#Neuland_labs

A thread to understand a few anti thesis points of Neuland labs.

Disc- This is not a buy/sell recommendation. Do your own due diligence.

I'll share my opinion backed by data.

You don't have to buy my opinion. Do some hard work by analysing past concalls.

A thread to understand a few anti thesis points of Neuland labs.

Disc- This is not a buy/sell recommendation. Do your own due diligence.

I'll share my opinion backed by data.

You don't have to buy my opinion. Do some hard work by analysing past concalls.

It all started with the curiosity to understand very weak margins of a player with CDMO exposure who manufactures innovator molecule like Deutetrabenazine.

There was something very striking.

I had expected the CMS commercialised molecules revenues to go up. But it was kind of flat/ degrowing.

I had expected the CMS commercialised molecules revenues to go up. But it was kind of flat/ degrowing.

There was this one innovator molecule called Deutetrabenazine which is used in the treatment of chorea in Huntington's disease and tardive dyskinesia.

Neuland was the only supplier of the same molecule to the innovator during 2018 when the drug was commercialised.

Neuland was the only supplier of the same molecule to the innovator during 2018 when the drug was commercialised.

Neuland has mentioned in the concall that it was a main molecule for them and it was 1 of the 3 molecules which generates significant part of their CMS commercialised revenues.

But what happened was, there wasn't a good correlation between Deutetrabenazine (Austedo) revenues and Neuland's CMS commercialised molecules revenues.

You can see that during a period of 1 year in which Austedo made 706 Million sales, Neuland made 103 crores.

1 year back, Neuland has made almost 102 crores when the Austedo sales was 344 Million. Then why wasn't it moving like Austedo revenues?

1 year back, Neuland has made almost 102 crores when the Austedo sales was 344 Million. Then why wasn't it moving like Austedo revenues?

I do understand that CMS revenues are lumpy. But that didn't seem like lumpiness to me. In my interpretation, last 5 quarters were showing a decline of revenues. (50>45>21>23>14)

That didn't match with the general narrative that once the innovator drug gets commercialised,the revenues will rise/ shows hockey stick growth.

Numbers and narratives were not matching for me.

They must have stopped supplying to Teva or their supply must have been reduced.

Numbers and narratives were not matching for me.

They must have stopped supplying to Teva or their supply must have been reduced.

That made me to look up the API manufacturers of Deutetrabenazine.

Guess what?

There were other API players who were making Deutetrabenazine. Since only Teva has the right to sell the molecule, they all must have been making for Teva, right?

Guess what?

There were other API players who were making Deutetrabenazine. Since only Teva has the right to sell the molecule, they all must have been making for Teva, right?

That means,on 2021 Neuland wasn't the only supplier of Deutetrabenazine to Teva. They must have arranged contracts with these API players to supply the molecule. That can explain the lack of correlation.

We can’t get much details about CMS business (Success/failure/challenges/setbacks) as they don’t disclose anything about molecules and it is indeed confidential data.

We can only gauge the progress or outcome of the business with numbers and management commentary.

We can only gauge the progress or outcome of the business with numbers and management commentary.

Numbers was against Neuland. Neuland might have faced some setbacks on scaling the commercialisation of Deutetrabenazine.

Neuland had some capacity constraints on 2018. I think,this might have urged Teva to seek other suppliers as Neuland might have failed to supply enough.

Neuland had some capacity constraints on 2018. I think,this might have urged Teva to seek other suppliers as Neuland might have failed to supply enough.

"Innovator may change the main supplier if they find the first source is not up to the task."

I don't have any conclusive data to prove this. But this might have happened with Deutetrabenazine.

I don't have any conclusive data to prove this. But this might have happened with Deutetrabenazine.

Coming to the current scenario, compare the growth in Austedo revenues on past 9 months with 9 months CMS commercialised revenue decline of Neuland.

Coming to this quarter (Q3), management says topline decline was primarily due to weak performance of 2 key molecules. (Mirtazepine & Levetiracetam)

2 months before Q3, the same management had told that they were seeing good traction on Mirtazepine & Levofloxacin.

This was a concern for me. Management always paints a positive future outlook and couldn't stay true to their words.

Over promise & under deliver.

This was a concern for me. Management always paints a positive future outlook and couldn't stay true to their words.

Over promise & under deliver.

Management always had justification for lower revenues and lack in growth.

They had guided about spillage of revenue into subsequent quarters, a few times. But had we seen that?

They had guided about spillage of revenue into subsequent quarters, a few times. But had we seen that?

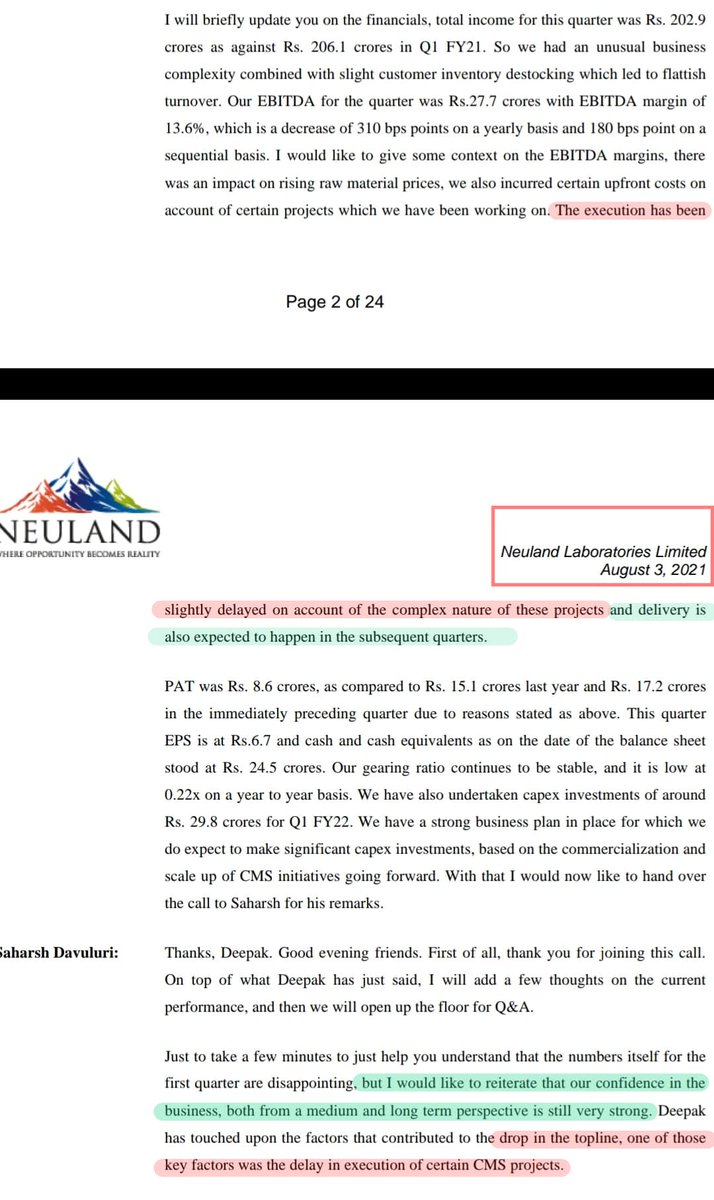

I will add few earnings call snippets regarding management’s justification of lower revenues.

Q3 - Levetiracetam and Mirtazepine didn’t perform to our expectations. This is largely owing to lower customer off take and hopefully we should be back to that with next few quarters.

Q3 - Levetiracetam and Mirtazepine didn’t perform to our expectations. This is largely owing to lower customer off take and hopefully we should be back to that with next few quarters.

Q2 - Few products didn’t perform to our expectations which are largely owing to customers delaying their orders, hopefully we’ll be able to get those orders soon

Q1 - Dip in revenues was because of the delay in execution of projects. Whatever hit we had in Q1 would be delivered in subsequent quarters. Expect FY22 performance to be intact.

Q4 last year - Commercial orders were low and that’s because we didn’t have orders in that quarter, we perhaps delivered in Q3 or we will deliver them in the upcoming quarters.

It seems delay in orders are a routine thing for them. They've always had justifications for the lack of topline growth and weak margins.

They usually guides abt spillage of revenues into subsequent quarters. However there hasn't been any significant improvement like that.

They usually guides abt spillage of revenues into subsequent quarters. However there hasn't been any significant improvement like that.

There were questions in the past earnings calls regarding why the CMS commercialised molecules revenues were falling continously.

That time management had conveyed that CMS revenues were lumpy and they were expecting spillage of revenues on subsequent quarters.

That time management had conveyed that CMS revenues were lumpy and they were expecting spillage of revenues on subsequent quarters.

But on recent earnings call they have told that, it was due to a patent expiry of one of the CMS commercialised molecules.

“That has actually been the single factor that has created that drop in

Commercial revenues.”

They could have told this on the earlier con calls.

“That has actually been the single factor that has created that drop in

Commercial revenues.”

They could have told this on the earlier con calls.

On this quarter Sajal sir asked almost same concern.

"When I see our

performance over the last few quarters and not just this quarter, even previously, the narrative and the opportunity landscape as I see is not quite matching with our

performance.

So what has gone wrong?"

"When I see our

performance over the last few quarters and not just this quarter, even previously, the narrative and the opportunity landscape as I see is not quite matching with our

performance.

So what has gone wrong?"

What management answered were

1. For some products, either for a quarter or for a year we might see a dip in sales, because of stocking up of the customers of certain products

2.For other reasons that haven’t been specified.

1. For some products, either for a quarter or for a year we might see a dip in sales, because of stocking up of the customers of certain products

2.For other reasons that haven’t been specified.

3.Some of the approvals that we originally anticipated didn’t materialize from a timing perspective.

(Have they got enough sales from the molecules they have already got approval?)

(Have they got enough sales from the molecules they have already got approval?)

4.Products like broad spectrum antibiotics, such as Ciprofloxacin, Levofloxacin which are also degrowing.

5.Mirtazapine and Levetiracetam - We have seen dip in shipments for these two products. That could be because customers are holding on to inventory from the orders that they may have placed in the past or it’s just that they don’t have production campaign or a need right now.

What do you think?

Are u satisfied with the response management has given to Sajal sir's query?

I wasn't satisfied.

The query was about mismatch between numbers & narrative on a longer term like, for the past 1 yr i suppose.

But the answer was very vague & inadequate for me.

Are u satisfied with the response management has given to Sajal sir's query?

I wasn't satisfied.

The query was about mismatch between numbers & narrative on a longer term like, for the past 1 yr i suppose.

But the answer was very vague & inadequate for me.

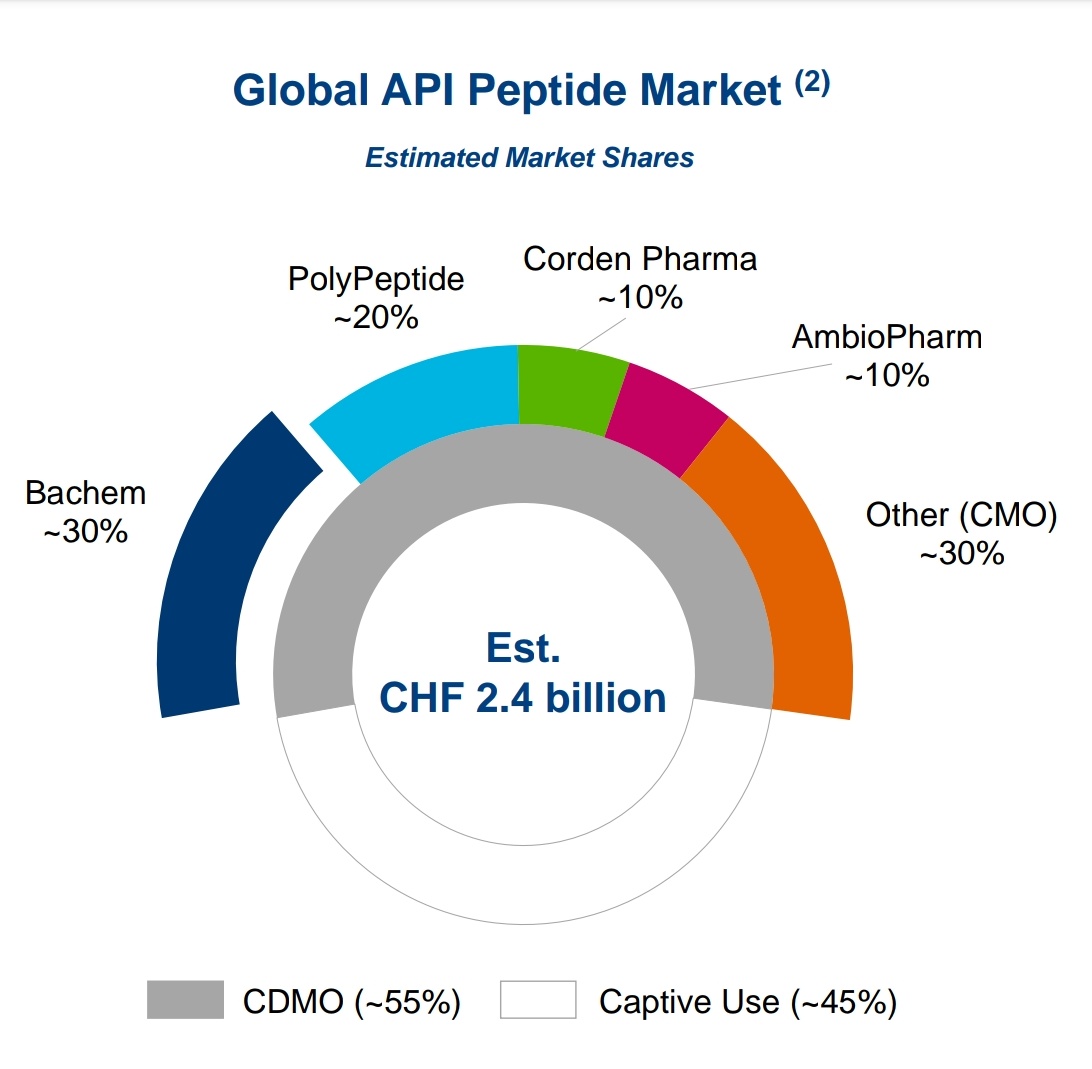

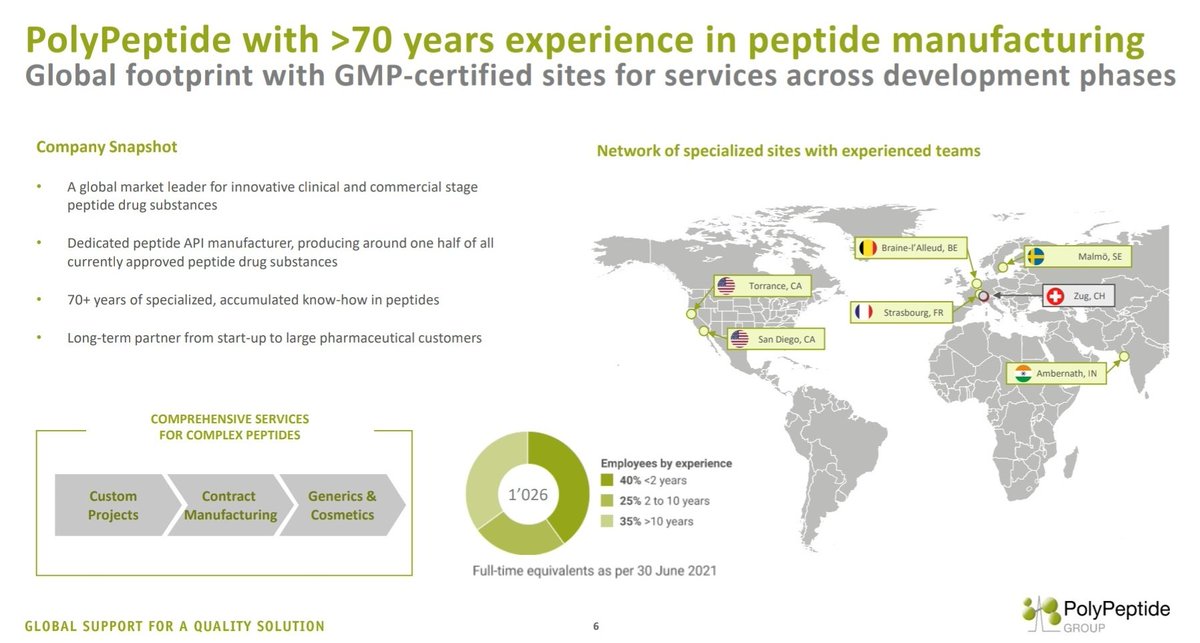

Peptides was another thing which Neuland management has been quoting as their strength on their website, blogs and presentations.

They have been developing 2 peptides- Semaglutide & Liraglutide from early 2019, I believe.

They have been developing 2 peptides- Semaglutide & Liraglutide from early 2019, I believe.

They sounded very confident on the development of these 2.

In the past, management had guided that it would take 2 years to file a DMF of a peptide molecule. But it has been nearly 3 years, and they are still in early development phase and expect to file DMF at the end of FY23.

In the past, management had guided that it would take 2 years to file a DMF of a peptide molecule. But it has been nearly 3 years, and they are still in early development phase and expect to file DMF at the end of FY23.

In annual reports and blogs, they had always highlighted about their expertise in the peptide manufacturing.

But we are yet to see a peptide DMF filing from Neuland.

Rather than promises, it would have been great if they showed some execution.

But we are yet to see a peptide DMF filing from Neuland.

Rather than promises, it would have been great if they showed some execution.

In one of the previous earnings call, they had mentioned about their aspirations of becoming the first to supply generic versions of Semaglutide locally and internationally.

But now, Indian players like Dr.Reddy’s and Sun pharma have already got US-DMF for Semaglutide.

But now, Indian players like Dr.Reddy’s and Sun pharma have already got US-DMF for Semaglutide.

Bigger player like Piramal pharma is also developing Semaglutide and Liraglutide.

Almost 20 players are working on these 2 molecules globally and almost 9 of them have got US DMF for Semaglutide.

Almost 20 players are working on these 2 molecules globally and almost 9 of them have got US DMF for Semaglutide.

Competition is little more intense in Liraglutide. Indian players like Biocon, Sun pharma, Dr.Reddys have already got US DMF for Liraglutide.

• • •

Missing some Tweet in this thread? You can try to

force a refresh