1) Introducing Healthcare Breakdowns, a weekly twitter thread that aims to unpack the known, and unknown, healthcare companies that affect each of us on a weekly basis.

To kick things off, let's dive into electronic health records (EHRs) and the behemoth that is Epic…

To kick things off, let's dive into electronic health records (EHRs) and the behemoth that is Epic…

2) Epic is the largest Electronic Health Records business in the United States. If you go to a hospital, it's a good chance that they're using Epic.

Currently over 250 million patients have an electronic record in Epic and they control ~31% of the hospital EHR market in the US.

Currently over 250 million patients have an electronic record in Epic and they control ~31% of the hospital EHR market in the US.

3) The business is privately held and was famously founded in Judith Faulkner's basement in 1979 in Wisconsin.

Judith has a CS background, and is still the CEO of the business 43 years later. Originally a scheduling business, Epic launched their first EHR product in 1992.

Judith has a CS background, and is still the CEO of the business 43 years later. Originally a scheduling business, Epic launched their first EHR product in 1992.

4) The EHR was first introduced to help providers get a unified patient record.

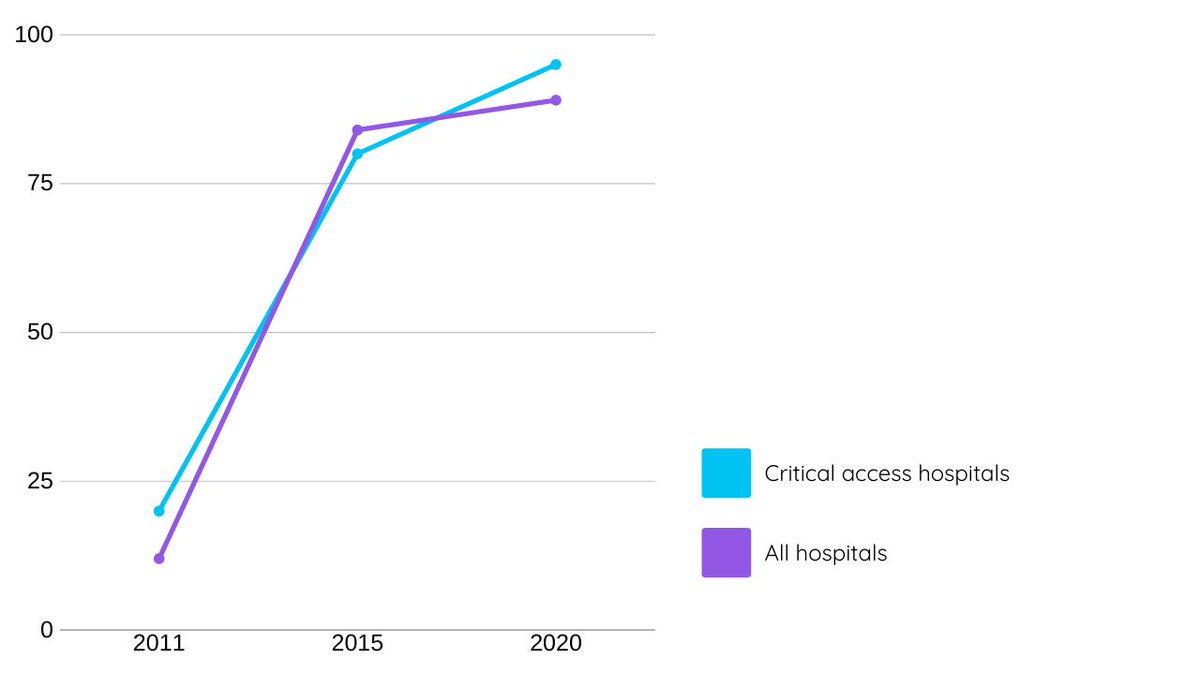

Although adoption was slow initially, the 2009 HITECH Act significantly accelerated adoption as the US government funded $27B in incentives to drive EHR adoption. Now 89% of hospitals use an EHR

Although adoption was slow initially, the 2009 HITECH Act significantly accelerated adoption as the US government funded $27B in incentives to drive EHR adoption. Now 89% of hospitals use an EHR

5) This was a boon for the EHR market and drove huge growth for Epic, Cerner & Meditech, who combined own over 75% of the market.

As a private company, Epic's exact revenue is unknown, but was estimated at $3.2B in 2019 & has touted at 15% growth rate for the past decade.

As a private company, Epic's exact revenue is unknown, but was estimated at $3.2B in 2019 & has touted at 15% growth rate for the past decade.

6) Epic charges a SaaS fee to clients, but also makes an immense amount of money from very complex implementations at different health systems. Ex. Mayo Clinic paid over $1.5B over 5 years...

Pricing tends to vary based on size of the organization and the level of customization

Pricing tends to vary based on size of the organization and the level of customization

7) Although the organization is collecting billions of dollars of revenue, their product is notoriously disliked by physicians.

When launched, the goal of EHRs was to improve patient experience and simplify provider's workflows (think more time with patients, less admin)

When launched, the goal of EHRs was to improve patient experience and simplify provider's workflows (think more time with patients, less admin)

8) But...EHRs as a whole have a NPS that is sub 0. Data is hard to find, but a 2016 survey landed Epic with a NPS of -38. Many providers actually cite EHRs as a driver of increased burn-out.

9) From a product standpoint, providers often criticize that Epic optimizes coding/billing vs improved patient and provider experience.

As the healthcare market has pushed for interoperability, Epic has been a staunch opponent and is often seen as a "walled garden."

As the healthcare market has pushed for interoperability, Epic has been a staunch opponent and is often seen as a "walled garden."

10) This approach creates huge enterprise lock-in and very high switching costs for health systems.

Although it is hard to see Epic being unseated anytime soon, there are a handful of start-ups like @CanvasMedical that are actively working to bring EHRs into the 21st century

Although it is hard to see Epic being unseated anytime soon, there are a handful of start-ups like @CanvasMedical that are actively working to bring EHRs into the 21st century

• • •

Missing some Tweet in this thread? You can try to

force a refresh