Trendline is basically use for majoring trend 📈 of any stock.

It is also useful for indentify demand & supply ....

Here it's applications 👇

It is also useful for indentify demand & supply ....

Here it's applications 👇

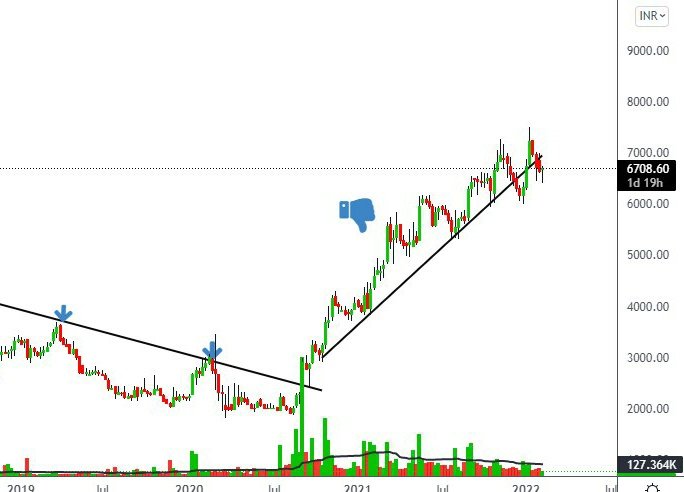

➡️It is formed when a diagonal line can be drawn between a minimum of three or more price pivot points.

And that all three points must tested equally.

example 👇 #sis

And that all three points must tested equally.

example 👇 #sis

➡️ Trendline is mainly useful for identifying trend 👇

⚡Uptrend - #happiestmind

⚡Downtrend - #bluedart

⚡Uptrend - #happiestmind

⚡Downtrend - #bluedart

➡️ It is also useful big trend changing move 🚀

⚡After 4 years of consolidation #sis is ready for trend changing .

⚡ #adanipower is also consolidating from 9 months now it's trend going to change after trendline BO

⚡After 4 years of consolidation #sis is ready for trend changing .

⚡ #adanipower is also consolidating from 9 months now it's trend going to change after trendline BO

Hope this is helpful 🙏 for inhance ur knowledge 📚

Follow @Trading0secrets more techincal threads 🧵

Next thread 🧵 I m going to make on demand & supply (zone) .

Follow @Trading0secrets more techincal threads 🧵

Next thread 🧵 I m going to make on demand & supply (zone) .

• • •

Missing some Tweet in this thread? You can try to

force a refresh