One of the primary problems with social media, including Twitter and Facebook, is that they create a space that allows individuals and trolls to think that because they are anonymous.

Or at least they believe that they are anonymous to attack people in a way that they would never do either in a face-to-face meeting or in a public space.

This is not a new problem and has even been addressed philosophically by Plato. In the Ring of Gyges, we see the effects of what happens when a person gains the power to remain anonymous.

Most of the effort on Twitter remains in the realm of logical fallacies. It includes the Ad hominem attack and that of using the Genetic fallacy.

The logical fallacy evolves around attacking another person’s character or personality in ad hominem. This is done not to create a valid response but to attack the argument by ultimately attacking the person.

In the genetic fallacy, an equal basis of creating a judgement around an argument and whether it’s right or wrong is derived from attacking who the argument comes from. This rhetorical method is no less a fallacy. And, in neither case does it come to truth.

Many people in social media circles do not understand that the validity of an argument or the truth of something has no relationship to the individual unless the argument is about the individual’s character.

Consequently, there is no place to argue the person or the person’s personality or similar rhetorical constructs in creating a valid logical argument. Rather, the argument needs to be based objectively on the truth. That is the evidence.

When individuals use these personalised attacks, they generally start to fall into other forms of logical fallacy. The use of special pleading or is it is also called moving the goalposts, may apply.

We see the use of special pleading as a logical fallacy throughout the digital asset industry. People change the story and create exceptions whenever the evidence demonstrates that their premise has been demonstrated to be false.

A prime example is derived from the attacks on me as the creator of bitcoin. The argument is that I’m nothing like Satoshi. Whereas the alternative that BTC is anything like bitcoin should be addressed.

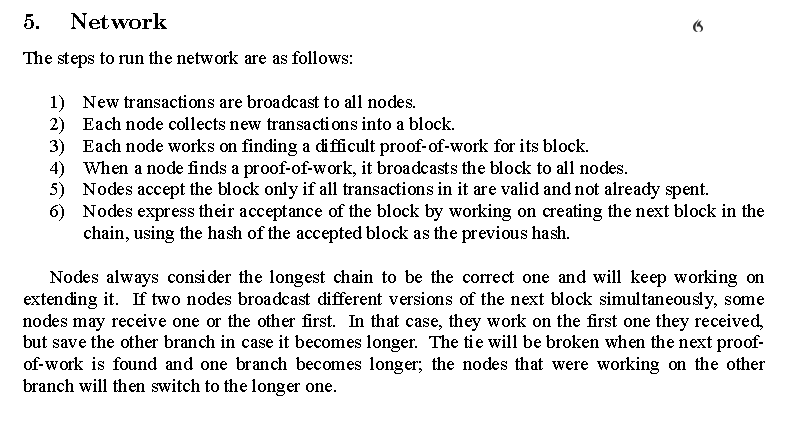

A simple example of this is the definitions presented in the whitepaper that I released and distributed in 2008. In section 5, I noted how nodes (aka miners or pools) create blocks, and this is the only consensus mechanism used in bitcoin.

Yet, the argument is presented that 14,000 nodes can exist, have existed, or may exist in the future. Therefore, calculating how many nodes exist on the bitcoin network can be conducted in any difficulty adjustment period. Nodes create blocks.

This is public. Only 2016 nodes could exist in a difficulty period. However, even that is far higher than what exists because of the unequal node power distribution. 3 to 4 nodes control over 50% of the network at any time.

Next, the argument is presented that I intended block size to remain small. Even that it wasn’t Hal Finney’s idea as a temporary change. One which I documented how to change to ensure that the block size was never reached. Ever.

That is an argument that has nothing to do with who I am. It is an argument based on historiography. It can be answered by looking at the primary source material. That is publicly available and not too difficult to analyse.

I won’t link it here on Twitter; I’m sure other people can find it.

Equally, the block size position was documented when I argued with James Donald in 2008. In a series of exchanges in November of that year, I stated that bitcoin was designed to evolve into a few server farms. My position was always very clear.

It is possible that you may not agree with my position. However, whether you believe that I’m Satoshi or not, the simple answer is that when I posted a Satoshi, I stated it (I am, but then again, people believe the earth is flat and all sorts of other crazy things).

So, in arguing the nature of bitcoin, it becomes very simple to see that it was a micropayment system with a block-based structure that grew into gigabytes and then terabytes per block. It was a system designed for fees that were next to nothing at scale.

It was a system that will change the world because it introduces low transaction fees, creates new opportunities, and removes economic friction.

The existing incumbent actors, Facebook, Twitter et cetera see this as a threat. To them, this is a system that destroys their advertising based empires.

Why do you think both Mark Zuckerberg and Jack Dorsey are suing me? It is not because I’m saying I’m Satoshi. I may happen to be, and I am. They are suing me because I am a threat to their business model.

Facebook is a system that will collapse like all other corporations throughout history. It has a lifespan. Already, they have hit their limit and will start to diminish as other players, including tik-tok become more widely disseminated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh