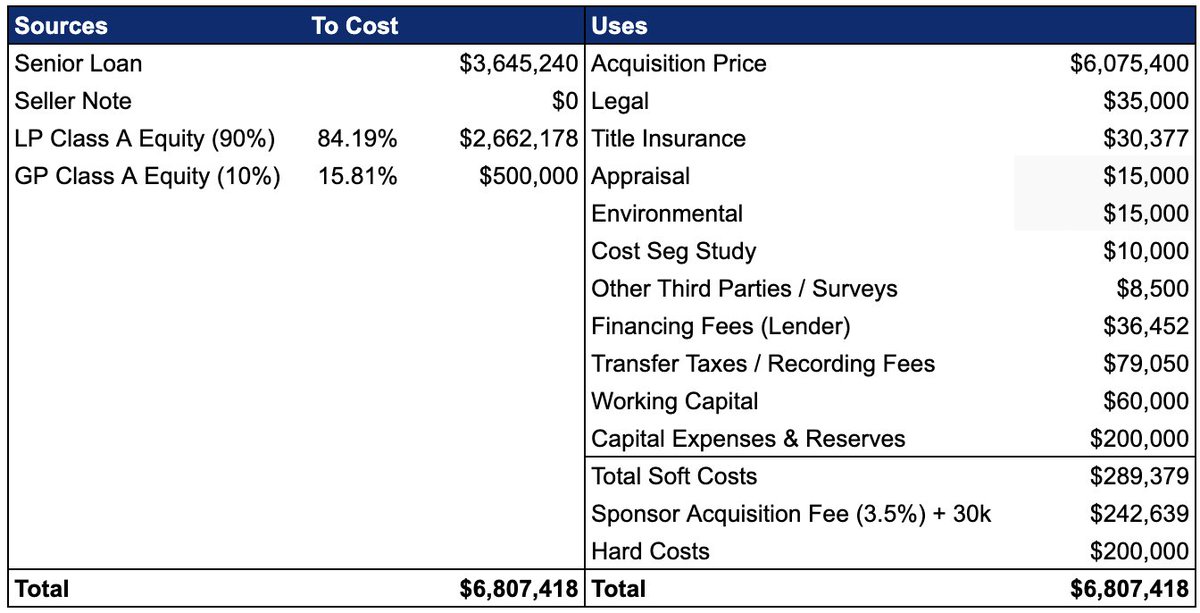

Build out the sources / uses on your acquisition like this:

Attorney fees, transfer taxes, appraisals, inspections, cost seg studies, new signage, gravel, repairs, etc.

Build out the sources / uses on your acquisition like this:

So to buy a $500k facility you'll likely need $200k in cash to close.

And I'd recommend another $100k on the sidelines incase a surprise arises.

Remember the golden rule of real estate:

If you run out of cash, it's game over.

And I'd recommend another $100k on the sidelines incase a surprise arises.

Remember the golden rule of real estate:

If you run out of cash, it's game over.

You can raise money from investors (I did on my first deal) using a private equity structure.

I'll make a thread on this next week.

I'll make a thread on this next week.

Due dilligence is important and includes two main things:

Make sure the rent roll is accurate and the money you thought was coming in is actually coming in.

And make sure the property is in good shape.

Make sure the rent roll is accurate and the money you thought was coming in is actually coming in.

And make sure the property is in good shape.

Get management reports. Dive into the rent roll during an owner interview.

You'll often find 10 or 20 units that aren't paying or are full of junk that the owner hasn't done the work to empty.

Get an inspection with an in-depth inspection report. Consult a contractor as needed.

You'll often find 10 or 20 units that aren't paying or are full of junk that the owner hasn't done the work to empty.

Get an inspection with an in-depth inspection report. Consult a contractor as needed.

Build an 84 month pro-forma to estimate cashflow, future revenue and expenses.

You'll need this to present to the bank along with a market study of the competition.

(I do consulting on this, link in bio)

You'll need this to present to the bank along with a market study of the competition.

(I do consulting on this, link in bio)

Close, get the units clean and a website built, optimize your google my business listing, and go.

Add value through increased revenue and low expenses.

Refinance 12 months later to pull your cash out.

Rinse and repeat.

(this is basically my story and I have 43 props now)

Add value through increased revenue and low expenses.

Refinance 12 months later to pull your cash out.

Rinse and repeat.

(this is basically my story and I have 43 props now)

I send out a ton of info on real estate and self storage on my newsletter.

Deal breakdowns, acquisition strategies, and more.

sweatystartup.ck.page

Signup here 👆

Deal breakdowns, acquisition strategies, and more.

sweatystartup.ck.page

Signup here 👆

A few notes:

This is hard, uncomfortable stuff.

There is nuance. You can never be sure a deal is a good deal.

It's very difficult to find a good deal (I spend millions a year on my acquisitions pipeline).

I make it sound easy here on Twitter. It isn't.

This is hard, uncomfortable stuff.

There is nuance. You can never be sure a deal is a good deal.

It's very difficult to find a good deal (I spend millions a year on my acquisitions pipeline).

I make it sound easy here on Twitter. It isn't.

Another thing:

Real estate has been on a 10 year bull run. The past 2 years have been insane.

This can't go on forever.

Rates are going up.

Values may go down.

Keep cash on hand and lock in interest rates for 5+ years if possible.

Real estate has been on a 10 year bull run. The past 2 years have been insane.

This can't go on forever.

Rates are going up.

Values may go down.

Keep cash on hand and lock in interest rates for 5+ years if possible.

If your goal is to buy, increase profit, and flip...

Pick a different business.

Risky AF and real estate is expensive to buy and expensive to sell. It also takes a long time.

You can sell your NFT or FB shares in 1 click in 1 second.

Costs thousands and months to sell RE.

Pick a different business.

Risky AF and real estate is expensive to buy and expensive to sell. It also takes a long time.

You can sell your NFT or FB shares in 1 click in 1 second.

Costs thousands and months to sell RE.

The key is the operations.

People think real estate is passive and you just cash checks all day.

It's a sweaty, unsexy, small business.

I'm good at this because I ran a small biz for 10 years.

Don't know how to run a biz?

Tread lightly.

People think real estate is passive and you just cash checks all day.

It's a sweaty, unsexy, small business.

I'm good at this because I ran a small biz for 10 years.

Don't know how to run a biz?

Tread lightly.

Be resourceful.

There are no direct answers here. There are only strategies that work sometimes.

You can learn and study all you want. But DMing me on how to build a website isn't the way.

Figure it out yourself.

(Use launchkits.com/sweaty by the way for a $700 site)

There are no direct answers here. There are only strategies that work sometimes.

You can learn and study all you want. But DMing me on how to build a website isn't the way.

Figure it out yourself.

(Use launchkits.com/sweaty by the way for a $700 site)

Here's a podcast episode where I give you an overview of how self storage investing works:

open.spotify.com/episode/6hXEzx…

open.spotify.com/episode/6hXEzx…

Here's another (released yesterday) where I discuss the current risks in the real estate market and how I'm navigating them at my own firm.

Interest rates, inflated values, etc.

open.spotify.com/episode/76lSfz…

Interest rates, inflated values, etc.

open.spotify.com/episode/76lSfz…

I've acquired 43 properties and over 1.1 million square feet of storage.

We have 38 people on our team.

I am STILL learning new things every single day and have a lot left to learn.

Take this as learning material only. Buy property at your own risk.

We have 38 people on our team.

I am STILL learning new things every single day and have a lot left to learn.

Take this as learning material only. Buy property at your own risk.

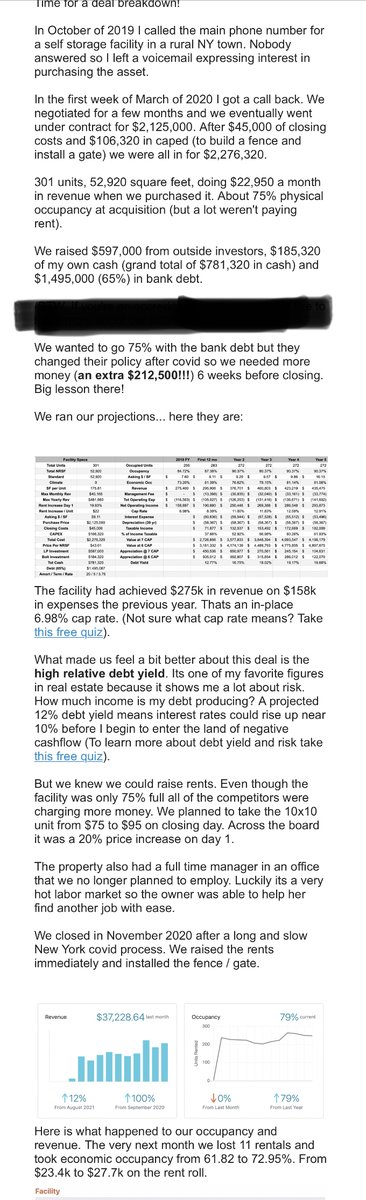

Here's an example of the type of emails I send out on my newsletter:

sweatystartup.ck.page

Signup here 👆

sweatystartup.ck.page

Signup here 👆

Yes, a market study is as simple as calling competitors.

Yes, acquisitions is as simple as picking up the phone.

Yes, operations is as simple as keeping a building clean and answering the phone.

No, it isn't easy and scalable. It requires work.

And thats why its so beautiful.

Yes, acquisitions is as simple as picking up the phone.

Yes, operations is as simple as keeping a building clean and answering the phone.

No, it isn't easy and scalable. It requires work.

And thats why its so beautiful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh