1/ This is the first in a new series summarizing research papers at the intersection of anti-money laundering discourse and effectiveness and outcomes science, a surprisingly rare confluence. #AML #KYC

🧵

🧵

🇮🇹🇺🇸2/ Context: Before the modern anti-money laundering era, “follow the money” policing was proving increasingly productive, culminating in the “Maxi trial” in the late 1980s, the most significant trial against the Sicilian mafia & reportedly the biggest trial in world history.

3/ Paradoxically, the modern global AML movement, which began in 1990, ostensibly based on “follow the money” ideas, has not been as effective as hoped. Scientists soon exposed serious flaws, but for many people the first awareness of serious problems came with a 2011 UN report.

4/ For two decades, FATF insisted that AML effectiveness was defined by adherence to its standards. Then, in 2011, the United Nations issued a 138pp report which asked (and answered) a different question about effectiveness; delivering a stunning rebuke to the compliance mantra.

5/ "'follow the money' has been sound advice in law enforcement...for decades. Nevertheless, tracking the flows of illicit funds generated by drug trafficking and organized crime and analysing [their] magnitude and…laundering through...financial systems remain daunting tasks.”

6/ “Prior to this report, perhaps the most widely quoted figure for the extent of money-laundering was the IMF's ‘consensus range’ of between 2-5 per cent of global GDP, made public in 1998.” [Still cited uncritically today, “the IMF estimate” is a myth, Ed].

7/ “A meta-analysis of the results from various studies suggests that all criminal proceeds are likely to amount to some 3.6% of global GDP (2.3%-5.5%), equivalent to about US$2.1 trillion (2009).”

8/ “If invested, a study...revealed that criminal income went…into real estate,…bank accounts, or into various ‘business activities’…Similarly, the cartels in Colombia in the 1990s [reportedly] concentrated their investment mainly in real estate and the construction sector.”

9/ “[The] ‘success’ rate of identifying criminal capital flows is limited, to say the least…[T]he ‘interception rate’ for AML efforts…remains low. Globally, it appears that much less than 1% [~0.2%] of [crime proceeds] laundered via the financial system are seized and frozen.”

10/ “In comparison, more than 20% of the globally produced illicit opiates are being seized and more than 40% of the cocaine. Are money-launderers really so much smarter than drug traffickers, or is there something wrong with the existing control system?”

11/ “The problem does not seem to be a lack of international instruments, [but], more likely, shortcomings in the implementation of existing instruments.” [End, UN Report]

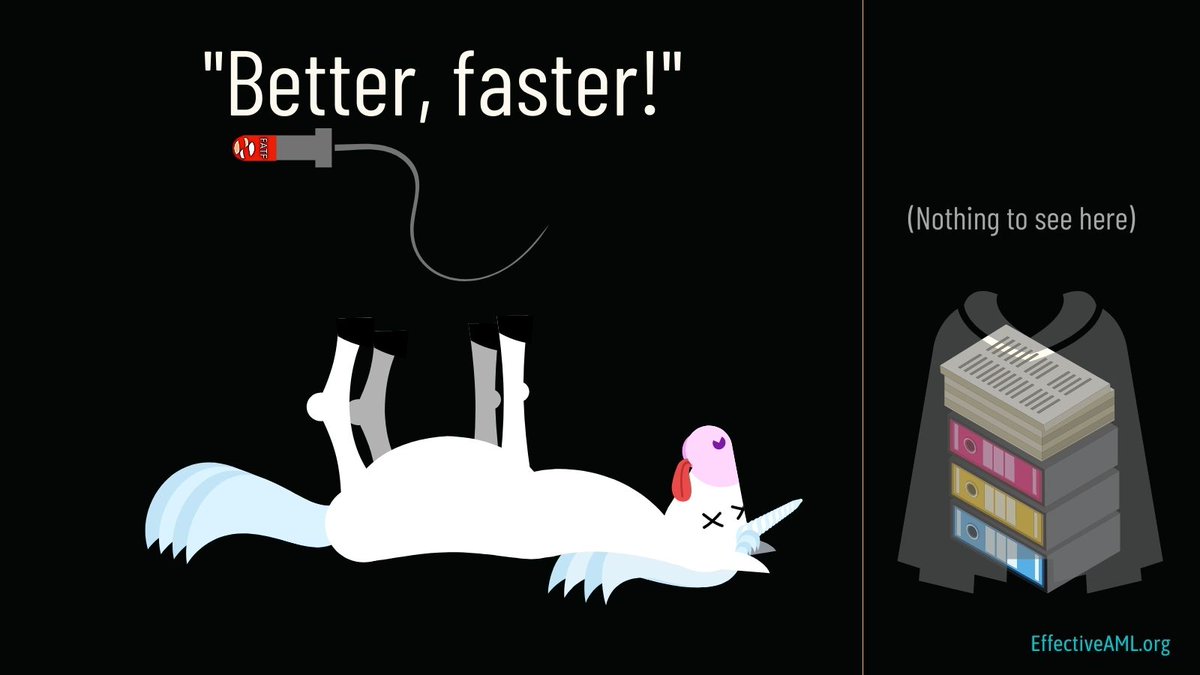

12/ Ed: While questionable (logically & empirically) if “more of the same” is the answer, over a decade later FATF still insists on the same prescription. Nonetheless, while the “solution” has not worked, the UN exposed a troubling truth. The AML system is profoundly ineffective.

PS: With thanks to @anilsaidso for storybook concept and Dragan for cartoon art (Oxymoron/IMF. Loot)

• • •

Missing some Tweet in this thread? You can try to

force a refresh