The biggest #IPO in the history of the Indian capital markets is here (India's Aramco Moment as it is called)

We are talking about #LIC - A Rs 70000 to 1 lakh cr IPO!

Let's know everything about LIC & its IPO in the detailed thread below👇🧵

Please retweet for wider reach :)

We are talking about #LIC - A Rs 70000 to 1 lakh cr IPO!

Let's know everything about LIC & its IPO in the detailed thread below👇🧵

Please retweet for wider reach :)

1/n

First up, this thread wouldn't have been possible without @AnishA_Moonka

About LIC -

- A Domestic Systemically Important Insurer (“D-SII”),

- Providing life insurance in India for 65 years+

- Largest life insurer in India

First up, this thread wouldn't have been possible without @AnishA_Moonka

About LIC -

- A Domestic Systemically Important Insurer (“D-SII”),

- Providing life insurance in India for 65 years+

- Largest life insurer in India

2/n

- Largest Indian life insurer in terms of GWP (gross written premium), NBP (new business premium), number of individual and group policies issued for FY21.

- 5th largest Life insurance company by Gross written premiums and the 10th largest by assets globally.

- Largest Indian life insurer in terms of GWP (gross written premium), NBP (new business premium), number of individual and group policies issued for FY21.

- 5th largest Life insurance company by Gross written premiums and the 10th largest by assets globally.

3/n

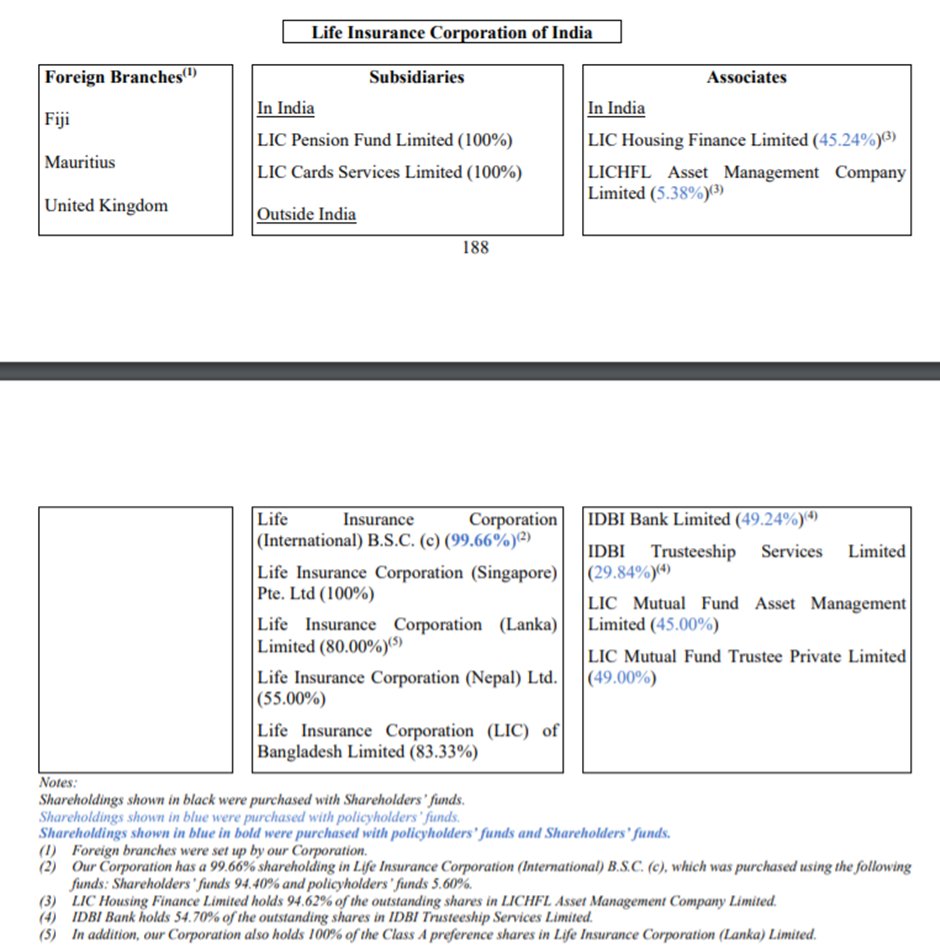

- Foreign subsidiaries - Sri Lanka, Nepal, Bangladesh, Singapore, Bahrain

- 6MFY22 - 8 zonal , 113 divisional , 4,700+ branch/satellite/mini offices

- NBP for LIC in FY21 was Rs 1.8 trillion+ which was 66% of the aggregate industry NBP

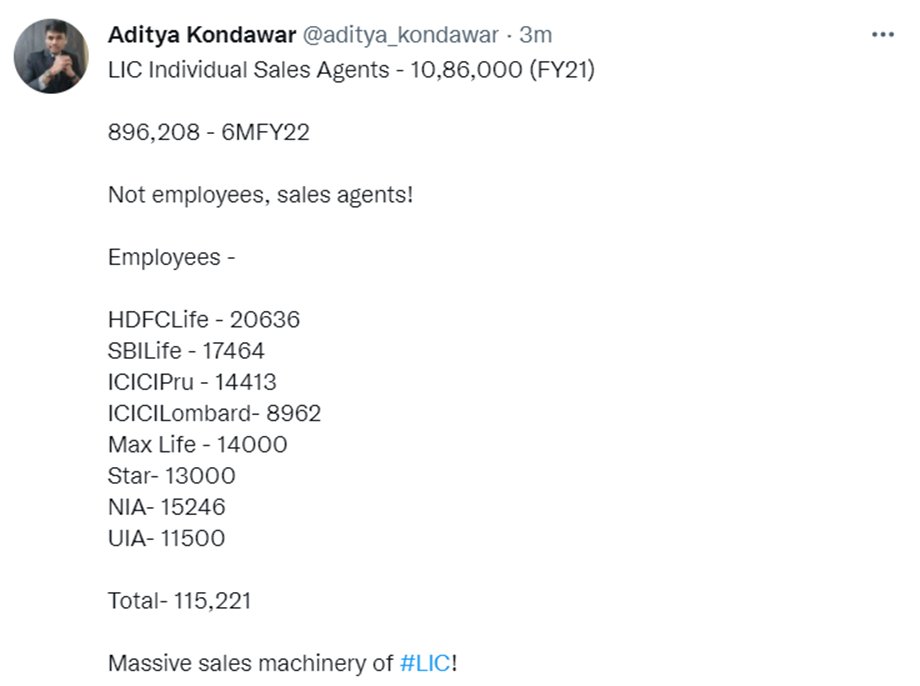

- 896208 people in Sales!

- Foreign subsidiaries - Sri Lanka, Nepal, Bangladesh, Singapore, Bahrain

- 6MFY22 - 8 zonal , 113 divisional , 4,700+ branch/satellite/mini offices

- NBP for LIC in FY21 was Rs 1.8 trillion+ which was 66% of the aggregate industry NBP

- 896208 people in Sales!

3/n

No AAM (Ordinary) AUM -

LIC's AUM is 3.3x of the total AUM of all private insurers combined and 1.1x AUM of the entire MF Industry

16.2x higher than 2nd largest SBI Life!

It is one of the few sectors where there is a wide gap between Market leaders and Other Players!

No AAM (Ordinary) AUM -

LIC's AUM is 3.3x of the total AUM of all private insurers combined and 1.1x AUM of the entire MF Industry

16.2x higher than 2nd largest SBI Life!

It is one of the few sectors where there is a wide gap between Market leaders and Other Players!

4/n

Market Shares -

64.1% - terms of premium (GWP)

66.2% - new business premium (NBP)

74.6% - in no. of individual policies issued

81.1% - in terms of no. of group policies issued

55% - number of individual agents in India

Market Shares -

64.1% - terms of premium (GWP)

66.2% - new business premium (NBP)

74.6% - in no. of individual policies issued

81.1% - in terms of no. of group policies issued

55% - number of individual agents in India

5/n

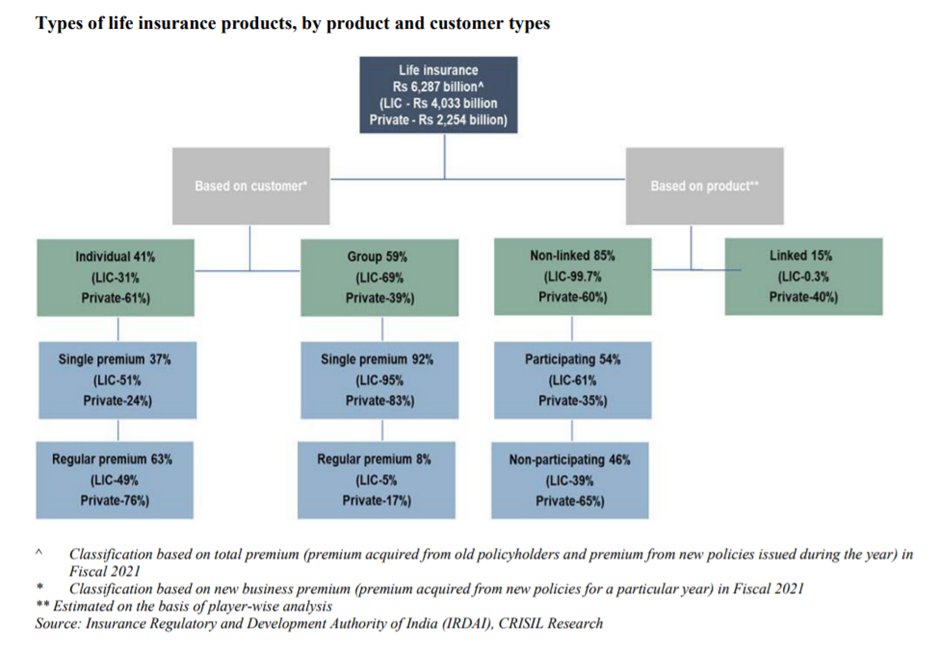

Type of products -

- LIC is only into non-linked products

- 40% of the private sector’s book is in linked products.

- Linked products’ returns are tied to the performance of debt and equity markets and are also savings-cum-protection products

Type of products -

- LIC is only into non-linked products

- 40% of the private sector’s book is in linked products.

- Linked products’ returns are tied to the performance of debt and equity markets and are also savings-cum-protection products

6/n

Other Key metrics -

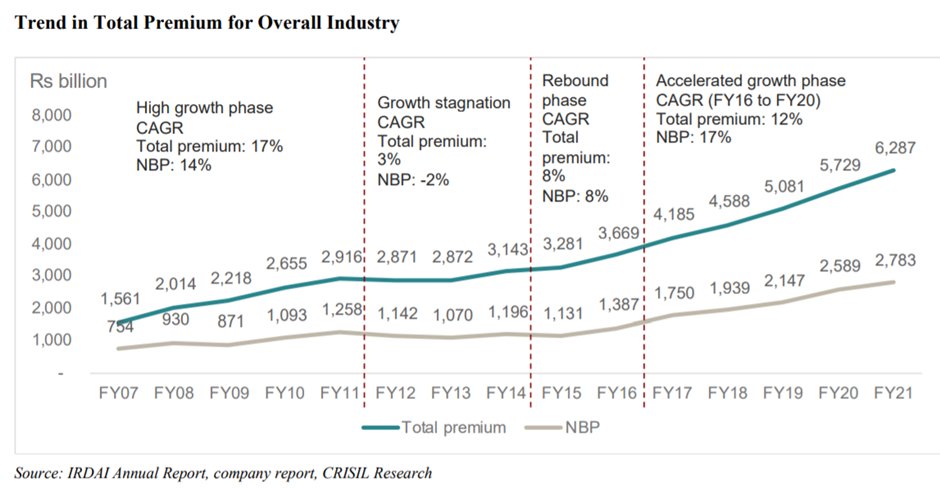

The trend in overall premium for overall Industry -

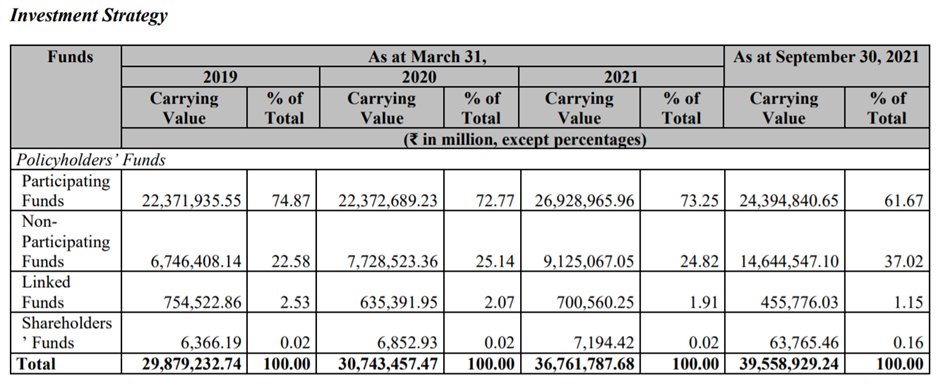

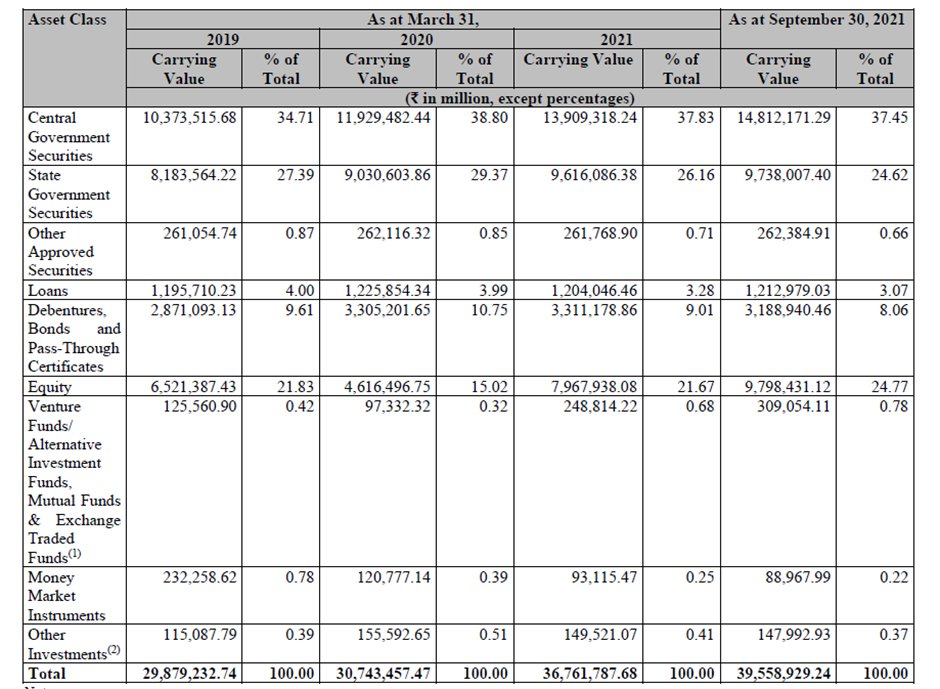

Investments of LIC -

A massive 39.6 lakh cr investment arsenal!

More than the entire mutual fund industry!

Out of that, 9.8 lakh cr equity portfolio!

Other Key metrics -

The trend in overall premium for overall Industry -

Investments of LIC -

A massive 39.6 lakh cr investment arsenal!

More than the entire mutual fund industry!

Out of that, 9.8 lakh cr equity portfolio!

7/n

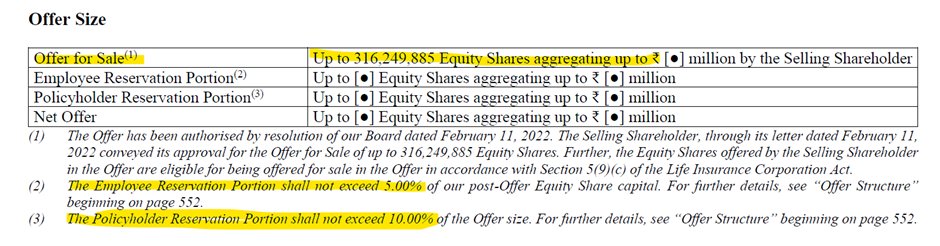

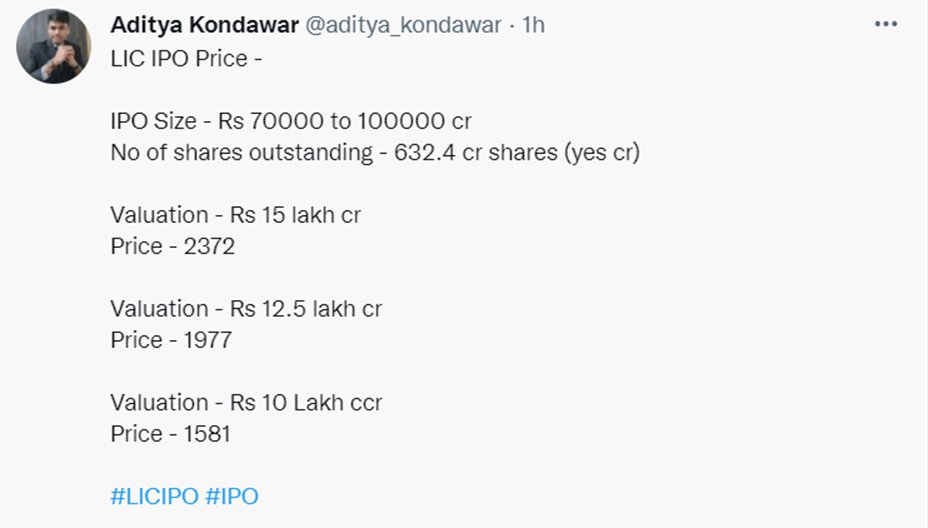

About the IPO -

Complete offer for sale (OFS) – money goes to selling shareholder which is the Government

OFS of 31.6 cr shares

Employee Quota – 5% of IPO

Policyholder Quota – 10% of IPO

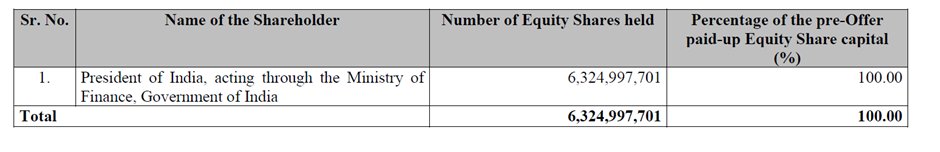

Govt owns 632.4 Cr shares, selling 31.6 cr shares, which is 5% of the company

About the IPO -

Complete offer for sale (OFS) – money goes to selling shareholder which is the Government

OFS of 31.6 cr shares

Employee Quota – 5% of IPO

Policyholder Quota – 10% of IPO

Govt owns 632.4 Cr shares, selling 31.6 cr shares, which is 5% of the company

8/n

The IPO is expected to raise Rs 70000 to 100,000 cr from the sale of 5% valuing the company at 14 lakh cr to 20 lakh cr meaning 200 bn$ to 267 bn $! I have done some

Capital Structure -

The IPO is expected to raise Rs 70000 to 100,000 cr from the sale of 5% valuing the company at 14 lakh cr to 20 lakh cr meaning 200 bn$ to 267 bn $! I have done some

Capital Structure -

9/n

Strengths -

- No other life insurer anywhere globally enjoys such a large market share as LIC

- The trust in the brand ‘LIC’ is evidenced by the 282.58 million in-force policies under individual business being serviced in India as of 6MFY22

- Sheer scale of LIC

Strengths -

- No other life insurer anywhere globally enjoys such a large market share as LIC

- The trust in the brand ‘LIC’ is evidenced by the 282.58 million in-force policies under individual business being serviced in India as of 6MFY22

- Sheer scale of LIC

10/n

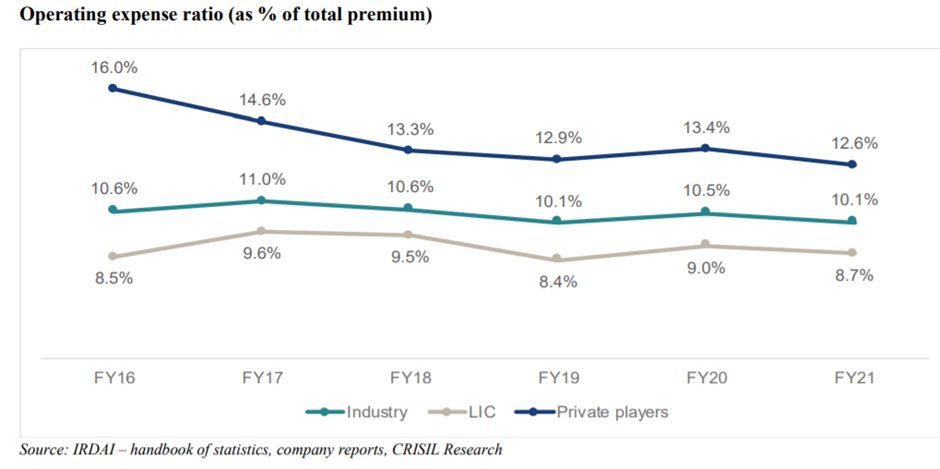

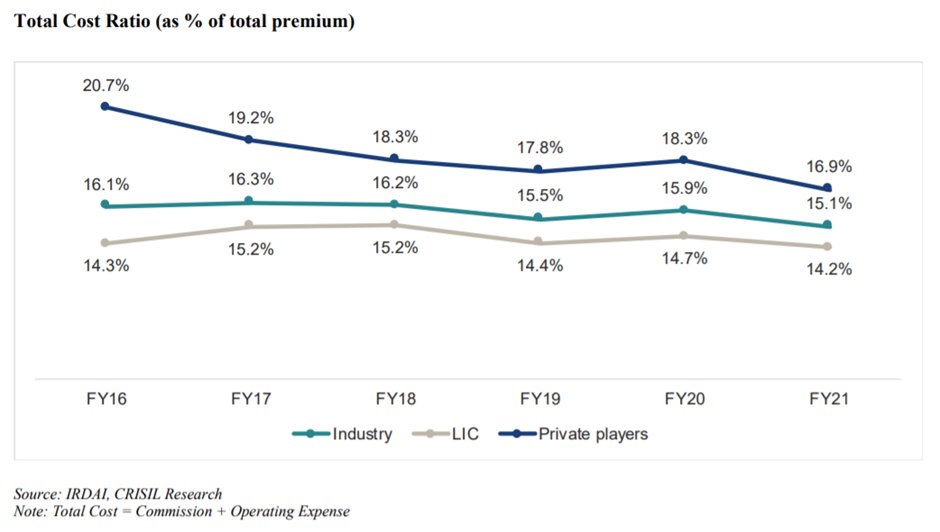

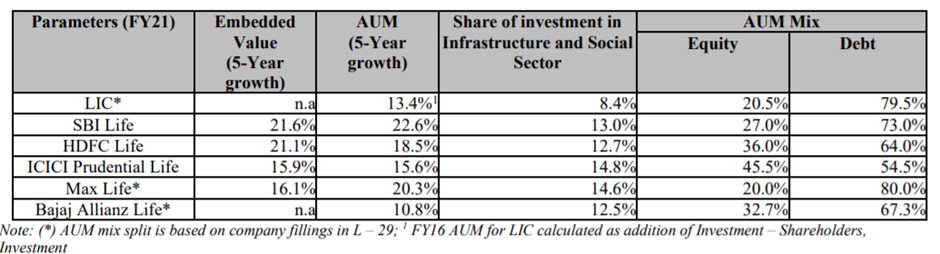

- Scale of LIC leads to much better-operating expense ratios: years/decades before private players challenge LIC on this aspect

- Strong asset management capability: largest asset manager in India (3.3x total private life insurers AUM and 1.1x of total MF industry)

- Scale of LIC leads to much better-operating expense ratios: years/decades before private players challenge LIC on this aspect

- Strong asset management capability: largest asset manager in India (3.3x total private life insurers AUM and 1.1x of total MF industry)

11/n

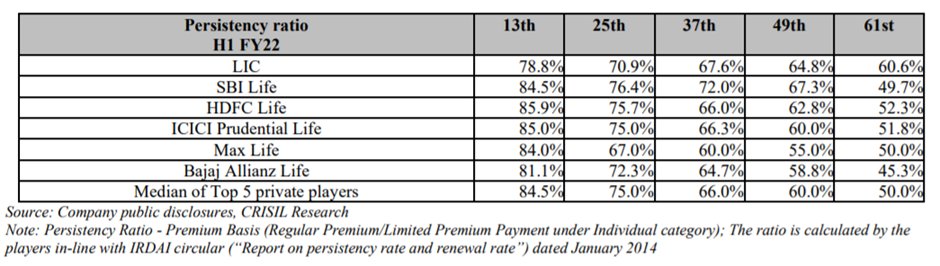

- Ability to missell: Lowest persistency ratios in the industry. (Their Salespeople are 9L! Much Much Much more than the total employees of the entire industry)

- Ability to missell: Lowest persistency ratios in the industry. (Their Salespeople are 9L! Much Much Much more than the total employees of the entire industry)

12/n

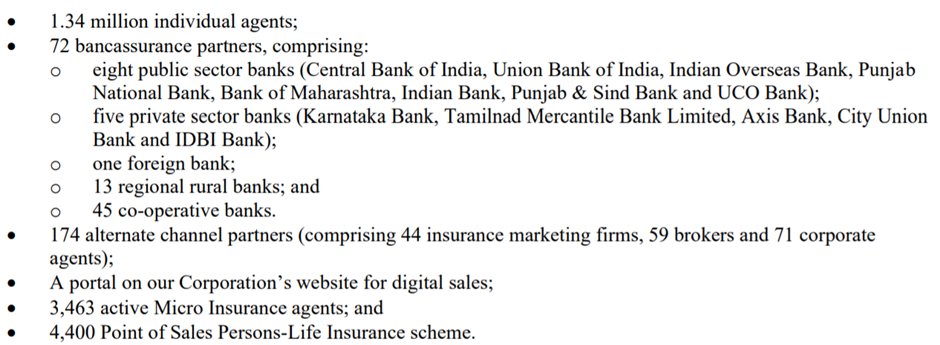

Formidable Agent network -

- FY21 - Individual agents sold 15.3 policies each on an avg v/s 3.9 policies by individual agents of the best performing of the top 5 private players and the average of 1.6 policies by the median of the top 5 private players

Formidable Agent network -

- FY21 - Individual agents sold 15.3 policies each on an avg v/s 3.9 policies by individual agents of the best performing of the top 5 private players and the average of 1.6 policies by the median of the top 5 private players

13/n

- Average NBP per agent is 3.5x the median of the top five private players & 1.3x the best among them.

Risks -

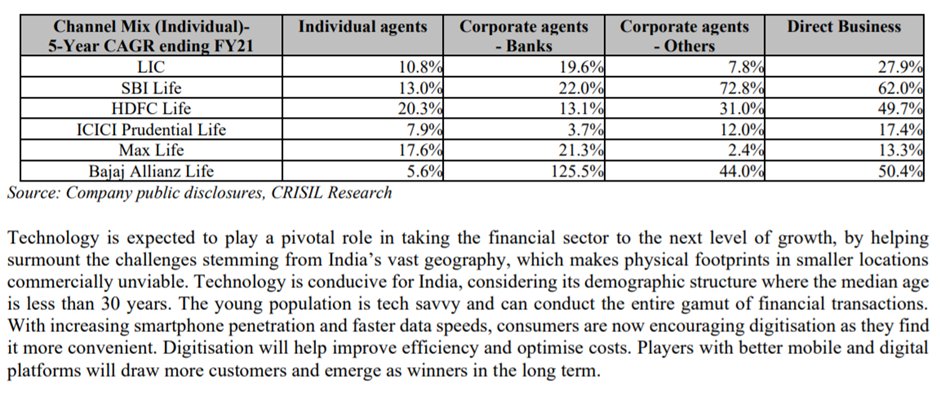

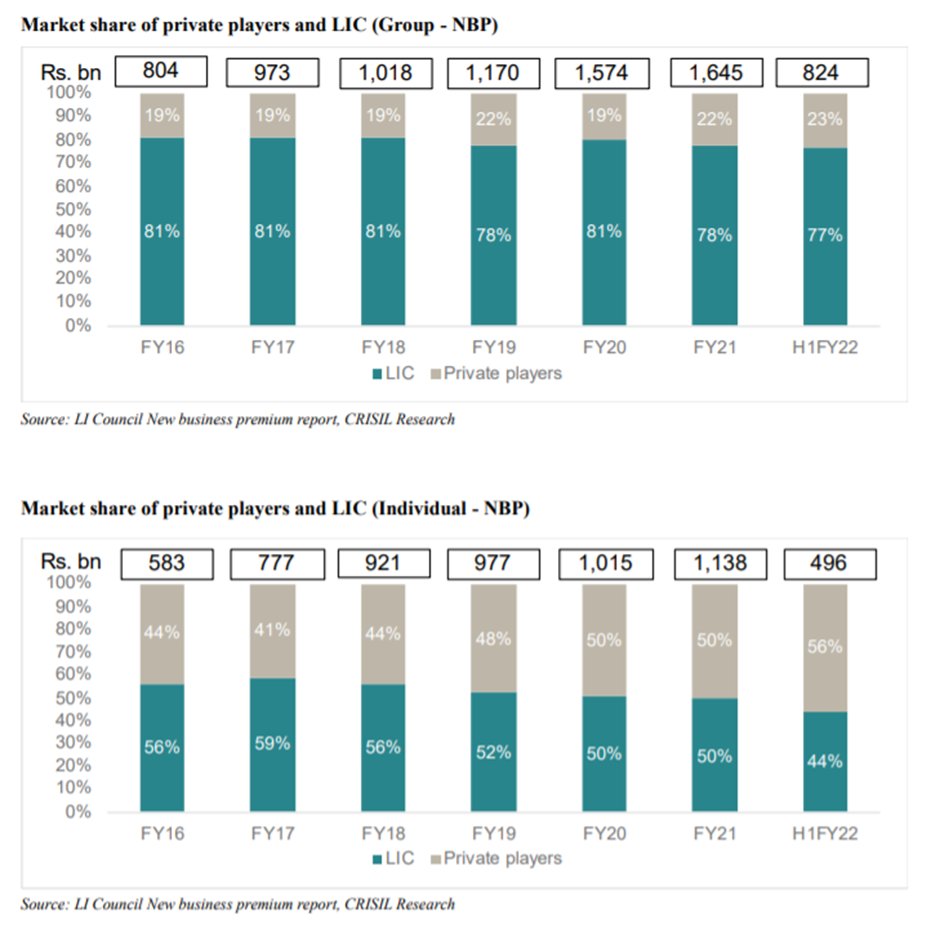

- Losing market share: LIC holds a 64% share by the total life insurance premium. It grew at 9% CAGR from FY16-21 (Private insurers grew 18% CAGR)

- Average NBP per agent is 3.5x the median of the top five private players & 1.3x the best among them.

Risks -

- Losing market share: LIC holds a 64% share by the total life insurance premium. It grew at 9% CAGR from FY16-21 (Private insurers grew 18% CAGR)

14/n

- New business premium (NBP) has grown at 15% CAGR in the past 5 years with LIC and private insurers growing at 14% and 18% CAGR, respectively.

- Digital concerns - Just 36% of individual renewal premiums were collected digitally, compared to 90%+ for private players

- New business premium (NBP) has grown at 15% CAGR in the past 5 years with LIC and private insurers growing at 14% and 18% CAGR, respectively.

- Digital concerns - Just 36% of individual renewal premiums were collected digitally, compared to 90%+ for private players

15/n

- Death Claims settlement ratio is among the lowest in the industry

- Active Agents reduced from 11L to 9L (6MFY22, could be due to Covid)

- Dependence on sales agents is very high! – 96% of NBP came from individual sales agents as of 6MFY22

- Death Claims settlement ratio is among the lowest in the industry

- Active Agents reduced from 11L to 9L (6MFY22, could be due to Covid)

- Dependence on sales agents is very high! – 96% of NBP came from individual sales agents as of 6MFY22

16/n

- Contingent Liabilities

- Bancassurance channel was just 2.3% of NBP (6MFY22)

- Infused 4743 Cr into IDBI Bank using policyholder funds (OCt 2019) - Company says IDBI doesn't need more funds, but we all know what may happen in future

- bailed out HAL and BDL IPOs in 2018

- Contingent Liabilities

- Bancassurance channel was just 2.3% of NBP (6MFY22)

- Infused 4743 Cr into IDBI Bank using policyholder funds (OCt 2019) - Company says IDBI doesn't need more funds, but we all know what may happen in future

- bailed out HAL and BDL IPOs in 2018

17/n

- LIC had infused Rs 21,600 crore for 51% in IDBI Bank. In 2019, another 4743 Cr was infusion and then bailed out IPOs as well. The DRHP itself states that the promoter i.e. Govt of India may ask them to carry out actions that may be against Shareholder interests

- LIC had infused Rs 21,600 crore for 51% in IDBI Bank. In 2019, another 4743 Cr was infusion and then bailed out IPOs as well. The DRHP itself states that the promoter i.e. Govt of India may ask them to carry out actions that may be against Shareholder interests

18/n

Why has the profitability taken a hit in FY21 & H1FY22?

Due to COVID, death claims in FY21 were 1.5x of Pre-COVID & just in H1FY22, is 1.3x of a normal year!

Competition: 23 private insurance companies; LIC is the sole public insurer.

Why has the profitability taken a hit in FY21 & H1FY22?

Due to COVID, death claims in FY21 were 1.5x of Pre-COVID & just in H1FY22, is 1.3x of a normal year!

Competition: 23 private insurance companies; LIC is the sole public insurer.

19/n

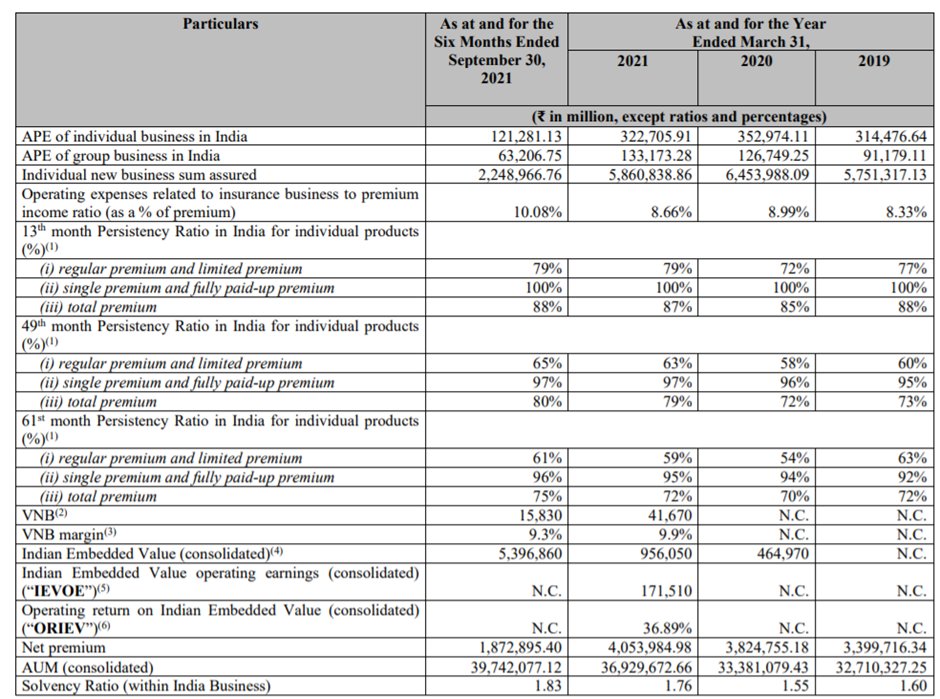

VNB margins tell the potential profitability of the business done in a single year

If the VNB margin is 10%, it means the insurer earns 10 rs on a 100 rs premium in a single year

LIC VNB margin in FY21 - 9.9% , in 6MFY22 - 9.3% (Normalized @ 12%)

VNB margins tell the potential profitability of the business done in a single year

If the VNB margin is 10%, it means the insurer earns 10 rs on a 100 rs premium in a single year

LIC VNB margin in FY21 - 9.9% , in 6MFY22 - 9.3% (Normalized @ 12%)

20/n

For other insurers, the VNB margins are 20-25%!

Conclusion -

One needs to be conservative with the price to embedded value (P/EV) multiple one pays for LIC given the continuous market share loss.

Note - Globally insurers of this size trade at 1-2x P/EV max!

For other insurers, the VNB margins are 20-25%!

Conclusion -

One needs to be conservative with the price to embedded value (P/EV) multiple one pays for LIC given the continuous market share loss.

Note - Globally insurers of this size trade at 1-2x P/EV max!

21/n

Industry size -

- Based on life insurance premiums, India is the 10th largest life insurance market in the world and 5th largest in Asia (Swiss Re’s sigma No 3/2021 report for July 2021)

Industry size -

- Based on life insurance premiums, India is the 10th largest life insurance market in the world and 5th largest in Asia (Swiss Re’s sigma No 3/2021 report for July 2021)

22/n

The size of the Indian life insurance industry was Rs. 6.2 trillion (Of which LIC is Rs. 4 trillion) based on total premium in Fiscal 2021, up from Rs. 5.7 trillion in Fiscal 2020.

The size of the Indian life insurance industry was Rs. 6.2 trillion (Of which LIC is Rs. 4 trillion) based on total premium in Fiscal 2021, up from Rs. 5.7 trillion in Fiscal 2020.

23/n

The industry’s total premium has grown at 11% CAGR in the last 5 years ending in Fiscal 2021

Severely underpenetrated. Surprised? Proved by Protection gap which is nothing more than the difference b/w total losses & insured losses.

The industry’s total premium has grown at 11% CAGR in the last 5 years ending in Fiscal 2021

Severely underpenetrated. Surprised? Proved by Protection gap which is nothing more than the difference b/w total losses & insured losses.

24/n

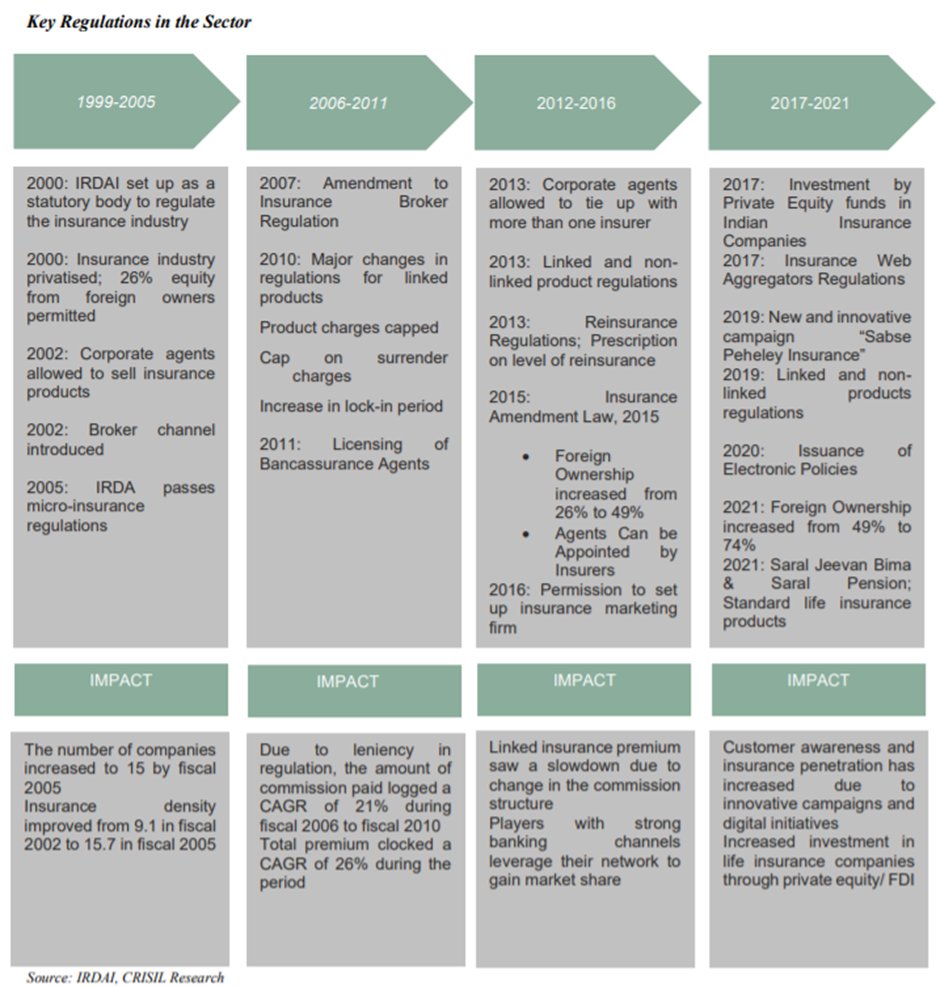

Interesting historical fact -

- After the sharp growth during Fiscals 2007 to 2011, the industry saw a sudden slowdown over the subsequent 3 years.

- IRDAI Regulatory changes with respect to linked products, decline in the financial savings rate and weak performance

Interesting historical fact -

- After the sharp growth during Fiscals 2007 to 2011, the industry saw a sudden slowdown over the subsequent 3 years.

- IRDAI Regulatory changes with respect to linked products, decline in the financial savings rate and weak performance

25/n

of the equity markets led to the deceleration.

- The IRDAI’s guidelines (June 2010), streamlining the expenses charged on linked products, resulted in a decline in upfront commission of linked products, thereby making sales of these products less lucrative for sellers.

of the equity markets led to the deceleration.

- The IRDAI’s guidelines (June 2010), streamlining the expenses charged on linked products, resulted in a decline in upfront commission of linked products, thereby making sales of these products less lucrative for sellers.

26/n

- This affected growth of private players because of their high exposure to linked products that had a 71% share of private players’ portfolio mix in FY11. Between Fy11-14, the total premium of private players declined at 4% CAGR as compared to 5% CAGR for LIC.

- This affected growth of private players because of their high exposure to linked products that had a 71% share of private players’ portfolio mix in FY11. Between Fy11-14, the total premium of private players declined at 4% CAGR as compared to 5% CAGR for LIC.

27/n

Will digitization lead to a huge change in market share?

Agency and bancassurance distribution models continue to dominate globally owing to the need for human interaction to understand customer needs and personal touch!

Will digitization lead to a huge change in market share?

Agency and bancassurance distribution models continue to dominate globally owing to the need for human interaction to understand customer needs and personal touch!

28/n

In India, LIC has the largest agent network of 1.35 million individual agents as of FY21 which accounted for 55% of the total agent network in the country

However, one needs to incorporate the latest technologies into their processes to become relevant in the longer term

In India, LIC has the largest agent network of 1.35 million individual agents as of FY21 which accounted for 55% of the total agent network in the country

However, one needs to incorporate the latest technologies into their processes to become relevant in the longer term

29/n

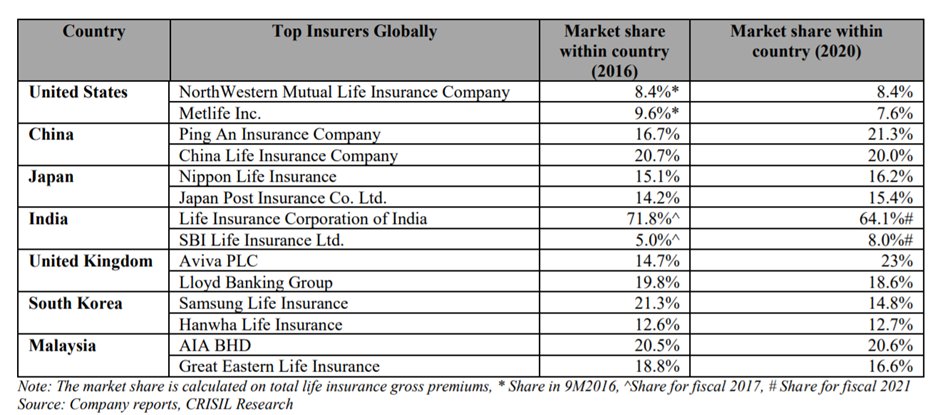

Global market:

The life insurance industry is capital intensive with a long gestation period, which has resulted in only a few players being active in the industry across most markets and the larger players within each market having a significant market share.

Global market:

The life insurance industry is capital intensive with a long gestation period, which has resulted in only a few players being active in the industry across most markets and the larger players within each market having a significant market share.

30/n

However, nowhere in the world is the difference in market share between the largest and the second-largest life insurer as stark as in India, with the second-largest player having only 8.0% market share of GWP compared to LIC’s market share of 64.1% by GWP for Fiscal 2021.

However, nowhere in the world is the difference in market share between the largest and the second-largest life insurer as stark as in India, with the second-largest player having only 8.0% market share of GWP compared to LIC’s market share of 64.1% by GWP for Fiscal 2021.

31/n

Questions to management -

- How will they come back in terms of growth and market share? Where are they lacking? How do they plan to adopt the omnichannel strategy?

- Why Private players are gaining market share?

- bancassurance and product mix.

Questions to management -

- How will they come back in terms of growth and market share? Where are they lacking? How do they plan to adopt the omnichannel strategy?

- Why Private players are gaining market share?

- bancassurance and product mix.

32/n

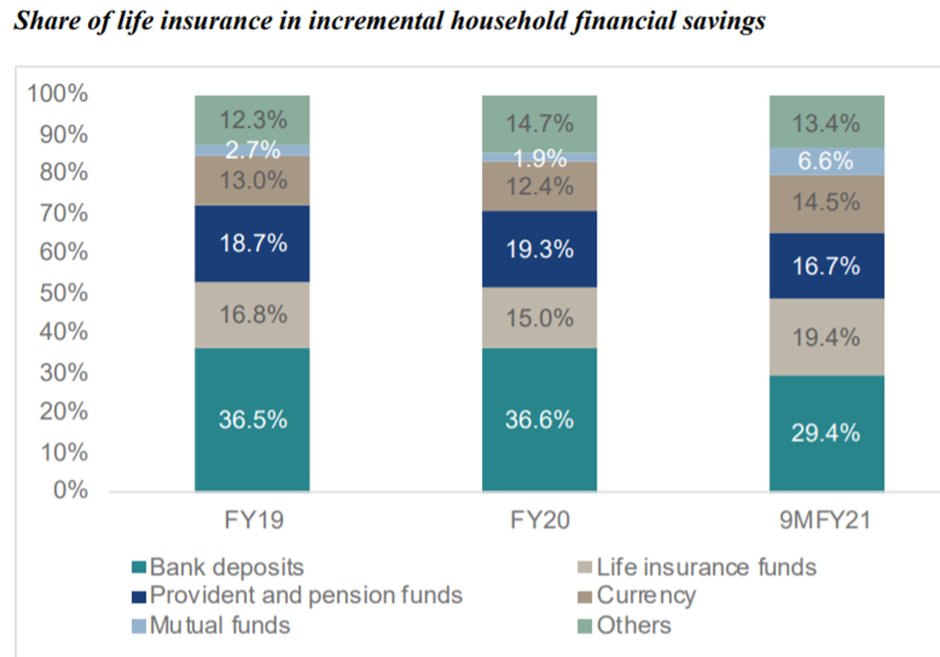

Long term trends -

- The GWP for life insurers in India is forecasted to grow at 14-15% CAGR from FY21-26 to reach ₹12,400 billion (CRISIL)

- Most of the incremental household financial savings are flowing toward insurance & MFs. The financialization of savings is here

Long term trends -

- The GWP for life insurers in India is forecasted to grow at 14-15% CAGR from FY21-26 to reach ₹12,400 billion (CRISIL)

- Most of the incremental household financial savings are flowing toward insurance & MFs. The financialization of savings is here

33/n

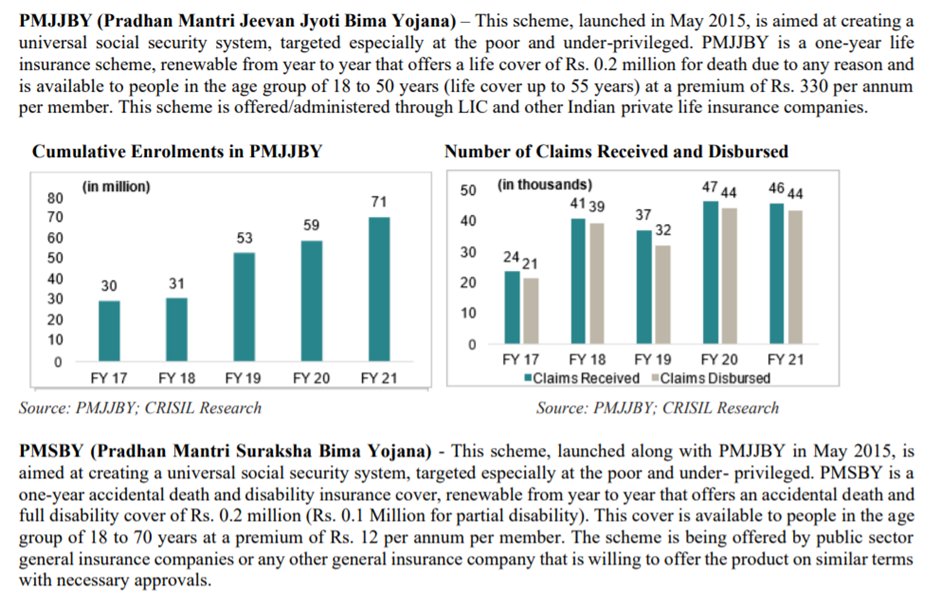

- The NBP of the Indian life insurance industry is expected to grow at a CAGR of approximately 18% from FY21 to Fy26 for individual business as compared to a CAGR of 17% for group business over the same period.

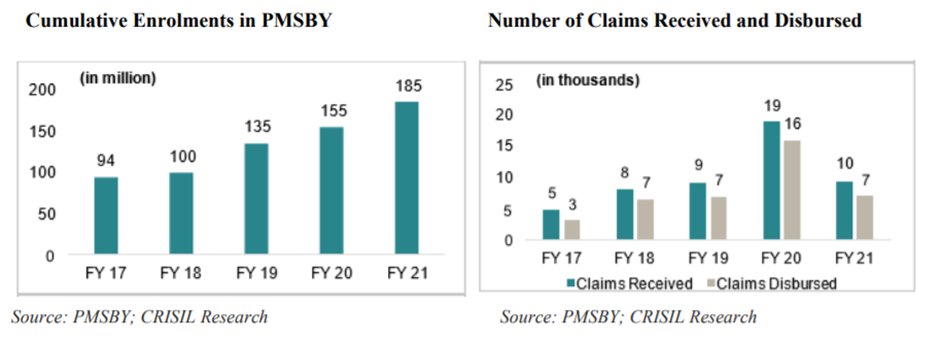

- Schemes like PMJJBY & PMSBY doing their magic.

- The NBP of the Indian life insurance industry is expected to grow at a CAGR of approximately 18% from FY21 to Fy26 for individual business as compared to a CAGR of 17% for group business over the same period.

- Schemes like PMJJBY & PMSBY doing their magic.

35/n

Next Leg of Growth -

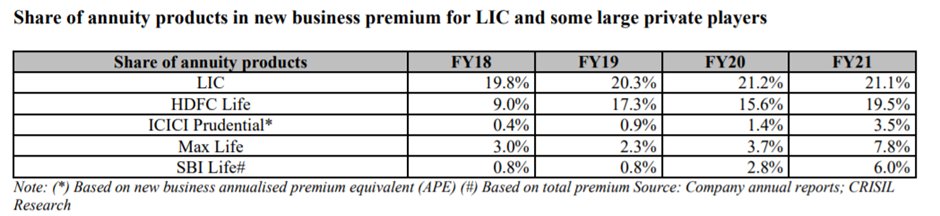

Basis the evolving market needs, insurers have increased their focus on non-participating saving, protection, and annuity products

Over the years, customers and insurers have shifted their focus towards protection products from savings led products

Next Leg of Growth -

Basis the evolving market needs, insurers have increased their focus on non-participating saving, protection, and annuity products

Over the years, customers and insurers have shifted their focus towards protection products from savings led products

36/n

Additionally, with effect from April 2021, income earned on contribution beyond Rs. 0.25 million per annum in ULIPs was made become taxable reducing the incentive for ULIPs and driving a shift towards protection and other savings/ annuities products.

Additionally, with effect from April 2021, income earned on contribution beyond Rs. 0.25 million per annum in ULIPs was made become taxable reducing the incentive for ULIPs and driving a shift towards protection and other savings/ annuities products.

37/n

That's it, folks! End of thread! Thanks so much for reading :)

Spent a good amount of time on this one!

If you liked it, do retweet the main thread here -

Make sure to hit the follow button and never miss any such threads in the future :)

That's it, folks! End of thread! Thanks so much for reading :)

Spent a good amount of time on this one!

If you liked it, do retweet the main thread here -

Make sure to hit the follow button and never miss any such threads in the future :)

https://twitter.com/aditya_kondawar/status/1493479327681241089

• • •

Missing some Tweet in this thread? You can try to

force a refresh